Consumers wondering which is the best credit card in Chile are now able to use a government-run platform to compare hundreds of cards from dozens of providers and choose products with the most competitive rates or appealing features.

The country’s National Consumer Service (SERNAC) launched its new Credit Card Comparator on March 7, with the official announcement highlighting that the platform will allow users to research maintenance and administrative charges, the cost of cash advances, and how expensive cards are to use overseas.

Currently, 194 cards offered by 26 different providers can be researched on the platform, including some cards that are no longer available to new customers, but are still in circulation.

SEE ALSO: Find a Professional Employer Organization (PEO) in Chile

According to Lucas Del Villar, national director of SERNAC, the platform is not simply intended to allow consumers to make better choices.

“It will also be an incentive for the companies themselves to compete with better conditions, simplify their contracts, and provide more information,” he was quoted as saying in the SERNAC announcement.

According to SERNAC, at the time of the launch of the Credit Card Comparator, there were around 15.4 million credit cards in circulation in the country – both those issued by banks, and those issued by other providers.

That equates to roughly four credit cards for every five people in Chile, which had a population of approximately 19.1 million people in 2020, according to the World Bank.

Among credit cards issued by traditional banks, SERNAC reports that the average debt per card stood at 555,837 Chilean pesos (approximately USD 689 at time of publication), while among cards issued by other providers it stood at an average of 240,876 Chilean pesos (approximately USD 299).

Which is the best credit card in Chile?

According to SERNAC, identifying which is the best credit card in Chile based on individual needs is made easier by some of the features of the Credit Card Comparator.

While the likes of credit limits and availability of cash advances are often what draws people to take credit cards, the platform allows consumers to get a good idea of the associated costs for products with comparable benefits.

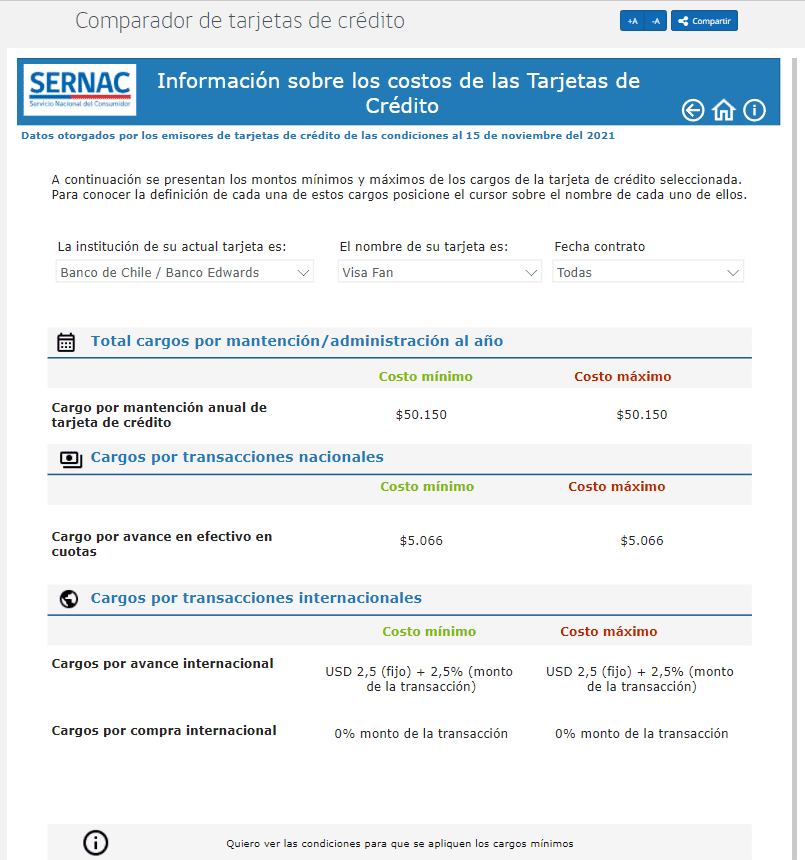

Among the cards featured on the platform, annual administrative and maintenance fees range from zero to 350,000 Chilean pesos (approximately USD 434).

Meanwhile, fees tied to cash advances, allowing consumers to pay off purchases in installments, range from zero to 29,990 Chilean pesos per transaction (approximately USD 37.20).

When you search for a particular card on the Credit Card Comparator, the results show the maximum and minimum maintenance or administrative charges, as well as the maximum and minimum fee for domestic and international transactions.

With the platform allowing potential customers to easily identify credit cards with the best features on offer, it has the potential to have a profound effect on consumer behavior.

However, the extent of that effect will depend on how successful the Government of Chile is at raising awareness about it’s availability.

You can access the SERNAC Credit Card Comparator here. However, be aware that the platform is only available in Spanish.

Biz Latin Hub can assist you doing business in Chile

At Biz Latin Hub, we provide integrated market entry and back office services throughout Latin America and the Caribbean, with offices in 17 major cities around the region.

Our portfolio includes accounting & taxation, company formation, due diligence, hiring & PEO, legal services, and visa processing, while our unrivaled reach in the region means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Contact us today to find out more about how we can assist you.

If you found this article on how the SERNAC Credit Card Comparator is helping consumers decide which is the best credit card in Chile of interest, you might want to check out the rest of our coverage of this highly developed South American country – which is one of Latin America’s most popular investment destinations.

Or read about our team and expert authors.