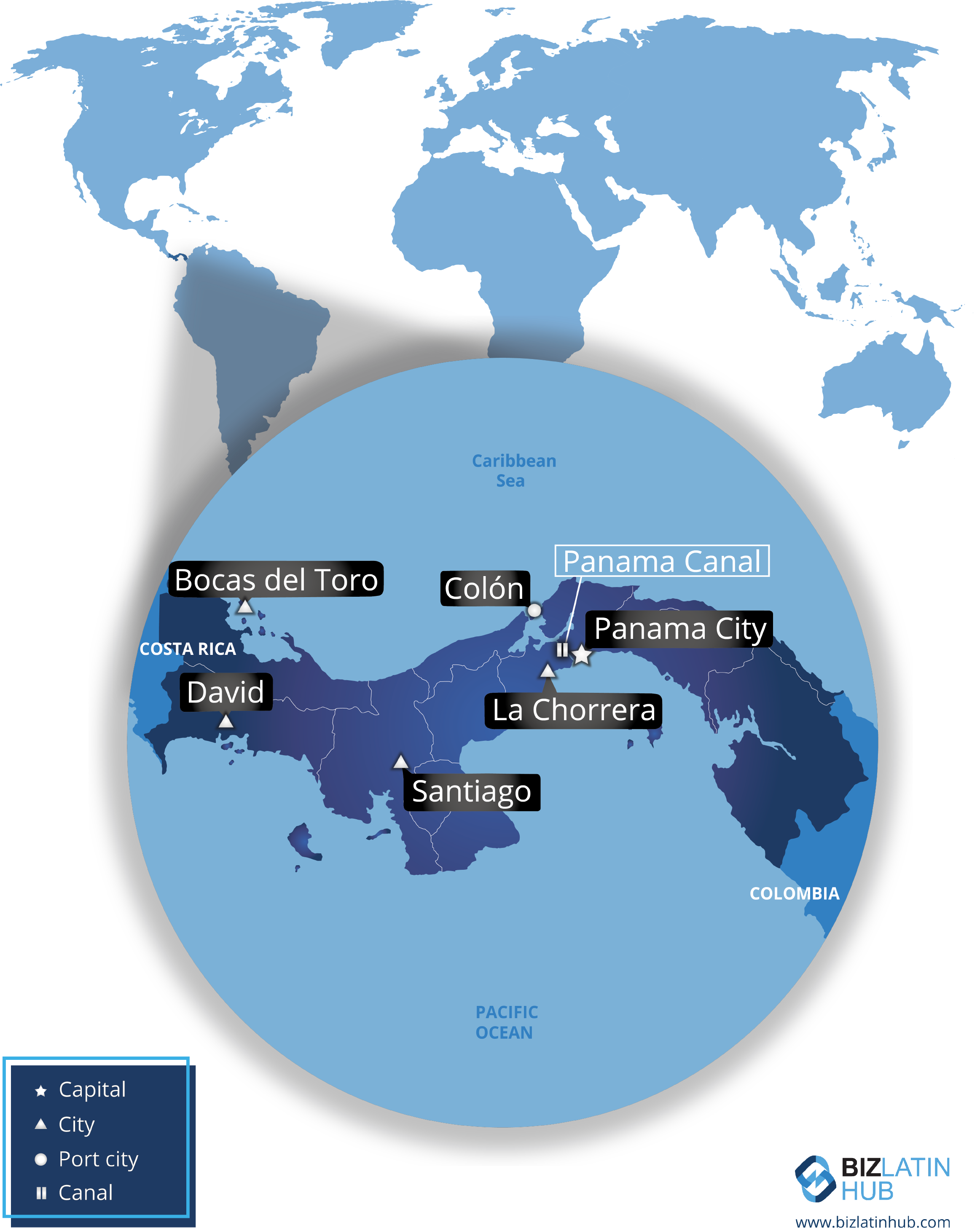

With its famous canal, Panama is a hub for international trade. The country is therefore extremely open to international trade and conscious of the need to conform to global standards. This includes measures such as identifying a UBO in Panama.

