Getting an entity health check in Australia is a vital step before incorporating a company in the country. As it becomes an exciting destination for foreign investors, Australia offers a favorable business environment, promoted by a dynamic and competitive economy and it takes corporate compliance very seriously. Thus, an entity health check will allow you to access critical information to understand the risks and opportunities when doing business in Australia. This guide explains why a proactive compliance audit is a crucial part of risk management and details the primary areas of review for any Australian proprietary company.

Key takeaways on an entity health check in Australia

| What is a corporate entity health check? | An entity health check is a detailed diagnostic of a company’s statutory records and filings. |

| What are the key areas reviewed for an Australian company? | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Which authorities will a health check look at? | It verifies compliance with ASIC and the Australian Taxation Office (ATO). |

| Will a health check look at tax obligations? | A health check ensures the annual statement has been reviewed and paid. |

| Why is the resident director requirement a critical compliance point? | This is a legal requirement in Australia. |

The Importance of a Corporate Health Check in Australia

An entity health check is a comprehensive review of a company’s statutory records and obligations. Its purpose is to ensure the company is meeting all its legal duties under the Corporations Act 2001, thereby protecting the company and its directors from significant financial and legal penalties.

An entity health check in Australia is the best way to identify and calculate the risks and challenges executives may face when expanding their business in the country. It relies on a due diligence process to determine whether a company is fully compliant with local regulations or not.

In the same way, an entity health check refers to a detailed professional investigation that examines a company’s legal and accountancy data, human resources processes, and environmental practices to calculate future contingencies.

Main Areas of an Australian Entity Health Check

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Expert Tip: Reviewing the ASIC Annual Statement

From our experience, a common point of failure for foreign-owned companies in Australia is the handling of the ASIC annual statement. ASIC sends this statement to the company’s registered agent shortly after the anniversary of its incorporation. This is not just an invoice for the annual fee; it is a legal document that the directors must review to ensure all company details are correct.

Failure to pay the fee on time incurs significant late penalties, and failure to notify ASIC of any changes to the company’s details is a breach of the Corporations Act. A health check must verify not only that the annual fee was paid but that the details on the last statement were accurate.

1. Corporate Compliance with ASIC

This audit verifies that the company has paid its annual review fee, that its details on the ASIC register are correct, and that all required notifications of changes (e.g., of address or directorship) have been filed.

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in Australia.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

2. Director and Officer Duties

This review confirms that the company is meeting its obligations under the Corporations Act, including maintaining a resident director and a resident Public Officer for tax purposes.

3. Tax Compliance with the ATO

This involves reviewing the company’s status for income tax, GST, and Pay As You Go (PAYG) withholding to ensure all returns are filed and payments are up-to-date.

4. Financial Reporting and Records

This check ensures the company is keeping sufficient financial records to explain its transactions and financial position, as required by law.

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

Evaluating legal, financial and other aspects

An entity health check may vary in terms of extension, scope, and depth. It can include legal information but also commercial and financial records. A basic entity health check should cover the following aspects:

- Basic company details such as the name, commercial address, type of industry, and shareholders

- License numbers, operational status, legal address, and representatives

- Analysis of potential risks and credit ratings

- Tax compliance

- Parent company/shareholders information

- Legal background of the company

- Litigations

- Encumbrances.

Due diligence in Australia

An entity health check in Australia is essential if you are looking to invest in a locally based company. It requires an in-depth audit of a potential acquisition or investment, aimed to mitigate possible risks and unexpected expenses that may arise in the future.

Likewise, an entity health check is the best way to diagnose symptoms of poor management practices, and troubleshoot operational issues that hold reputational risk, or could lead to legal inconsistencies, or even license suspensions.

An entity health check undertaken by experts will help you make the best possible informed decisions before doing business in Australia.

FAQs on an entity health check in Australia

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

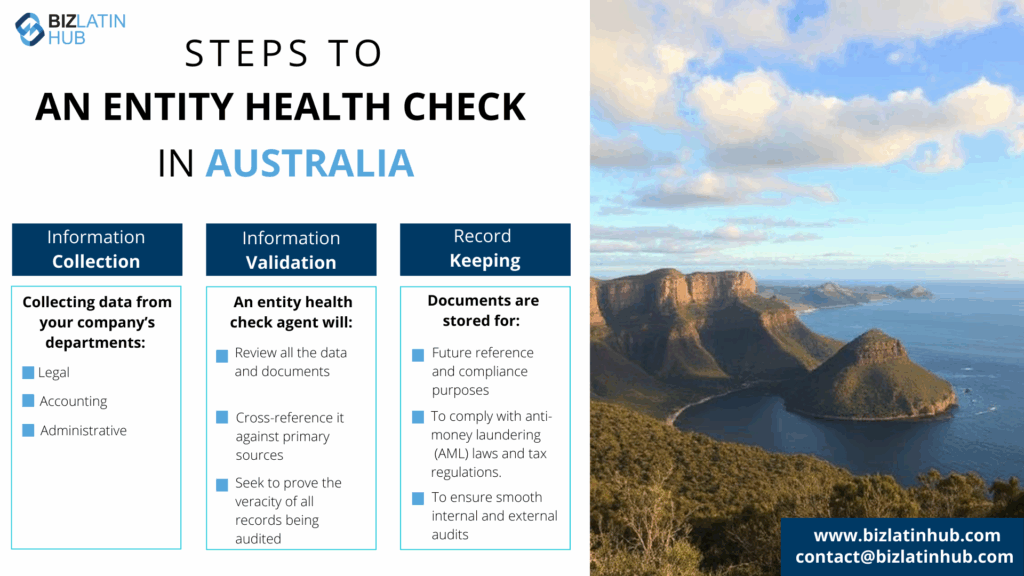

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Australia?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

5. What is ASIC?

ASIC stands for the Australian Securities and Investments Commission. It is Australia’s corporate regulator, responsible for registering companies and enforcing the Corporations Act 2001.

6. What is the ATO?

The ATO is the Australian Taxation Office, the government’s main tax collection agency. A health check verifies the company’s compliance with its obligations for income tax, Goods and Services Tax (GST), and employee payroll taxes.

7. What is the resident director requirement?

For a proprietary company, at least one director must ordinarily reside in Australia. This is a strict requirement, and failure to maintain a resident director at all times is a serious compliance breach.

8. What happens if a company is non-compliant?

Non-compliance with ASIC or the ATO can lead to significant late fees, financial penalties, and, in serious cases, prosecution of the company’s directors. It can also lead to the involuntary deregistration of the company.

Biz Latin Hub can help carry out your entity health check in Australia

Although Australia is a very favorable business destination, there may arise some complexities when doing business abroad due to legal and cultural hoops. At Biz Latin Hub, we have a group of professionals that offer services that can help you tax compliance and all other complexities that may arise when doing business in Latin America. We provide solutions tailored to your specific needs.

Biz Latin Hub specializes in assisting market entry to new foreign businesses. We provide a range of legal and financial services to aid in the incorporation and ongoing operations of your company in full compliance with Australian law.

Get in touch with us to start your international business adventure now.

Learn more about our team and expert authors.