The panorama of Latin American Politics has been shifting unexpectedly, economies are changing and the world at large seems to be headed towards recession. For most expats and executives living in LATAM, the question is how to confront such present and future. How to keep your savings accessible, invested and safe. Those of you looking for specialist investment funds to manage your money have some complicated choices. In this article we tell you why offshore investment funds can be a great option for you as an expat.

SEE ALSO: Investment Options as an EXPAT

Why offshore expat investment funds in the first place?

Financial products aren’t a one size fits all affair. As an expat or an executive who may travel from temporary posting to posting your needs are unique. An investment fund that adequately caters to your needs must be able to balance the following:

- Tax efficiency: The lowest possible tax burden on your investment

- Regulation: Key in providing you with the safety, you will doubtlessly want, is how an investment fund is overseen, what norms and laws they must comply with and who they regulated by and how that regulation is enacted

- The Product: Ultimately the most important part of any investment fund is the financial products that they offer, whether there is a varied portfolio on offer and what kind liquidity the fund offers

- Currency: What currencies are available – this may prove key in deciding whether a fund suits your specific needs

- Accessibility: Whether or not a fund allows you free access to your funds is also an important factor

- Costs: What are the flat rates (base fees), management fees and transaction costs, you’re paying so make sure this as low as possible

1. Tax efficiency

Location is very important, as with regulation, the location of your offshore investment fund will decide how your investments are taxed. Aiming to invest in places like the Bahamas, the British Virgin Islands and Bermuda assure that your investment is the paying the minimum of tax possible. Countries like Bermuda have no tax on investment funds, so when your fund grows in value you aren’t paying for the privilege. Of course, when that money arrives to your personal account it will be subject to the tax laws of the country in which you reside.

2. Regulation – Offshore Investment

Why is it important to know about regulation?

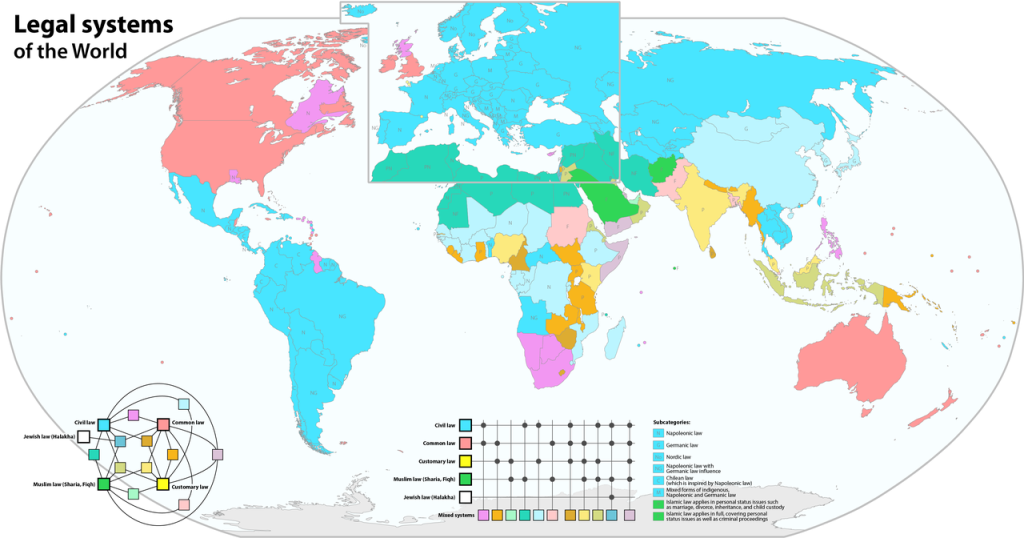

When considering which country, you want your offshore investment fund to be in regulation is also important. Whether they have a common law basis or a Napoleonic law basis can make a difference in the responsibility’s funds have to their investors.

Also regulatory bodies like the Bermuda Monetary Authority (BMA) or the Central bank of the Bahamas are vital in guaranteeing financial fair play and ensuring that funds are guaranteed by financial institutions.

Making sure your money is in a well regulated fund is a significant part of choosing the right fund for you.

3. What Investment Product are you investing in?

Any fund worth considering should offer you a wide variety of Stocks and ETFs, Options, Funds, options in the FX and Metals markets, Futures and of course Crypto Funds.

You are investing to make sure your money doesn’t lose any of its value and to make sure that your capital will increase in value. As a person who may be geographically mobile you may not have a predictable future in terms of what your personal circumstances may be. That shouldn’t mean you shouldn’t have a stable economic one. Try to balance a decent return with acceptable levels of risk. A sufficiently diverse fund should be able to facilitate you with a portfolio that allows you a mix of higher risk higher reward products and more stable lower reward products.

Look for diversity in any fund, it’s as simple as that.

4. What currency do you hold in your offshore investments?

This is an important consideration. Again a good fund ought to offer you a variety of currency options. Currency exchange, fluctuation and devaluation can cause unexpected costs and therefore are to be avoided if possible.

Most funds will offer you USD, GBP and Euro however there are many funds that may offer a range of other currencies. When comparing two or more funds this may be a real deciding factor if they are offering otherwise similar services.

5. Accessibility

How your money is accessed is one of the main issues surrounding an offshore investment.

Most funds will require a minimum value to be kept in an account. For example if you were to put $30,000 USD in a fund the minimum value required in your account might be $10,000 USD. Understanding the minimum value required in an account is crucial before making any investment.

Equally it is important to understand when and how your account can be closed out. There may be establishment periods or similar concepts which refer to an initial period after you have opened an account in which you may be penalized for closing it.

Understanding how withdrawals and account closures are structured are an important part of choosing an offshore investment fund.

6. Costs when investing offshore?

There is no such thing as a free lunch and unfortunately that holds true in the offshoring investment world too. There is a cost structure involved in any fund you will encounter. The normal costs that you will encounter are the flat rates (base fees), management fees and transaction costs however you may also have surrender fees (the cost of closing an account), early surrender fees (the cost of closing an account before a certain period of time has elapsed) and investment transfer fees (charged when merging other investments with your portfolio).

It is difficult to generalize all these costs as most funds will do things a little differently. Having good knowledge of the cost structure of any firm is important. The way costs are structured may benefit your particular situation more with one fund than another and of course the period of time you wish to invest for will be an important factor too.

7. Your role

Choosing offshore investment funds will require you to carefully investigate every fund you are interested in and have a clear criteria of what conditions best suit your needs.

You will need a clear strategy on what kind of investments and returns you want.

Additionally you will need professional advice on how to navigate the legal and tax structures of your country of residence as regards your investment.

Offshore investment funds are excellent vehicles for your capital and may offer stability from adverse local economic conditions. As in all things there are good, bad and mediocre funds. Research and rigorous investigation are required. You must organize your personal financial and tax situation to maximize your benefits. But when all is said and done there are few other alternatives that are so well suited to Expats and Executives.

Biz Latin Hub has a highly qualified team that can assist you in your offshore investment process

At the Biz Latin Hub we have a strong reputation for being the market leaders in working with clients to understand and operate within the local market, and likewise we are well positioned to direct you to a reputable financial advisor that will support your investment decisions. Choosing the right investment advisor when doing offshore investment can mean the difference between low or high returns.

Contact us today to find out more about how we can assist you. Also, read about our team and expert authors.