Guatemala is an increasingly attractive destination for foreign investment in Central America. Choosing the correct legal entity is essential to operating legally and efficiently after you incorporate a company in Guatemala. Whether you’re a multinational or a local entrepreneur, this guide will help you understand the key company types in Guatemala — such as SA, SRL, and branch offices — and how to choose the best option for your expansion.

Key Takeaways

| Common legal entity types in Guatemala | Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.). Corporation (Sociedad Anónima – S.A.). Foreign Company Branch. |

| What is the most common Guatemalan business entity? | The most common business formation in Guatemala is the Sociedad Anónima or S.A., that offers a greater ease of doing business for foreign investors. |

| What are the primary considerations when choosing a business entity in Guatemala? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

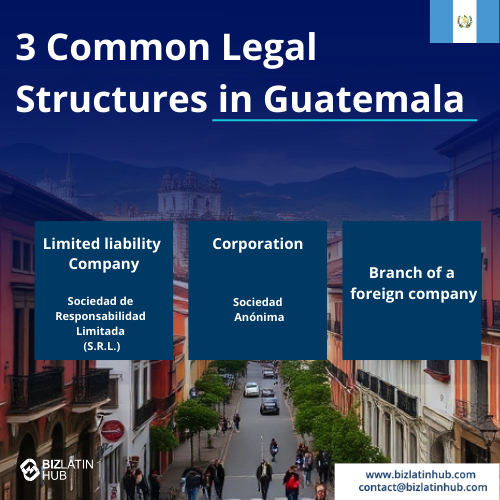

Main Legal Entity Types in Guatemala

There are several different types of companies in Guatemala to incorporate your company. Each legal entity offers different conditions and governance structures to suit varying business needs.

The legal entity you choose will influence the amount of capital to invest, economic activities to be carried out, how many shareholders you will have, and other factors.

The most common types of legal entities that are usually used to establish a company are included below.

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.)

- Corporation (Sociedad Anónima – S.A.)

- Foreign Company Branch

Comparison Table: Key Legal Entity Types in Guatemala

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SA (Sociedad Anónima) | Larger businesses or external investors | 2+ | Limited to capital | Yes | Corporate tax applies |

| SRL (Sociedad de Responsabilidad Limitada) | Small partnerships or closely held businesses | 2–20 | Limited to capital | Yes | Corporate tax applies |

| Branch | Foreign companies operating in Guatemala | 1 (foreign HQ) | Parent company liable | Yes | Taxed as a local entity |

1. Sociedad de Responsabilidad Limitada (SRL)

The Limited Liability Company (LLC) is one of the types of companies in Guatemala, also called Sociedad de Responsabilidad Limitada (S.R.L.) in Spanish. It can be made up of several partners who are only required to pay their capital contributions, and whose personal assets are not liable for company debt. Only the company assets are liable for the social obligations, and where appropriate, sums that total more than the contributions agreed on the social deed.

The Limited Liability Company in Guatemala possesses additional characteristics, including:

- It is a mercantile society: a legal entity created for commerce and having commercial activities as its objective

- Participation is not represented in shares, but in contributions from each partner

- Only a maximum of 20 partners are allowed

- The company will operate under a denomination or company name. The name will be freely formed but will always refer to the main social activity. The company name will be formed with the full name of one of the partners or the last name of two or more of them. In both cases, it is mandatory to add the following words ‘Limited Company,’ which may be abbreviated: Ltda. or/and Cía. Ltda, respectively.

2. Sociedad Anónima (SA)

Among the types of companies in Guatemala, we have the Corporation (Sociedad Anónima) is a legal entity with capital divided and represented by shareholders. The responsibility of each shareholder is limited to the payment of the shares that they have subscribed to.

The Corporation’s legal entity has elements similar to those of the Limited Liability Company. Both are mercantile companies created for commerce and their objectives are aimed at such. However, there are some differences in the characteristics of these legal entities in Guatemala which businesses must take into account. The following factors highlight the differences in these characteristics :

- Capital is represented by registered shares

- The shares have freedom of transmission, although the form of transmission of the shares will depend on how the form is regulated in the articles of incorporation

- The contributions for capital formation can be in cash

- The name of the company can be freely formed, but it must carry the word Corporation, which can also be abbreviated S.A.

3. Branch of a Foreign Company

A Foreign Company Branch is the third type of company in Guatemala and is for companies legally constituted abroad who wish to operate in the country by establishing one or more branches or agencies. They are subject to the provisions of the Commercial Code and other laws of the Republic of Guatemala.

