A PEO in Australia is a valuable resource for testing market entry and establishing your business successfully. By managing critical HR functions, a PEO enables you to focus on scaling operations while remaining compliant. Collaborating with a trusted local partner is essential, and Biz Latin Hub delivers expert support with its extensive experience across Latin America and the Pacific. From market entry to company formation in Australia, we offer the services needed to help your business succeed in Australia and the wider region.

Key Takeaways

| Is it legal to hire in Australia through PEO services? | Yes it is legal to use PEO services in Australia to hire employees. |

| Benefits of hiring through a PEO in Australia | Hiring through a PEO in Australia leverages quick access to the market without the need to establish a local entity, letting you prioritize scaling-up. |

| Steps to hire through a PEO in Australia | Finalize an agreement with the third-party provider (PEO). Confirm the employment offer for the selected candidate. Issue the employment offer to the candidate. Upon the candidate’s acceptance, the PEO drafts and finalizes the employment contract. The candidate reviews and signs the contract. The PEO handles all mandatory employee registrations in Australia. The employee starts work, reporting directly to the foreign company. |

| Why employ Australian employees? | Australia has a highly skilled workforce with advanced skills and knowledge across various industries. |

What is a Professional Employer Organization (PEO) in Australia?

In general terms, people are probably more familiarized with the concept of a proprietary company than a Professional Employer Organization.

According to the US leader for Professional Employment Organisation industry news, NAPEO, “A professional employer organization (PEO) provides comprehensive HR solutions for small and mid-size businesses. Payroll, benefits, HR, tax administration, and regulatory compliance assistance are some of the many services PEO companies provide to growing businesses across the country.”

In other words, a PEO provides companies with human resource services. For those expanding into Australia, a PEO enables you to hire staff locally without having to formally incorporate a company in the country.

PEO services for expanding into Australia

By partnering with a PEO, you are giving the power to outsource many of your human resource functions such as employment liability, visa management, payroll and compliance. The PEO firm will become your overseas staff members’ ‘Employer of Record’. These organizations engaging with your management team to address complicated human resource-related matters as part of the team.

A PEO will hire the staff members you need to get your business off the ground in Australia. Typically, these are senior sales executives. They will manage all compliance paperwork and requirements for these staff in Australia, so your company doesn’t need to be physically present and registered in the country.

Key Kenefits of a PEO

A PEO service company can support business expansion into Australia by hiring and managing staff for your company without needing your physical presence in the country. This saves you the hassle of having to register your company in Australia, which is a more cost-effective approach in the short term.

By hiring employees through a PEO, you bypass strict compliance requirements in place for incorporating an entity in the country, which for Australia includes:

- Establishing a locally registered address (for fiscal purposes)

- Appointing a resident director and

- Appointing a public officer.

The Professional Employer Organization will ensure all employment compliance measures are met, freeing up your time to focus on other core elements of business. Your locally-based employees can then work to develop business and client relationships, and build brand awareness in advance of a full-scale market entry investment.

By electing a PEO to be your Employer of Record in Australia, you’re taking advantage of valuable economies of scale when it comes to group fee structures for insurance and compliance. Employees hired through PEO may also enjoy certain organizational benefits that smaller businesses can’t offer, such as health plans and insurance.

How to Partner With an Professional Employer Organization in Australia?

To partner with a PEO in Australia, the hiring company establishes an agreement with a third-party organization, appointing it as the Employer of Record (EOR) for the employees they wish to onboard. This makes the PEO/EOR responsible for complying with all Australian employment regulations, as outlined in official documentation.

This arrangement streamlines the hiring process for the foreign company, removing the need to navigate Australia’s intricate labor laws independently. It minimizes the risk of non-compliance and allows the company to concentrate on scaling its business and expanding its presence in the Australian market.

The process of hiring through an Employer of Record in Australia is efficient and involves the following steps:

- Finalize an agreement with the third-party provider (PEO).

- Confirm the employment offer for the selected candidate.