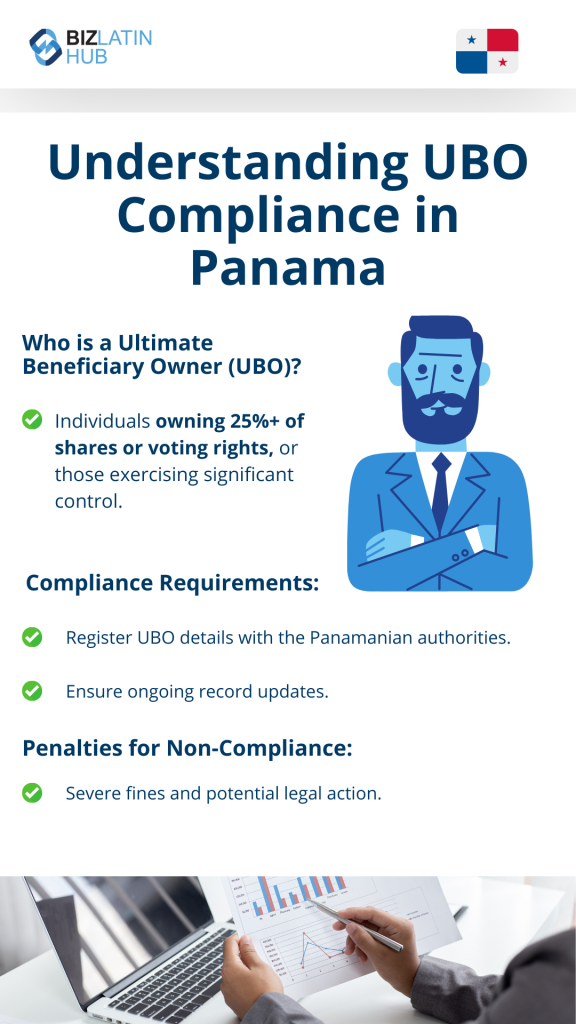

A UBO in Panama refers to an Ultimate Beneficiary Owner, meaning someone who gains financially from the eventual aim of the business. This is covered under law 129 of 2020, and means you must register with the Superintendence of Non-Financial Subjects (SSNF). If you want to register a company in Panama, you will need to take these regulations into account.

That means it makes sense to partner with a local specialist such as Biz Latin Hub. We have a local office that can handle compliancy with the regulations for UBO in Panama, as well as another 17 countries across Latin America and the Caribbean. No one knows the region as well as we do.

What is UBO in Panama?

Legal regulation of UBO in Panama goes back to 2020. The relevant legislation is known as law 129 of 2020 and is overseen by the Superintendence of Non-Financial Subjects (SSNF).

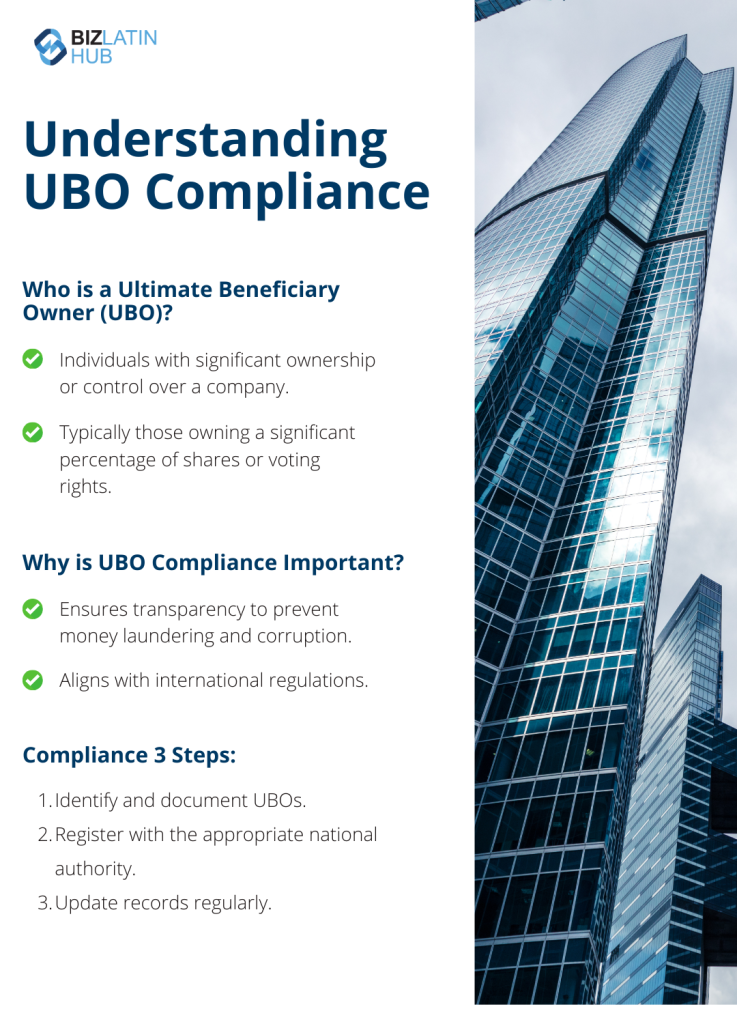

An ultimate beneficiary owner (UBO) in Panama is defined as:

A natural person, who directly or indirectly owns, controls, and/or has a significant influence over the account relationship, contractual relationship and/or the business; or the natural person benefitting from a transaction or who ultimately controls the legal entity’s decisions.

