This Caribbean island is an unincorporated part of the United States, meaning there are some local differences to be aware of compared to the rest of the country. In this article, we delve into the significance of understanding employment laws in Puerto Rico to establish a successful and compliant business presence in the region. Biz Latin Hub can help you with market entry and company formation in Puerto Rico among many other things.

Key Takeaways

| What are the working hours mandated by employment laws in Puerto Rico? | Employment laws in Puerto Rico set a maximum work schedule of 8 hours per day and 40 hours per week, not including overtime. |

| What is the minimum wage in Puerto Rico? | The current minimum wage as of January 2025 is USD$10.50 an hour, which is roughly USD$1,820 per month for a full time employee. |

| Types of Employment Contracts in Puerto Rico | Fixed-term. Indefinite-term. |

| What percentage of an employee’s salary is contributed to social security in Puerto Rico? | Employers must pay 7.65% of an employee’s gross salary to social service contributions. |

Does Puerto Rico follow US labor laws?

Employment laws in Puerto Rico are governed by both U.S. labor regulations and Puerto Rico’s constitution. This legal framework upholds employees’ entitlement to select their profession, secure a fair minimum wage, maintain a standard workday within eight hours, and obtain additional remuneration for tasks surpassing this limit.

Contracts are generally indefinite, but can also be fixed-term under certain circumstances. In the case of a fixed-term agreement it must be clearly stated in writing. This is the same as most of the incorporated States in the Union.

What is the PTO law in Puerto Rico?

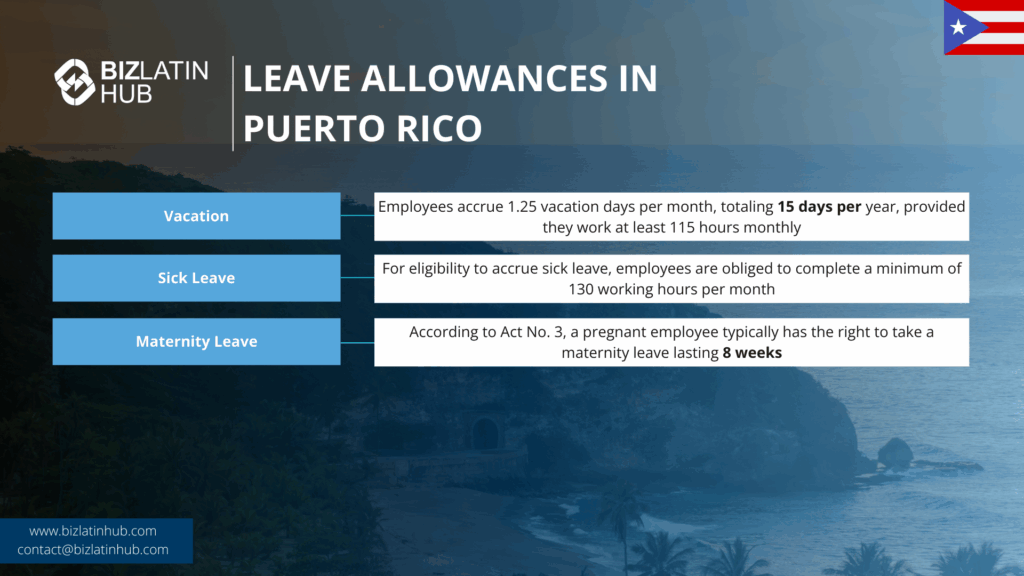

In Puerto Rico, employees receive 15 days of annual leave. Upon completing a minimum of one hundred and thirty (130) hours of work each month, every employee becomes eligible for vacation leave accrual.

The rate of vacation leave accrual varies: starting with one-half (1/2) day in the initial year of service, increasing to three-fourths (3/4) of a day from the second to fifth (5) years of service, reaching one (1) day after the fifth year up to the fifteenth (15) year of service, and culminating at one and one-fourth (1 1/4) days after the fifteenth (15) year of service.

What is the law 80 in Puerto Rico?

In Puerto Rico, employees do not have at-will status, which means they can not be fired any time, for any reason. For employers in Puerto Rico, unique challenges arise compared to other U.S. regions, as local laws prioritize employee rights.

