Barbados welcomes foreign investors with open arms. The nation provides a regulated, transparent, and supportive investment environment. Before you launch your business, It is essential to understand the tax and accounting requirements in Barbados. Discover key information about doing business in this growing Caribbean nation if you want to form a company in Barbados. This guide details the competitive tax rates introduced by the tax convergence, suitable for both local and international business entities.

Key Takeaways On Tax and Accounting Requirements in Barbados

| What accounting standards does Barbados use? | In Barbados, financial statements are prepared by either the International Financial Reporting Standards (IFRS), the International Financial Reporting Standard for Small and Medium-Sized Entities (IFRS for SMEs), or the International Public Sector Accounting Standards (IPSAS). All companies must file an annual tax return with the Barbados Revenue Authority (BRA). |

| What Is The Corporate Tax Rate in Barbados? | Corporate tax is applied to profits at 25%. Small businesses enjoy a reduced tax rate of 15%. International Business Companies and Offshore Banks are subject to corporate tax at rates of 2.5%, which can decrease to 1%. |

| What Is The Bajan Value Added Tax Rate? | The Value-Added Tax (VAT) rate is 17.5%. |

| What is the new tiered corporate income tax system in Barbados? | The corporate income tax is applied in tiers: 5.5% on the first BBD $1 million of profit, 3% on profits between BBD $1 million and $20 million, 2.5% on profits between BBD $20 million and $30 million, and 1% on all profits over BBD $30 million. |

| Dividend Tax Rate in Barbados | Dividends are subject to a basic withholding tax of 15% unless covered by a relevant taxation treaty. |

Corporate tax system in Barbados

The place of management and control determines the residency for tax purposes in corporations. Domestic corporations are taxed on their global income, while foreign companies conducting business through a branch pay corporate tax on locally generated income and a tax on remitted branch profits.

1. Tiered Corporate Income Tax

The tax on corporate profits is progressive. The rate starts at 5.5% and decreases to as low as 1% for companies with very high profits. All companies must file an annual income tax return by June 15th for the previous income year.

Corporate tax is applied to profits at 25% for every complete dollar of taxable income. Small businesses, as per the ‘Small Business Development Act,’ enjoy a reduced tax rate of 15% for every dollar of taxable income under specific conditions.

In the offshore sector, locally incorporated International Business Companies and Offshore Banks are subject to corporate tax at rates of 2.5%, which can decrease to 1%. Captive Insurance Companies in this sector, however, are exempt from taxation.

Expert Tip: Understanding the Tax Tiers for Small Businesses

From our experience, the tiered corporate tax system is highly beneficial for small and medium-sized enterprises (SMEs), but understanding the brackets is key. The lowest rate of 5.5% applies only to the first BBD $1 million of profit. Many new business owners mistakenly assume this rate applies to all their profit.

We advise clients to work with a local accountant to accurately forecast their profits and budget for the correct blended tax rate. Accurately projecting which tax brackets your profits will fall into is essential for proper financial planning and avoiding unexpected tax liabilities at year-end.

Expert Tip: Strategic Profit Allocation

From our experience, the Barbados sliding scale tax is unique: the more you earn, the lower the rate percentage. The rate drops from 5.5% on the first BBD 1 million to just 1% on profits over BBD 30 million. For international groups, this makes Barbados an incredibly efficient jurisdiction for consolidating global profits.

We advise clients to model their projected income carefully; reaching the higher profit tiers significantly reduces the effective tax rate, making it one of the most competitive regimes globally.

2. Value-Added Tax (VAT)

This is a 17.5% tax on goods and services. VAT-registered businesses file returns and make payments every two months.

3. Withholding Tax

Payments to non-residents for items like interest, royalties, and management fees are subject to a 15% withholding tax. This must be deducted and remitted to the BRA by the paying company.

4. National Insurance Scheme (NIS) Contributions

Employers must contribute to the NIS on behalf of their employees. This social security contribution is calculated as a percentage of the employee’s insurable earnings.

Tax and accounting requirements in Barbados: What are the key local tax rates?

Navigating the accounting and taxation requirements in Barbados is crucial when entering this market. Here are the tax rates you need to know.

