Accounting and taxation in Puerto Rico can be complicated; certain businesses and individuals in the U.S. territory must pay U.S. federal income taxes. Companies that sell goods or services overseas and qualify for the Act 20 incentive need only pay a 4-percent flat tax on income generated outside the island. If you incorporate a company in Puerto Rico, you will likely be able to take advantage of its various schemes. Puerto Rico’s tax authority, Hacienda, administers all corporate tax and SUT reporting through its online platform, SURI (Sistema Unificado de Rentas Internas).

Key Takeaways Tax and Accounting Requirements in Puerto Rico

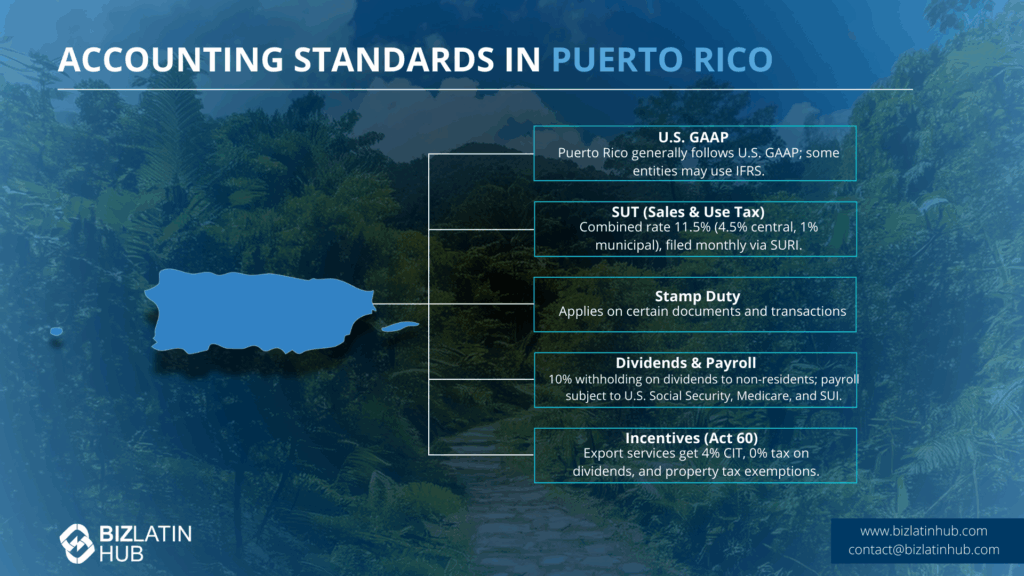

| What Are The Accounting Standards in Puerto Rico? | Puerto Rico typically follows the U.S. Generally Accepted Accounting Principles (GAAP) for financial reporting. |

| What Is The Corporate Tax Rate in Puerto Rico? | The corporate tax rate in Puerto Rico is based on a normal tax and surtax structure, whereby a taxpayer who is not a member of a controlled group, taxable income will be subject to a normal tax of 18.5% and the balance in excess of the $25,000 surtax exemption will be subject to the following surtax: – $0-$75,000 5% – $75,001 – $125,000 $3,750 plus 15% of excess over $75,000 – $125,001 – $175,000 $11,250 plus 16% of excess over $125,000 – $175,001 – $225,000 $19,250 plus 17% of excess over $175,000 – $225,001 – $275,000 $27,750 plus 18% of excess over $225,000 – $275,001 – Over $36,750 plus 19% of excess over $275,000 |

