Accounting and taxation in Uruguay is a critical element of any market entry strategy, helping to ensure when you register a company in Uruguay it remains compliant with the country’s regulatory framework. This guide delivers key insights to efficiently manage Uruguay’s fiscal obligations. Biz Latin Hub provides tailored assistance in understanding and applying Uruguay’s accounting standards. Our regional presence includes an extensive network of offices across Latin America and the Caribbean.

Key Takeaways on Accounting and Taxation in Uruguay

| What Are The Accounting Standards in Uruguay? | Submission of Financial Statements Fiscal Year Structure Tax Reporting Obligations Registration of Financial Statements External Audit Requirements |

| What Is The Corporate Tax Rate in Uruguay? | The current corporate tax rate in Uruguay is set at 25%. |

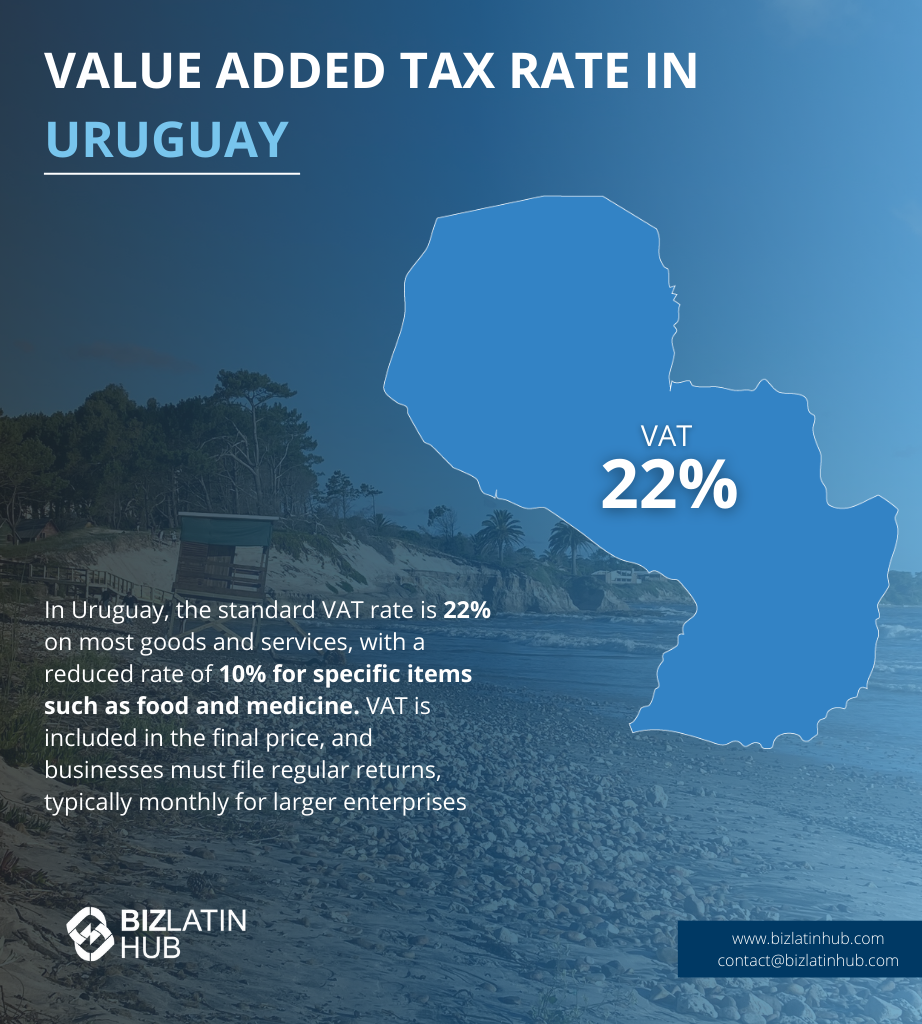

| What Is The Uruguayan Value Added Tax Rate? | The standard VAT (IVA) rate in Uruguay is set at 22% |

| Dividend Tax Rate in Uruguay | A rate of 7% applies to dividends and other certain interests. |

What are the Reporting Requirements in Uruguay?

- Submission of Financial Statements

- Business entities must submit their financial statements within four months after the fiscal year-end.