The form of constitution and requirements for this legal entity in Guatemala are very similar to those in other Central American countries. The essential elements of a Foreign Company Branch in Guatemala include:

- The company must permanently have a legal representative in the country who will have broad powers to carry out all the legal acts and businesses of their business.

- Contract a bond in favor of third parties for an amount no less than the equivalent in Quetzales of approximately US$50,000. The amount of the deposit is set by the Mercantile Registry (Registro Mercantíl)

- The approximate time to set up a branch is 30-45 days after receiving the corresponding legal documentation.

Who Should Choose Which Entity Type in Guatemala?

SA – Sociedad Anónima

Who should choose this: Ideal for larger operations or companies that plan to raise capital. SA offers greater flexibility in share transfers and external investment.

SRL – Sociedad de Responsabilidad Limitada

Who should choose this: Suited for small-to-medium-sized businesses where ownership is restricted and managed internally among partners.

Branch

Who should choose this: Foreign corporations wishing to operate directly in Guatemala without incorporating a new company. Requires registration with the Mercantile Registry.

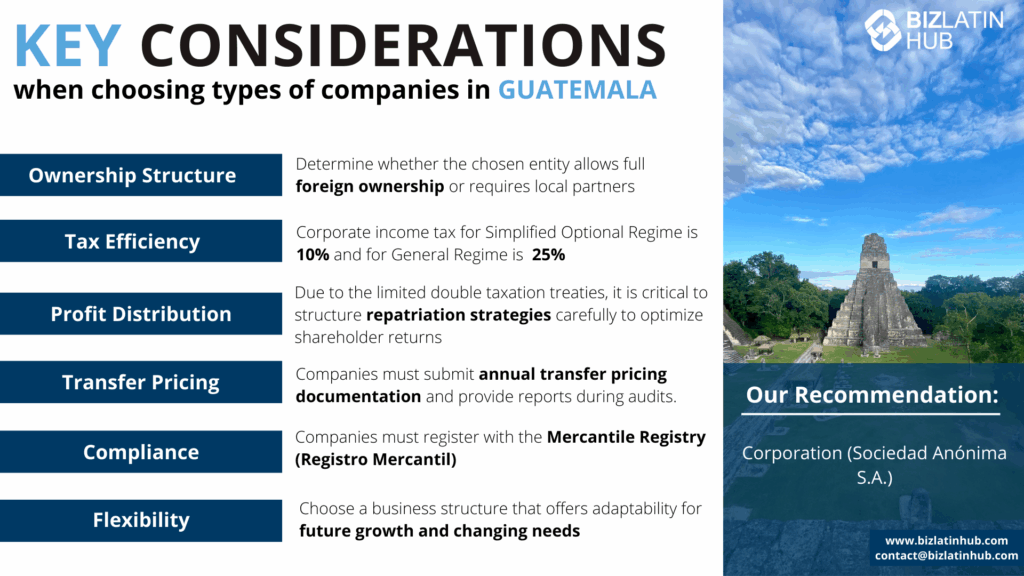

How to Choose the Right Legal Structure in Guatemala

Ownership Structure

Evaluate whether the chosen business entity allows full foreign ownership. Guatemala generally permits 100% foreign ownership across most industries, creating an investor-friendly environment. However, certain sectors like telecommunications, mining, and energy may have additional regulatory oversight or licensing requirements. Understanding these regulations ensures compliance and supports seamless operations in the local market.

Tax Efficiency

Analyze the effects of Guatemala’s tax framework on your business. Corporate income tax operates under two regimes:

- Simplified Optional Regime (10%): Tax applied on gross income.

- General Regime (25%): Tax applied on net taxable income.

Additionally, a value-added tax (VAT) of 12% applies to most goods and services. Companies operating in strategic sectors, such as renewable energy or tourism, or within special economic zones (ZOLIC), can benefit from tax incentives, including reduced rates or exemptions. Proper tax planning and selection of the appropriate tax regime are crucial for optimizing costs while maintaining compliance with local laws.

Profit Distribution

Consider the taxation of profit distribution in Guatemala. Dividends paid to non-residents are subject to a 5% withholding tax, in addition to corporate taxes. Guatemala has limited double taxation treaties, so it is critical to structure repatriation strategies carefully to optimize shareholder returns. Understanding the local framework will ensure efficient and compliant fund transfers.

Transfer Pricing

Comply with Guatemala’s transfer pricing regulations for cross-border transactions between related parties. These rules follow OECD guidelines, requiring businesses to justify that intercompany transactions reflect arm’s-length market values. Companies must submit annual transfer pricing documentation and provide reports during audits. This is particularly important for businesses involved in international trade, intellectual property, or intercompany financing.

