Chile’s impressive year-on-year GDP growth of 1.9% in 2023 is a testament to its strong legal system, macroeconomic stability and high-quality infrastructure. With a GDP (PPP) per capita easily surpassing the regional average, at over USD$29,000, the country has grown impressively. Along with this, it is increasingly globalized, meaning that measures such as UBO in Chile are taking on greater importance.

A UBO in Chile is an Ultimate Beneficiary Owner, meaning someone who gains financially from the business. This is usually defined as a 10% stake in the company at minimum, though can be for other reasons as well. All possible beneficiary owners in finance must be registered with the Unidad de Análisis Financiero (UAF) and this will extend to all companies under the oversight of the SII (the Chilean tax authority).

If you’re considering LLC formation in Chile, you will need to take these regulations into account. It makes sense to partner with a local specialist such as Biz Latin Hub. We have a local office that can handle compliancy with the regulations for UBO in Chile, as well as another 17 countries across Latin America and the Caribbean. Our array of back office services can keep you compliant across the region.

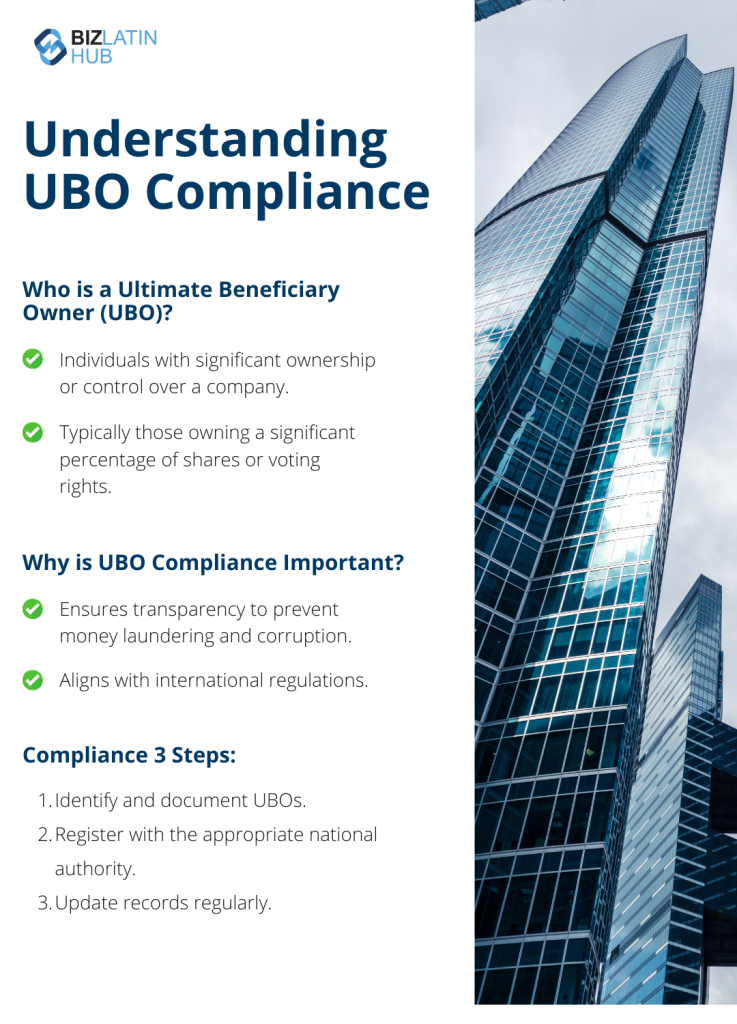

What is UBO in Chile?

The country has taken a long time to get moving on this, with definition of UBO in Chile going back to 2017. However, the creation of an official registry has faced bureaucratic delay, with the bill to do so only being proposed in late 2023 and discussed in parliament in 2024. It is likely to pass and be extended to all entities in the country, controlled by the SII (the Chilean tax authority).

For now, Circular UAF N° 57, from 2017 and the 3rd article of Ley N° 19.913 oblige all people who could be considered a UBO in Chile working in the financial sector to be registered with the UAF.

An ultimate beneficiary owner (UBO) in Chile is defined as a person who fulfils one or both of:

A: a natural person who controls 10% or more of the stock and/or voting rights in the entity

B: a person with less stock/voting rights but who has effective control of decisions in the entity

The term effective control usually refers to mechanisms within the company structure such as veto powers and so forth. It can also be defined as holding control (directly or indirectly) of the board or the power to elect a majority of administrators.

