A Professional Employer Organization (PEO) in Dominican Republic is the optimal resource for testing the market entry and improving your business success. By managing critical HR functions, a PEO enables you to focus on scaling operations while navigating the Dominican Republic’s legal and operational complexities. Collaborating with a trusted local partner is essential, and Biz Latin Hub delivers expert support with its extensive experience across Latin America. From market entry to company formation in the Dominican Republic, we offer the services needed to help your business succeed in the region.

Key Takeaways

| Is it legal to hire in the Dominican Republic through PEO services? | Yes you are able to use PEO services in the Dominican Republic. |

| What are the benefits of hiring through a PEO in the Dominican Republic? | Using a professional employer organization in the Dominican Republic leverages quick access to the market without the need to establish a local entity, letting you focus on business success. |

| Steps to hire through a PEO in the Dominican Republic | Sign an agreement with the third-party PEO. Confirm the employment offer for the candidate. Share the employment offer with the candidate. Once the candidate accepts the offer, the PEO drafts the employment contract, assuming the role of the Professional Employer Organization. The candidate reviews and signs the employment contract. As the Professional Employer Organization, the PEO completes all mandatory employee registrations in the Dominican Republic. The employee begins work and reports to the hiring foreign company. |

| Why employ Dominican Republican employees? | The country’s young population, skilled in technology and seeking remote work in the digital economy, presents a compelling choice for employers expanding global teams. |

