A growing hub in Central America, attracting global investors with its strategic location and business-friendly government policies, company formation in Nicaragua is increasing. However, to succeed in this market, companies need to have a deep understanding of the tax and accounting requirements in Nicaragua. For example, knowing the different tax rates and credits available to foreign investors. This guide details the essential obligations for businesses, including the unique Minimum Definitive Payment system and mandatory record-keeping.

Key Takeaways On Tax and Accounting Requirements in Nicaragua

| What Are The Accounting Standards in Nicaragua? | The accounting standards, regulated and issued by the CCPN (Colegio de Contadores Publicos de Nicaragua), include: Accounting and auditing standards, which include technical resolutions, IFRS adoption circulars, interpretations of international accounting standards and other documents. Regulations of the Corporate Syndicate. Anti-money laundering regulations. Standards of Professional Conduct for Certified Public Accountants, Actuaries and Graduates in Economics and Administration. |

| What is the corporate income tax rate in Nicaragua? | In Nicaragua corporate rates range from 10% to 30%. In general, micro and medium-sized companies pay a rate of 30%. |

| What Is The Nicaraguan Value Added Tax Rate? | The Value-Added Tax (VAT) rate is 15%. |

| What are the main corporate books a company must maintain? | Companies in Nicaragua are legally required to maintain three official books: a Journal Book (Libro Diario), a Ledger Book (Libro Mayor), and a book for meeting minutes (Libro de Actas). These books must be authorized by the Mercantile Registry. |

Nicaragua’s Key Tax Requirements for Companies

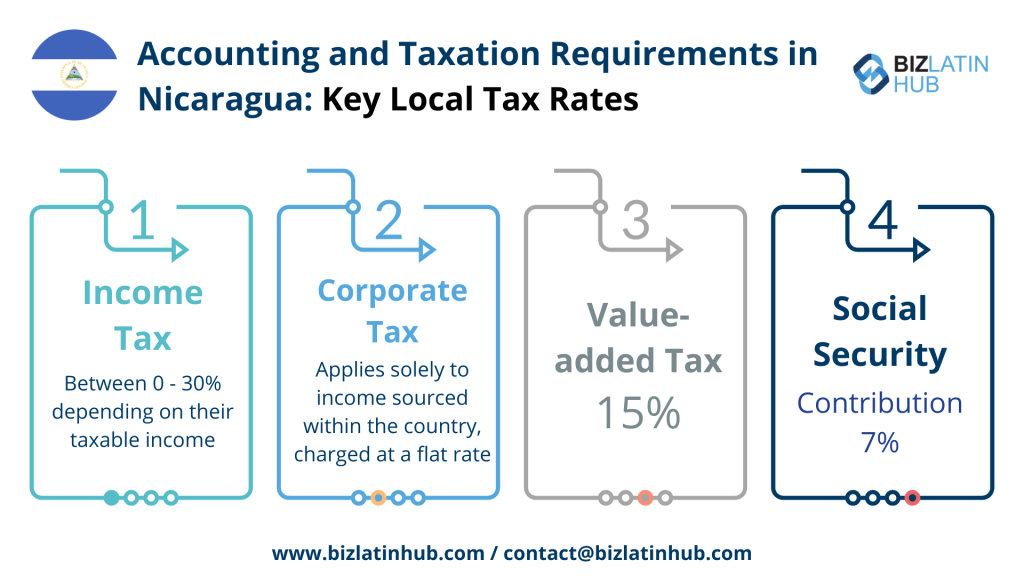

Understanding accounting and taxation in Nicaragua is vital when entering this market. Here is a selection of key tax rates.

1. Corporate Income Tax (IR)

This is a 30% tax levied on the net profit of a company at the end of the fiscal year. Corporate Income Tax (CIT) applies solely to income sourced within the country, charged at a flat rate. The rate is determined as the higher of either 30% of net taxable income (gross taxable income minus permitted deductions) or a fixed minimum tax ranging from 1% to 3% of the gross income earned in the fiscal year.