Compliance

Prepare to meet Guatemala’s regulatory compliance requirements. Companies must register with the Mercantile Registry (Registro Mercantil) and the Tax Administration Superintendency (SAT). Monthly tax filings for VAT and payroll taxes are mandatory, along with annual income tax declarations. Financial statements must align with Guatemalan accounting standards (based on IFRS for certain entities). Labor compliance is also key, including social security contributions to the Guatemalan Social Security Institute (IGSS) and adherence to local labor laws. Staying up to date with these obligations is essential to maintain legal standing and avoid penalties.

Flexibility

Choose a business structure that offers the right balance of simplicity and adaptability. Common legal structures in Guatemala include:

- Sociedad Anónima (S.A.): The most common structure for businesses, offering limited liability and the ability to issue shares. It requires at least two shareholders and is suitable for businesses of all sizes.

- Sociedad de Responsabilidad Limitada (S.R.L.): Ideal for small to medium-sized businesses, with limited liability and fewer corporate governance requirements. It has a limit of 20 shareholders.

- Empresa Individual de Responsabilidad Limitada (E.I.R.L.): A structure for sole proprietors that offers limited liability protection and simplicity in operations.

Choosing a flexible structure ensures that your business can adapt to changing regulations and opportunities in Guatemala.

Our recommendation: From experience we recommend clients the S.A. company strucutre, as it offers limited liability protection to shareholders, flexibility in shareholding structure, management and capital contributions.

Steps to Incorporate a Company in Guatemala

When you register a company in Guatemala, whether you are supported by a company formation agent or otherwise, you must complete the following 5 steps:

- Step 1 – Choose the Type of Entity.

- Step 2 – Register a Company in Guatemala with an appropriate name.

- Step 3 – Determine the Amount of Initial Share Capital and Open a Corporate Bank Account.

- Step 4 – Notarize and Establish the Bylaws of Your Company.

- Step 5 – Registration of the Company Before Guatemalan State Entities.

Compliance Tip:

All entities must register with the Mercantile Registry, obtain a NIT from SAT (Guatemalan tax authority), and enroll in social security (IGSS) if employing staff.

Common Pitfalls When Choosing a Legal Entity in Guatemala

Selecting an SRL when future share transfer flexibility is important

Failing to appoint a legal representative with a local presence

Underestimating compliance and financial reporting requirements

Choosing a branch without understanding that the foreign HQ assumes liability

Missing industry-specific regulatory licensing (e.g., finance, import/export)

Partnering with Biz Latin Hub for Company Formation in Guatemala

The Guatemalan government authorities are open to national and foreign businesses looking to expand to Guatemala since it will stimulate the growth of their economy. For this reason, the facilities for establishing a company and various commercial, tax incentives are offered for people interested in establishing a legal entity for commercial purposes. As explained in the article, you have 3 types of companies in Guatemala to choose from.

Choosing the right type of legal entity to enter the Guatemalan market is of utmost importance as it lays the foundation for your future expansion around the Central American region. For this reason, we recommend working with a local partner who knows the legal and accounting regulations of Guatemala. Contact Biz Latin Hub and our team of local experts will provide tailor-made services to help you establish your business in Guatemala.

If you are interested in obtaining more information about the types of legal entities in Guatemala, do not hesitate to contact us at contact@bizlatinhub.com.

Learn more about our team and expert authors.

FAQs: Legal Entities in Guatemala

1. Can a foreigner register a company in Guatemala?

Yes, foreign individuals and entities are permitted to register companies in Guatemala. The country encourages foreign investment across various sectors and offers streamlined processes for company formation.

2. What type of legal entity is recommended in Guatemala?

The recommended legal type for businesses in Guatemala varies depending on factors such as the size of the enterprise, the nature of its activities, and the preferences of its founders. However, one commonly recommended legal structure is the Sociedad Anónima (S.A.).

3. How do I create a company in Guatemala?

Creating a company in Guatemala involves several steps, including selecting a business structure, registering with the Mercantile Registry, obtaining a tax identification number, and complying with licensing and permitting requirements.

4. What is an LLC in Guatemala?

In Guatemala, an LLC refers to a Sociedad de Responsabilidad Limitada (S.R.L.), which combines elements of partnerships and corporations. It offers limited liability to its members and allows for flexible management structures.

5. What is the business structure of a Simplified Shares Company (S.A.S) in Guatemala?

This type of company structure in Guatemala offers a combination of speed, flexibility, and investor-friendly features that make it a suitable choice for both domestic and foreign businesses looking to establish a presence in the country.

