Peru continues to perform well in its exportation of natural resources, particularly copper being the second largest producer in the world. As the country continues to grow and develop its economy, it is increasingly falling into line with international standards. This includes measures such as identifying an Ultimate Beneficiary Owner in Peru.

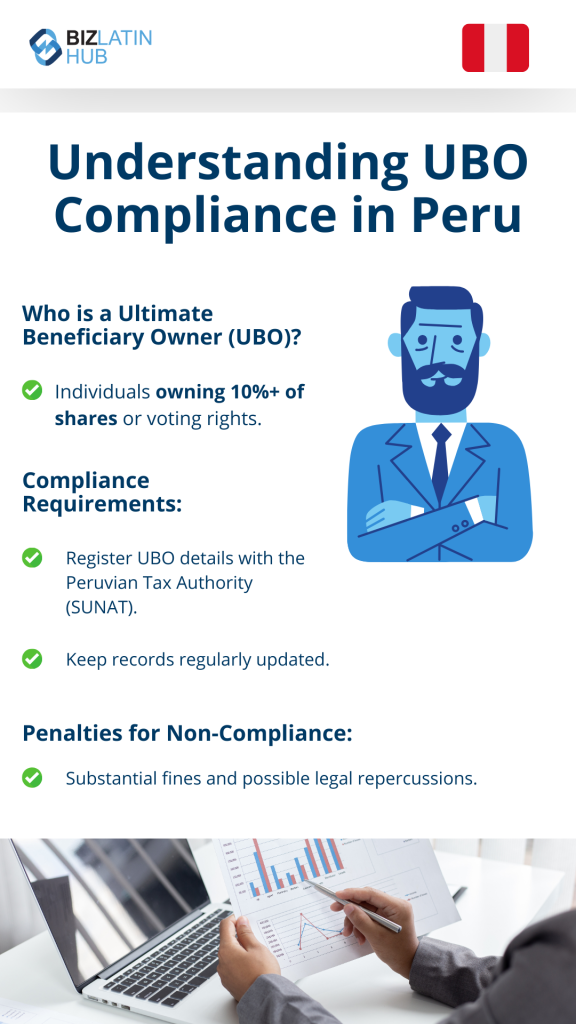

In Peru’s context, a UBO refers to an individual who gains financially from the business. These individuals must be registered locally with the Peruvian Tax Authorities (SUNAT). If you’re considering forming a company in Peru, you will need to consider who will qualify as an ultimate beneficiary owner in Peru.

It is common for business structures to make identifying who are the ultimate beneficiary owners in Peru. Therefore it makes sense to partner with a local specialist such as Biz Latin Hub. We have a local office that can handle compliance with the regulations for UBO in Peru. With an additional 17 across Latin America and the Caribbean.

What is UBO in Peru?

The Andean country is one of the power houses in South America, with disclosure of UBO in Peru dating back to 2018. The relevant legislation, Legislative Decree 1372 requires individuals to file and send a special form to the Peruvian Tax Administration (SUNAT). It should be noted that for entities incorporated outside Peru, the obligation lies with the branch, agency, or permanent establishment in Peru.

An UBO in Peru is defined as a person who fulfils one or all of:

- An individual is deemed a UBO if they hold at a minimum 10% of an entity’s capital.

- An individual who, acting individually or as a decision unit, has power to designate or remove the majority of the administerial, managerial or supervisory bodies.

- Has decision-making power in the financial, operational and/or commercial agreements that are adopted.

When there is no possibility to identify a person by criteria 1, 2, and, 3 the UBO of the legal entity should be reported as the individual within the company holding the highest administrative position. This would typically be a general manager or members of the board of directors deemed as the ultimate beneficial owner.

While some of these definitions are clear, others are a little harder to identify. If in doubt, contact a local lawyer to make sure that you are receiving the best possible advice for your situation. As the definitions are broad, there is room for some interpretation of the law.

Why does Peru check UBO?