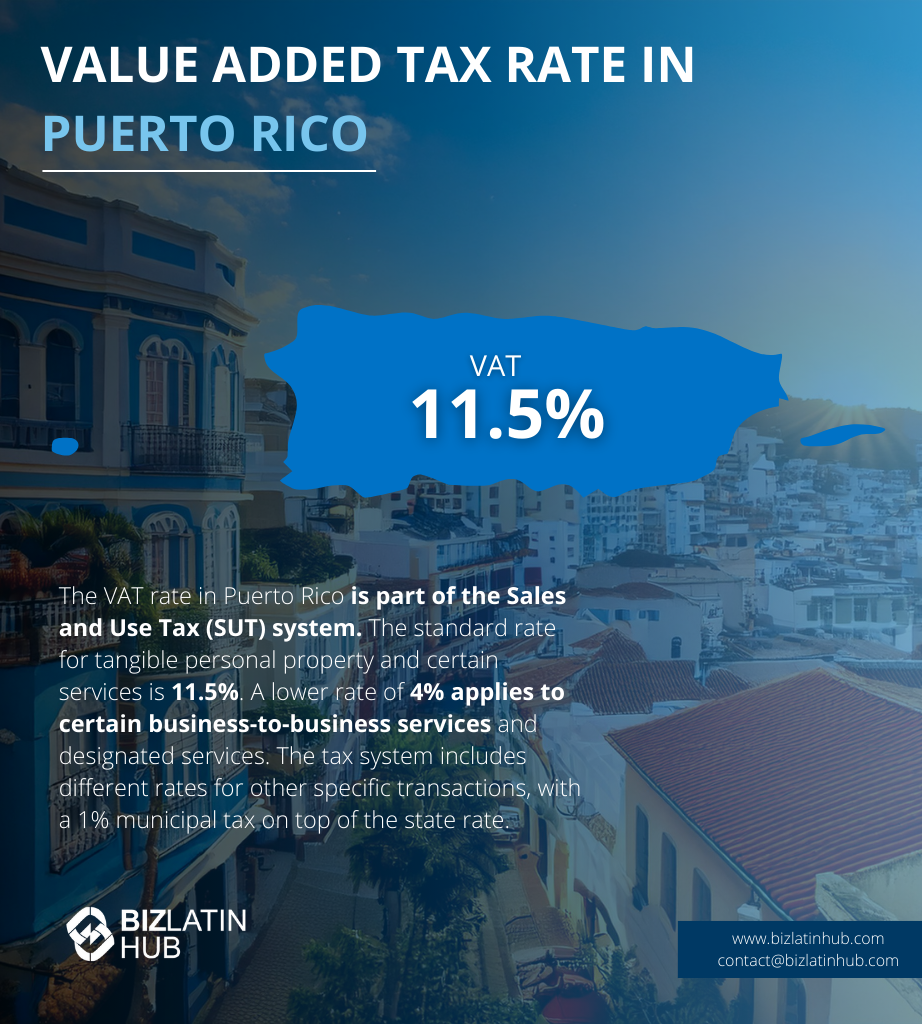

| What Is The Puerto Rican Value Added Tax Rate? | The rate of VAT (known locally as IVA) is 11.5%. |

| Dividend Tax Rate in Puerto Rico | There is a standard rate of 10% on dividends paid to non-residents. |

How to Become a Resident to Benefit from Accounting and Taxation in Puerto Rico?

It’s not easy to become a resident of Puerto Rico. It is usually Americans who move to the island to avoid paying U.S. taxes, but one must meet several criteria and pass numerous ‘tests’ to qualify for residency:

- A physical presence on the island – You must be in Puerto Rico at least 183 days a year to qualify to become a resident.

- The ‘closer-connection’ test – You can’t become a bona-fide resident of Puerto Rico for tax purposes if you have a “closer connection” to the U.S. or another jurisdiction. But in essence, you need to prove to Puerto Rican authorities that you conduct most of your business from the island itself.

- The ‘tax home’ test – Another requirement for Puerto Rican residency is that you do not have a tax home outside of Puerto Rico during any part of the tax year. With accounting and taxation in Puerto Rico, your tax home is where you live and conduct business regularly, regardless of where you reside.

- Not all types of income qualify for tax exemptions – Only Puerto Rican-sourced income is exempt from U.S. taxes. But certain types of income will be tax exempt, while others are subject to Puerto Rican income taxes, ranging from anywhere between 13 and 33 percent.

Many analysts talk about “good” and “bad” types of income, the good being income that enjoys tax exemptions and low taxes. The bad income is subject to either U.S. or Puerto Rican tax regimes.

Accounting and taxation in Puerto Rico: What is good income?

Good income (i.e., income that can be tax-exempt):

- Contract or service-related income generated on the island

- Capital gains income

- Investment advisory services

- Dividend payments from Puerto Rico-based companies

- Asset management services

- Affiliate marketing activity

- Income generated by an online business

- People who own large quantities of cryptocurrency such as Bitcoin

Bad income (i.e., income that is subject to U.S. or Puerto Rican tax regimes):

- Salary-based income

- Monthly pension benefits

- Traditional Individual Retirement Accounts (IRAs)

- Social Security benefits

To benefit from the tax incentives the island offers requires a lifestyle change, as you will have to live in Puerto Rico for the medium- or long-term to qualify for residency. It takes at least six months of living on the island to become a “bona-fide” resident of Puerto Rico.

