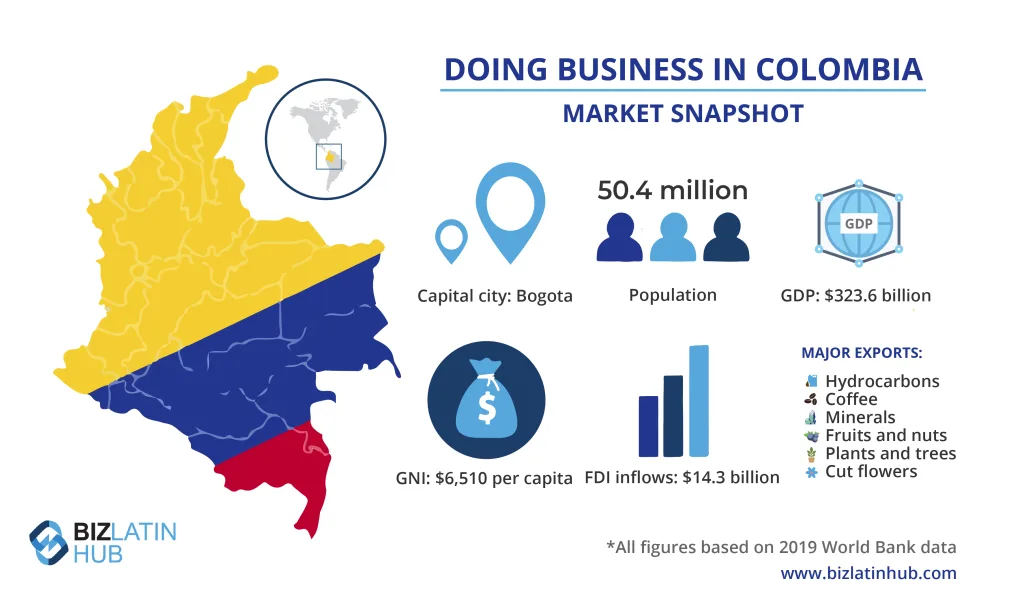

Operating a company in a free trade zone in Colombia can provide significant cost savings and tax breaks. That’s why so many international investors are looking at how to incorporate a company in Colombia and maximize their entry into this growing market

The country has had a free trade regime for a long time, but in 2021 the decreto 278 came into effect, which streamlined many procedures and slashed red tape for setting up a free trade zone in Colombia. This was part of a wider strategy for the country’s economy which was aimed at restarting the economy post-COVID.

In summary, establishing a company in a free trade zone in Colombia represents a strategic opportunity for companies looking to expand their international presence and take advantage of the many benefits offered by the special zones. Biz Latin Hub can help you set up shop and support you doing business over the years to come.

How does a free trade zone in Colombia work?

Colombia has two types of free trade zone, single-company (special permanent) and multi-company (permanent). Together, there are a whopping 120 free trade zones distributed around the country, with the vast majority (79) being single-company operations.

Decree 278 made it much faster to set up a free trade zone, which can now be done in around nine months and also opened up the possibility of changing use in the future. Up to 50% of the workforce can now work remotely, which was a major change aimed at promoting service provision in free trade zones.