Understanding the Role of a PEO in the Dominican Republic

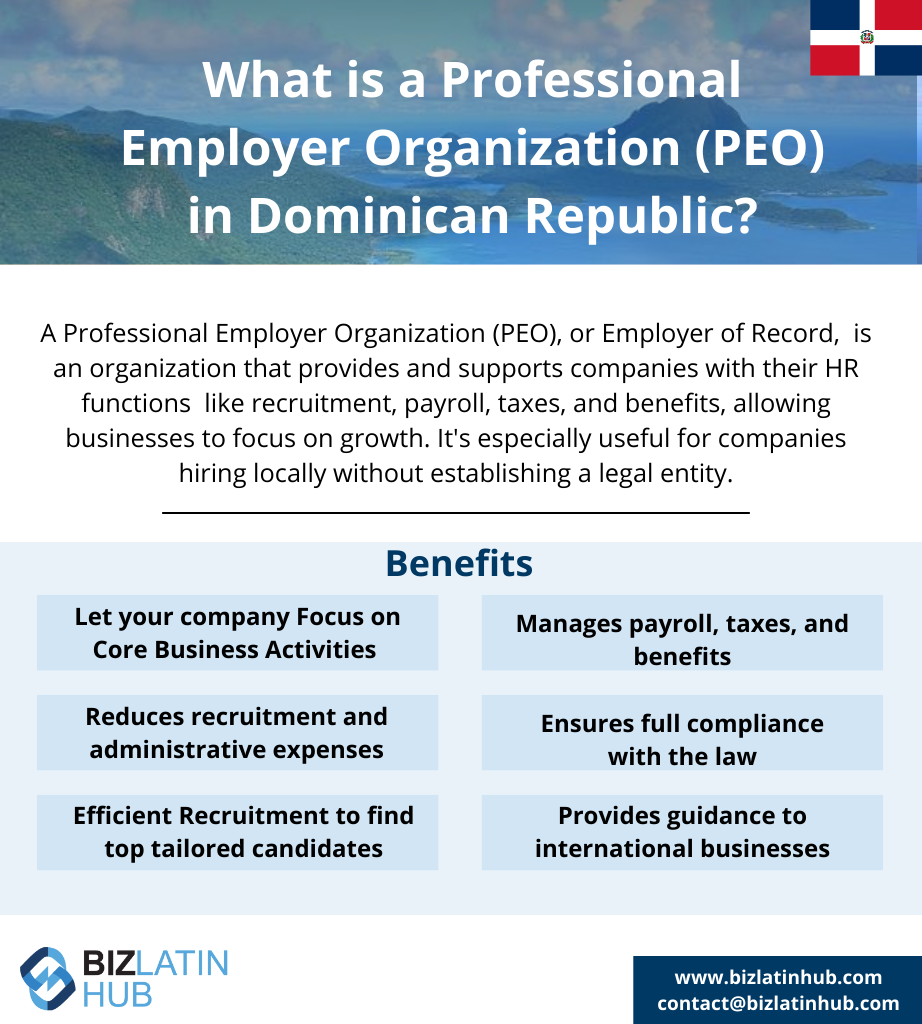

A Professional Employer Organization (PEO) offers a set of employee management services, such as payroll processing, benefits management and social contributions to government authorities. The employment services of a PEO in the Dominican Republic can be valuable for foreign executives, as these organizations take responsibility for complying with local employment laws.

Through a co-employment model, these companies offer far-reaching human resource services abroad for organizations without a physical presence in the nation. A PEO can support smaller businesses and it is especially helpful for businesses that are not sure yet about whether they want to open an office in a new foreign market.

Working with a PEO makes it easier to hire workers, and decreases the amount of administrative tasks the company must undertake. This could increase their chances of success by empowering them to concentrate on their core tasks and the growth of their business operations in the Dominican Republic.

5 Benefits of Using a PEO in the Dominican Republic

1. Comply with Legal Requirements

Employment laws and legal requirements in the Dominican Republic can change annually, making it hard to keep up with recent updates. Keeping up with the law, and ensuring your company’s hiring activities are fully compliant, involves spending time and resources investigating the legislation. This isn’t easy for foreign executives with no previous experience hiring staff in the Dominican Republic, or for those who don’t speak Spanish.

A PEO in the Dominican Republic can support your business’s compliance with employment regulations. Although you can choose the extent of activities a PEO undertakes on your company’s behalf, they can manage all non-revenue generating paperwork regarding your employees working in the country.

2. Manage Risk

Since your partnered PEO in the Dominican Republic is handling your employment compliance requirements, they mitigate the risk of non-compliance with local legislation. Professional employer organizations shoulder this burden, so your business is protected and all employment activities undertaken by your company are ‘above board’.

3. Save Time

PEO providers are important for small- and medium-sized organizations hiring staff abroad. Local care, information, and engagement are important for overseas staff. The process of employee management services could take the majority of your time. This weight will be taken off your shoulders when you work with a PEO.

4. Entering and Exiting the Market Made Easy

Save money on full company incorporation when expanding by starting small. If it’s best for your business to begin expanding into the Dominican Republic with a light footprint, hiring staff through a local PEO provider is an ideal solution.

You can employ a small number of sales representatives or executives who can begin building connections, meeting distributors, and marketing your company. With further market validation, and industry and distribution connections, you can then consider formally incorporating your company in the Dominican Republic.

Likewise, if operations don’t work out as planned, or you need to pivot your business strategy, winding up operations in the Dominican Republic is made easier with a PEO. With a lighter presence in the country, you can more smoothly exit the market, and save on liquidation costs.

5. Focus on Core Operations

PEO providers allow small and medium-sized companies to develop their business and brand awareness in the Dominican Republic without the requirement of full company incorporation, which could be a time consuming and costly process.

One of the most substantial advantages you will receive from using a PEO specialist organization is the amount of time you save and can use to focus on your job. Removing administrative weight for your company and outsourcing it to a PEO specialist allows you to work directly with your employees and increase your success in your company.

Are there any downsides to using a PEO in the Dominican Republic?

Cost considerations

While hiring through an EOR offers administrative convenience, it does come at a cost. Employers should carefully assess the financial implications of using an EOR, as their fees can be higher compared to an in-house HR department or partnering with a traditional staffing agency. Businesses should weigh the benefits against the expenses to determine the most cost-effective approach for their circumstances.

Limited control over HR Functions:

Outsourcing employment functions to an EOR means relinquishing direct control over certain HR processes. The lack of control can affect the quality of candidate selection, employee management, and cultural fit within the organization. Businesses should conduct thorough due diligence when selecting an EOR to ensure their values, goals, and employee management practices align.

