The Brazilian Senate is currently dicussing a major tax reform which will significantly simplify the system. This will involve changes to a range of taxes that the Treasury collects, most of which are not fully defined so far. One thing we do know is that, if the government is able to conclude its voting agenda in time, VAT changes in Brazil are planned to take effect from 2026 onwards.

The country is a federal republic, meaning that individual states have a high level of autonomy and responsibility. The planned VAT changes in Brazil are likely to affect this to a degree, as indirect taxation – which are currently defined by each state – tends to have standardize rates across the country.

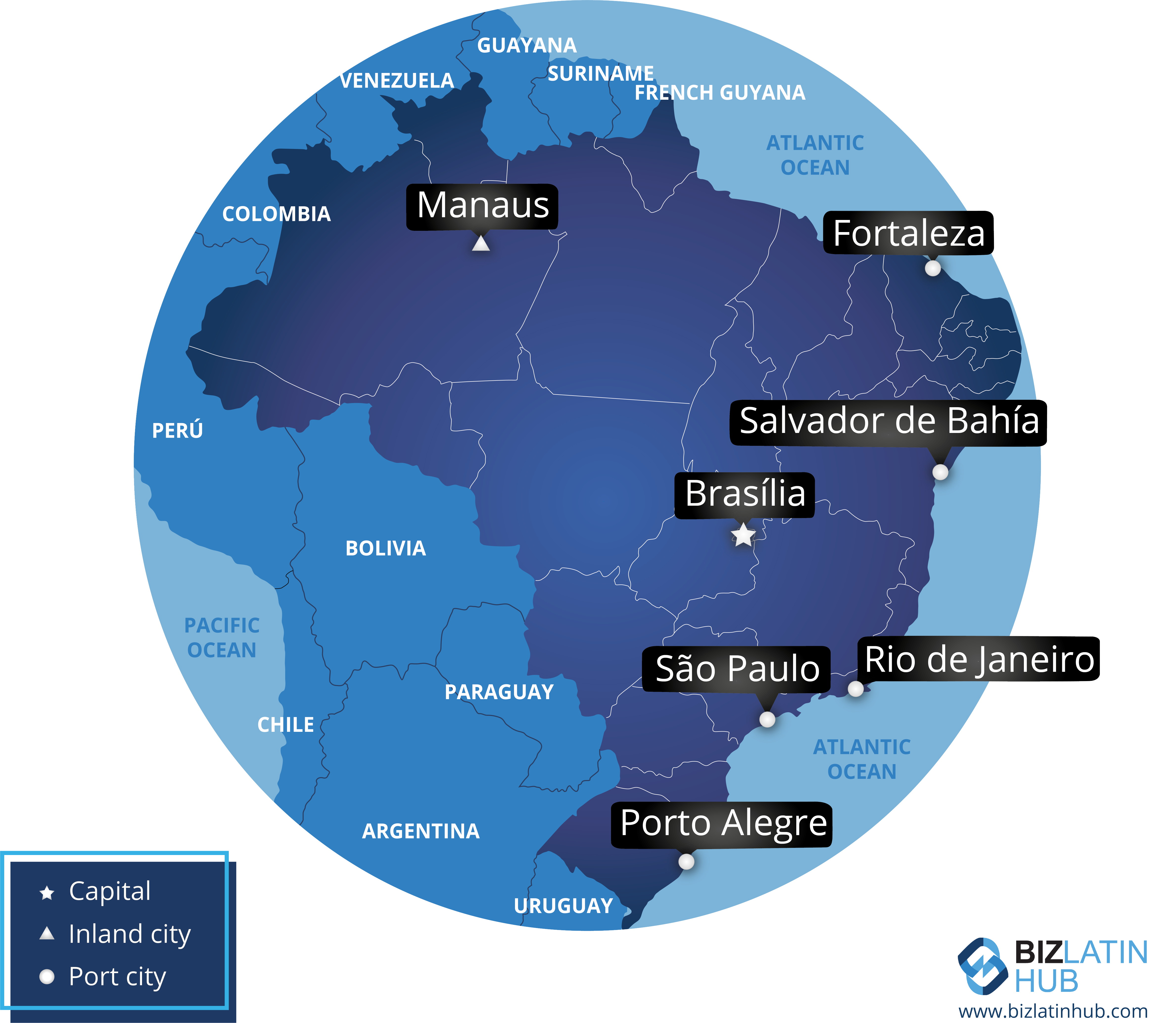

That’s why it makes sense to partner with a local specialist such as Biz Latin Hub to navigate accounting in Brazil. With our network of dedicated local offices across Latin America and the Caribbean, no one knows the region better than us. Our experts in Sao Paolo know all about the coming VAT changes in Brazil and can make sure you stay compliant in the long term.

