Doing business in Panama can be a smart option for US companies due to strong international relations between these two countries, benefits for foreign investment and the US-Panama free trade agreement.

Panama has the lead in economic growth in Central America, with an estimated GDP growth of 3.7% in 2019 and a GDP per capita of US$15,642. Furthermore, the country is expected to grow by 3.8% in 2020, promising stability and growth for investors.

Doing business in Panama: Attractiveness for US investors

With attractive benefits for US investors such as currency pegged to the US dollar, easier immigration access, regulations favoring the protection of the company’s information and low fiscal duties, foreign direct investment (FDI) has increased. In fact, c

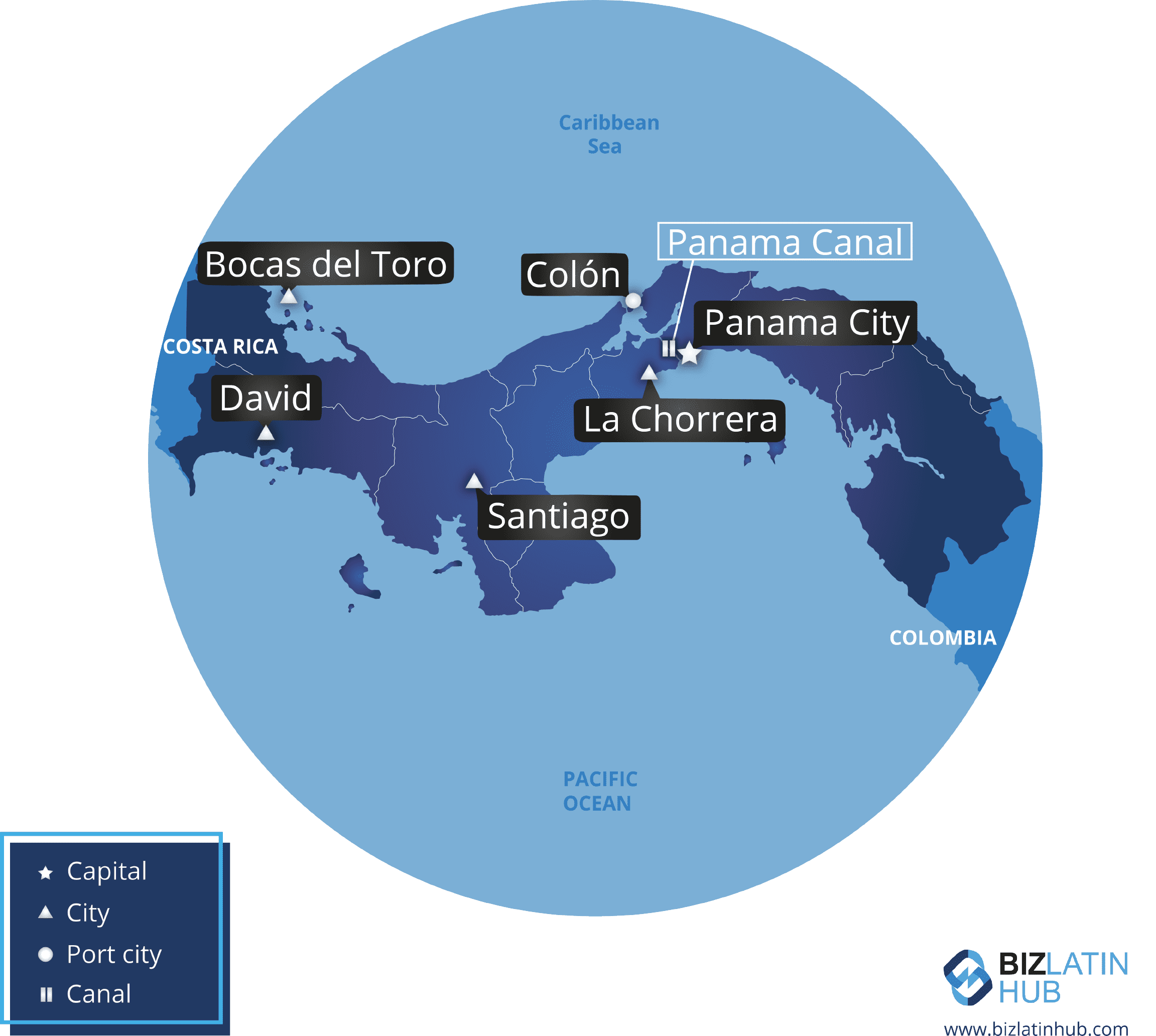

Doing business in Panama is attractive to US companies due to the wealth of business opportunities. The Panama Canal strongly supports import and export activities to Latin America, the Caribbean, and Europe. In addition, financial services, construction, tourism, real estate amongst other ventures are profitable in the country.

