If you read anything about the prospects for the economy in Latin America in 2023, the news isn’t very optimistic. The Economic Commission of Latin America and the Caribbean (ECLAC) told Bloomberg in November that while some prices on food and other goods have come down from their inflationary highs, it has not been enough to improve the growth prospects for the region in 2023.

The economy in Latin America’s 2023 projection is slightly down from 1.4 percent growth, while ECLAC expects the region’s economies to expand by 3.7 percent this year, up from a previous forecast of 3.2 percent.

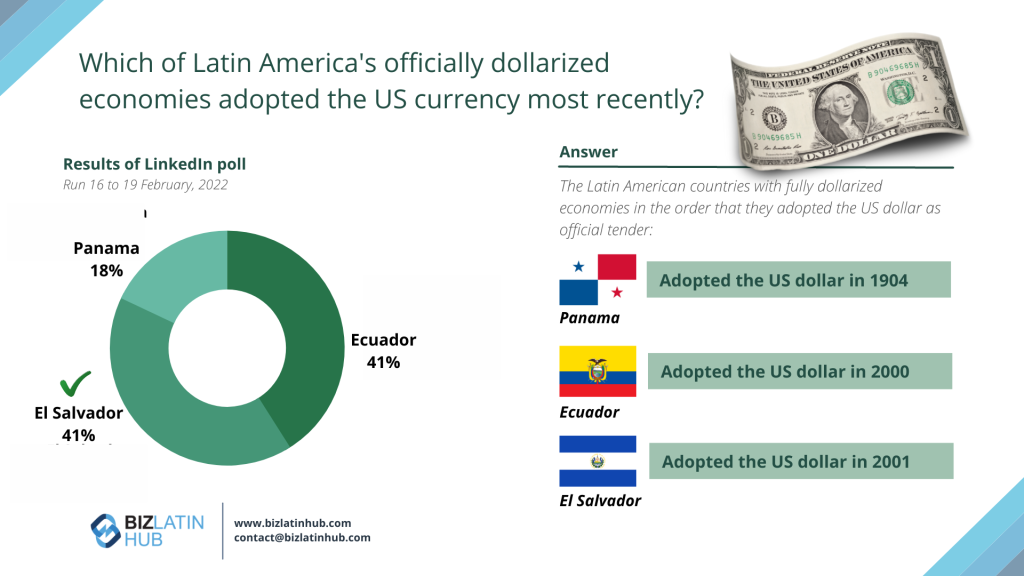

Inflation across the region has been high for almost two years now, and most indicators point to it being a problem well into the new year. And that, coupled with the continuing strength of the US dollar, will put pressure on Latin American currencies (as the US is the biggest trading partner of most countries in the region), and also because many companies in Latin America only accept payment in US dollars.

The sluggish, even stagnant growth projections for some countries (such as Colombia, for example) does not bode well for investors, entrepreneurs and companies thinking of starting a business in Latin America in the new year.

But these effects will vary widely from one nation to the next; some Latin American currencies are performing better than others. Before we go any further, let’s take a look at the rich mosaic of currencies found in Latin America.

List of Latin American currencies by country

What follows is a list of every Latin American country and their national currencies:

- Argentina – peso

- Belize – Belize dollar

- Bolivia – boliviano

- Brazil – real

- Chile – peso

- Colombia – peso

- Costa Rica – colón

- Cuba – convertible peso

- Dominican Republic – peso

- Ecuador – US dollar

- El Salvador – US dollar

- French Guiana – euro

- Guatemala – quetzal

- Guyana – Guyanese dollar

- Haiti – gourde

- Honduras – lempira

- Mexico – peso

- Nicaragua – córdoba

- Panama – US dollar

- Paraguay – guarani

- Peru – sol

- Puerto Rico – US dollar

- Suriname – Surinamese dollar

- Uruguay – peso

- Venezuela – bolivar

While there is downward pressure on currencies against the USD across the region, a handful of Latin American currencies have bucked the trend and have appreciated in value over the past year. Why? It all comes down to three reasons, according to the economic research firm Oxford Business Group:

- Aggressive central bank rate hikes

- Strong commodity prices

- Shifting supply chains away from China

While most Latin American currencies are down (many by a large margin), three Latin American currencies have actually appreciated this year.

Latin American currencies: Winners and losers in 2022

Here’s a break-down of how the currencies of the region’s six biggest economies performed against the US dollar in 2022.

Appreciated:

- Brazil: +7.49%

- Mexico: +6.35%

- Peru: +5.34%

Depreciated:

- Argentina: -41.04%

- Colombia: -16.54%

- Chile: -4.26%

Just before what’s commonly referred to as the “post-Covid” era, the central banks of Brazil and Mexico made aggressive moves to nip the coming torrent of inflation in the bud. Brazil’s central bank carried out 12 straight hikes to push its rate from 2 percent in March 2021 to 13.75 percent in September, but it has signaled that it will pump the breaks on their inflation-fighting measures after consumer prices recorded two consecutive monthly drops.

For its part, Mexico’s central bank also pushed up its rate 5.25 percentage points since June 2021, including a 0.75 percentage point increase on September 29 so that it reached 8.5 percent, as inflation hit a two-decade high in the first half of the month.

The two Latin American currencies have also benefitted from a repositioning of the global supply chain in recent months. As a result of the US-China trade war, many US companies have shifted manufacturing away from China and are nearshoring or “friend-shoring” closer to home, and Mexico and Brazil have been the main Latin American beneficiaries of this trend.

Furthermore, the spike in commodity prices, specifically oil & gas after Russia’s invasion of Ukraine, have boosted revenues of both Mexico and Brazil’s fossil fuel export-heavy economies. This trend could have helped Colombia’s economic situation – as it too relies heavily on oil & gas exports – but the new president Gustavo Petro’s very public pledge to transition away from fossil fuels has cast a cloud of uncertainty over Colombia’s energy sector, and this has severely curtailed foreign investment in the country.

Biz Latin Hub can help you

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about Latin American currencies, our portfolio of services includes hiring & PEO accounting & taxation, company formation, and corporate legal services.

Contact us today to find out more about how we can assist you in finding talent, or otherwise do business in Latin America and the Caribbean.

If this article about Latin American currencies was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.