Conducting an entity health check in Peru is increasingly important due to the set of local regulations outlining fiscal responsibilities and corporate compliance in the country. Even though investing in and incorporating a business in Peru can be profitable, there are specific processes and requirements such as law 30424 for establishing an entity and complying with fiscal and statutory law.

Key takeaways on an entity health check in Peru

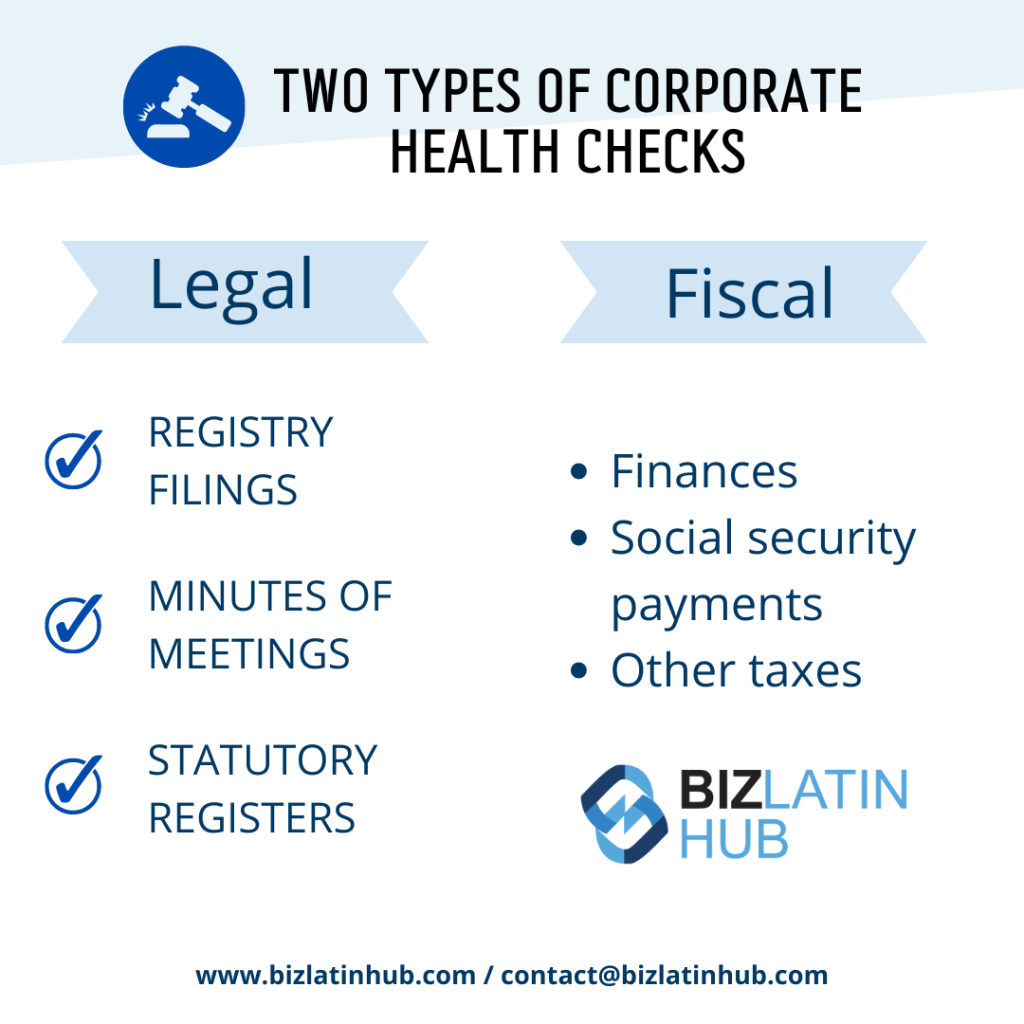

| Types of entity health check in Peru | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Why have an entity health check in Peru? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| Are entity health checks in Peru necessary? | It is not a legal necessity in of itself, but it will help you make sure you are staying compliant. |

| Who conducts an entity health check in Peru? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Peruvian company law. |

Why is it important to have an entity health check in Peru?