The term control is usually defined as holding at least 25% of the shares or, either directly or indirectly. It can also be defined as holding control (directly or indirectly) of the board or the power to elect a majority of administrators.

While some of these definitions are clear, others are a little harder to identify. If in doubt, contact a local lawyer to make sure that you are receiving the best possible advice for your situation. As the definitions are broad, there is room for some interpretation of the law.

Why does Panama check UBO?

UBO checks are becoming increasingly standard globally and in Latin America and the Caribbean especially. This is of particular importance for international businesses who may also be doing business in other territories.

Money laundering from illegal gangs is often disguised by routing cash flows through complex bureaucratic systems, for example. Another area of interest for the government is confirming that anyone who has been barred from company ownership is not in fact exercising control over a business.

As a member of GAFILAT, the Latin American anti-fraud grouping, the country has certain responsibilities to uphold. Identifying who may be a UBO in Panama is a central plank of that strategy. Companies that work internationally will particularly want to avoid triggering the Patriot Act in America, alongside other legislation such as the UK Bribery Act, FCPA and others.

By following well-established international norms, Panama offers a sense of investor confidence for foreign firms or individuals that may want to operate in the country. With clear proof that you are not connected to illegal organizations, you can rest assured that your local operations will not imperil other areas of your global business.

How can you stay compliant with UBO in Panama?

You must present full and up to date fiscal information to the SSNF. Non-compliance with this means significant financial and administrative penalties. First off, you can be suspended from commercial operations. Secondly, there are fines of up to USD$5,000 per legal entity not registered. On top of that, the fine may be increased by 10% per day if not corrected. These are serious penalties and ones you want to avoid.

This is best done with a competent and well-regarded local lawyer, specifically someone with solid and fully up-to-date information on the most recent implementation of the law. It will help if this person is familiar with Panamanian bureaucratic standards.

This is especially true of companies that operate in a range of territories, particularly if they have multiple tax responsibilities. Large companies with complex bureaucracy across regions may find it difficult to identify all their UBOs.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

- Copy of ID and personal information.

- Place of residence.

FAQs on UBO in Panama

These are the questions we most often field from our clients on issues connected to UBO in Panama.

Yes, 100% ownership is permitted under Panamanian law.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

Copy of ID and personal information

Place of residence

An ultimate beneficiary owner (UBO) in Panama is defined as a person who directly or indirectly owns, controls, and/or has a significant influence over the account relationship, contractual relationship and/or the business; or the natural person benefitting from a transaction or who ultimately controls the legal entity’s decisions.

The term control is usually defined as holding at least 25% of the shares or, either directly or indirectly. It can also be defined as holding control (directly or indirectly) of the board or the power to elect a majority of administrators.

To avoid international non-compliance with issues such as money laundering, to fulfil its obligations under GAFILAT and to provide investor confidence.

Non-compliance with this means significant financial and administrative penalties. First off, you can be suspended from commercial operations. Secondly, there are fines of up to USD$5,000 per legal entity not registered. On top of that, the fine may be increased by 10% per day if not corrected. These are serious penalties and ones you want to avoid.

Biz Latin Hub can keep you compliant with UBO in Panama

Identifying UBO in Panama can be complex and requires due diligence to ensure the success of market entrants. Biz Latin Hub can ensure your company is fully compliant with local regulations and can operate with minimal delay.

We offer a range of market entry and back-office services to support your commercial success in Panama. The Biz Latin Hub team is built of well-experienced, bilingual, and knowledgeable accountants and lawyers striving to offer premium service.

Our team of local and expatriate professionals offers responsive, tailored legal and accounting solutions in Panama where procedures tend to be lengthy and complex. If you want to set up a company, then Biz Latin Hub can be your professional partner.

Reach out to our team of local experts for advice and comprehensive market services.

Learn more about our team and expert authors.