6. What is the most common legal structure for foreign companies in Guatemala?

The Sociedad Anónima (SA) is the most commonly used by foreign companies because it allows greater flexibility for raising capital and working with third-party investors.

7. Can I own 100% of a Guatemalan company as a foreigner?

Yes. Foreign individuals and legal entities can fully own Guatemalan companies, including both SA and SRL structures.

8. What’s the difference between SA and SRL?

SA is more flexible in share transfer and ideal for raising external investment, while SRL is more restricted, allowing only a limited number of partners and tighter ownership control.

9. What are the key tax obligations for companies in Guatemala?

Companies must pay income tax, VAT (if applicable), and employer contributions to social security. Monthly and annual tax filings are required through SAT.

10. How long does it take to incorporate in Guatemala?

It typically takes 4–6 weeks depending on document readiness, notarizations, and registration processes.

11. Do I need a resident legal representative?

Yes. All companies must appoint a legal representative residing in Guatemala with the authority to act on behalf of the business.

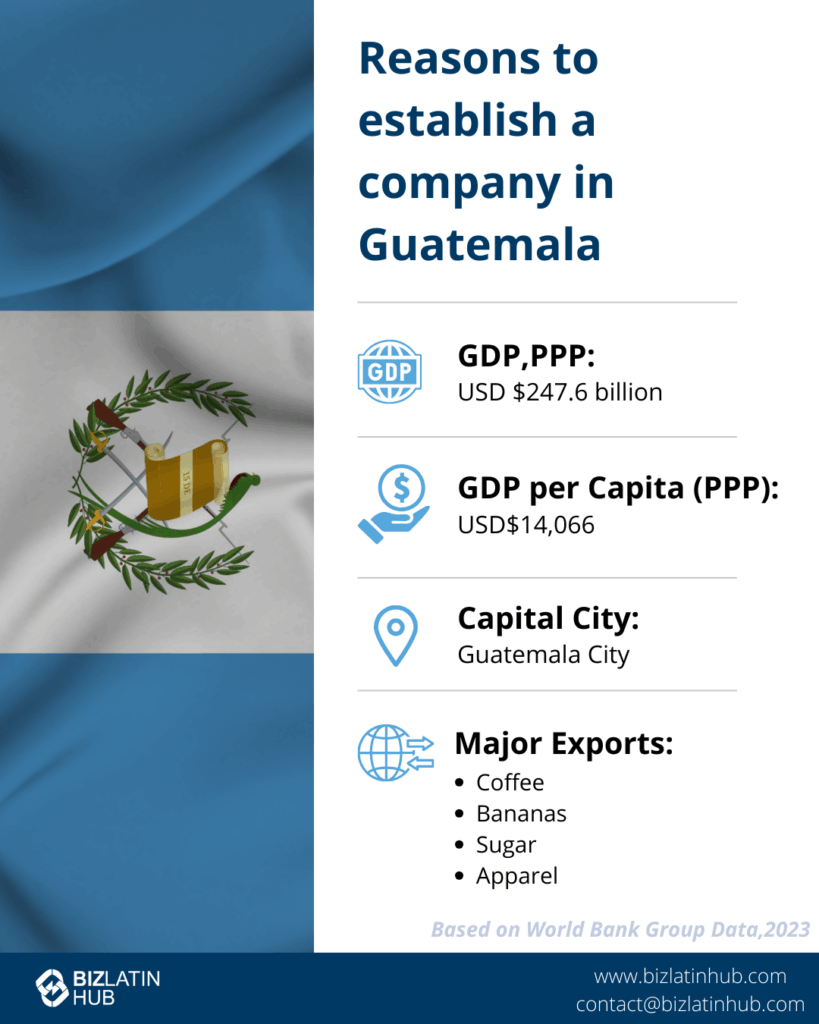

Why Choose to Invest in Guatemala?

With Central America emerging as a focal point for foreign multinationals interested in taking advantage of opportunities spanning North and South America, discerning the optimal corporate structure is imperative. Whether considering the formation of a Sociedad Anonima (S.A.), a Sociedad de Responsabilidad Limitada (S.R.L.), or other entity models, our experience in Guatemalan company formation facilitates informed decision-making, ensuring a smooth entry into Guatemala’s dynamic business landscape.

Central American countries have a lot to offer to foreign and local companies, such as tax benefits, special economic zones, and access to the Atlantic and Pacific Oceans. Guatemala maintains several free trade agreements for businesses to obtain certain benefits for the sale of products within the region.