While some of these definitions are clear, others are a little harder to identify. If in doubt, contact a local lawyer to make sure that you are receiving the best possible advice for your situation. As the definitions are broad, there is room for some interpretation of the law.

Why does Chile check UBO?

UBO checks are becoming increasingly standard globally and in Latin America and the Caribbean especially. This is of particular importance for international businesses who may also be doing business in other territories. Chile is a particularly forward looking country in this regard, having started making moves on the issue nearly a decade ago.

Money laundering from illegal gangs is often disguised by routing cash flows through complex bureaucratic systems, for example. Another area of interest for the government is confirming that anyone who has been barred from company ownership is not in fact exercising control over a business.

As a member of the international group Financial Action Task Force of Latin America (GAFILAT), the country has certain responsibilities to uphold. Identifying who may be a UBO in Chile is a central plank of that strategy. Companies that work internationally will particularly want to avoid triggering the Patriot Act in America, alongside other legislation such as the UK Bribery Act, FCPA and others.

By following well-established international norms, Chile offers a sense of investor confidence for foreign firms or individuals that may want to operate in the country. With clear proof that you are not connected to illegal organizations, you can rest assured that your Chilean operations will not imperil other areas of your global business.

How can you stay compliant with UBO in Chile?

You must present full and up to date fiscal information to the SII. Failure to do means a fine from 1 UTM (around USD$60) up to 40 UTA (around USD$29,000) for each individual not registered. This can be increased for repeated failure and/or malfeasance.

In addition, a penal sanction of minimum to medium term imprisonment is possible for serious infringements. This makes it critical to stay on top of UBO reporting, especially as it is open to change.

This is best done with a competent and well-regarded local lawyer, specifically someone with solid and fully up-to-date information on the most recent implementation of the law. It will help if this person is familiar with Chilean bureaucratic standards.

This is especially true of companies that operate in a range of territories, particularly if they have multiple tax responsibilities. Large companies with complex bureaucracy across regions may find it difficult to identify a UBO in Chile.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO in Chile. Anything not written in Spanish must have an officially recognized translation. This includes, but may not be limited to, the following:

- Copy of ID and personal information

- Place of residence

- History and details of the entity in which they are UBOs

FAQs on UBO in Chile

These are the questions we most often field from our clients on issues connected to UBO in Chile.

Yes, 100% ownership is permitted under Chilean law.

You will need to make sure that you keep up to date records for anyone that could be considered a UBO in Chile. Anything not written in Portuguese must have an officially recognized translation. This includes, but may not be limited to, the following:

Copy of ID and personal information

Place of residence

History and details of the entity in which they are UBOs

An ultimate beneficiary owner (UBO) in Chile is defined as a person who fulfils one or both of:

A: a natural person who controls 10% or more of the stock and/or voting rights in the entity

B: a person with less stock/voting rights but who has effective control of decisions in the entity

The term effective control usually refers to mechanisms within the company structure such as veto powers and so forth. It can also be defined as holding control (directly or indirectly) of the board or the power to elect a majority of administrators.

To avoid international non-compliance with issues such as money laundering, to fulfil its obligations under GAFILAT and to provide investor confidence.

You must present full and up to date fiscal information to the SII. Failure to do means a fine from 1 UTM ( around USD$60) up to 40 UTA (around USD$ 29,000) for each individual not registered. This can be increased for repeated failure and/or malfeasance.

In addition, a penal sanction of minimum to medium term imprisonment is possible for serious infringements. This makes it critical to stay on top of UBO reporting, especially as it is open to change.

Biz Latin Hub can keep you compliant with UBO in Chile

Identifying UBO in Chile can be complex and requires due diligence to ensure the success of market entrants. Biz Latin Hub can ensure your company is fully compliant with local regulations and can operate with minimal delay.

We offer a range of market entry and back-office services to support your commercial success in Chile. The Biz Latin Hub team is built of well-experienced, bilingual, and knowledgeable accountants and lawyers striving to offer premium service.

Our team of local and expatriate professionals offers responsive, tailored legal and accounting solutions in Chile where procedures tend to be lengthy and complex. If you want to set up a company, then Biz Latin Hub can be your professional partner.

Reach out to our team of local experts for advice and comprehensive market services.

Learn more about our team and expert authors.