Potential communication challenges

Working with an EOR in a foreign country like the Dominican Republic may present language and cultural barriers. Although many EORs have multilingual workers, miscommunication or misunderstandings can occur, potentially impacting day-to-day operations or employee satisfaction. Establishing clear communication channels and regularly reviewing progress can help mitigate these challenges.

Perception and employer branding

In some instances, hiring through an EOR may lead to the perception that the company lacks a local presence or commitment. This could affect employer branding and the ability to attract top talent. Businesses should consider how hiring through an EOR may impact their reputation and explore ways to address these concerns through transparent communication and active involvement in the local business community.

Hiring through an employer of record in the Dominican Republic offers numerous benefits, including compliance support, administrative simplicity, talent acquisition assistance, and flexibility. However, when choosing to work with an EOR, businesses should carefully evaluate the potential drawbacks such as costs, limited control over HR functions, communication challenges, and employer branding implications.

EOR vs. PEO in the Dominican Republic – What’s the Difference?

When expanding into the Dominican Republic, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in the Dominican Republic.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution for the Dominican Republic market, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in the Dominican Republic. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Dominican regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence in this Caribbean nation, we can guide you through the process.

How to Partner With an Professional Employer Organization in the Dominican Republic?

To partner with a PEO, the hiring company signs a contract with a third-party organization, designating them as the Professional Employer Organization (PEO) for the staff they wish to hire in the Dominican Republic. This designation ensures that, on official documentation in the Dominican Republic, the third-party company (the PEO/EOR) assumes responsibility for complying with all employment regulations for those employees.

The foreign company is thus freed from the complexities of understanding and adhering to Dominican labor laws independently. This reduces the risk of non-compliance and allows the foreign company to focus its efforts on business development and market expansion.

