If we look back to 2018, we have seen an impressive year for financial technology or ‘Fintech’ startups. As an interesting note, the market cap of the Matrix FinTech Index grew 50 percentage points in 2018, which is expected to continue its upward trend. Fintech in Costa Rica is not currently well developed, but shows great potential.

Latin America – and Costa Rica in particular – is quickly responding to this market development. In 2018, the Digital Readiness Index by Cisco measured the digital preparation of 118 countries, 19 of which are from Latin America. According to the index, the country ranked third in Latin America, meaning fintech in Costa Rica is ready for FDI.

Biz Latin Hub can help you respond to the need for fintech in Costa Rica by smoothing over the path to market entry in the country. While it is open to foreign investment, there are some local specifics that may trip up unwary businessfolk. As regional specialists, we can help you to register a company in Costa Rica, whether that’s in fintech or any other sector.

Fintech developments in Costa Rica

Bill Gates – co-founder of Microsoft – once said: “financial services will always be necessary, but not necessarily banks.’’ This statement is an insightful nod to the future of Fintech.

Fintech forms a link between finance and technology and is translated into the use of technology to provide financial services or create innovative products that are not related to a physical financial institution directly. In this way, the business model is changing as everything becomes more oriented towards online financial services.

The focus has been on enhancing the value to customers such as:

- providing straightforward online registration processes.

- resolving customer requests in the shortest possible time.

- personalizing customer service treatment to each client.

- finding ways to reach out to people who haven’t opened a bank account.

Fintech in Costa Rica: untapped potential

Loans between people and financial institutions have enormous potential in Latin America. This offers great potential in the Fintech sector that has not yet breached the surface. Traditional banking has not yet developed proper online mechanisms to make transactions faster and smoother. The lack of investment alternatives and the constant request for more accessible credits indicate the size of the opportunity in Costa Rica.

Even though Fintech-focussed organizations have been around for approximately 20 years, the Latin American tech startup environment is only now shifting into a more proactive attitude regarding their value. Estimates say around a quarter of consumers have access to an online bank account in Latin America.