- These statements must adhere to the applicable regulatory framework.

- A registered public accountant must provide a report to accompany the financial statements.

- Fiscal Year Structure

- The fiscal year in Uruguay runs from January 1st to December 31st.

- Companies must prepare a balance sheet and a profit-and-loss account to reflect their financial position and performance for the fiscal year.

- Financial statements must be audited by an external auditor to ensure compliance and accuracy.

- Tax Reporting Obligations

- Corporate Income Tax (IRAE) taxpayers are required to make monthly advance tax payments.

- An annual affidavit must be filed with the Uruguayan Tax Office within four months after the fiscal year-end.

- The audited financial statements form the basis for determining and settling tax liabilities.

- Registration of Financial Statements

- Financial statements must be registered with the appropriate regulatory body, typically within 180 days of the fiscal year-end.

- Registration is crucial to maintain official records and comply with national regulations.

- External Audit Requirements

- Financial statements of companies must be audited by an independent external auditor.

- The audit ensures alignment with International Financial Reporting Standards (IFRS) or relevant local standards.

These comprehensive requirements ensure that businesses in Uruguay maintain a high level of financial integrity and adhere to global best practices.

What are the Accounting Standards in Uruguay?

In Uruguay, accounting standards are primarily governed by the International Financial Reporting Standards (IFRS). These standards have been adopted to ensure uniformity, transparency, and accuracy in financial reporting for businesses and organizations. Uruguayan companies are therefore able to align their financial reporting with international practices, which is particularly beneficial for multinational companies and foreign investors.

The Uruguayan College of Accountants, Economists, and Administrators (CCEAU) also plays a key role in overseeing the application of IFRS within the country. This professional body provides technical guidance and support to accountants and organizations to ensure compliance with IFRS requirements.

For financial institutions, such as banks and insurance companies, the Central Bank of Uruguay (BCU) will issue specific regulations. These regulations are designed to complement IFRS by addressing sector-specific needs and ensuring that the unique characteristics of financial institutions are adequately reflected in their financial reporting. The BCU’s guidance ensures that these institutions remain compliant with both international and national standards.

Types of Taxes and Their Requirements

Working with a local expert will make it easier to understand what are your businesses tax requirements. Some of the more common are:

- Corporate Income and Capital Gains

- Personal Income Tax

- Value Added Tax (IVA)

- Withholding Tax

Corporate Income and Capital Gains

Corporate income tax in Uruguay is currently set at a flat rate of 25%. All businesses are expected to register with the Direccion General Impositiva (DGI) and file their annual returns within four months of the year ending or will face financial penalties as a result.

For both residents and non-residents with permanent establishment in Uruguay, corporate income tax sits at 25%. This figure applies only to income generated through activities in the country and requires businesses to correctly label, monitor, and document their expenses in the country.

Personal Income Tax

In the National Budget Bill of 2010, income tax on resident individuals was broadened and currently stands at between 10% and 36% of salaries, depending on industry and location. This is up from a record low of 0% tax back in 2005 and is currently at its highest level in order to help fund vital government services and infrastructure projects around the country.

In addition, foreign investors who spend more than 183 days per year in Uruguay will receive a five-year window during which they will not pay income tax on any type of foreign income. It is another reason why investors choose to incorporate in Uruguay, and why foreign direct investment (FD) in the country is so important.

According to the UNCTAD 2018 World Investment Report, the country’s FDI is estimated to be worth USD$30.4 billion, representing 52.4% of the country’s GDP, demonstrating the power of becoming an attractive nation to invest in.

Value Added Tax (IVA)

One of the most common taxes in Uruguay is a standard Value Added Tax (VAT), which stands at 22% on all commercial transactions. Some goods and services are exempt or subsidized to a 10% VAT tax rate in the country, so it’s important to find out whether your company’s products and services fall into that category, as it could lead to profit increases.

Withholding Tax

As a foreign investor, the chances are that you hope to incorporate a company in Uruguay and maximize profitability in the country, with the plan to send assets back to your native country. Indeed, the whole point of international expansion is to grow profits and diversify income streams, but it is important to calculate your profit margins and long-term profitability once you have factored in a 7% withholding tax that is applicable on dividends paid to non-resident firms.