The Puerto Rican accounting and taxation system is designed in such a way as to deter unscrupulous or opportunistic investors from moving their money in and out of the island’s banks come tax season or using it as a tax shelter without contributing to the island’s economy.

Act 60 Tax Incentives and Export Services

Much of the island’s tax incentive legislation is aimed at attracting certain kinds of businesses to the territory – namely export services, commerce, and the tech sector. With favorable accounting and taxation in Puerto Rico, authorities hope to turn the island into an international export service and commerce hub.

Under Act 60, businesses offering export services (e.g., consulting, tech, finance) can access a 4% CIT, exempt dividends, and 75% exemption on property tax. A compliance report and government fee are required annually. Businesses and industries that Puerto Rico wants to see more of include:

- Advertising and public relations

- Digital/online marketing

- Corporate Headquarters

- Call Centers

- Financial services

- The creative sector (design, art, music, publications, app development, etc.)

- Software developers

- Education technology companies

- R&D businesses

- Professional services (legal, tax, and accounting services)

A U.S. citizen who becomes a bona fide Puerto Rico resident and moves their business to the island (thus turning its revenues into Puerto Rico-sourced income) may benefit from paying a 4-percent fixed corporate tax rate. In addition, they will be 100 percent exempt from paying property taxes as well as exempt from taxes on dividends.

Payroll Contributions and Employment Tax

Employers must register with Puerto Rico’s Department of Labor and comply with Social Security, Medicare, SUI, and worker’s comp laws. W-2PR and 941-PR forms must be filed each quarter.

Puerto Rico operates within the ambit of the US social security system, resulting in Puerto Rican employers and employees being bound by the mandates of US Social Security and Medicare taxes.

The Federal Insurance Contributions Act (FICA) governs the imposition of social security tax on individual employees’ wages or salaries, aimed at supporting the retirement benefits offered by the federal government. FICA enforces two distinct taxes:

- Old-age, survivors, and disability insurance (OASDI)

- Hospital insurance (Medicare)

As of 2019, the OASDI tax is levied at a rate of 6.2% each for the employee and the employer on the first $176,100 of income. The Medicare tax, on the other hand, is applied at a rate of 1.45% each for the employee and the employer without any income ceiling. Notably, high-income employees, not their employers, are required to pay an additional 0.9% Medicare tax.

The specific income thresholds for this additional Medicare tax differ based on filing status. Married couples filing jointly are subject to the extra tax on combined earnings exceeding USD$250,000. Single taxpayers and heads of households are affected when earnings exceed USD$200,000, while married individuals filing separately are impacted by earnings surpassing USD$125,000. The calculation includes self-employment income in determining the threshold.

FICA tax is applicable to remuneration for services rendered within the United States, irrespective of the nationality or residence of the employee or employer. Consequently, unless exempted, nonresident alien employees working in the United States are liable for FICA tax, even if they are exempt from US income tax based on statutory regulations or income tax treaties.

Certain groups are exempt from FICA tax, encompassing foreign government employees, exchange visitors holding J visas in the United States, foreign students with F, M, or Q visas, and individuals covered by social security totalization agreements between the United States and other nations. These agreements enable eligible individuals to continue contributing to their home countries’ social security systems, usually for up to five years.

Sales and Use Tax (SUT) Compliance and Electronic Invoicing

Local companies use US GAAP. Foreign or multinational companies may apply IFRS where applicable, particularly in banking or global trade sectors.

All corporations must file an annual report with the Department of State on or before April 15 of each year, or the next business day if it is a weekend or holiday, containing the following information:

- Name and registration number of incorporation

- Physical and mailing address of the designated office

- Name and physical address of the resident agent

- Name and postal address of at least 2 officers of the corporation who are in an established office at the date of filing the report, including that of the officer who signs the report, and the expiration dates of their respective positions

- The report must contain a status statement of the economic condition of the corporation at the close of operations during the previous calendar year

- If the business volume of the corporation exceeds USD$3 million, this report must be audited by a certified public accountant licensed in Puerto Rico

- The report must be signed by an authorized officer, a director or incorporator

LLCs will not have to file an annual report with the Department of State. They only pay annual fees in the amount of USD$150 on or before April 15 of each year, or the next business day if it is the end of the year or a holiday.

FAQs About Accounting and Tax in Puerto Rico

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting and taxation in Puerto Rico.