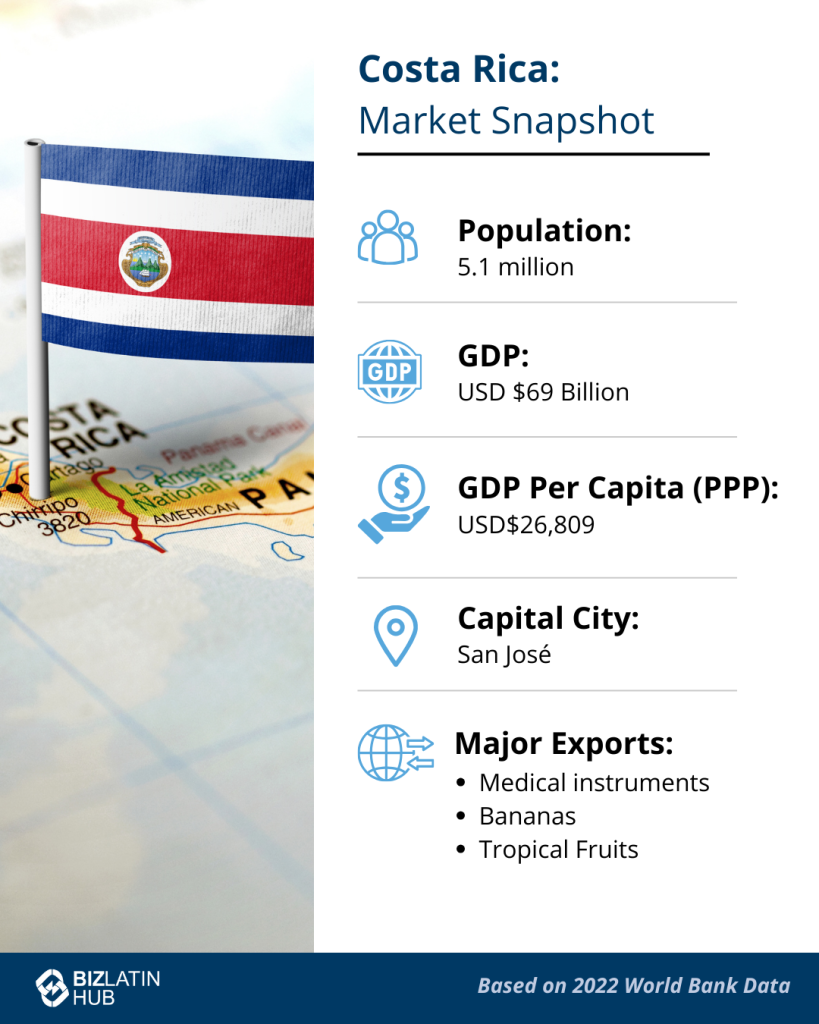

One of the reasons why Costa Rica is host to a booming Fintech sector is because the territory offers a highly-educated workforce, lower labor costs, a strong macroeconomic framework, and it is among the safest countries in Latin America. In the same vein, Costa Ricans put their faith mainly in digitalization, which demands financial institutions to be innovative, agile and to speed up their services.

However, in the country, the trend of financial technology is relatively new. Right now, there are just 7 prominent Fintech actors in the market that share activities such as online payments, loans, and commerce. Competitively, these actors are still far from squaring up against the largest banks.

Costa Rica’s untapped potential for foreign Fintech hubs offer opportunities that should be considered for Fintech investment:

- The insurance market demands enhanced connectivity between insurance companies and clients

- The real estate sector is booming in Costa Rica, and demand for mortgages will therefore rise

- Digital signatures can be used for company operations, paving the way for Fintech companies to perform business activities online.

A budding online business climate and relatively low levels of competition make Costa Rica a hotspot for future Fintech growth.

Private banks promote alliances with Fintech companies

Major Costa Rican financial institutions are willing to form alliances and agreements with these Fintech companies, as well as invest in the development of their technology platforms. These alliances would become a win-win since they reduce administrative burdens and maximize resources. The front end of these alliances manifests in an advanced online platform and user experience.

New impulses in this line of development come from the Scotiabank, which have begun to develop sponsorship programs with techno-financial startups so that they can develop quality and optimized services.

Mario Hernández, president of Impesa – one of the 7 major actors in the Costa Rican Fintech industry – believes many banks and financial institutions now see Fintech companies as their allies, as they can support them in the automation of their processes. This creates new business opportunities to Fintech specialists who can help financial institutions with their ‘old-fashion’ way of banking. Therefore, Fintech can be allies or competition of banks, but in any case, we agree on the promising future of digital banking.