Why are there going to be VAT changes in Brazil?

The country, like many others in Latin America, has a quite complex and unwieldy bureaucratic system. The Ministério de Fazenda is looking to reform and streamline some of the unnecessary red tape. This applies not only in local terms but also global. Brazil has long operated outside of international norms and would like to align more closely with the rest of the world.

VAT changes in Brazil are mainly aiming to reduce the regional disparity between areas, as this throws up some unusual problems for businesses and strange quirks between states. At the moment there is a sort of internal market for investment and company formation as individual states can offer tax incentives.

It’s also noticeably difficult for foreign companies and/or investors to enter the Brazilian tax system because of these localized discrepancies. A largely standarized system will make that side of foreign investment smoother, as regional tax incentives will be eliminated.

However, international standardization on VAT application means that foreign companies may have tax liabilities in Brazil for the first time. This is because VAT will now be charged according to destination rather than origin. Again, this is to eliminate red tape and to come into line with international norms.

How do taxes currently work in Brazil?

Because of the wide disparity between taxation regimes in different states, VAT rates can be anywhere from 7% to 25%. To put that into a little context, that’s either far below or significantly above regional averages. This creates all sorts of different tax situations.

At the moment there is a state VAT known as the Imposto sobre circulação de mercadorias e serviços (ICMS) and also a municipal tax on services called Imposto sobre serviços de qualquer natureza (ISS). Of course, these vary according to location, and the VAT changes in Brazil will unify these together in a single tax.

All of this means friction for the ease of doing business and provides a dizzying array of potential indirect tax liabilities. Navigating this requires hiring not only local accountants, but often people with specific knowledge of certain regions. This sort of inclarity and confusion deters many foreign investors.

It’s also worth mentioning that Brazil, like many other Latin American nations, sees indirect taxation as a primary driver of tax revenues. It is easier to collect and monitor VAT than many direct taxes, meaning that it takes on a particularly large importance within the country’s budgeting.

What’s going to change under the new system?

The proposed VAT changes in Brazil are essentially all about streamlining and standardizing. This means that everything is geared towards eliminating some double measures that the existing system throws up. However, for at least a decade there will be turbulence as the country phases in one system and phases out the other.

There will no longer be one tax for services (ISS) and another for goods (ICMS), as both will be covered by a single new VAT system known as the Imposto sobre bens e serviços (IBS). This will be complemented by the Contribuição sobre bens e serviços (CBS) which will mean everything is effectively harmonized across the country. There are likely to be some exceptions such as the Manaus Free Trade Zone, though.

It appears that non-resident sellers will also potentially face liability for sales in Brazil. While there will probably be an exception for purely online platforms that already have similar systems in place, everyone else will have to register as an IBS/CBS contributor with the Receita Federal do Brasil (RFB), which is responsible for the implementation and regulation of tax and customs legislation in Brazil.

While it is clear that VAT changes in Brazil are coming and will take effect from 2026 onwards, the fine detail is still being worked out in the Brazilian Senate and is likely to be fully approved later this year. As many known unknowns remain in the air, it’s now more than ever critical to make sure you are working with local specialists such as Biz Latin Hub to make sure you stay compliant throughout any adjustments.

Biz Latin Hub can help you with VAT changes in Brazil

Once you understand the accounting process, laws, and legal requirements in Brazil, you are ready to do business there. However, these do change, and there are major adjustments coming. That’s why it makes sense to partner with a company like Biz Latin Hub to stay abreast of any new requirements for compliancy.

Biz Latin Hub is the market leader in helping both local and foreign companies to successfully expand their business in Brazil, by providing a full suite of multi-lingual commercial representation and back-office services.

Contact us today to find out more about how we can support you doing business or read about our team and expert authors.