Accounting and tax requirements in Argentina are necessary to keep in mind if you’re looking to register a company in Argentina. With a complex regulatory landscape, it is essential to stay up-to-date with all accounting and tax obligations to ensure compliance with local authorities. Biz Latin Hub can help you understand the accounting and tax requirements in Argentina that apply to your individual company. Not only that, but we can do the same across the region, thanks to our network of dedicated local offices spanning Latin America and the Caribbean.

Key Takeaways

| Accounting Standards in Argentina | Accounting and auditing standards encompass technical resolutions, IFRS adoption circulars, interpretations of international accounting standards, and related documents. Rules governing corporate receivership. Regulations for anti-money laundering (AML). Professional conduct standards for certified public accountants, actuaries, and graduates in economics and administration. |

| Corporate Tax Rate in Argentina | 25 – 35% depending on a variety of reasons: business activity, size of the business, net income, etc. |

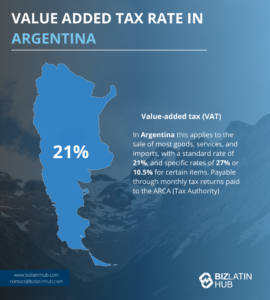

| Argentine Value Added Tax Rate | The current VAT rate (IVA) is set at 21%, with a few variations depending on services and business activity. |

| Dividend Tax Rate in Argentina | A 7% witholding tax applies on dividends paid from an argentine company to resident individuals and non-resident individuals/entities. |

Different Tax Categories in Argentina

In Argentina, taxes are collected at the federal, provincial, and municipal levels. Federal taxes are primarily collected by the Customs Collection and Control Agency (ARCA) (Formerly AFIP). The main federal taxes include:

- Income taxes.

- Minimum presumed income tax.

- Social security.

- Value-added tax (IVA).

- Import and export taxes.

- Tax on financial transactions.

- Net-worth tax.

- System of Withholding Tax Control (SICORE).

Provincial taxes are mainly collected by AGIP (Gubernamental Agency of Public Revenue) and ARBA (Revenue Collection Agency of the Province of Buenos Aires), with the primary provincial tax being the Gross Income Tax.

What is the Corporate Taxation in Argentina?

Let’s start with the corporate tax rate, as shown in the table below.

- Corporate income tax rate:

- IVA (Value-Added Tax): 21%

- Gross Income Tax (Ingresos Brutos): 3% to 7.50%

Taxation For Residents and Non-Residents

The income tax law in Argentina establishes that individuals or legal entities resident in the country are subject to tax on their worldwide income, whether earned domestically or abroad. They can receive tax credits for similar taxes paid on their foreign activities.

Non-residents are subject to tax only on their Argentine-source income. Generally, non-resident taxes are collected through a final withholding tax, depending on the type of income.

*Income taxes are payable on the net income earned during the fiscal year.

What Countries does Argentina Have Tax Agreements With?

Argentina has signed agreements to avoid double taxation with several countries, including Germany, Australia, Belgium, Bolivia, Brazil, Canada, Denmark, Finland, the United Kingdom, Italy, Sweden, France, Norway, Russia, Spain, Switzerland, the United Arab Emirates, Mexico, the Netherlands, Qatar, and Chile.

These agreements were established to prevent double taxation between residents in different jurisdictions, with the primary aim of reducing the tax burden on residents of various jurisdictions under these agreements.

FAQs on Accounting and Tax Requirements in Argentina

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand the accounting and tax requirements in Argentina.

In Argentina, tax rates for companies range from 25% to 35%. In general, micro and medium-sized enterprises pay a rate of 30%.

In Argentina, companies must pay taxes on their goods and services when they have been perfected with the delivery of goods and services. The taxes they must pay are at the local, provincial, and national levels.

The equivalent of the IRS in Argentina is the Customs Collection and Control Agency (ARCA) (Formerly AFIP), the Collection Agency of the Province of Buenos Aires (ARBA), the Government Agency of Public Revenue (AGIP), and municipalities.

The accounting standards, regulated and issued by the FACPCE (Argentine Federation of Professional Councils of Economic Sciences), include:

– Accounting and auditing standards, including technical resolutions, IFRS adoption circulars, interpretations of international accounting standards, and other documents.

– Corporate Receivership Rules.

– Anti-Money Laundering Regulations.

– Standards of Professional Conduct for Certified Public Accountants, Actuaries, and Graduates in Economics and Administration.

The professional in Economic Sciences is the National Public Accountant, a professional who publicly attests to their functions and must by law be required to have a qualifying license to practice the profession in the jurisdiction in which they operate in the country.

The IASB’s International Financial Reporting Standards (IFRS) are adopted in the country. These standards have different levels of application:

– Mandatory for entities under the control of the CNV.

– Optional for entities not subject to IFRS obligation.

– Discontinuous if previously applied optionally.

– Comprehensive for entities that present consolidated or individual financial statements, depending on their control over other entities.es that present consolidated or individual financial statements, depending on their control over other entities.

Why do Business in Argentina?

Now is a great time to invest in Argentina due to its abundant natural resources, strategic location, and emerging markets. The country boasts one of the world’s largest reserves of lithium, critical for electric vehicle batteries, and significant agricultural output, particularly in soybeans, corn, and beef. Its renewable energy sector, supported by government incentives, is also expanding rapidly, creating opportunities in wind, solar, and bioenergy projects.

Argentina is currently undergoing economic reforms aimed at stabilizing the market and encouraging foreign investment. Policies to address inflation, promote export growth, and attract international capital are creating a more favorable business environment of late. Additionally, its skilled labor force and competitive costs make it an attractive destination for industries such as technology, manufacturing, and agribusiness. Rising bilateral trade with regions such as Asia and Europe further promotes Argentina’s position as a hub for global business, providing a compelling case for entrepreneurs and investors seeking long-term opportunities.

Biz Latin Hub can assist you with accounting and tax requirements in Argentina

Biz Latin Hub provides tailored market entry support and integrated back-office service packages to meet the unique needs of our clients.

Our portfolio includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, and we are active in markets all around Latin America and the Caribbean,

That makes us the ideal partner for supporting cross-border operations and facilitating multi-jurisdiction market entry.

We are committed to compliance with regulations everywhere we operate, so working with us comes with the guarantee that your company will adhere to every aspect of employment law in Argentina or any other country where we assist you.

Contact us today to find out more about how we can support you in doing business in Argentina.

Or learn more about our team and expert authors.