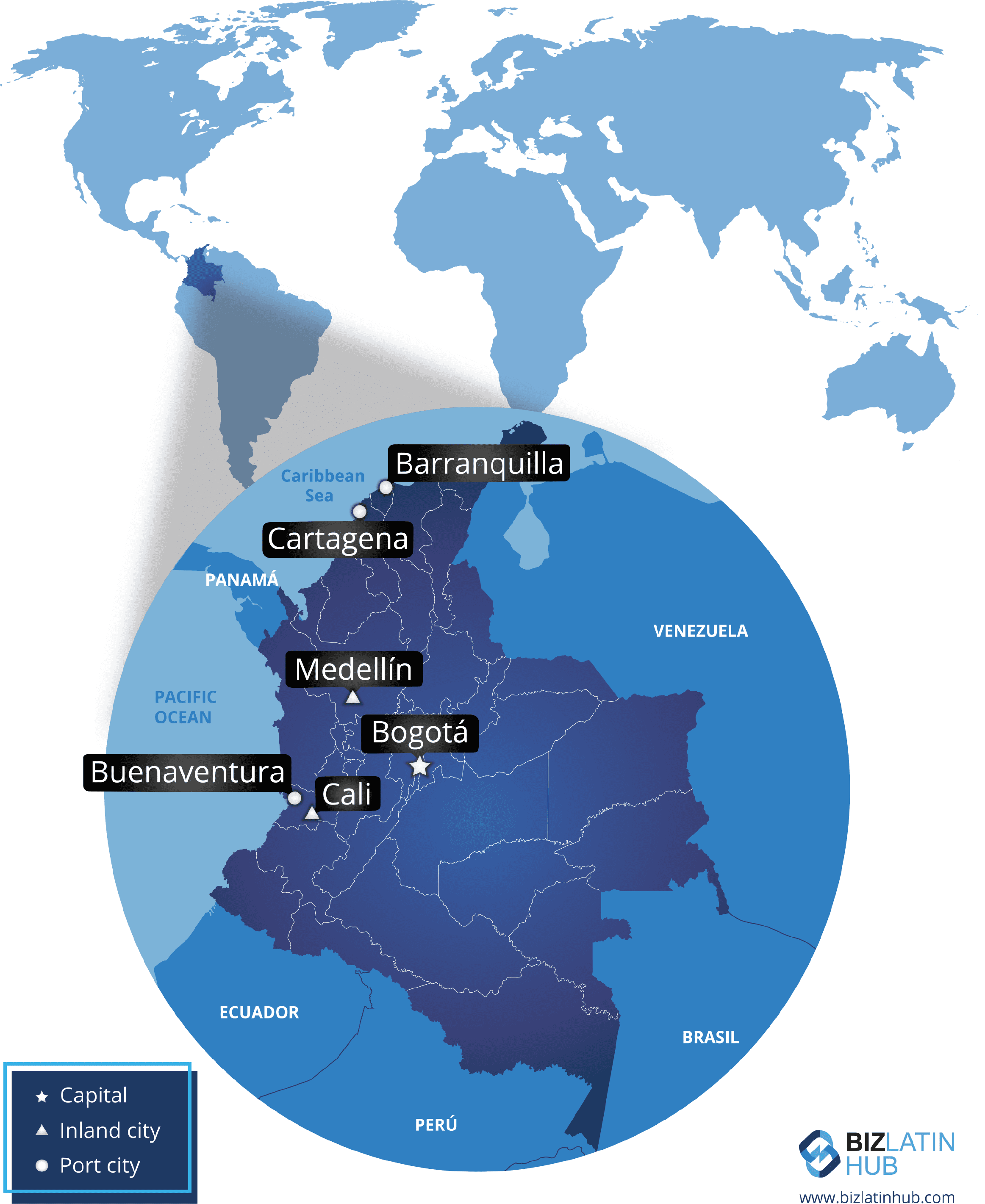

The capital, Bogotá, is especially focused on building BPO as a key area for its economic future. The city has a large number of graduate-level young people, often with good proficiency in English. The Zona Franca of Bogotá is the biggest free trade zone in Colombia. Boosting this is that e-commerce sales from the free trade zones are not considered to be imports, plugging them directly into the local economy.

Health services are also a booming sector. Colombia is rightly very famous for the quality and reach of its medical care and this is opening up new possibilities, some of taking advantage of the various benefits that the free trade zone regime in Colombia provides.

Which industries are best for a free trade zone in Colombia?