2. Minimum Definitive Payment (Pago Mínimo Definitivo)

This is a 1% to 3% tax on a company’s gross monthly revenue. At the end of the year, the company pays the greater of its total IR liability or its total Minimum Definitive Payment liability.

Expert Tip: Understanding the Minimum Definitive Payment

Our experience indicates that the Minimum Definitive Payment is the most confusing tax concept for foreign investors in Nicaragua. It is crucial to understand that at year-end, your company will pay whichever amount is higher: the 30% tax on net profits (IR) or the 1-3% tax on gross revenue (Minimum Definitive Payment).

This means a company can have a significant tax liability even if it does not make a profit. We advise all clients to create financial forecasts that project both calculations. This allows for accurate tax budgeting and prevents cash flow problems from an unexpectedly high tax bill based on gross revenue.

3. Value-Added Tax (VAT)

VAT is a 15% tax on consumption. Businesses must charge VAT on their sales and file monthly returns with the DGI, remitting the net amount of tax collected. Exports of goods and services are subject to a 0% rate.

4. Municipal Tax

Companies must also pay a monthly municipal tax, which is typically 1% of their gross revenue, to the local government where they operate.

Other Key Taxes in Nicaragua

Income Tax: Residents are subject to income tax of between 0 – 30% depending on their taxable income. For instance, anyone earning between 350,000 – 500,000 Nicaraguan cordobas pays an income tax rate of 25%.

Capital Gains Tax: Income generated from leasing both fixed and non-fixed assets are taxed at a rate of 12% and 10.5% WHT (Withholding Tax) respectively.

Property Tax: According to Executive Decree No. 3-95 of the Real Estate Tax, a tax rate of 1% is applied to 80% of the cadastral value of properties already registered or acquired by December 31 of each taxable year.

Social Security: An employee’s social security contribution (7.00%) is considered a deductible expense for income tax purposes.

Accounting and Record-Keeping Requirements

Companies in Nicaragua are legally required to maintain three official books: a Journal Book (Libro Diario), a Ledger Book (Libro Mayor), and a book for meeting minutes (Libro de Actas). These books must be authorized by the Mercantile Registry. The accounting standards, regulated and issued by the CCPN (Colegio de Contadores Publicos de Nicaragua), include:

Accounting and auditing standards, which include technical resolutions, IFRS adoption circulars, interpretations of international accounting standards and other documents.

Regulations of the Corporate Syndicate.

Anti-money laundering regulations.

Standards of Professional Conduct for Certified Public Accountants, Actuaries and Graduates in Economics and Administration.

The International Financial Reporting Standards (IFRS) are used in the country. These standards are mandatorily implemented if a company meets any of the following criteria:

Its debt or equity instruments are traded in a public market or it is in the process of issuing these instruments for trading in a public market (either a domestic or foreign stock exchange or an off-exchange market, including local or regional markets), or one of their main activities is to hold assets in a fiduciary capacity for a broad group of third parties. This is usually the case for banks, credit unions, insurance companies, stockbrokers, mutual funds and investment banks.

They publish financial statements for general information purposes for external users. Examples of external users are owners who are not involved in the management of the business, current and potential creditors and credit rating agencies, who do not require financial statements to be presented for specific purposes or tailored to their particular needs. Otherwise the implementation of IFRS is optional.

The Role of the DGI

The General Directorate of Revenue (Dirección General de Ingresos – DGI) is the Nicaraguan government’s tax authority. It is responsible for the administration and collection of all national taxes, including income tax and VAT. All businesses must register with the DGI and file their monthly and annual returns.

How Do I Set Up a Company in Nicaragua?

To register a company in Nicaragua, businesses must follow these steps:

Drafting Act of Incorporation: Mandate the involvement of two shareholders possessing a minimum startup capital of C$10,000. It is imperative to designate a Nicaraguan resident legal representative. The final document necessitates certification by a Nicaraguan public notary.