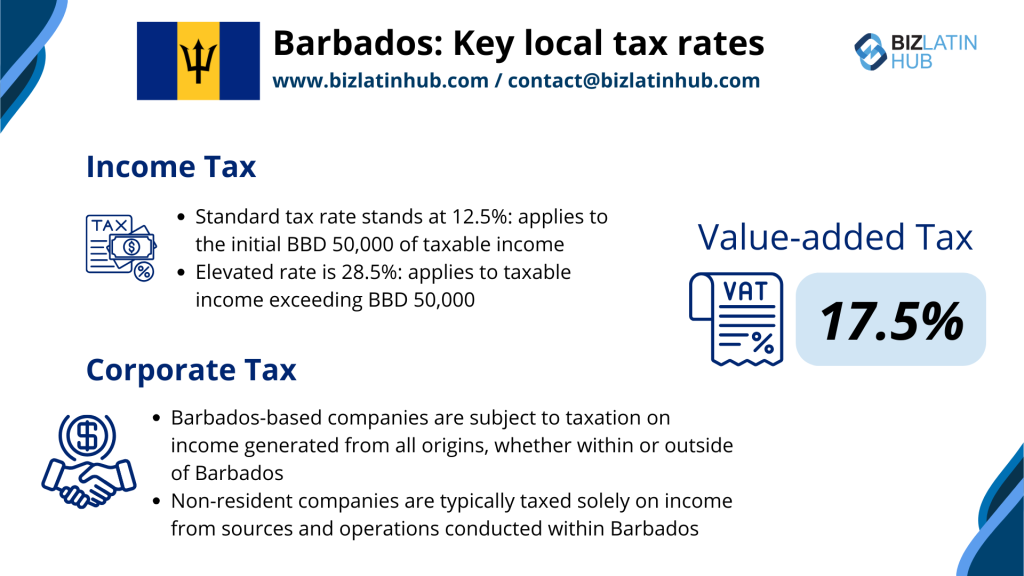

Income Tax

Starting from January 1, 2020, the standard tax rate stands at 12.5%, while the elevated rate is 28.5%. The standard rate applies to the initial BBD$50,000 of taxable income, and the higher rate of 28.5% applies to taxable income exceeding BBD$50,000.

Value-added Tax

VAT is 17.5% of the value of various goods and services imported or provided in Barbados by VAT-registered individuals.

Certain services, such as financial services, real estate, medical services, and education, are exempt from VAT. Transactions between different groups are subject to taxation.

Entities operating under Barbados’ VAT system are required to be registered. The threshold for mandatory VAT registration is BBD 200,000, but those with an annual turnover below this amount can voluntarily register.

Capital Gains Tax

There is no capital gains tax in Barbados.

Foreign Tax Credit

Barbados permits a credit for foreign taxes (taxes paid in jurisdictions outside Barbados). However, the total credit allowed cannot diminish the overall tax liability for that income to less than 1%.

