Just as people need a checkup at the doctor’s office at least once a year, companies should also routinely perform an entity health check in Mexico for their subsidiary or branch. It’s recommended to conduct these checks annually. Hiring external auditors to review the status of your company after company formation in Mexico protects it from unforeseen penalties and manages the risk of non-compliance.

Key takeaways on an entity health check in Mexico

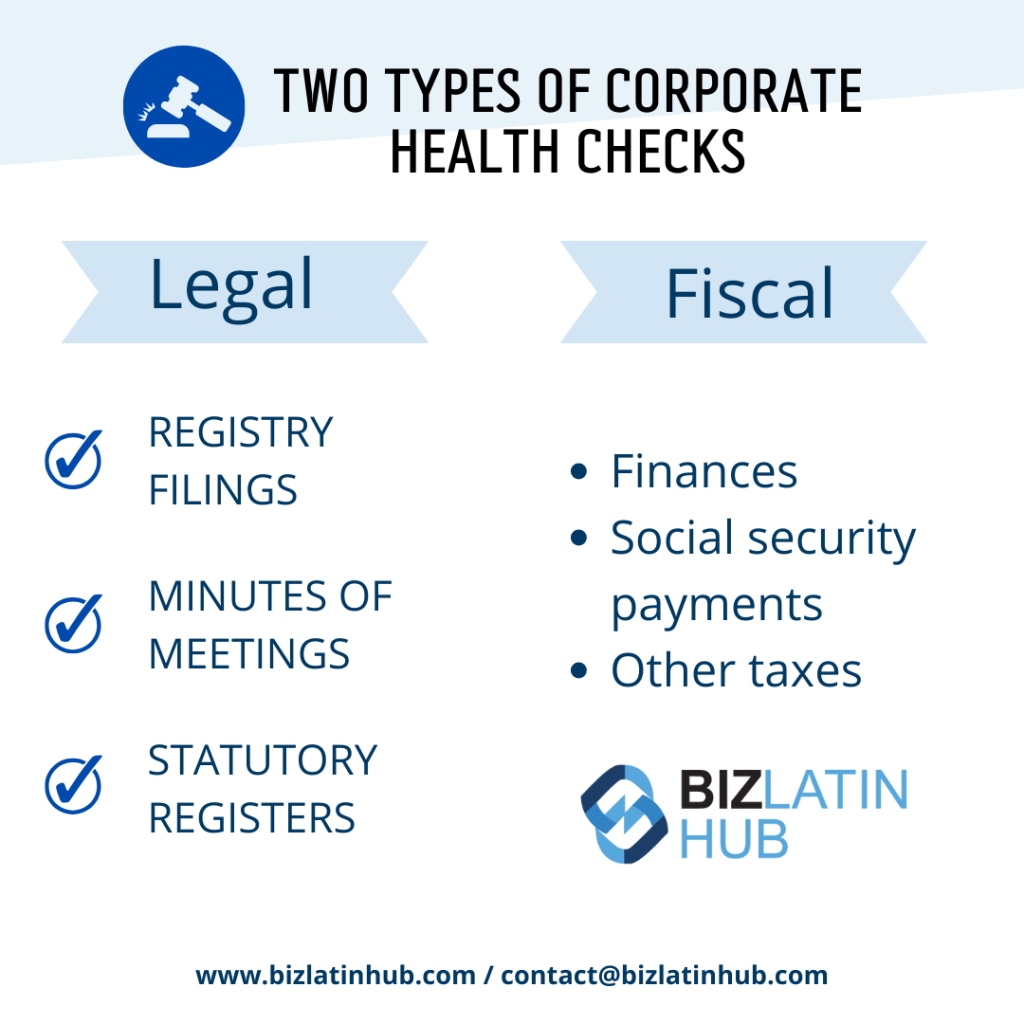

| Types of entity health check in Mexico | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Why have an entity health check in Mexico? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| Are entity health checks necessary in Mexico? | It is not a legal necessity in of itself, but it will help you make sure you are staying compliant. |

| Who conducts an entity health check in Mexico? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Mexican company law. |

What is an entity health check in Mexico?

