Colombia has one of the most agile legal systems in South America when it comes to starting a business. With an emphatic government agenda to encourage foreign investors and entrepreneurs into the country, institutional support to start a business in Colombia is strong. Below we will assess various legal requirements to when looking to start a business in Colombia.

Why start a business in Colombia?

Colombia is a great place to open a business for several compelling reasons.

Firstly, its strategic location in South America provides access to both the Pacific and Atlantic Oceans, making it an ideal hub for international trade and commerce. This geographical advantage offers opportunities for businesses to expand their reach into regional and global markets.

Secondly, Colombia has experienced significant economic growth and stability in recent years. The country has implemented strong macroeconomic policies, leading to low inflation rates and a stable currency. This favorable economic climate provides a solid foundation for business operations and investments.

Moreover, Colombia has a large and dynamic domestic market. With a population of over 50 million people, the country offers a substantial consumer base to cater to various industries and sectors. The growing middle class in Colombia is increasingly demanding quality products and services, creating a fertile ground for businesses to thrive, so long as they abide by the key legal requirements to start a business in Colombia.

Furthermore, the Colombian government has actively pursued policies to attract foreign investment and promote entrepreneurship. They have implemented measures to simplify business registration processes, reduce bureaucracy, and provide incentives for foreign investors. Additionally, the government has been working on improving infrastructure and logistics, facilitating efficient supply chains for businesses.

Lastly, Colombia boasts a talented and diverse workforce. The country has a well-educated labor force with expertise in various fields, including technology, engineering, and finance. The availability of skilled professionals, combined with competitive labor costs, presents a compelling advantage for businesses seeking to establish operations in Colombia.

In conclusion, Colombia offers a combination of strategic location, economic stability, a large domestic market, favorable government policies, and a skilled workforce. These factors make it an attractive destination for entrepreneurs and businesses looking to expand their operations and tap into the growing opportunities in Latin America. Now, lets consider the variuous legal requirements to start a business in Colombia.

In this article, our experts outline the legal requirements to start a business in Colombia.

Legal requirements to start a business in Colombia – Key steps to start a business in Colombia

It is crucial to be aware that numerous legal requirements exist when looking to start a business in Colombia. It is advisable to seek the aid and counsel of a local legal specialist in the nation to guarantee compliance with all corporate law and accounting prerequisites. Below, we list and delve deeper into the legal requirements establishing a business in Colombia.

1. Draft and sign Power of Attorney

- To start your business in Colombia, the initial requirement entails preparing and executing the Power of Attorney (POA) document for your authorized legal representative.

In situations where the shareholders and the legal representative are not physically present in Colombia, it becomes necessary to create a power of attorney to enable the signing of the company’s bylaws and their submission to the Chamber of Commerce.

When shareholders are individuals or entities from foreign countries, the Colombian government may require supplementary documentation from overseas. Both the additional documents and the POA need to undergo legalization by a Public Notary, obtain an apostille, and be physically dispatched to Colombia. This is just one of the legal requirements to start a business in Colombia.

2. Choose the name of your company

To ensure that the name you desire for your business is available, it is necessary to verify its availability in the government’s public database, specifically the Single Business Register or RUE. It is crucial to note that the legal name of your company may differ from your brand name, so careful consideration should be given to both aspects. This is an imperative legal requirement to start a business in Colombia.