The corporate tax rate in Puerto Rico is based on a normal tax and surtax structure, whereby a taxpayer who is not a member of a controlled group, taxable income will be subject to a normal tax of 18.5% and the balance in excess of the $25,000 surtax exemption will be subject to the following surtax:

– $0-$75,000 5%

– $75,001 – $125,000 $3,750 plus 15% of excess over $75,000

– $125,001 – $175,000 $11,250 plus 16% of excess over $125,000

– $175,001 – $225,000 $19,250 plus 17% of excess over $175,000

– $225,001 – $275,000 $27,750 plus 18% of excess over $225,000

– $275,001 – Over $36,750 plus 19% of excess over $275,000

Businesses in Puerto Rico are subject to various taxes, including corporate income tax, sales and use tax (known as IVA), property tax, and other local taxes. The specific tax liabilities of a business can vary based on factors such as its industry, location, and eligibility for tax incentives under Puerto Rico’s tax code. Income taxes are calculated on the difference between revenue minus deductible expenses.

In Puerto Rico, the equivalent of the Internal Revenue Service (IRS) in the United States is known as the Departamento de Hacienda or the Puerto Rico Department of Treasury. It is responsible for administering tax laws and collecting taxes on the island.

Puerto Rico typically follows the U.S. Generally Accepted Accounting Principles (GAAP) for financial reporting.

In Puerto Rico, the equivalent of a Certified Public Accountant (CPA) is known as a Contador Público Autorizado (CPA). A Contador Público Autorizado is a certified professional accountant who is licensed to practice accounting, audit, and taxation services in Puerto Rico.

Puerto Rico primarily follows U.S. GAAP for financial reporting. However, some entities in Puerto Rico, especially those under the jurisdiction of the Puerto Rico Financial Oversight and Management Board, may use International Financial Reporting Standards (IFRS).

Puerto Rico has a combined 11.5% SUT, with 4.5% going to the central government and 1% to municipalities. Businesses must file monthly returns via the SURI platform. Electronic invoicing and digital fiscal reporting are required under Hacienda’s tax modernization plan.

Employers contribute to Social Security (6.2%), Medicare (1.45%), state unemployment insurance (SUI), and the Puerto Rico Workmen’s Compensation Fund. Employees also contribute to Social Security and Medicare. Payroll must be reported to the Department of Labor and included in quarterly filings via Form 941-PR.

Act 60 (Incentives Code) consolidates several prior tax incentive laws, including Acts 20 and 22. It provides 4% corporate tax for qualifying export services, 0% tax on dividends, and reduced capital gains tax for eligible residents. Applicants must submit an annual compliance report and pay a flat annual fee to maintain benefits.

Corporate tax returns are due by the 15th day of the 4th month after the end of the fiscal year (typically April 15). SUT returns are due monthly by the 20th, payroll reports quarterly, and Act 60 annual reports by April 15 with filing fees.

Why Invest in Puerto Rico?

Located in the Caribbean Sea between the Dominican Republic and the US Virgin Islands, Puerto Rico has a population of around 3.2 million people and registered a gross domestic product (GDP) of $103.1 billion in 2020. That represented a slight GDP decline compared to the previous year, owing to the turmoil caused by the COVID-19. However, the Puerto Rican economy has now bounced back.

Once a major producer of sugar, Puerto Rico now has a dynamic and diverse economy. Its well-developed manufacturing industry contributes more than 50% of total GDP and is a major draw for investors. Among the manufactured products representing key export goods to Puerto Rico are pharmaceuticals, medical equipment, garments, and computers.

Call centers are also a growing business activity because of the high level of English proficiency on the island. Puerto Rico is also home to a dynamic startup scene and an increasing pool of tech talent.

For investors looking to take advantage of these growing sectors and incorporate a business in Puerto Rico, the island has three free trade zones (FTZs) — known as foreign trade zones in the United States and its territories — that offer lucrative financial incentives to businesses located within their boundaries. Beyond the FTZs, the island also has a huge tourism sector that draws significant overseas investment.

Being a US territory, Puerto Rico uses the US dollar, which creates stability for locally-based businesses. The island also boasts considerably better infrastructure than many other nations in Latin America and the Caribbean.

Although a great deal of Puerto Rico’s trade is with the mainland United States, local businesses benefit from preferential access to a wide range of major global and regional markets, via US participation in a wide range of free trade agreements (FTAs).

Biz Latin Hub can Help You With Accounting and Taxation in Puerto Rico

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean. Our unrivaled reach means we can support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about accounting and taxation in Puerto Rico, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent or otherwise doing business in Latin America and the Caribbean.If this article on accounting and taxation in Puerto Rico was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.