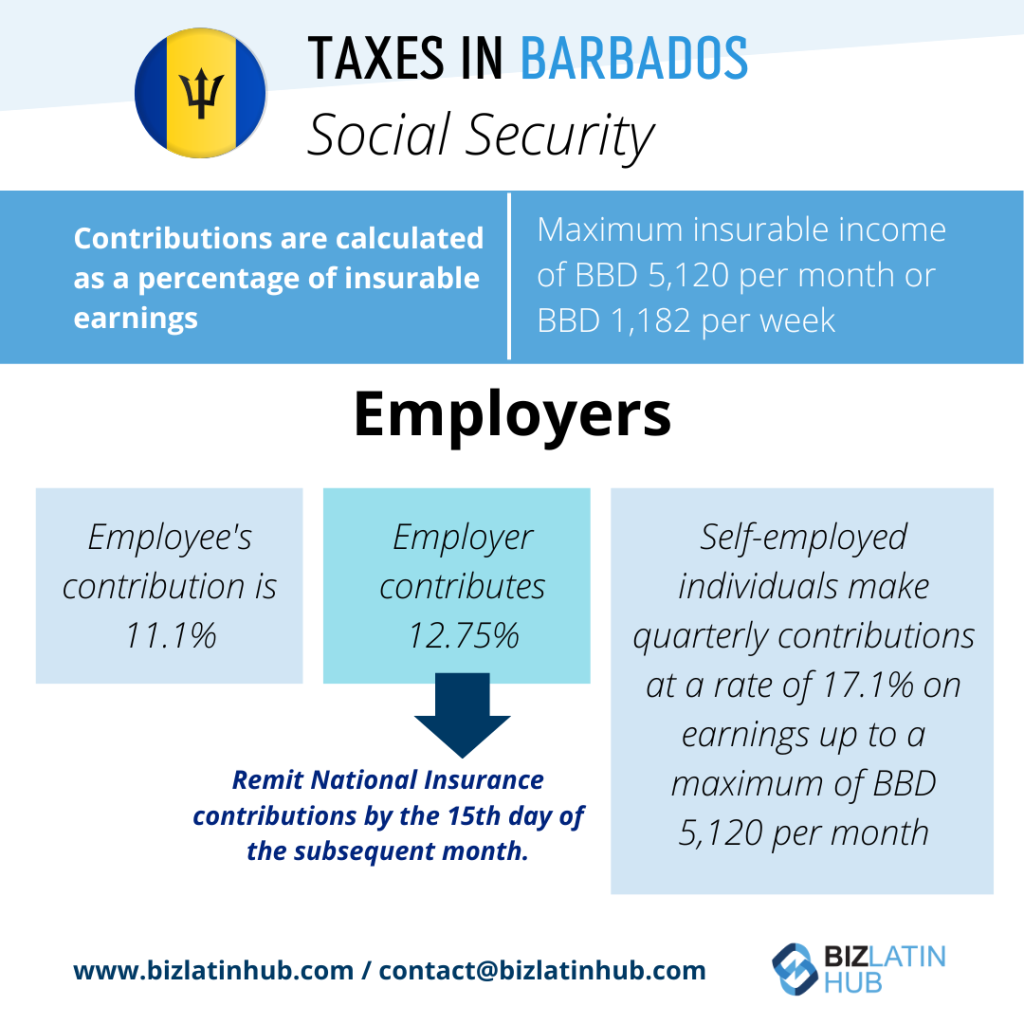

Social Security

Every individual aged 16 to 67, engaged in gainful employment in Barbados under a service contract, must be insured under the National Insurance and Social Security Act.

Contributions are calculated as a percentage of insurable earnings, capped at a maximum insurable income of BBD 5,120 per month or BBD 1,182 per week. Employers must remit National Insurance contributions by the 15th day of the subsequent month.

Starting from October 1, 2018, the employee’s contribution is 11.1%, while the employer contributes 12.75%. Self-employed individuals make quarterly contributions at a rate of 17.1% on earnings up to a maximum of BBD 5,120 per month.

Does Barbados have double taxation agreements?

Barbados has established double taxation agreements with 40 countries including:

The UK, Canada, USA, Finland, Norway, Sweden, China, Cuba, Switzerland, Venezuela, Iceland, Czech Repúblic, Austria, Cyprus, Italy, and more.

The Role of the BRA

The Barbados Revenue Authority (BRA) is the tax collection agency. All companies must register with the BRA to obtain a Tax Identification Number (TIN) and use the Tax Administration Management Information System (TAMIS) for all filings.

FAQ regarding tax and accounting requirements in Barbados

Using our experience, we’ve pinpointed common questions and worries our clients often have when dealing with accounting and taxes in Barbados.

The corporate income tax is applied in tiers: 5.5% on the first BBD $1 million of profit, 3% on profits between BBD $1 million and $20 million, 2.5% on profits between BBD $20 million and $30 million, and 1% on all profits over BBD $30 million.

Businesses residing in Barbados are taxed on income earned globally, inclusive of both local and international sources, after deducting expenses related to income generation within a fiscal period not exceeding 53 weeks. Non-resident companies, on the other hand, are typically taxed solely on income derived from operations within Barbados. Notably, insurance companies face a 2% tax rate, while Captive Insurance companies enjoy tax exemption.

The revenue collection authority in Barbados is known as the Barbados Revenue Authority.

In Barbados, financial statements are prepared by either the International Financial Reporting Standards (IFRS), the International Financial Reporting Standard for Small and Medium-Sized Entities (IFRS for SMEs), or the International Public Sector Accounting Standards (IPSAS).

Barbados officially recognizes and accepts several professional accounting designations, including ACCA, CPA, CGA, and CMA, as equivalents to the Certified Public Accountant (CPA) designation.

A Permanent Establishment (PE) is defined in Barbados’s double taxation agreements (DTAs), aligning with the Organisation for Economic Co-operation and Development (OECD) Model Convention.

According to domestic legislation, a non-resident person is considered to be conducting business in Barbados and must file a CIT return if, in an income year, they either:

Produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved, or constructed anything in Barbados, whether or not exported. Solicited orders or offered anything for sale in Barbados through a factor, agent, or servant.

VAT is a consumption tax applied to most goods and services in Barbados at a standard rate of 17.5%. Businesses with annual revenue over BBD $200,000 must register for VAT.

Employers must deduct Pay As You Earn (PAYE) income tax from employee salaries and remit it to the BRA. They must also deduct and contribute to the National Insurance Scheme (NIS), which covers pensions and other social security benefits.

Yes, under the Companies Act, most companies are required to have their annual financial statements audited by a qualified accountant. These statements must be prepared in accordance with International Financial Reporting Standards (IFRS).

It allows entities that earn 100% of their income in foreign currency to be exempt from exchange controls and certain other duties.

Biz Latin Hub can organize your tax and accounting requirements in Barbados

At Biz Latin Hub, we provide an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

Our team has expertise in tax and accounting requirements in Barbados, with legal services, accounting and taxation, hiring, and visa processing available.

Our strong presence in the LATAM region is supported by robust partnerships that stretch across the area. This broad network provides numerous resources to support global projects and venture into new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.

If this article about tax and accounting requirements in Barbados interests you, check out the rest of our coverage of the region. Or read about our team and expert authors.