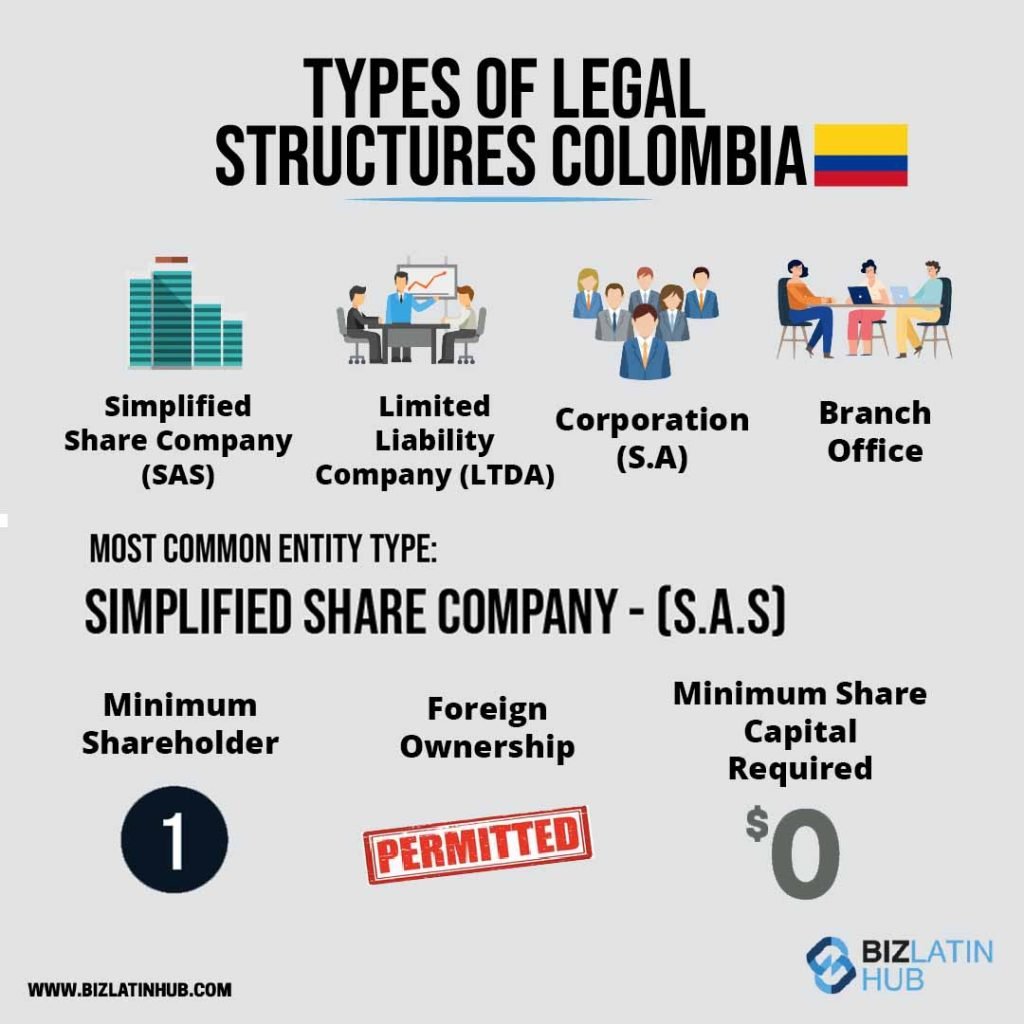

3. Choose the legal structure when starting a business

When establishing a company in Colombia, it is essential to select a social structure that aligns with the needs and economic activities of your business. It is important to note that depending on the chosen structure, specific documentation and additional legal and accounting procedures may be required. This goes alongside the other legal requirements created by Colombia.

The three most commonly used legal structures for company formation in Colombia are as follows:

- Simplified Shares Company (Sociedad por Acciones Simplificadas or SAS): This structure allows for an unlimited number of shareholders, and there is no requirement to make corporate documents publicly available.

- Corporation (Sociedad Anónima or SA): In this structure, the company’s capital is divided into shares of equal value, which are represented by negotiable titles.

- Foreign Company Branch: This structure involves establishing an extension of a foreign parent company in Colombia.

By carefully considering the nature of your business and its requirements, you can select the most suitable social structure, ensuring compliance with the corresponding legal and accounting obligations in Colombia. This is important when considering the legal requirements to start a business in Colombia.

4. Write the company bylaws

To establish your business in Colombia, it is necessary to draft the bylaws, which serve as the constitution of the company. These bylaws should include all pertinent information about the company, such as its operations, economic activities, capital, number of shares, shareholders, and legal representative(s).

The bylaws document provides a framework for how the company will function, outlining its internal processes, the scope of its activities, and the roles and responsibilities of shareholders and legal representative(s).

Creating comprehensive bylaws ensures a solid foundation for the company’s governance and promotes transparency in its operations. It is advisable to seek guidance from a local legal expert to ensure that the bylaws meet all legal requirements and accurately reflect the specific details and objectives of your company. This is crucial to when looking to start a business in Colombia.