Fintech legal challenges

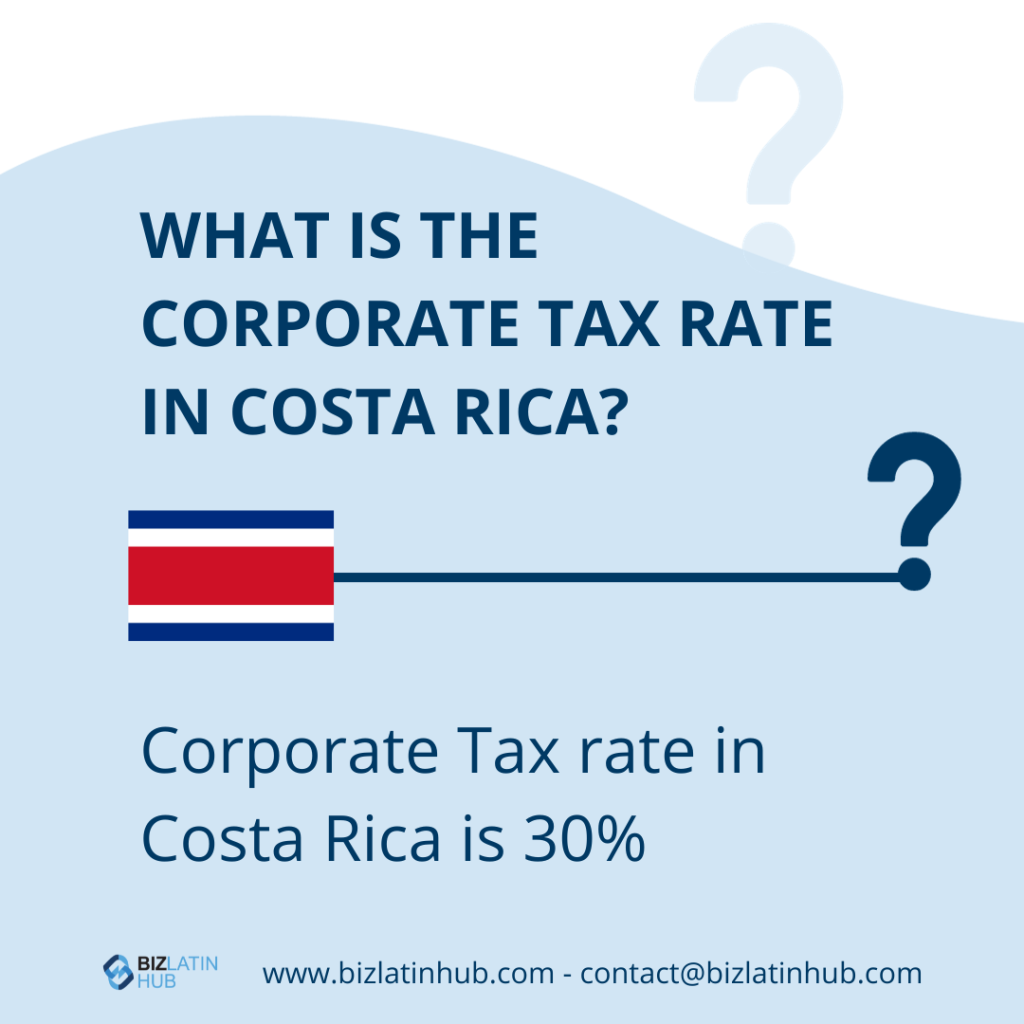

The evolution of the financial market is increasingly accelerated and is based on the transformation to online services. Technology will always advance faster than the law, and this phenomenon poses challenges to governing authorities.

As in many countries, fintech in Costa Rica has practically no regulations yet governing the use of Blockchain, and the development of Smart Contracts. However, some regulations do already exist in order to protect personal data.

For instance, the provisions of the Civil Code, the Commercial Code and Law No. 8454 ‘Law on Certificates, Digital Signatures and Electronic Documents’ establish rules of functional equivalence between physical and digital documents.

Regarding the digital signature that validates identities in a more secure way – which is necessary for Fintech – Costa Rica applies a law about the Standards for the Protection of Personal Data.

The challenge to facilitate innovations and modernize financial services lies in whether or not more regulations are required. Relevant regulation can support the development of innovation and the digital transformation, getting the right controls, protecting consumers and healthy market development.

Biz Latin Hub can help with fintech in Costa Rica

The upcoming Fintech Industry is one of the reasons why Costa Rica is one of the centers of entrepreneurship in Latin America in 2019. In addition, internet penetration and mobile telephony influence the adoption and use of online financial services. In this context, we are sure Fintech business opportunities are on the rise, and especially Costa Rica will be ready to adopt these innovations with pleasure.

However, regulatory authorities will adopt new standards regarding data protection, transparency and responsibility, with the aim to put technological innovations on the economic agenda. This involves cooperation between regulatory authorities, financial institutions and Fintech startups.

It’s therefore advisable to team up with a local partner that specializes in personalized services such as legal & accounting, commercial presentation, or company formation. At Biz Latin Hub, we provide customized business solutions to customers and keep track of new market trends. This includes monitoring the rise of Fintech startups in Costa Rica.

For more information, please contact our Costa Rica office, and see how her local team can assist you. Watch our short video below for more information on expanding your business to Costa Rica.