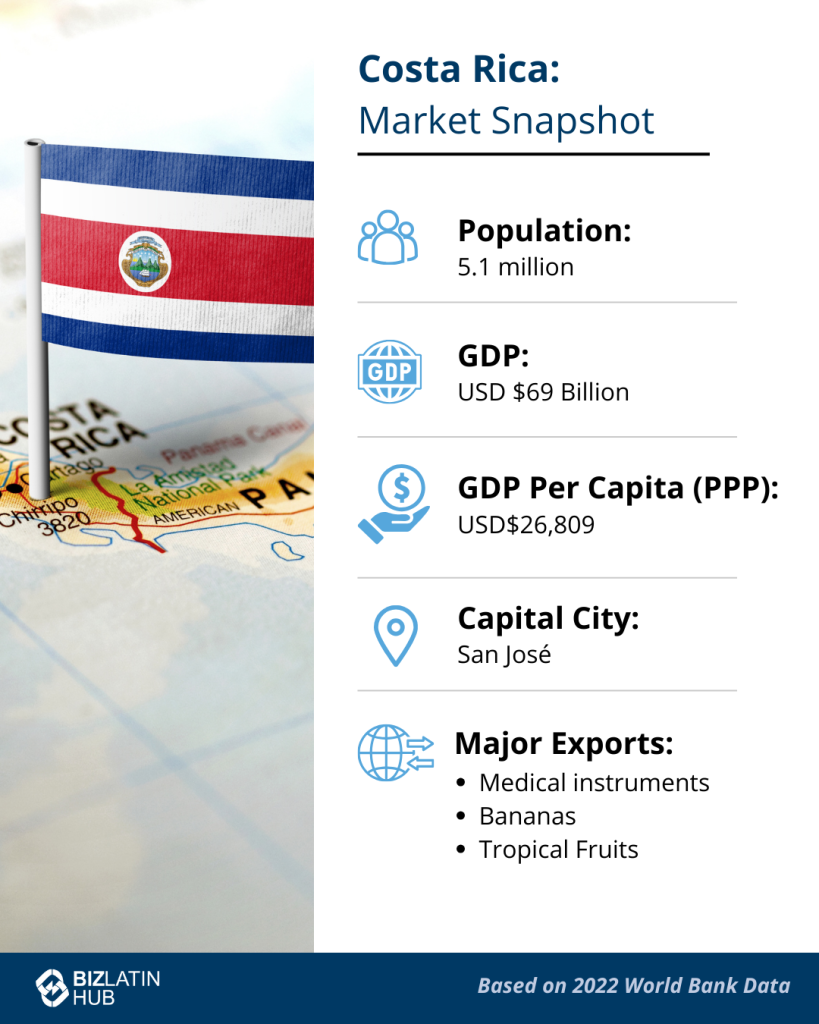

Good things often come in small packages – and Costa Rica is a superb example of this. With just over five million people, the country manages to punch significantly above its weight. The economy is worth a whopping USD$69 billion despite the small population.. This includes measures such as identifying a UBO in Costa Rica.

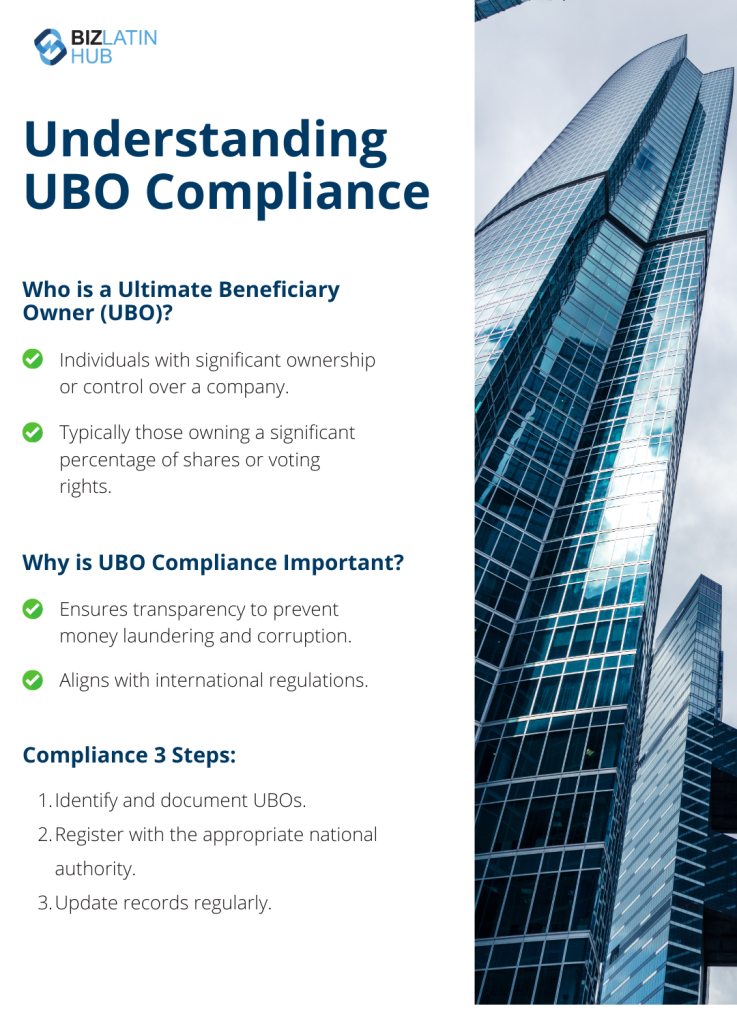

A UBO in Costa Rica is an Ultimate Beneficiary Owner, meaning someone who gains financially from the eventual aim of the business. This is covered by the RTBF Beneficial Owner Transparency Laws. If you want to register a company in Costa Rica, you will need to take these regulations into account.