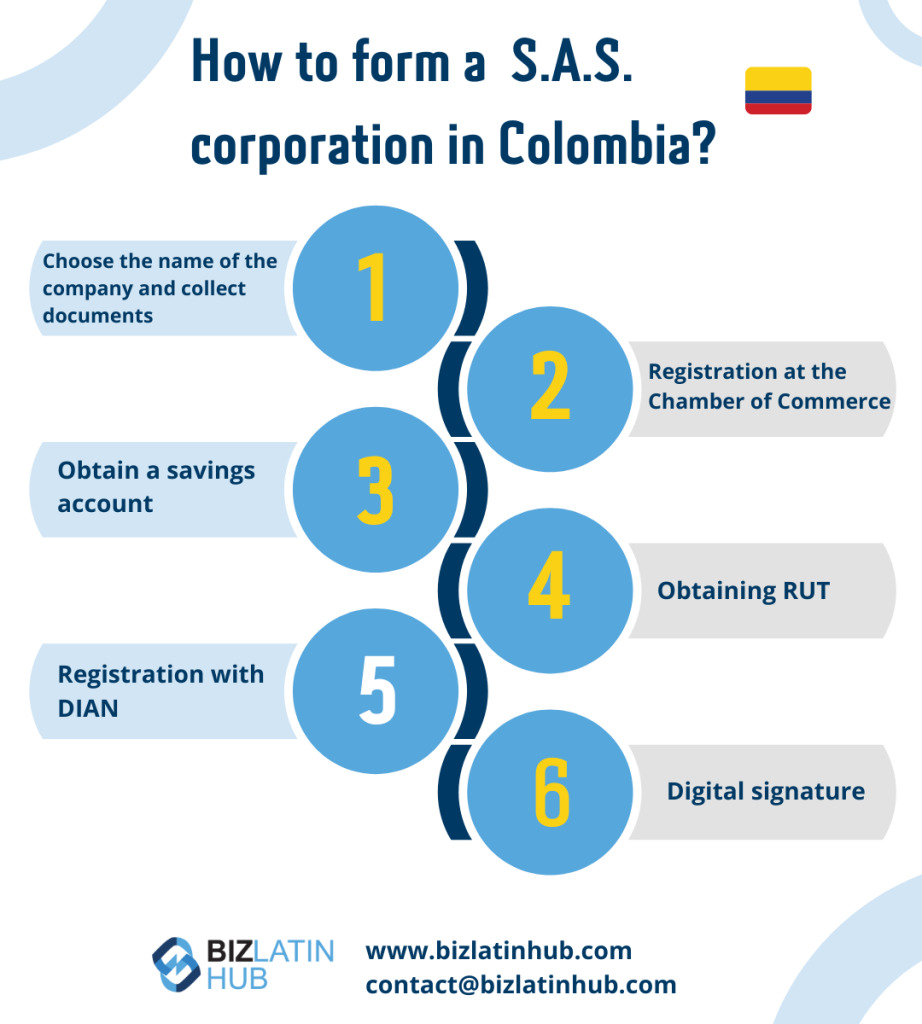

5. Register with the Chamber of Commerce

The Chamber of Commerce in Colombia assumes the regulatory role in overseeing the establishment of companies in the country. To start a company in Colombia, you must submit a set of documents that outline the company’s activities, including the bylaws and Power of Attorney, as well as shareholder information.

The Chamber of Commerce carefully reviews these documents to ensure compliance with the legal requirements and company formation policies in Colombia.

Once the registration is submitted, the approval process typically takes only 24 hours. After receiving approval, your company is authorized to commence operations and conduct business activities.

6. Obtain tax identification (NIT)

The assignment of a tax identification number, known as ‘NIT’, to your company is handled by the National Directorate of Taxes and Customs, DIAN. This unique number serves as an identification for your company in all tax and accounting-related matters, including the submission of monthly and annual tax returns.

After the Chamber of Commerce approves your registration, the NIT may be generated automatically in certain cases. However, in other instances, the legal representative of the company is required to personally visit the DIAN offices to complete the NIT application process. Obtaining an NIT is another legal requirement to start a business in Colombia that must be followed.

7. Open your corporate bank account

As the final step in the process of starting your business in Colombia, it is essential to open a corporate bank account. There are several banks in Colombia, each offering different benefits and agreements for corporate accounts.

To open a corporate bank account, you will need to provide certain documents, including the Chamber of Commerce certificate verifying the existence of your company in Colombia, the tax certificate (NIT), the legal representative’s identification number, and the initial account balance. Additionally, each bank may have specific requirements and may request additional information during the account opening process.

It is worth noting that the Colombian government is committed to promoting foreign investment and streamlining administrative procedures. Therefore, many of the company incorporation processes, including opening a bank account, can be conveniently completed online.

Once you have successfully completed these steps, your company will be fully prepared to commence operations in Colombia

Colombia takes third place in the region for ease of doing business. Colombia has varied opportunities for foreign investors interested in doing starting their next commercial venture in Latin America.

Biz Latin Hub can help you with starting a business in Colombia

If you want to start a business in Colombia and want support to carry out this process without complications or setbacks, our team of legal experts in Colombia can help. Contact us now to find out how we can advise you to start a company in Colombia.

Our customized market entry services and back-office solutions will guide you throughout the entire company startup process, and ensure your business expansion starts off on the right foot and in full compliance with local law.

Learn more about our team and expert authors, and check out our short presentation below for more information on starting a business in Colombia.