Dismissing an employee demands substantial evidence of just cause to avoid the risk of providing substantial compensation, known as “una mesada,” which can resemble an enhanced severance package. This encompasses a minimum of two months’ salary along with additional compensation based on their service duration.

Potential grounds for termination in Puerto Rico include:

- Documented history of inappropriate or disorderly behavior.

- Tangible instances of subpar work performance (efficiency, quality, etc.).

- Breach of reasonable written regulations.

- Business closure.

Understanding these intricacies of employment laws in Puerto Rico is crucial for businesses operating there.

Employment laws in Puerto Rico: Key guidelines

- Employment Probation Period

- Working Hours

- Overtime in Puerto Rico

- Sick Leave

- Maternity Leave

Employee Probation Period: The probationary period occurs automatically without requiring a written agreement. It lasts for a duration of up to nine (9) months for non-exempt employees and can be extended to twelve (12) months for exempt employees, including executives, administrators, and professionals as defined by relevant regulations.

Working Hours: In Puerto Rico, a standard workday consists of eight hours, while a regular workweek comprises forty hours.

Overtime in Puerto Rico: If your earnings surpass the minimum wage in Puerto Rico, you have the right to receive a minimum of 1.5 times your standard hourly wage for any overtime hours worked. In Puerto Rico, a unique overtime rate is set at twice the regular hourly wage for any hours worked exceeding 8 in a day or 40 in a week.

Sick Leave: For eligibility to accrue sick leave, employees are obliged to complete a minimum of 130 working hours per month. This translates to an approximate daily average of just under 6.5 hours or around 32.5 hours per week. Workers who meet this hourly threshold are entitled to earn one day of paid sick leave for each month of employment. Importantly, sick leave utilization contributes to the fulfillment of the 130-hour minimum requirement for subsequent months’ sick leave accrual.

Maternity Leave: According to Act No. 3, a pregnant employee typically has the right to take a maternity leave lasting eight (8) weeks. To initiate this leave, the employee needs to provide a medical certificate confirming her pregnancy and the anticipated childbirth date. The maternity leave is divided into two parts: a four (4) week prenatal leave and a four (4) week postnatal leave.

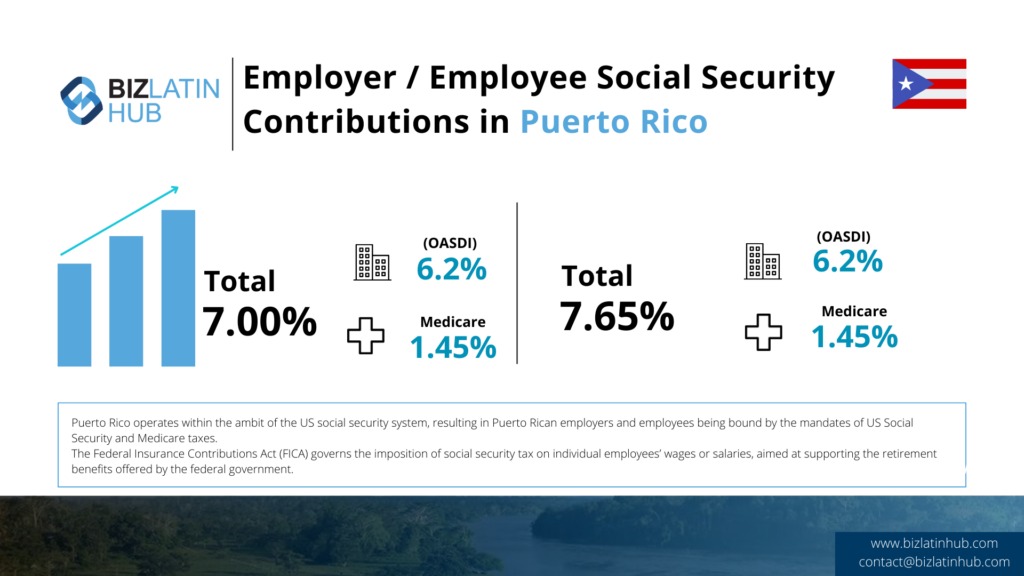

Puerto Rico operates within the ambit of the US social security system, resulting in Puerto Rican employers and employees being bound by the mandates of US Social Security and Medicare taxes.

