Companies that are residents of Australia must pay taxes on their domestic and international income. In general, non-resident companies are only subject to Australian tax on income created from Australian operations. Australia also holds double taxations treaties with more than 40 countries. These income tax treaties prevent double taxation on businesses and fiscal evasion.

Find out what the company tax is in Australia, and key tax considerations to be aware of when operating in the country.

Australian Taxation – Corporate Income Tax Rate

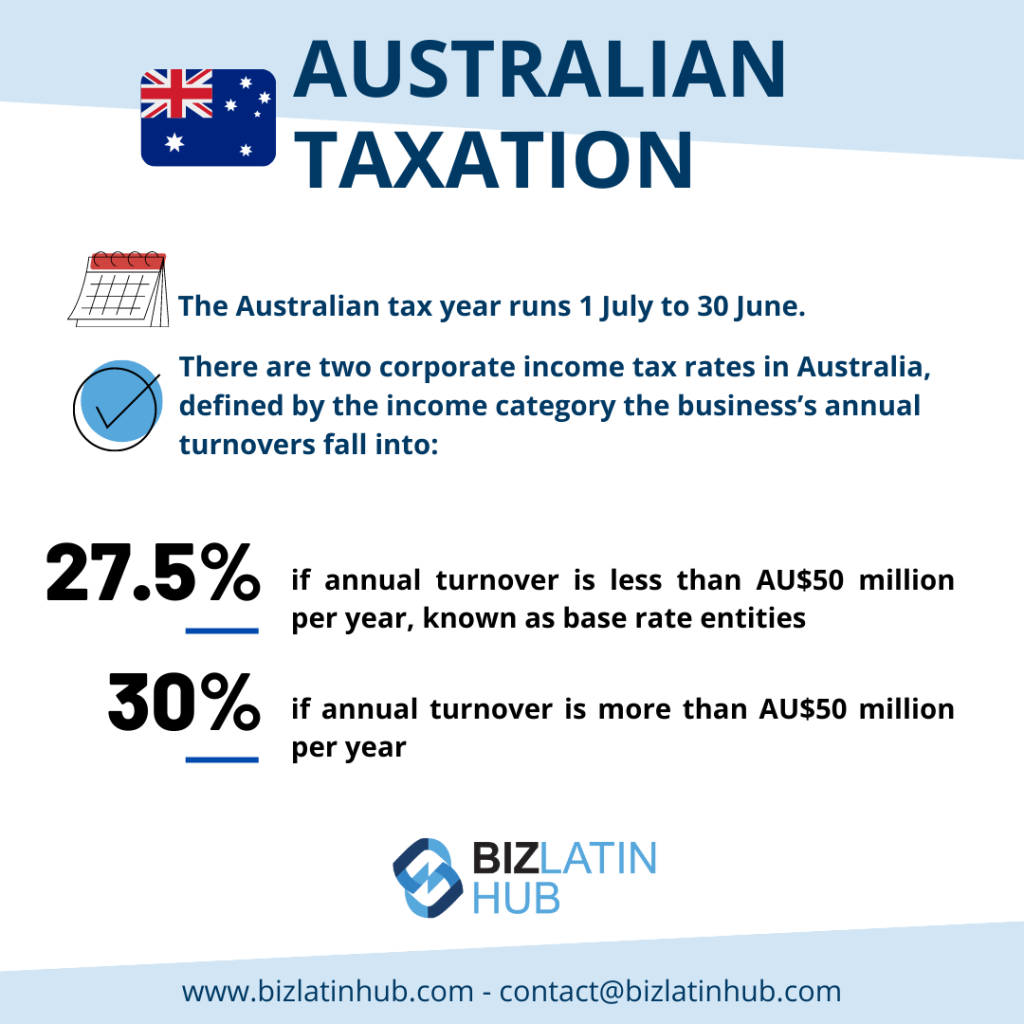

The Australian tax year runs 1 July to 30 June. A corporation could implement a substitute income year, such as 1 January to 30 December. There are two corporate income tax rates in Australia, defined by the income category the business’s annual turnovers fall into:

- 27.5% if annual turnover is less than AU$50 million per year, known as base rate entities

- 30% if annual turnover is more than AU$50 million per year

The lower corporate tax rate of 27.5% is a concession given to ‘small business’ companies or ‘base rate entities’. This rate is will be reduced in the coming years:

- 26% for the 2020/2021 tax year

- 25% for the 2021/2022 tax year.