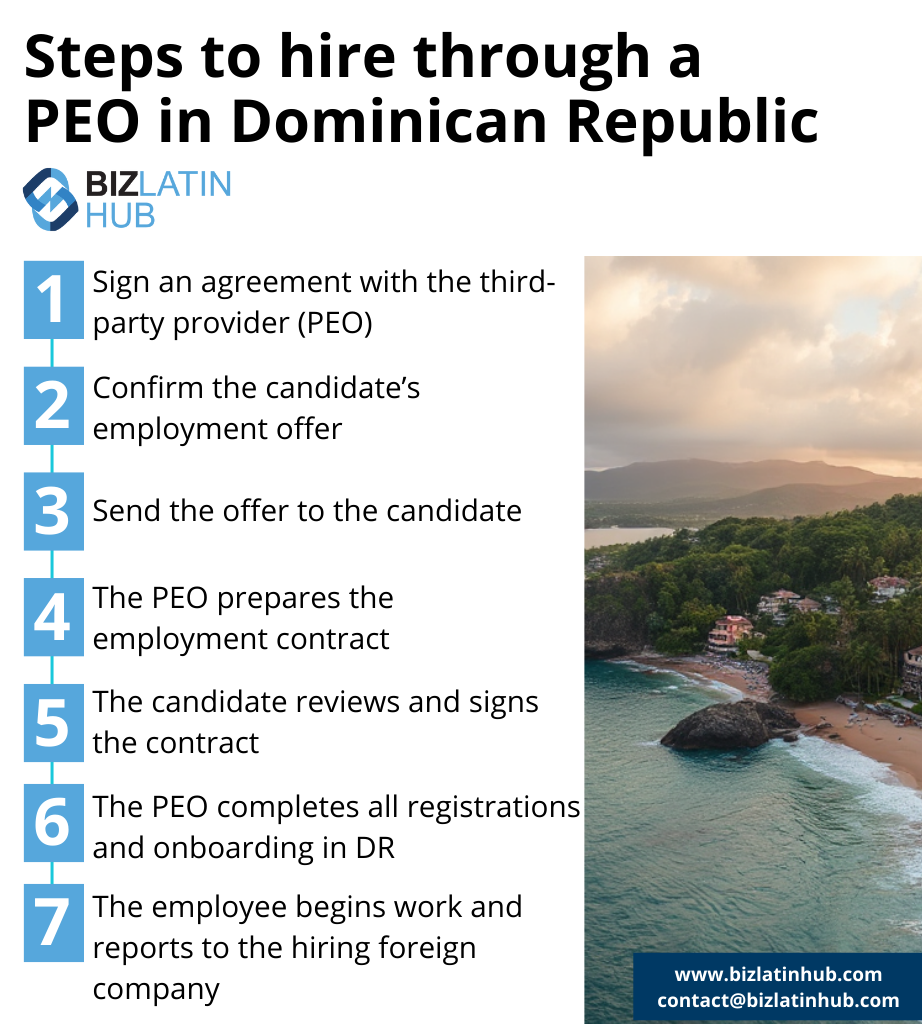

The process of hiring an employee through a Professional Employer Organization in the Dominican Republic is straightforward. The following steps outline the process:

- Sign an agreement with the third-party EOR.

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- Once the candidate accepts the offer, the EOR drafts the employment contract, assuming the role of the employer of record.

- The candidate reviews and signs the employment contract.

- As the employer of record, the PEO completes all mandatory employee registrations in the Dominican Republic.

- The employee begins work and reports to the hiring foreign company.

What are the laws for operating a PEO in the Dominican Republic?

The legal framework governing Employers of Records (EORs) in the Dominican Republic consists of various labor laws and regulations that define the rights and obligations of employers, employees, and EORs. Understanding this framework is crucial for businesses considering hiring through an EOR in the country. Here are the fundamental aspects of the legal framework:

Labor Code: The Labor Code of the Dominican Republic (Law No. 16-92) is the primary legislation governing labor relations in the country. It sets out the rights and obligations of both employers and employees, covering aspects such as working hours, minimum wage, social security, and termination of employment contracts. EORs must comply with the provisions outlined in the Labor Code to guarantee the protection of workers’ rights.

Employment Contracts: Employment contracts in the Dominican Republic can be written or verbal. However, it is recommended to have written contracts that specify vital details such as job description, working hours, compensation, benefits, and duration of employment. EORs play a crucial role in ensuring that employment contracts comply with the requirements of the Labor Code and other relevant regulations.

Social Security Contributions: Under Dominican law, employers must contribute to the social security system on behalf of their employees. These contributions cover health insurance, retirement benefits, and other social programs. EORs are responsible for managing and ensuring the accurate calculation and payment of these social security contributions on behalf of the employer and the employees.

Taxation and Payroll Compliance: EORs in the Dominican Republic must adhere to the tax regulations set forth by the General Directorate of Internal Revenue (DGII). They are responsible for calculating and deducting the appropriate income tax and social security contributions from employee salaries. EORs also ensure the accurate filing and payment of these taxes to the tax authorities, relieving the hiring organization of the administrative burden associated with payroll compliance.

Employment Termination: The Labor Code establishes the grounds and procedures for terminating employment contracts in the Dominican Republic. To avoid legal disputes, EORS should follow legal requirements when terminating an employee’s contract. Termination may be based on reasons such as mutual agreement, expiration of the employment contract, disciplinary issues, or economic reasons, subject to the provisions of the Labor Code.

Work Permits and Immigration: If hiring foreign employees through an EOR, it is necessary to comply with the immigration laws and regulations of the Dominican Republic. EORs assist in obtaining the required work permits and visas for foreign employees, ensuring compliance with immigration requirements.

Health and Safety: Employers, including EORs, are responsible for providing a safe and healthy work environment. They must comply with the Occupational Health and Safety regulations, including implementing safety measures, necessary training, and ensuring compliance with workplace health and safety standards.

Businesses need to work with EORs with a deep understanding of the Dominican Republic’s employment law framework. These EORs ensure compliance with labor laws, taxation, and other regulatory requirements, minimizing the risk of legal issues and ensuring a smooth employment process for employers and employees.