Businesses want to avoid any confusion or mishap that would damage their reputation or result in severe penalties. It is strongly recommended to conduct an entity health check in Peru, as it’s not uncommon to find even minor irregularities or risks in small and large businesses that you otherwise wouldn’t have been aware of. Entity health checks are crucial for identifying and remedying any risks early on when doing business in Peru.

Risk mitigation

Penalties that you could avoid by conducting an entity health check include temporary closure, permanent closure, financial sanctions, restriction to work with the government, bad reputation, amongst others.

Prevention law

In 2016, the government implemented Law N. 30424, a piece of legislation that established the economic and administrative responsibility for certain types of crimes. This law states that the business is responsible for specified crimes that occur in or through a business unless it can be accredited that it has an effective prevention model, consisting of surveillance and control measures suitable to prevent or mitigate such criminal risk.

This law is an example of the relevance that corporate compliance has in the country. Although developing this system isn’t compulsory, it can be beneficiary to avoid confusions and mitigate risks if activities not aligned with the law happen to occur by human error or other events out of the company’s control

Furthermore, In 2019, this law was amended to specify the aspects that these control measures should include:

- Identification, evaluation and mitigation of risks.

- Appointment of a prevention officer

- Implementation of internal complaint procedures

- Dissemination and periodic training of the prevention model

- Evaluation and continuous monitoring of the prevention model

- Policies for specific risk areas

- Activity log and internal controls

- Integration of the prevention model in commercial processes

- Appointment of an internal audit body

- Procedures that guarantee the interruption or remediation of risks

- Continuous improvement of the model.

Companies that are in the incorporation or expansion process can assure they are compliant with laws such as N. 30424. This can greatly contribute to being on top of tax, legal and regulatory compliance.

What is an entity health check in Peru?

An entity health check, also known as a corporate health check, is a service that assesses your business’ legal status and compliance with Peru’s tax regulations, employment laws, and other industry-specific laws. The results of the check will uncover any gap in your commercial contracts that may put your business at risk and will identify any unknown issue with your taxes and licenses.

Entity health checks are conducted by external, independent auditors that are experts in corporate compliance. Typically, entity health checks investigate both the fiscal and legal status of a business.

Fiscal entity health check in Peru

A fiscal health check will make sure that your finances, social security payments, and taxes are compliant with regulations and provide you with data that will be useful for your future decisions and strategies. For instance, you may discover invoices that your business was incurring over the year that haven’t been paid, or that your business inadvertently falls short of corporate compliance as a result of a recently reformed tax policy.

