Home to a welcoming business environment and rapidly growing economy, Guyana presents promising business opportunities for international investors. The tourism, mining, and agriculture industries, in particular, offer exciting investment prospects. Learn more about Accounting and Taxation in Guyana in this article.

Before launching your business in this thriving market, it’s essential to understand the regulations for accounting and taxation in Guyana. A lack of knowledge of the local laws could lead to serious compliance and legal problems.

To help you manage these challenges, we have outlined the must-know information about accounting and taxation in Guyana. Read on to discover insights about doing business in this untapped marketplace.

See also: Company Formation in Guyana

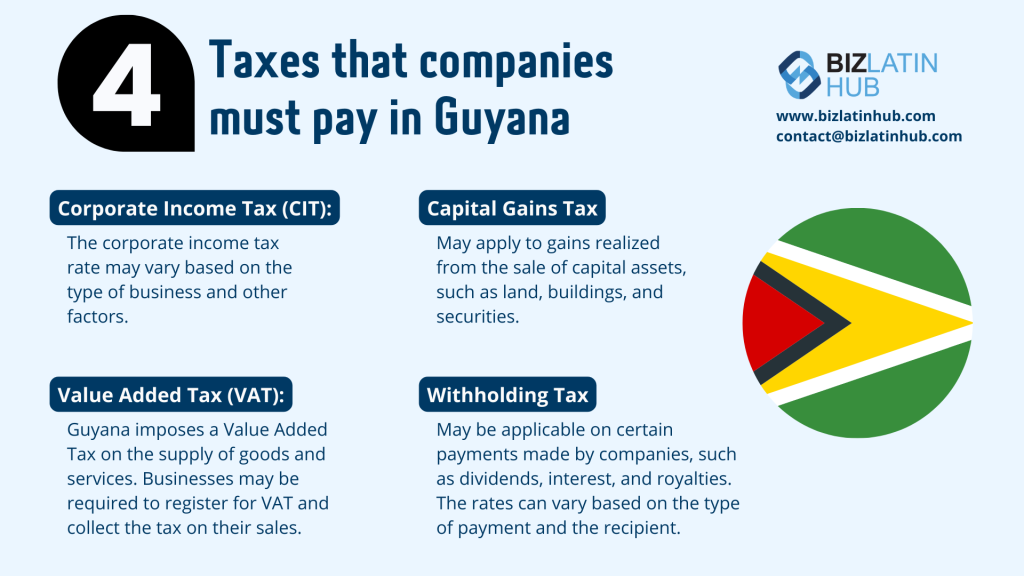

What are the Taxes for Companies in Guyana?

Resident companies are taxed on all income earned globally. While non-resident companies operating a business in Guyana are taxed on the income generated within the country.

The tax year aligns with the calendar year. Tax is calculated based on income earned during the assessment year, typically the calendar year preceding the tax year. However, companies using a non-calendar accounting year may request to align taxes with their chosen accounting period.

Tax returns must be completed by April 30th of the tax year.

Accounting and Taxation in Guyana: Key local tax rates

Understanding accounting and taxation in Guyana is crucial when starting a business in this market. Here are the tax rates you need to know.

Income Tax: Residents (present in Guyana for at least 183 days in the year) get a personal allowance of GYD 1,020,000 or 1/3 of their income, whichever is more. For individuals earning under GYD 2,040,000 yearly, the tax rate is 28%. If their income exceeds GYD 2,040,000, the tax rate rises to 40%.

Corporate Tax: The current rates of corporate tax are as follows:

- Telephone companies – 45%

- Commercial companies – 40%

- Other companies (non-commercial) – 25%

- Both non-commercial and commercial – 25 – 40%

- Small businesses engaged in manufacturing and construction services and registered with the Small Business Bureau – 25%

Value Added Tax (GCT): VAT in Guyana is either 14% or 0% for registered businesses. They must file returns and pay VAT by the 21st of the following month. Zero-rated supplies include exports and certain medical items. Exempt supplies encompass various sectors like education, finance, and certain medical services, as well as renewable energy equipment.

Withholding Tax: WHT applies to payments to non-residents. A return and total monthly payments are due by the 14th of the next month. If a treaty rate is higher than the statutory rate, the lower rate applies. See WHT rates below.

| Recipient | WHT | ||

| Dividends | Interest | Royalties | |

| Non-treaty | 20 | 20 | 20 |

| Treaty: | |||

| Canada | 15 | 25 (1) | 10 |

| United Kingdom | 10 | 15 | 10 |

| CAPRICOM | 0 | 15 | 15 |

Social Security: Employers must deduct and remit social security contributions for employees. Contributions apply to monthly earnings up to GYD 280,000 and weekly earnings up to GYD 64,615, with rates of 8.4% for employers and 5.6% for employees.

Tax Payment in Guyana

Corporate tax obligations are structured around quarterly advance payments, based on the previous year’s tax liability. These payments are due on the 15th of March, June, September, and December of the preceding calendar year.

However, the Commissioner General reserves the authority to request estimated income calculations for the current fiscal period.

Any remaining tax balance must be settled by the 30th of April in the tax year. Failure to adhere to these deadlines incurs penalties:

- 1. A 10% charge on outstanding tax amounts for failure to file tax returns and settle dues by the end of April.

- 2. Penalties for late payments include a 2% monthly charge on unpaid taxes and an 18% annual interest rate.

- 3. Additionally, a fixed fee of GYD 50,000 is levied for each deficit return submitted after the stipulated deadline.

Tax Audit Process

Tax audits are a routine part of regulatory compliance for companies, often initiated through random selection with an average frequency of every three years.

Upon selection, companies are obligated to furnish comprehensive financial data and relevant documentation to tax officials. Oversight of tax matters in Guyana falls under the purview of the Guyana Revenue Authority.

International tax treaties in Guyana

Guyana currently has tax treaties with the following countries.

- Canada

- Caribbean Common Market (CARICOM) member states

- United Kingdom

Frequently Asked Questions (FAQs) on Accounting and Taxation in Guyana:

Using our experience, we’ve identified common questions and worries our clients often have when dealing with accounting and taxation in Guyana.

1. What are the tax rates for individuals and businesses in Guyana?

Tax rates vary depending on income levels and types of businesses. For individuals, rates range from 28% to 40%, while corporate tax rates are generally 25%.

2. How does the tax year work in Guyana?

The tax year in Guyana aligns with the calendar year, with assessments based on income earned during the preceding year.

3. What are the requirements for VAT registration and filing in Guyana?

VAT registration is mandatory for businesses with taxable supplies. VAT returns and payments are due by the 21st day of the month following the taxable period.

4. What is the Withholding Tax system in Guyana?

VAT registration is mandatory for businesses with taxable supplies. VAT returns and payments are due by the 21st day of the month following the taxable period.

5. What are the Social Security contribution requirements for employers and employees in Guyana?

Employers must deduct and remit social security contributions on monthly and weekly earnings, with rates of 8.4% for employers and 5.6% for employees.

6. Are there tax incentives for businesses in Guyana?

Guyana offers various tax incentives to encourage investment and economic development. These incentives may include tax holidays, reduced tax rates, and exemptions for specific industries or activities. Interested businesses should consult with local authorities or tax advisors to explore eligibility and application processes.

Biz Latin Hub Can Assist with Accounting and Taxation in Guyana

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as our extensive knowledge of accounting and taxation in Guyana, our range of services includes hiring and PEO, accounting and taxation, company formation, bank account opening, and corporate legal services.

Contact us now to learn more about how we can assist you in finding top talent or doing business in Latin America and the Caribbean.