Legal Requirements Your PEO Will Oversee

In the Dominican Republic, workers are legally entitled to a number of requirements. As part of the compliance guarantee that an EOR in the Dominican Republic will offer you, the firm will fulfill these requirements for you. This is a list of some of the most important and relevant details:

Enforcing statutory limits on working hours: Working hours stand at 44 hours per week and 8 hours per day for full-time workers, and 29 hours per week for part-time employees.

Adhering to provisions regarding additional pay: Reasons for additional pay and special statutory leave include maternity or compassionate leave.

Honoring all national holidays. In the Dominican Republic there are 12 national holidays annually.

Guarantee the minimum wage: The EOR must guarantee that any employee will receive at least the national minimum wage — which varies according to sector and company size, among other factors.

Complying with nationality quotas: Dominican firms are obliged to have at least 80% local staff.

Bonuses: The EOR must ensure the company is paying any contractually agreed bonuses in a timely manner.

Maternity and paternity leave

A total of 12 weeks of paid maternity leave is granted to new mothers, beginning six weeks before the expected date of the birth. Dominican employment law also provides for two days of paid paternity leave for new fathers, to be granted following the birth.

Sick leave

Under employment law in the Dominican Republic, employees are not entitled to paid sick leave and, as such, it is at the employer’s discretion to remunerate time missed due to illness.

Bereavement leave

Bereavement leave totaling three days is granted in the event of the loss of a parent, child, partner, or other dependent.

How to use a payroll calculator to understand the costs of a PEO in the Dominican Republic

If you want to get an idea of the possible costs involved in payroll outsourcing in the Dominican Republic, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in the Dominican Republic would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on using a PEO in the Dominican Republic

Based on our experience these are the common questions and doubts of our clients.

1. How does one hire employees in the Dominican Republic?

You can hire an employee by incorporating your own legal entity in the Dominican Republic and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in the Dominican Republic by acting as the legal employer. Meaning you do not need a Dominican Republic legal entity to hire local employees.

2. What is in a standard employment contract in the Dominican Republic?

A standard Dominican Republic employment contract should be written in Spanish (and can also be in English) and must contain the following information:

- ID and address of the employer and employee

- City and date

- The location where the service will be provided.

- Type of tasks to be carried out

- Remuneration and bonifications/commissions (if applicable)

- Method payment frequency

- Duration of the contract.

- Probation period

- Work hours

- Additional benefits (if applicable)

3. What are the mandatory employment benefits in the Dominican Republic?

The mandatory employment benefits in the Dominican Republic are the following:

- Working tools necessary to carry out the work (if applicable)

- Payment of social security contributions (health, pension, and labor risks).

- Social benefits (severance pay, Christmas bonus, maternity, or paternity leave, profit sharing).

- Paid time-off (vacation and a day off).

- Transportation allowance (if applicable)

- Overtime and surcharges (if applicable)

For more information on mandatory employment benefits read our recent article on employment laws in the Dominican Republic.

4. What is the total cost for an employer to hire an employee in the Dominican Republic?

The total cost for an employer is 16.39% percent of the employee’s salary, which must be paid and reported to the Dominican Republic Social Security monthly.

Please use our Payroll Calculator to calculate employment costs.

5. How does a PEO in the Dominican Republic save costs on hiring staff?

Time is money. Hiring a PEO will save you a substantial amount of time and will decrease costs for your business. The grounds that PEOs allow you to offer more advantages to your employees at a reduced rate. A PEO can show signs of improvement rate for benefits like retirement plans, worker’s compensation, insurances, medical benefits and so forth. Through this, a PEO could save you a significant amount of money.

Furthermore, being fully compliant with employment law in the Dominican Republic will lower your risks of receiving penalties because your company fulfills all the legal requirements of the employee management services.