In companies where Uruguay has a tax treaty (more on that later), the rate may be reduced. Withholding tax on interests that are paid to non-resident companies stands at 3%, 5% or 12%, depending on the type of currency or the duration of a business loan, and a 12% tax is applicable on technical service fees and royalties that are paid to non-resident companies.

Requirements for Foreign Branch Offices

Rather than subjecting a business to the risks of market expansion and incorporating a new business abroad, some entrepreneurs choose to incorporate foreign branches of their businesses in other territories. This allows them to enter a market and trade freely without the initial upfront investment.

In Uruguay, opening a branch office is certainly something to consider, although legal entities will be required to pay a 7% withholding tax on remittances sent to their native countries, which could impact their bottom line and cut profitability levels.

Something to consider, however, is that the Republic of Uruguay is a signatory to 13 double tax treaties around the world, including Mexico, Spain, Germany, and Argentina, increasing the chance of succeeding in a Latin American business environment. In addition, Uruguay is home to several free trade agreements, including ALADI and the MERCOSUR, allowing you to trade freely with several other nations without the worry of a withholding tax on assets.

Taxes for Employers in Uruguay

Most foreign investors entering into Uruguay hire local employees, and as such are subject to monthly social security contributions. This contribution can be up to 23% of an employee’s monthly salary. In addition, businesses are required to pay 13% of their total monthly payroll to the Uruguay social security fund.

Additional Taxes

There are several other taxes to consider when working in Uruguay, including a 1.5% capital duty tax, that is levied on the total net worth of a company, and a 2% transfer tax for companies transferring or selling their real estate. Something to bear in mind, however, is that tax losses in the country can be carried forward for up to five years, although carryback (that is, applying a loss to the tax return) is not permitted, so working with an experienced local accountant – or indeed hiring an accountant in-house in Uruguay – is key to success.

FAQs When Understanding Accounting and Taxation in Uruguay

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting and taxation in Uruguay

The corporate tax rate in Uruguay is 25% and the business wealth tax rate is 1.5%.

Companies in Uruguay are taxed based on local tax regulations. Income tax is calculated on the difference between fiscally adjusted income and expenses.

The IRS in Uruguay is called Dirección General Impositiva (DGI) and is responsible for controlling the correct application of tax regulations.

In Uruguay, it is mandatory to apply the International Financial Reporting Standards (IFRS) decreed by the International Accounting Standards Board (IASB). Depending on the income of the company, the IFRS FULL standards or the IFRS for SMEs are applied.

There are annual accounting closings in local currency and additionally in functional currency if applicable.

The equivalent to the CPA in Uruguay is the collegium of accountants, economists, and administrators of Uruguay. (CCEA)

Yes. FULL or SME IFRS are mandatory to apply.

Why Invest in Uruguay?

Uruguay is one of South America’s most stable and reliable investment destinations, offering a transparent business environment and a strong, democratic government. The country stands out for its modern infrastructure, free trade zones, and pro-business policies that make it easy for investors to operate and access major regional markets. Key sectors like renewable energy, technology, agribusiness, and logistics are thriving, thanks to Uruguay’s focus on sustainability and innovation. With a favorable tax framework and strong export networks, it’s an ideal hub for global trade and business growth.

Uruguay’s appeal goes beyond its policies. It boasts a skilled workforce, affordable operating costs, and cutting-edge digital infrastructure, making it an attractive choice for companies looking to expand. The country is a global leader in renewable energy, producing over 98% of its electricity from sustainable sources, and its premium exports—such as beef, dairy, and soy—are recognized worldwide. Whether you’re looking to invest in agriculture, tech, or green energy, Uruguay offers a unique blend of stability, opportunity, and forward-thinking development.

Biz Latin Hub can help with Accounting and Taxation in Uruguay

Understanding accounting and taxation requirements in Uruguay will make it easier for you to budget. Additionally, it will help you understand what you will have to deal with when it’s time to declare your taxes.

If you would like more information about accounting regulations or tax laws in Uruguay, Biz Latin Hub’s group of experts offer you legal and accounting assistance for your business in Bolivia. Take advantage of our large range of multilingual market entry and back-office business solutions to meet your company’s incorporation and compliance needs.

Contact us now for help in establishing a successful business in Uruguay.

Learn more about our team and expert authors.