Those 120 free trade zones, are unsurprisingly scattered far and wide across the national territory. However, they do tend to be closer to large economic hub cities such as Bogotá, Medellín and Cali. There is also a large number of free trade zones on the northern coast, where they have access to the Atlantic shipping routes.

Some of the most common fields include:

- BPO services

- Agribusiness

- Health services

- Port services

- Shipping

- Dairy products

- Flower exports

- e-commerce

8 Benefits of Operating a Company in a Free Trade Zone in Colombia

Colombia’s free trade zone regime grants beneficiary companies a wide range of benefits, including:

- Corporation tax is 20% rather than the standard rate of 35%

- No VAT is paid on foreign goods arriving in the zone

- No tariffs are paid on foreign goods arriving in the zone

- Foreign goods may be kept in the zone indefinitely

- Possibility to export to third countries under the terms of Colombia’s 18 free trade agreements

- 20% unified income tax rate.

- Exemption of customs duties such as VAT and tariffs on raw materials, parts, supplies, and finished goods entering the Free Trade Zones, as long as they are part of the corporate purpose.

- The possibility of partial processing outside the Free Trade Zone for up to 9 months, given that production of these goods and services, do not exceed 40% of the companies’ total production of goods or services.

What are the FTZ requirements?

To operate a company in a free trade zone in Colombia you must follow these requirements:

- A minimum investment requirement of between USD$200,000 and USD$2,200,000 depending on the company’s location and type of economic activity. Companies with less than USD$159,000 of assets pay nothing.

- Creation of a certain number of jobs depending on the asset size of the company, but between 7-50

- Companies submit an annual report proving that the entity is fulfilling a minimum export requirement which varies according to sector, location and asset size. However, it is usually high and expected to move towards 100% export in coming years.

- For single-company zones, the rules are much stricter – investment of 2-30 million and creation of as many as 500 jobs depending on size, location and sector as in other cases.

FAQs on Free Trade Zone in Colombia

Yes, foreign companies can operate a company in a Free Trade Zone in Colombia by following the designated registration procedure and fulfilling regulatory requirements.

Yes. It varies widely according to sector and physical location, but is generally between USD$200,000 and USD$2.2 million.

Colombia’s free trade zone regime grants beneficiary companies a wide range of benefits, including:

Corporation tax is 20% rather than the standard rate of 35%

No VAT is paid on foreign goods arriving in the zone

No tariffs are paid on foreign goods arriving in the zone

Foreign goods may be kept in the zone indefinitely

Possibility to export to third countries under the terms of Colombia’s 18 free trade agreements

20% unified income tax rate.

Exemption of customs duties such as VAT and tariffs on raw materials, parts, supplies, and finished goods entering the Free Trade Zones, as long as they are part of the corporate purpose.

The possibility of partial processing outside the Free Trade Zone for up to 9 months, given that production of these goods and services, do not exceed 40% of the companies’ total production of goods or services.

To operate a company in a free trade zone in Colombia you must follow these requirements:

A minimum investment requirement of between USD$200,000 and USD$2,200,000 depending on the company’s location and type of economic activity. Companies with less than USD$159,000 of assets pay nothing.

Creation of a certain number of jobs depending on the asset size of the company, but between 7-50

Companies submit an annual report proving that the entity is fulfilling a minimum export requirement which varies according to sector, location and asset size. However, it is usually high and expected to move towards 100% export in coming years.

For single-company zones, the rules are much stricter – investment of 2-30 million and creation of as many as 500 jobs depending on size, location and sector as in other cases.

Yes, and in certain free trade zones this is already common. Bogotá is a particular hub for BPO services and health services are also widespread.

Biz Latin Hub can help you start a company in a Free Trade Zone in Colombia

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogotá as well as various other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about companies entering a free trade zone in Colombia, our portfolio of services includes hiring & PEO accounting & taxation, company formation, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top tech talent, or otherwise do business in Latin America and the Caribbean.

If this article about companies entering a free trade zone in Colombia was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.