Chile’s pro-business environment makes it a top destination for investment in Latin America. To operate locally, investors must choose the correct legal entity type. This guide explores the main company structures (SpA, SRL, SA, and branches) and helps you identify which best fits your strategic needs for setting up your business in Chile.

Key Takeaways

| What are the common legal entity types in Chile | Corporation (S.A.). Simplified Corporation (S.p.A). Limited Liability Company (S.R.L). Branch Office. |

| What is the most common Chilean business entity? | The Simplified Corporation (S.p.A), or Sociedad por Acciones, is the most common business entity in Chile. Its popularity stems from its speed of formation and internal organization, which suit both foreign and domestic businesses. |

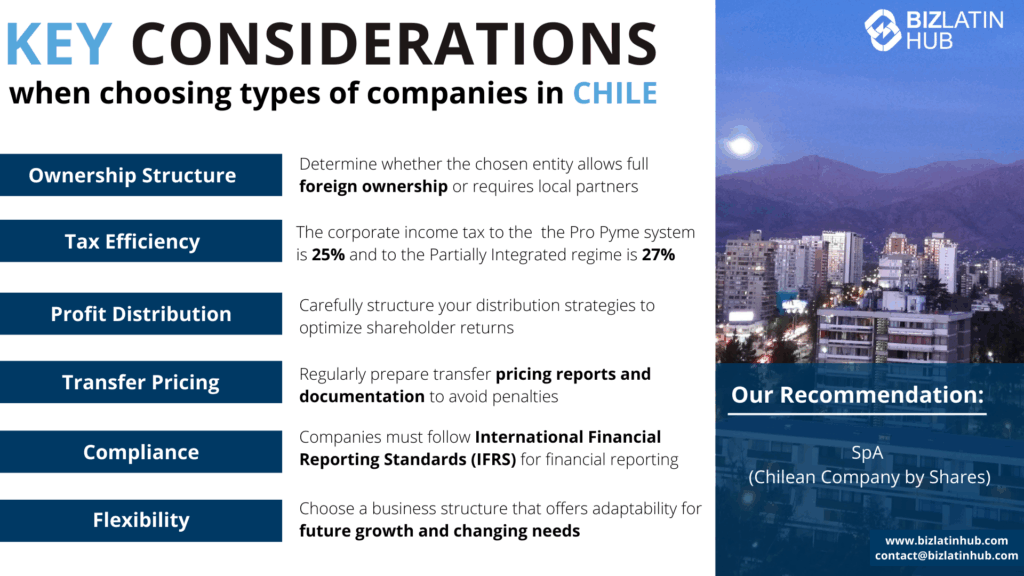

| What are the primary considerations when choosing a business entity in Chile? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

Key Legal Structures for Companies in Chile

The following four options (including a local branch) represent the best and most common types of legal business entities in Chile:

The 3 most common types of companies in Chile are:

- Corporation (S.A.).

- Simplified Corporation (S.p.A).

- Limited Liability Company (S.R.L).

Comparison Table: Key Legal Entity Types in Chile

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SpA (Simplified Shares Co.) | Startups, single-shareholder firms | 1+ | Limited to capital | Yes | Corporate tax applies |

| SRL (Ltd Liability Co.) | Small partnerships | 2–50 | Limited to capital | Yes | Corporate tax applies |

| SA (Corporation) | Larger enterprises | 2+ | Limited to capital | Yes | Corporate tax applies |

| Branch | Multinational operations | 1 (foreign HQ) | Parent company liable | Yes | Local tax residency |

1. Corporation (SA)

Who should choose this: Larger businesses planning to raise capital or operate in highly regulated industries.

A corporation or Sociedad Anónima, is a legal entity where the capital is divided into shares which can be either publicly traded or closely held. Publicly traded corporations must fulfill one of the following conditions: a) the shares are publicly traded, b) have at least 500 shareholders or c) 100% of the shares belong to at least 100 shareholders. Nearly all remaining corporations utilize a closely-held system.

See below the general characteristics for a corporation in Chile:

- There must be a minimum of two shareholders (who can be either individuals or legal entities).

- The shareholders must execute a public deed by providing all necessary information to a notary public.

- It is obligatory to publish an extract of the public deed on the website of the Official Gazette.

- The shareholders must register the corporation in a Company Registry Office.

- There are no minimum capital requirements to form a corporation.

- The shareholders are liable only up to their subscribed capital.

- The publicly traded corporations must publish their financial statements on an annual basis.

- They are also subject to the supervision of the Comision para el Mercado Financiero (CMF).

2. Simplified Shares Company (SpA)

Who should choose this: Entrepreneurs or small businesses needing flexibility. Allows one shareholder and fewer formalities.

In 2007, local authorities in Chile passed a new law introducing a new form of legal company structure called a Sociedad por Acciones or simplified corporation.

As suggested by the name, the simplified corporation has a less complicated structure that aims to encourage private entrepreneurship, attract new investments and facilitate the entrance of new types of companies in Chile. Like the corporation, its capital is divided into shares.

The biggest difference is that one sole shareholder (i.e. one individual or one company) can establish a simplified corporation. All other legal entities require at least two individuals or legal entities as the shareholders/owners.

See below some characteristics of the simplified corporation.

- There is no legislation prescribing the amount of minimum capital.