Generally speaking, an entity health check in Mexico is an overall assessment of the critical elements of the company. This health check is often referred to as corporate compliance and fiscal and legal compliance and is part of ensuring commercial due diligence.

This health check reflects what, if anything, your company needs to do to stay compliant with local law. Sometimes a company’s Directors cannot accurately assess the overall compliance status, or don’t possess the legal or financial know-how to understand their compliance requirements in Mexico. It pays to get a professional external auditor to conduct this review on the company’s behalf.

The checks review all fiscal, legal and other operational activities of a company, and raise any discrepancies or issues to be remedied. This includes:

- Assessing the commercial context of the company – are there any specific requirements the company must adhere to specific to its industry or activity?

- Reviewing registry filings, minutes of meetings and statutory registers

- Evaluating finances, social security payments and other taxes.

When should I get an entity health check for my company?

It’s a good idea to get an entity health check routinely, but it’s also a useful tool for:

- Demonstrating to potential partners and clients that you’re working in full compliance with regulations in Mexico

- Checking the status of a company before acquiring or merging with it

- Applying for a loan or other type of funding.

Corporate compliance in Mexico

Corporate compliance in Mexico is broken down into several areas.

Business objectives: Does the company follows its initial vision and maintain its company policies? The company must follow the strategies and plans laid out in its own policies and constitution.

Legal compliance: assessing contracts, corporate books, leasing arrangements, shareholder meetings, intellectual property documentation, and other key legal paperwork.

Finance and cash flow: The company must undertake regular reviews of its finances and bookkeeping. These are essential for decision making for the Directors and members of the board. The company’s financial experts must ensure that cash flow meets the requirements to generate a positive cash flow.

Human Resources: For many companies, people are their most important asset. A detailed entity health check should therefore also include a plan for optimal development of human resources practices to find and manage the best people to run the business.

Legal compliance requirements

Along with corporate compliance, a company must comply with two main areas that are vital for the proper function of the company: legal and fiscal compliance.

It is crucial to regularly review the company’s legal corporate activity in Mexico. Documentation that would fall under this area of an entity health check in Mexico include (but is not limited to):

- contracts signed with third parties

- corporate books (including minutes and other shareholder meeting notes)

- landlord or leasing agencies

- intellectual property agreements or trademark registrations.

In Mexico, all companies must hold an ordinary shareholders meeting once a year. For this, all information regarding the increase of capital stock, admission of new shareholders, and other agreements reached at the assembly must be stated and notarized to comply with Mexican corporate regulations.

Fiscal compliance requirements

The fiscal review is arguably the most important part of the entity health check in Mexico. It includes a complete audit of the company’s compliance picture with the tax institution in Mexico, SAT (Sistema de Administracion Tributaria).

The SAT produces a certification of good standing to a company, called ‘Opinión Del Cumplimiento de Obligaciones Fiscales’. This certification confirms whether or not the company is in full compliance with all mandatory fiscal contributions in Mexico. If applicable, it will outline any outstanding fiscal obligations the company has not complied with.

A negative certification can affect a company’s credit score and result in visits from the fiscal authorities, fines, surcharges, and other complications.

For the fiscal entity health check in Mexico, it’s important to keep in mind that for any legal activities such as liquidation, dissolution, and merging, the company must be fully compliant with its fiscal obligations in order to proceed.

FAQs on an entity health check in Mexico

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Mexico?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

Engage with Biz Latin Hub to complete your entity health check in Mexico

You’ll need to engage with experienced, trusted auditors to undertake a comprehensive entity health check in Mexico for your company. Conducting routine entity health and compliance checks protects your business and its operations from penalties imposed by government institutions

At Biz Latin Hub, our auditors conduct comprehensive compliance reviews for companies in Mexico and the wider Latin American region. Our team of local and expatriate professionals offer support and advice to improve your company’s corporate compliance, lifting its value and managing non-compliance risk.

Contact our multilingual legal and accounting experts today here at Biz Latin Hub for tailored support for your operations in Mexico.

Learn about our team and expert authors.