That means it makes sense to partner with a local specialist such as Biz Latin Hub. We have a local office that can handle compliancy with the regulations for UBO in Costa Rica, as well as another 17 countries across Latin America and the Caribbean. No one knows the region as well as we do.

What is UBO in Costa Rica?

The country is a regional leader, with legal regulation of UBO in Costa Rica going back to 2019. The relevant legislation is known as the RTBF Beneficial Owner Transparency Laws and is overseen by the BCCR (Central Bank of Costa Rica).

An ultimate beneficiary owner in Costa Rica is defined as a shareholder or ultimate beneficiary that has substantive ownership.

The term substantive ownership is usually defined as holding between 15-25% of the share capital, either directly or indirectly. It can also be defined as holding control (directly or indirectly) of the board or the power to elect a majority of administrators.

While some of these definitions are clear, others are a little harder to identify. If in doubt, contact a local lawyer to make sure that you are receiving the best possible advice for your situation. As the definitions are broad, there is room for some interpretation of the law.

Why does Costa Rica check UBO?

UBO checks are becoming increasingly standard globally and in Latin America and the Caribbean especially. This is of particular importance for international businesses who may also be doing business in other territories.

Money laundering from illegal gangs is often disguised by routing cash flows through complex bureaucratic systems, for example. Another area of interest for the government is confirming that anyone who has been barred from company ownership is not in fact exercising control over a business.

As a country that benefits from international trade, the country has certain responsibilities to uphold. Identifying who may be a UBO in Costa Rica is a central plank of that strategy. Companies that work internationally will particularly want to avoid triggering the Patriot Act in America, alongside other legislation such as the UK Bribery Act, FCPA and others.

By following well-established international norms, Costa Rica offers a sense of investor confidence for foreign firms or individuals that may want to operate in the country. With clear proof that you are not connected to illegal organizations, you can rest assured that your local operations will not imperil other areas of your global business.

How can you stay compliant?

You must keep details of anyone who may be a UBO in Costa Rica and submit these to the BCCR via their dedicated online platform. Non-compliance with this means financial penalties as defined by article 82 in the tax code. This can run up to 2% of annual profits, capped at a maximum of 100 minimum salaries. This is a severe penalty and one you want to avoid.

This is best done with a competent and well-regarded local lawyer, specifically someone with solid and fully up-to-date information on the most recent implementation of the law. It will help if this person is familiar with Costa Rican bureaucratic standards.

This is especially true of companies that operate in a range of territories, particularly if they have multiple tax responsibilities. Large companies with complex bureaucracy across regions may find it difficult to identify a UBO in Costa Rica.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO and appoint a local legal representative to complete the digital signature. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

- Copy of ID and personal information

- Place of residence

- Capital

- Type of and number of shares in the company

FAQs on UBO in Costa Rica

These are the questions we most often field from our clients on issues connected to UBO in Costa Rica.

Yes, 100% ownership is permitted under Costa Rican law. However, for import/export businesses, this must be a branch of an existing international company.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO in Costa Rica and appoint a local legal representative to complete the digital signature. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

Copy of ID and personal information

Place of residence

Capital

Type of and number of shares in the company

An ultimate beneficiary owner (UBO) in Costa Rica is defined as a shareholder or ultimate beneficiary that has substantive ownership.

The term substantive ownership is usually defined as holding between 15-25% of the share capital, either directly or indirectly

To avoid international non-compliance with issues such as money laundering, and to provide investor confidence

Non-compliance with this means financial penalties as defined by article 82 in the tax code. This can run up to 2% of annual profits, capped at a maximum of 100 minimum salaries. This is a severe penalty and one you want to avoid.

Biz Latin Hub can keep you compliant with UBO in Costa Rica

Identifying UBO in Costa Rica can be complex and requires due diligence to ensure the success of market entrants. Biz Latin Hub can ensure your company is fully compliant with local regulations and can operate with minimal delay.

We offer a range of market entry and back-office services to support your commercial success in Costa Rica. The Biz Latin Hub team is built of well-experienced, bilingual, and knowledgeable accountants and lawyers striving to offer premium service.

Our team of local and expatriate professionals offers responsive, tailored legal and accounting solutions in Costa Rica where procedures tend to be lengthy and complex. If you want to set up a company, then Biz Latin Hub can be your professional partner.

Reach out to our team of local experts for advice and comprehensive market services.

Learn more about our team and expert authors.