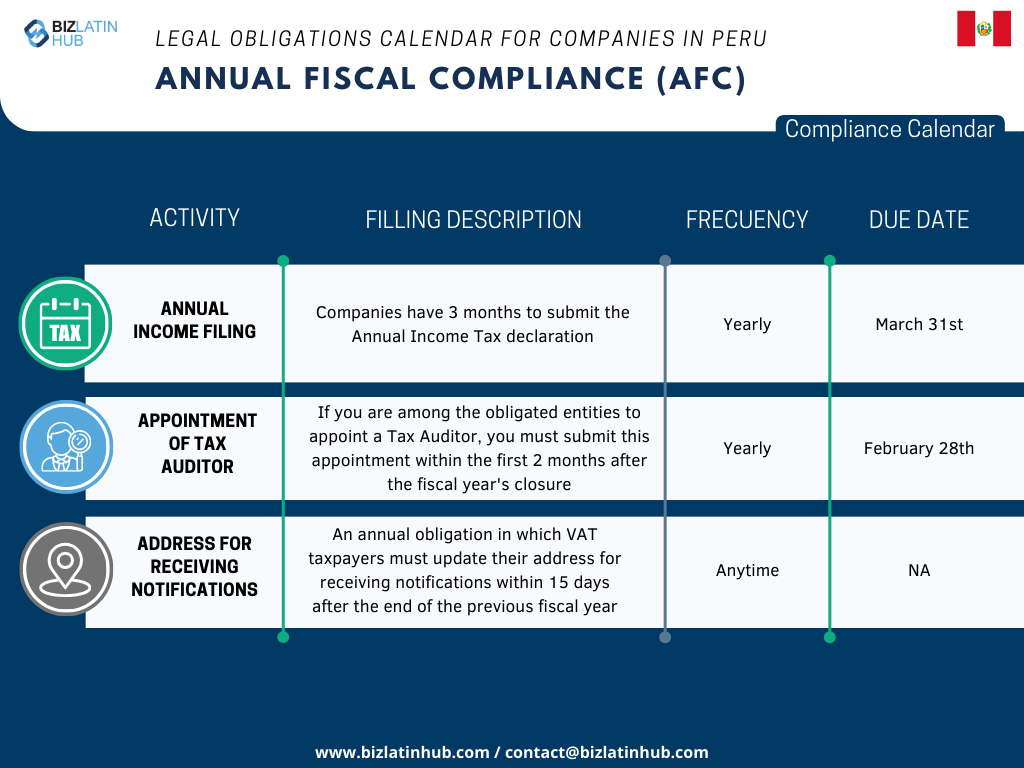

If conducting the entity health check around the appropriate time of the year, tax issues found could be avoided before the government issues any relevant penalties for non-compliance.

Legal health check

An entity health check with a legal focus reviews commercial contracts, intellectual property protection, employment contracts, and other industry-specific regulations. The industry in which your business operates is also important to consider when conducting a legal entity health check in Peru. There can be industry-specific regulations that businesses need to comply with, which you may not have previously been aware of.

For instance, a manufacturing business will focus on distribution contracts and suppliers. An entity health check will uncover any unfair terms of agreement or gaps that can create risk on your side.

Who can benefit from an entity health check in Peru?

Any small or large entity can benefit from an entity health check. When expanding a business abroad, it is particularly important to get assistance from local legal experts who can conduct these checks for you, and offer guidance on how to comply with local corporate law.

Businesses who particularly benefit from an entity health check in Peru include (but are not limited to:

Startups

An entity health check in Peru can benefit new arrivals to the market who lack knowledge or interaction with local corporate regulations. With a focus on growing a business, startup entrepreneurs may not necessarily focus on building watertight contracts initially or keeping track of any industry-specific requirements. As the business grows, gaps or issues in contracts can result in legal issues further down the line.

For instance, intellectual property is key for startups as often times the ownership of creations isn’t clearly defined. Startups often start with people working on the product before establishing a legal entity, in this sense, the ownership of the product could belong to these individuals. Entity health checks could help you define the rights of your company’s creation before it becomes a complex issue.

Mergers and Acquisitions

When considering acquiring a seemingly attractive business, it is important to conduct a thorough check on all aspects regarding the entity and its legal status or ‘health’.

Investors looking at incorporating a business in Peru must understand its current situation regarding any debt, contracts, fines, and financial statements. Knowing about the business’ health and any relevant risk factors makes it easier for prospective buyers to negotiate a fair agreement for its acquisition.

Parent companies with foreign branch offices

When expanding to Peru, companies need to understand the different legislation regarding zones, work culture, and performance, amongst other key issues.

To keep track of your branch’s performance as a parent company based outside of Peru and avoid potential legal issues, it is recommended to conduct entity health checks by external auditors within Peru. They’ll keep the parent company informed of the legal and fiscal status of its foreign branch, without the parent company needing in-house expertise to stay compliant with local law.

FAQs on an entity health check in Peru

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Peru?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

Biz Latin Hub can help with an entity health check in Peru

Investing in Peru is considered a safe option in the region due to a stable economic and political climate. With opportunities in industries such as agribusiness, financial services (fintech), retail, mining and many more, incorporating a business in the Andean country can be a profitable venture.

Make sure your business is compliant with its fiscal and legal duties through an entity health check in Peru, and get your business off the ground with the assistance of expert auditors.

At Biz Latin Hub, we help investors from all over the world incorporate their business in Peru and we provide auditing services regarding entity health checks, taxes and corporate and trade law. Our team of local lawyers is ready to assist your business and contribute to your success and growth in Peru. Contact us today for a consultation.

Learn more about our team and expert authors.