- Issue the employment offer to the candidate.

- Upon the candidate’s acceptance, the EOR drafts and finalizes the employment contract.

- The candidate reviews and signs the contract.

- The EOR handles all mandatory employee registrations in Australia.

- The employee starts work, reporting directly to the foreign company.

Downsides to using a Professional Employer Organization

The main disadvantage for businesses using a PEO as their market entry technique is that while cost-effective, it limits the company’s ability to make quick progress in raising brand awareness in Australia. Having an established office gives companies extra exposure, so relying on one or sales executives may mean a slower progression towards full expansion and company incorporation.

Additionally, employees isolated from your main headquarters and other colleagues may impact turnover. Though a PEO can offer greater benefits to staff in some cases, companies may find they need to replace their international contingent more often than those based at home.

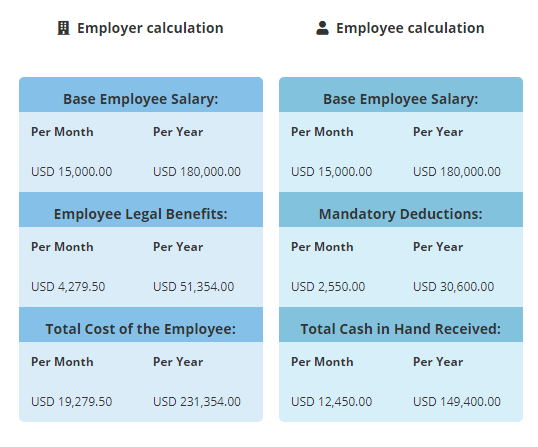

How to use a payroll calculator for a PEO in Australia

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Australia, using a payroll calculator is one way to get a very good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Pacific based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Bolivia would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

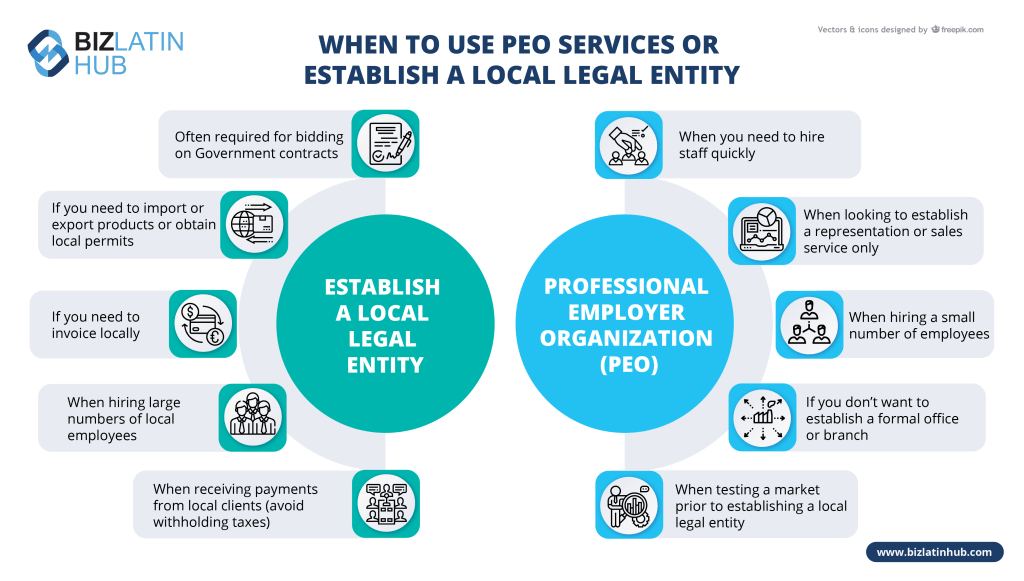

Benefits of Company Incorporation Instead of a PEO in Australia

The steps for company incorporation in new markets can be challenging for foreign entrepreneurs. However, the Worldbank Group assesses that in Australia, company incorporation time can take as little as 2 days.