UBO checks are becoming a standard requirement globally, gaining traction in Latin America and the Caribbean. This is of particular importance for international businesses who may also be doing business in other territories. Peru entered this trend half a decade ago, enacting legislative measures that ensured corporate compliance and responsibility. As the country continues to grow, it is increasingly viewed as a desirable destination for foreign direct investment.

An additional reason is money laundering from illegal gangs is often disguised by routing cash flows through complex bureaucratic systems. Another area of interest for the government is confirming that anyone who has been barred from company ownership is not in fact exercising control over a business.

As a member of the The Financial Action Task Force of Latin America (GAFILAT), the country has certain responsibilities to uphold. Identifying who may be a UBO in Peru is a central plank of that strategy. Companies that work internationally will particularly want to avoid triggering the Patriot Act in America, alongside other legislation such as the UK Bribery Act, FCPA and others.

By following international norms, Peru offers investor confidence for foreign firms or individuals wanting to operate in the country. Providing evident proof that removes your business from illegal activity is vital. Ensuring you guard your Peruvian operations from not impacting other areas of your global business.

How can you stay compliant with UBO in Peru?

You must present full and up to date fiscal information to SUNAT. The format to be filled out by the natural person qualifying as the UBO in Peru, supporting the information to be included in the UBO’s return, which may be managed electronically and with a digital signature (following certain steps).

The fine for failing to submit the UBO’s return or doing it incompletely or erroneously can amount to 0.6% of the net income, with a cap of up to 50 tax units. Likewise, not currently storing the information supporting compliance with due diligence procedures for the specified period can result in a penalty of up to 25 tax units.

To ensure compliance it is best to be done with a competent and well-regarded local lawyer, specifically someone with solid and fully up-to-date information on the most recent implementation of the law. It will help if this person is familiar with Peruvian bureaucratic standards.

This is especially true of companies that operate in a range of territories, particularly if they have multiple tax responsibilities. Large companies with complex bureaucracy across regions may find it difficult to identify a UBO in Peru.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO in Peru. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

- Copy of ID and personal information

- Place of residence

- Spouse’s ID

- Place of residence

- Marital status

- Role in the entity

FAQs about UBOs in Peru

These are the questions we most often field from our clients on issues connected to UBO in Peru.

Yes, 100% ownership is permitted under Peruvian law.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO in Peru. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

– Copy of ID and personal information

– Place of residence

– Spouse’s ID

– Place of residence

– Marital status

– Role in the entity

An ultimate beneficiary owner (UBO) in Peru is defined as:

– An individual is deemed a UBO if they hold at a minimum 10% of an entity’s capital.

– An individual who, acting individually or as a decision unit, has power to designate or remove the majority of the administerial, managerial or supervisory bodies.

– Has decision-making power in the financial, operational and/or commercial agreements that are adopted.

To avoid international non-compliance with issues such as money laundering, to fulfil its obligations under GAFILAT and to provide investor confidence.

The fine for failing to submit the UBO’s return or doing it incompletely or erroneously can amount to 0.6% of the net income, with a cap of up to 50 tax units. Likewise, not currently storing the information supporting compliance with due diligence procedures for the specified period can result in a penalty of up to 25 tax units.

Biz Latin Hub can help with UBO in Peru

Identifying a UBO in Peru can be complex and require due diligence to ensure the success of market entry. Biz Latin Hub can ensure your company is fully compliant with local regulations and can operate with minimal delay.

We offer a range of market entry and back-office services to support your commercial success in Peru. The Biz Latin Hub team is built of well-experienced, bilingual, and knowledgeable accountants and lawyers striving to offer premium service.

Our team of local and expatriate professionals offers responsive, tailored legal and accounting solutions in Peru where procedures tend to be lengthy and complex. If you want to set up a company, then Biz Latin Hub can be your professional partner.

Reach out to our team of local experts for advice and comprehensive market services.

Learn more about our team and expert authors.