Acquiring Accounting and Corporate Books: Secure the essential books required for company registration from local bookstores.

Submission of Act of Incorporation at VUI: Present the necessary documents at the Investment Service. The Commercial Registry processes the submission, demanding a payment equivalent to 1% of the company’s capital, capped at C$30,000.

Registration as a Trader and Accounting Bookkeeping: Following processing, register as a trader and the accounting books at the Commercial Registry via VUI.

Obtaining the Single Registration Document: This document, attained simultaneously with the previous step, encompasses the Municipal License, INSS License, and Tax Payer Registration. This process incurs a payment of 1% of the company’s capital.

Appointment of Legal Representation: Shareholders are required to designate a resident Nicaraguan legal representative. The powers of this representative can be limited by the Board of Directors. Ensuring the selection of a reliable individual is crucial.

FAQs When Understanding Accounting and Taxation in Nicaragua

Based on our extensive experience, these are the common questions and concerns of our clients when seeking to understand accounting and taxation requirements in Nicaragua.

In Nicaragua corporate rates range from 10% to 30%. In general, micro and medium-sized companies pay a rate of 30%.

In Nicaragua companies must pay taxes on their goods and services when these have been perfected with the delivery of goods and services. The taxes they must pay are at the municipal and national level.

The equivalent of the IRS in Nicaragua is the General Revenue Directorate (DGI) and the Municipal Mayors’ Offices.

The accounting standards, regulated and issued by the CCPN (Colegio de Contadores Publicos de Nicaragua), include:

Accounting and auditing standards, which include technical resolutions, IFRS adoption circulars, interpretations of international accounting standards and other documents.

Regulations of the Corporate Syndicate.

Anti-money laundering regulations.

Standards of Professional Conduct for Certified Public Accountants, Actuaries and Graduates in Economics and Administration.

The professional in Public Accounting is the National Public Accountant, a professional who gives public faith of its functions and who by law must be required to have a license to practice the profession in the jurisdiction in which he/she operates in the country.

The International Financial Reporting Standards (IFRS) are used in the country. These standards are mandatorily implemented if a company meets any of the following criteria:

Its debt or equity instruments are traded in a public market or it is in the process of issuing these instruments for trading in a public market (either a domestic or foreign stock exchange or an off-exchange market, including local or regional markets), or

One of their main activities is to hold assets in a fiduciary capacity for a broad group of third parties. This is usually the case for banks, credit unions, insurance companies, stockbrokers, mutual funds and investment banks.

They publish financial statements for general information purposes for external users. Examples of external users are owners who are not involved in the management of the business, current and potential creditors and credit rating agencies, who do not require financial statements to be presented for specific purposes or tailored to their particular needs.

Otherwise the implementation of IFRS is optional.

Yes, employers must contribute to the Nicaraguan Social Security Institute (INSS) on behalf of their employees. The employer contribution rate is a percentage of the employee’s salary.

Companies in Nicaragua are legally required to maintain three official books: a Journal Book (Libro Diario), a Ledger Book (Libro Mayor), and a book for meeting minutes (Libro de Actas). These books must be authorized by the Mercantile Registry.

The standard VAT (or IVA in Spanish) rate in Nicaragua is 15%. It is applied to most sales of goods and services.

Biz Latin Hub Can Manage Tax and Accounting Requirements in Nicaragua

At Biz Latin Hub, we offer a comprehensive range of market entry and back-office solutions in Latin America and the Caribbean.

Our team has expertise in tax and accounting requirements in Nicaragua, with legal services, accounting and taxation, hiring, and visa processing available.

We maintain a significant presence in the LATAM region, bolstered by robust partnerships that span the area. This extensive network equips us with many resources to facilitate international projects and expand into new markets across various countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.

If this article about tax and accounting requirements in Nicaragua interests you, check out the rest of our coverage of the region. Or read about our team and expert authors.