Corporate compliance in Panama is constantly changing. Therefore, after company formation, a regular entity health check in Panama will ensure that your business or the company you plan to do business with complies with local legislation. Foreign executives doing business in Panama must undertake an entity health check regularly. Hiring a trusted local partner to review the status of your company in terms of corporate compliance will protect your business from penalties and avoid risks.

Key takeaways on a entity health check in Panama

| Types of entity health check in Panama | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Why do an entity health check in Panama? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| Are entity health checks in Panama necessary? | It is not a legal necessity in of itself, but it will help you make sure you are staying compliant. |

| Who conducts an entity health check in Panama? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Panamanian company law. |

What is an entity health check in Panama?

An entity health check in Panama is an audit conducted by independent experts to examine accounting and legal compliance.

An entity health check reviews if a company doing business in the country complies with tax declarations, labour regulations, monthly reports, and accounting registries. As a result, there is a better understanding of the overall corporate compliance landscape.

The main objective of conducting an entity health check is to identify any discrepancies within a company that might affect business operations.

Why is it important to conduct regular entity health checks?

An entity health check in Panama is important to mitigate risks when doing business in the country. It covers various aspects of a company’s activities, including the legal, accountancy, tax and human resources practices. This examination seeks to understand if a legal entity established in Panama is and has been fully compliant with local corporate regulations.

Keeping up with regulatory updates across Latin America can be complicated. If you are expanding your business, conducting an entity health check is the best way to ensure the good health of your business.

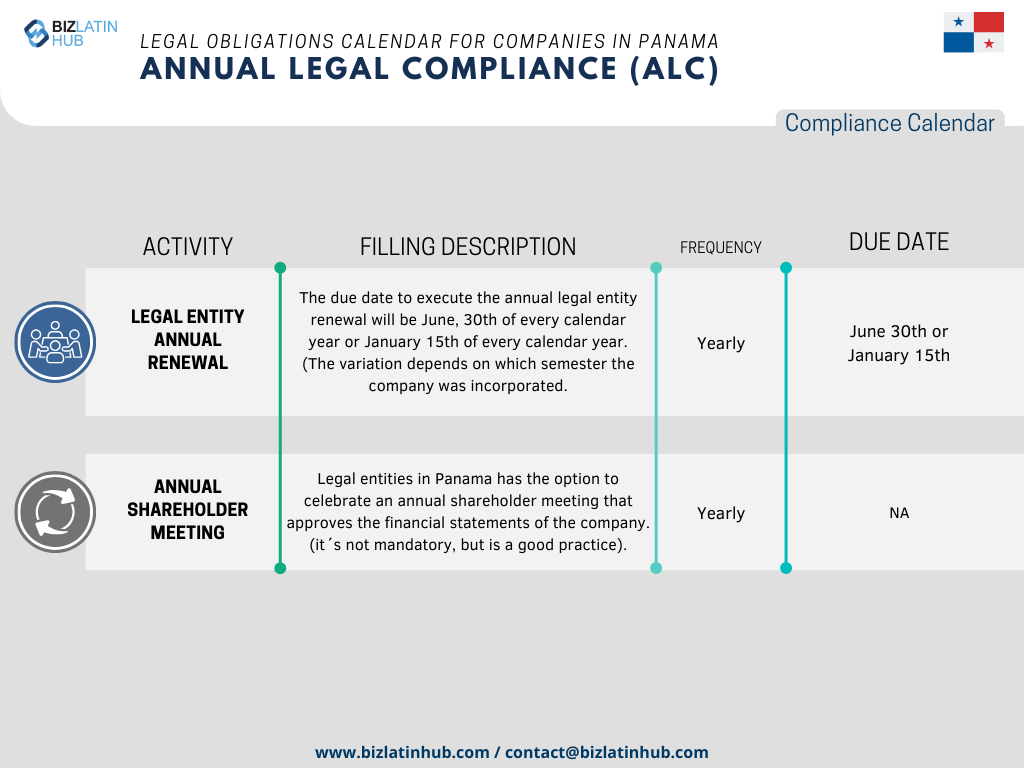

Types of compliance in Panama

An entity health check in Panama can be comprehensive, but it is also common to perfrom smaller checks.

These usually target one particular part of the company and that is usually either legal compliance or fiscal responsibility.

However, there are other types of health check that could be carried out, such as checking futureproofing and so on.

Legal compliance

The documents required for legal compliance in Panama are:

- Evaluation and review of contracts signed with third parties.

- Corporate books and accounting books (including minutes of the Assemblies).

- Shareholders meeting report.

- Rental agreements or leases.

- Other key legal documents for the company involved.

Fiscal compliance

Complying with tax regulations is critical when doing business in the country. The local tax authority (La Dirección General de Ingresos) is continuously verifying that companies comply with monthly/annual declarations and tax obligations.

Companies must submit monthly social security contributions and declarations. Be cautious with this procedure, as penalties from the Social Security authorities are severe and can lead to prison. Likewise, companies that develop local activities must submit an annual tax declaration to the corresponding township.

Furthermore, business owners must also consider special tax regulations that apply to companies that are part of a special regime like SEM (Sede de Empresa Multinacional) or special economic zones.

FAQs on an entity health check in Panama

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Panama?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

Engage with Biz Latin Hub to conduct your entity health check in Panama

It is essential to communicate with experienced and reliable professionals able to conduct entity health checks in Panama. This will protect your business operations from potential penalties imposed by government authorities.

At Biz Latin Hub, our multilingual team of legal experts have broad experience conducting entity health checks for companies in Panama and Latin America. With our full suite of market entry and legal advisory services, we offer support and advice to improve your company’s corporate compliance, increase its value, and manage risks.

Contact us today for personalized assistance on how to successfully run your operations in Panama.

Learn more about our team and expert authors.