With a proprietary company, you’ll avoid the need to pay a PEO service provider to manage and organise staff payment. This could therefore save you considerable expenses in the long term, freeing up your budget. By being directly responsible for all aspects of staff management, including payroll and benefits, there will also be less opportunity for misunderstandings between the employees and the employer.

Company incorporation could therefore be considered a better option for larger companies that have clear intentions to enter the Australian market for the longer term. Though upfront costs are higher, the company can enjoy the accessibility of in-house human resources staff and other professionals.

Downsides to company incorporation

The disadvantages of forming a company in Australia are higher initial investment, and relative difficulty of market exit, should operations not go to plan. A PEO partner can offer greater flexibility to enter Australia, whereas those who register their company with local authorities have a greater entry and withdrawal process.

Company Incorporation in Australia

Forming a company in Australia is a more complex process, but depending on what you need it could be the right option for you.

It’s helpful to operate in a country with an open economy for international business. Australia’s commercial environment offers a wide range of preferential trade tariffs with key partners, and government support for new business. Having a presence in this market means giving yourself the opportunity to position your company in one of the most reliably prosperous countries in the world.

Summary of options

Australian labor regulations for businesses that are expanding can be quite complex and difficult to navigate. Regulations do change from time to time and as a business owner, you might be finding it hard to keep up with. Partnering with a local PEO will give you the freedom to focus on other important areas for your business, as they manage employment requirements for your overseas staff.

However, having an established company in the country offers greater and more immediate brand exposure and access to in-house staff, which may be more desirable for larger multinational companies.

FAQs on PEO in Australia

You can hire an employee by incorporating your own legal entity in Australia, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in the country by acting as the legal employer. Meaning you do not need a local legal entity to hire local employees.

A standard Australian employment contract should contain the following information:

ID and address of the employer and employee

City and date

The location where the service will be provided.

Type of tasks to be carried out

Remuneration and bonifications/commissions (if applicable)

Method payment frequency

Duration of the contract.

Probation period

Work hours

Additional benefits (if applicable)

This will depend on the type of business and person you are hiring. Use our payroll calculator for more information.

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

Slower to establish.

Permanent presence in the country.

All costs deductible through a local entity.

Ability to sign contracts and agreements locally.

Ability to invoice through local entity.

Legal entity compliance support required.

Hire employees directly.

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

Why Invest in Australia?

Australia has caught international attention for its highly competitive, stable commercial environment. The Pacific continent nation has experienced 26 years of uninterrupted positive economic growth, and its powerful agricultural and mining sectors make significant contributions to the global economy. The country offers prime prospects for newcomers moving into the Asia-Pacific region through a PEO in Australia.

With a strong, transparent regulatory system and a business-friendly environment, Australia fosters confidence and ease for investors across industries. Its strategic location in the Asia-Pacific region provides unparalleled access to fast-growing global markets, while its modern infrastructure and advanced logistics make it an ideal hub for international trade. Key industries like mining, renewable energy, agribusiness, and technology thrive here, supported by a culture of innovation and sustainability.

The country also boasts large agricultural exports, such as premium beef, wine, and grains, are globally renowned for their quality. Meanwhile, a strong focus on R&D and tech innovation ensures that Australia stays ahead in emerging industries. For investors seeking growth, resilience, and access to cutting-edge opportunities, Australia delivers on every front.

Biz Latin Hub can provide a PEO in Australia

Whether you decide to incorporate a new company or start your international expansion first through a PEO, Biz Latin Hub can help. Our local legal experts can assist with the incorporation of a local company and can manage every step in the process, from the incorporation of the company, registration with local tax authorities to the opening of a corporate bank account.

Our experienced Australia team also offers top-quality PEO services. With local understanding of Australia’s talented workforce, we ensure your business finds the key staff it needs to further your expansion into the country.

Contact us now and we’ll help you design a strategy to capitalize on your commercial opportunities.

Learn more about our team and expert authors.