There are measures to make sure firms don’t qualify for the reduced rate if they have received more than 80% of their total assessable income from passive income. Passive income includes interest, rents and net capital gains. Tax is just one aspect of doing business in Australia you must consider.

Company Tax Returns in Australia

Company tax returns filed with the Australian Tax Authority (ATO) are due on the fifteenth day of the seventh month following the end of the income date (15th January). If you use a registered tax agent, the deadline may be extended. It’s extremely important to file tax returns on time. So, consider outsourcing your tax obligations to an experienced accountant to ensure your business is fully compliant. Local accountants can also identify tax concessions you may be eligible for.

Most companies have to pay tax on a monthly or quarterly basis. This avoids receiving a large annual tax bill and can help firms budget better for their tax obligations. If your companies annual turnover is more than AU$20 million, you must pay tax instalments each month.

Other Corporate taxes in Australia

There are other taxes that apply to companies in Australia, which are set by the government. Required taxes differ for different business structures.

Doing Business in Australia – Goods and services tax (GST)

Good and services tax is a 10% tax, added to consumer goods and services sold or consumed in Australia. A business that has an annual turnover of AU$75,000 per year are required to register for GST. This is done with the Australian Tax Office. The tax is designed for the end-consumer, so if a company has bought business supplies that included GST, they are entitled to a tax credit.

Capital Gains Tax (CGT)

Capital gains tax is paid on any capital gain, that is a profit generated from the sale of an asset. This tax is paid part of a company’s income tax.

Fringe Benefits Tax (FBT)

Fringe benefits tax is paid by companies that employ staff, and provide them with benefits (above their normal remuneration package). Examples include food vouchers, a company car for work and personal use and gym memberships.

The FBT rate for years ending March 2018-2020 is 47%.

Employers may be able to claim an income tax deduction for the cost of the fringe benefits they provided, and the FBT they pay. They usually are able to claim GST credit for fringe benefit items too.

Luxury Car Tax (LCT)

A 33% tax applies to all cars with a GST-inclusive value above the government set threshold. The threshold for the financial year 2017-2018 is:

- Fuel-efficient vehicles: AU$75,526

- Other vehicles: AU$66,331.

This company tax applies to any firms to engage in the importing or selling of luxury cars. The tax also extends to individuals that import cars.

Wine Equalisation Tax (WET)

This 29% tax applies to the wholesale value of wine if imported into or made in Australia. It also applies to companies that sell wine by wholesale. This tax generally only applies to firms registered for GST. It’s designed to be paid on the last sale of wholesale wine, or the end consumer of wholesale wine. In most situations, this tax applies between a wholesaler and retailer. However, cellar door sales where a producer sells directly fall under this net as well.

Fuel Tax Credits

Fuel tax credits are provided to business against the taxes included in the fuel they have bought. Businesses may use fuel for machinery, plants, equipment, heavy vehicles and light vehicles. The rates change regularly, as they are priced in line with the consumer price index, so it pays to check regularly what current rates are. To claim for fuel tax credits, your business must be registered for GST. There are also certain fuels that are not eligible for the tax, for example, aviation fuels. Check with the ATO for current legislation as it is subject to change.

Withholding Taxes

When operating in Australia as a foreign investor, it’s important to understand withholding tax and know how to distribute earnings to yourself, other shareholders, and businesses both in and out of Australia. If you run a subsidiary business, then you’ll be pleased to know that dividends paid to Australian and foreign parent companies are withholding tax-exempt, so long as the necessary corporate tax has been paid on profits. The interest that is paid to foreign entities has a 10% withholding tax, and real estate sales and transfers are subject to a property tax levied by your local authority (this figure can be anything from 4% to 7%).

What is interesting to note, however, is that Australia has taxation treaties with fifty countries around the world, reducing withholding tax on payments abroad.

From our Accounting team – What’s The Next Step?

Now, you should have a better idea of what aspects you need to consider when choosing your business structures. Certain structures suit different business functions better and may suit your control requirements. Remember that you are able to change your business structure as your company grows.

At Biz Latin Hub, we can aid in market entry, company incorporation, due diligence, recruitment, visa processing, accounting, taxation, law, and more. To find out more about how we can transform your business, contact us here for personalized support.