The Federal Insurance Contributions Act (FICA) governs the imposition of social security tax on individual employees’ wages or salaries, aimed at supporting the retirement benefits offered by the federal government. FICA enforces two distinct taxes:

- Old-age, survivors, and disability insurance (OASDI)

- Hospital insurance (Medicare)

As of 2019, the OASDI tax is levied at a rate of 6.2% each for the employee and the employer on the first $176,100 of income. The Medicare tax, on the other hand, is applied at a rate of 1.45% each for the employee and the employer without any income ceiling. Notably, high-income employees, not their employers, are required to pay an additional 0.9% Medicare tax.

The specific income thresholds for this additional Medicare tax differ based on filing status. Married couples filing jointly are subject to the extra tax on combined earnings exceeding USD$250,000. Single taxpayers and heads of households are affected when earnings exceed USD$200,000, while married individuals filing separately are impacted by earnings surpassing USD$125,000. The calculation includes self-employment income in determining the threshold.

FICA tax is applicable to remuneration for services rendered within the United States, irrespective of the nationality or residence of the employee or employer. Consequently, unless exempted, nonresident alien employees working in the United States are liable for FICA tax, even if they are exempt from US income tax based on statutory regulations or income tax treaties.

Certain groups are exempt from FICA tax, encompassing foreign government employees, exchange visitors holding J visas in the United States, foreign students with F, M, or Q visas, and individuals covered by social security totalization agreements between the United States and other nations. These agreements enable eligible individuals to continue contributing to their home countries’ social security systems, usually for up to five years.

FAQs about employment laws in Puerto Rico

In our experience, these are the common questions that our clients ask us.

Employment laws in Puerto Rico are governed by both U.S. labor law and Puerto Rico’s constitution. These laws protect the rights of employees, including the right to choose their occupation, receive a reasonable minimum salary, work a regular workday of no more than eight hours, and receive overtime compensation for any work done beyond eight hours.

The working conditions in Puerto Rico are highly regulated by labor laws. Non-exempt employees have a regular work shift of 8 hours per day and a workweek of 40 hours per week. Puerto Rico’s labor laws regarding overtime are more favorable to workers compared to federal overtime laws.

Puerto Rico is not an ’employment at will’ jurisdiction, and employees who are discharged without just cause are entitled to receive a statutory discharge indemnity. It is important to note that as an unincorporated territory of the United States, federal labor and employment laws also apply in Puerto Rico.

Non-exempt employees in Puerto Rico typically work 8 hours per day and have a standard workweek of 40 hours.

The minimum salary in Puerto Rico is USD$10.50/hr. Workers in Puerto Rico are entitled to be paid the higher state minimum wage.

Overtime in Puerto Rico is paid at a rate of time and a half the regular hourly rate for all hours worked over 8 hours per day. Additionally, double time is paid on statutory rest days and for hours worked over 40 per week.

Employment termination in Puerto Rico is governed by labor laws. Employees hired for an indefinite period of time can only be terminated for just cause, excluding probationary employees. If an employee is terminated without just cause, they are entitled to a severance payment based on their length of service and a statutory formula.

The severance payment is capped at nine months and is calculated as three months of salary plus two weeks of salary for every year of service. The severance payment is tax-free up to the statutory amount, with any excess being subject to taxation. Puerto Rico does not have a local WARN statute, but the US federal WARN Act applies in Puerto Rico for mass layoffs, which may include pay in lieu of notice in certain situations.

To terminate an employee in Puerto Rico, it is important to have proper and complete documentation to support any reported complaints or violations. If the issue is related to the employee’s performance, documentation may include error reports or periodic appraisal results.

Upon quiting, the individual is eligible to receive their final paycheck, which will coincide with the company’s upcoming regular payroll cycle. Additionally, the last paycheck will encompass any accrued vacation days. However, it’s important to note that accrued sick days are not compensated in the event of an employee’s resignation.

Biz Latin Hub can help with employment laws in Puerto Rico

At Biz Latin Hub, we have a dedicated team of specialists ready to deliver customized solutions that address your unique business requirements in Puerto Rico.

With our extensive legal, accounting, and back-office services, we serve as your primary point of contact, streamlining and accelerating your entry into the Puerto Rican market.

Talk to our team of local experts today about business opportunities in Puerto Rico, company formation, and how to best enter this LATAM market.