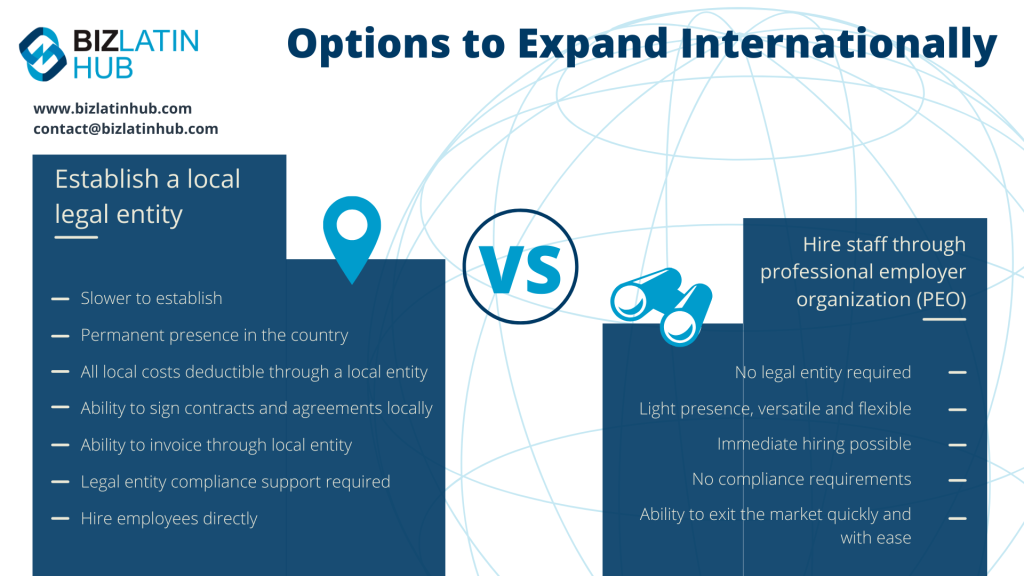

6. What is the difference between hiring through an EOR and forming a legal entity?

Forming a legal entity is different to hiring an EOR in the following ways:

- Slower to establish.

- Permanent presence in the country.

- All costs deductible through a local entity.

- Ability to sign contracts and agreements locally.

- Ability to invoice through local entity.

- Legal entity compliance support required.

- Hire employees directly.

Why invest in the Dominican Republic?

The Dominican Republic is the eighth-largest economy in Latin America by gross domestic product (GDP), and the largest in the Caribbean. It has experienced significant growth over recent decades, only registering a decline in GDP during one year since 1985. In 2019, GDP hit USD$113.5 billion.

The Dominican Republic-Central American Free Trade Agreement (CAFTA-DR) provides businesses based in the Caribbean nation with preferential access to markets in the United States and most countries in Central America. The Dominican Republic is also a member of the Caribbean Community (Caricom), providing its businesses access to 14 other economies in the Caribbean, and to the European Union via a free trade agreement (FTA).

Key economic sectors in the Dominican Republic include hospitality, tourism, and manufacturing of textiles and pharmaceuticals. The textile and pharmaceutical industries draw approximately 40% of the foreign direct investment (FDI) into the country’s free trade zones (FTZs), which recent legislation allows foreigners to invest in.

In 2022, the country’s total net inflows of FDI stood at more than USD$3.96 billion. Among the country’s key exports are gold, medical equipment, tobacco, and bananas. And the main recipients of Dominican goods are Canada, China, India, and the United States. If you are interested in doing business in this prosperous and growing market, read on to understand what an EOR in the Dominican Republic will be able to do for you.

Biz Latin Hub can be your provider of PEO in the Dominican Republic

At Biz Latin Hub we offer a full range of market entry and back-office services in Latin America, including as a PEO provider in the Dominican Republic. Our team of multilingual legal and accounting experts specializes in assisting foreign companies with all their corporate needs to enter a new market.

As your PEO provider, we help you find and hire local talent professionally, efficiently, and most importantly, in full compliance with Dominican law.

Contact us today to find out more about how we can support you.

For more information about hiring through a PEO solution in Latin America, see our short presentation below about your options, created by our employment and payroll specialists. Learn more about our team and expert authors.