1. Free trade agreement with the US

The US has a trade agreement with Panama called the United States – Panama trade promotion agreement (TPA). This agreement removes duties for 87% of US consumer and industrial products in Panama, with remaining tariffs to be phased out over the period of 10 years.

The list of consumer and industrial products with duty-free access includes:

- information technology equipment

- agricultural and construction equipment

- aircraft and parts

- medical and scientific equipment

- environmental products

- fertilizers

- agro-chemicals.

In addition, doing business in Panama is more profitable thanks to the duty-free access to the TPA grants. Panama is an important sector for US farmers as the agricultural exports to Panama reached US$683 million in 2018, and have been on an increasing trend over the past 10 years. With the TPA, US agribusiness enjoys duty-free entry for over 56% of agricultural exports, with most of the remaining tariffs to be phased out over the coming 15 years.

On top of that mentioned above, additional goods that became duty-free include:

- high-quality beef

- frozen turkeys

- soybeans

- corn oils

- almost all fruit and fruit products

- wheat

- peanuts

The TPA also provides duty-free access for specific volumes of products. The list of benefited products is in the Panamanian trade administration website.

2. Quick company incorporation

Incorporating a company in Panama is easy and swift as compared to other Latin American nations. It takes 2 weeks to set up a legal entity and the company owners do not need to be physically present.

In addition to this, company doing business in Panama benefit from confidentiality. Panama secrecy laws protect the name of corporate shareholders, which are not required to be publicly registered. Also, anonymous corporations do not have to declare income earned outside Panama.

3. No income tax for overseas profits

Under the Panamanian tax principle based on territory, income generated outside the country isn’t taxed. Income from external sources such as transfers or acquisition of securities, investments, transfer or sales of real property, retirement, and dividends are not subject to tax. Doing business in Panama is a great advantage to companies generating income abroad as tax exemptions maximize profitability.

Investors generating profits in Panama and conducting international operations can benefit from maximized profitability. The country has 17 tax treaties to avoid double taxation (TDT) with countries such as Mexico, Spain, United Kingdom, amongst others. Businesses handling operations with these countries can enjoy lower taxes and maximize profitability.

4. Free trade zones

Panama has free trade zones that offer tax breaks based on the purpose of activities. The Colon Free Trade Zone is a hub for import and export commercial activities. This zone consists of a port and transit system designed for international trade activities, and offers:

- no import duties

- 5% dividend tax

- zero tax on income from export activities

- zero tariffs and quotas on imports and exports to foreign countries.

In addition, businesses are exempt from tax for sales and transfers between companies settled in the Colon Free Trade Zone.

The other economic zone which is still growing is The Panama Pacifico Special Economic Zone. This zone has the objective to be a hub for the development and production of technology. Imports, exports and re-exports of merchandise that do not enter the country are exempted from tax.

5. Currency pegged to the dollar

Since Panama national currency, the Panamanian Balboa (B), is pegged to the US dollar, the exchange rate between these currencies is the same. Also, the US dollar is legal tender in the Panamanian territory and circulated regularly since 1904.

In this sense, it is comfortable for US companies and individuals doing business in Panama as currency conversion isn’t an issue and there is no currency volatility as the dollar responds to the US economic and political stability.

6. Member of Panama Friendly Nations Visa

Panama has a visa program that can ultimately lead to citizenship. Panama offers residency and the right to work to a list of countries included in their Friendly Nations list.

The US is included in this list so, US citizens can apply for this visa. Individuals with economic or professional ties in the country are eligible. To have an economic tie, an individual can set up a company in Panama, a great benefit that Panama offers is affordable prices to set up and run a business.

Aside from setting up a company, interested individuals can purchase property of at least US$10,000 or be employed by a Panamanian firm. After 5 years, residency visa holders can apply for Panamanian citizenship and passport.

Begin doing business in Panama with Biz Latin Hub

US investors can begin doing business in Panama by incorporating a company. Individuals interested in the growing Panamanian market can enjoy easy access to international markets, the growing Panamanian industries and tax exemptions to maximize profitability.

At Biz Latin Hub, we help entrepreneurs from the US enter the Panamanian market and conduct their business operations with compliance with the law. Our local team of lawyers and accountants can assist you with legal representation, company incorporation, visa services and more. Contact us at contact@bizlatinhub.com and get your venture started.Learn more about our team and expert authors and check our video about the benefits of doing business in Panama.