- The shareholders are liable only up to the amount of their subscribed shares.

- The individuals have two options on how to incorporate a simplified corporation: a) through a public deed or b) they are presenting a private document before the Chilean notary.

- Opposite to the corporation, the simplified corporation does not have to publish its financial statements.

3. Limited Liability Company (SRL)

Who should choose this: Private groups or family businesses that require controlled management and privacy.

The following attributes are typical of a limited liability company:

- A minimum of two partners can establish a limited liability company.

- The number of partners cannot exceed 50.

- Partners have to execute a public deed and register the company in the Registry if Commence.

- Partners must publish the public deed in the Official Gazette.

- There is no minimum capital requirement to incorporate.

- Partners are liable for their contributions.

- There is no requirement to publish the financial statements for a limited liability company, nor is it a subject of supervision of CMF.

Our Recommendation: We recommend the simplified corporation (S.p.A) because it combines the advantages of limited liability with simpler incorporation procedures compared to a traditional corporation (S.A). It offers flexibility in management and ownership structure while still providing limited liability protection to its shareholders.

Branch of a Foreign Company

Who should choose this: International companies expanding their global operations without forming a new legal entity.

This type of business is not autonomous, but rather a part of a bigger, established operation. A parent company must appoint a local agent in order to establish a branch of a foreign entity. The agent has to present all the necessary documentation to the local notary and act on behalf of the company.

The local agent is also responsible for publishing the financial statement annually. Similarly to other types of legal entities, there is no minimum requirement in regard to the capital amount. The following steps are necessary in order to create a foreign branch office in Chile:

- A local agent must execute a public deed containing a statement of establishment for the branch.

- An agent must present consul-certified and legalized copies of selected documents (e.g. articles of incorporation, by-laws of the foreign entity, certificate of good standing, and a power of attorney.

- The language of the documents must be Spanish. If the original language is not Spanish, the Ministry of Foreign Affairs in Chile must translate it.

- A local agent must publish a summary of the public deed in the Official Gazette website.

How to Select the Best Company Type in Chile

The key considerations when deciding on which is the best entity type in Chile are the following:

Ownership Structure

Determine whether the chosen entity type allows full foreign ownership or requires local partners, as Chile’s business environment is generally open but may have restrictions in certain strategic sectors like maritime transportation or natural resources. Understanding these nuances will help you ensure compliance with local regulations while achieving your business goals.

Tax Efficiency

Analyze how Chile’s tax system impacts your business. The corporate tax rate operates under two regimes: the Pro Pyme system for small and medium businesses, which has a reduced rate of 25%, and the general Partially Integrated regime, which applies a 27% corporate tax rate. Additionally, VAT stands at 19%, affecting most goods and services. Take advantage of tax treaties and incentives for investments in specific sectors like renewable energy, innovation, or free trade zones like the Zona Franca in Iquique. Strategic tax planning is critical to minimize costs and maintain compliance.

Profit Distribution

Consider the impact of Chile’s taxation on profit repatriation. Corporate income tax applies at the entity level, and shareholders are subject to withholding tax on dividends, which is generally 35% but can be reduced through double taxation treaties. Carefully structure your distribution strategies to optimize shareholder returns while ensuring compliance with Chilean tax laws.

Transfer Pricing

Comply with Chile’s transfer pricing regulations for cross-border transactions between related entities. The law requires companies to document and justify intercompany transactions to ensure they reflect arm’s-length market values. This is particularly important for businesses engaged in import/export, licensing intellectual property, or intercompany loans. Regularly prepare transfer pricing reports and documentation to avoid penalties or increased scrutiny during tax audits.

Compliance

Prepare to meet Chile’s robust compliance requirements. Companies must follow International Financial Reporting Standards (IFRS) for financial reporting. Annual tax declarations are mandatory, and businesses exceeding certain revenue thresholds are subject to external audits. Labor and social security compliance is also key, requiring timely and accurate filings. Ensuring adherence to these obligations is essential to maintain good standing and avoid legal or financial penalties.

Flexibility

Choose a business structure that provides adaptability for future growth and regulatory changes. The Sociedad por Acciones (SpA) offers high flexibility for ownership changes and capital adjustments, making it ideal for startups and foreign investors. Alternatively, the Sociedad de Responsabilidad Limitada (SRL) is suitable for smaller ventures with fewer partners, while the Sociedad Anónima (S.A.) is better suited for larger enterprises seeking external investment or public listing. Flexibility is key in Chile’s dynamic and investor-friendly business environment.

Note: In most cases from our experience, we would recommend establishing a SpA (Chilean Company by Shares), which is similar to an LLC in the US.

Steps to Register a Company in Chile

It takes approximately 2 to 4 weeks to complete the process of company formation in Chile once you have all of the required documents. Here are the 7 steps you will need to follow:

- Step 1 – Register the company.

- Step 2 – Notarize the company statutes.

- Step 3 – Obtain a RUT number.

- Step 4 – Print receipts/invoices.

- Step 5 – Seal accounting books and other documents.

- Step 6 – Acquire a patente municipal.

- Step 7 – Register for labor-related accident insurance.

Compliance Tip

All Chilean companies must obtain a RUT (tax ID), register with the IRS (SII), and maintain accounting records. Employing staff requires registration with social security and health institutions.

Common Legal Structure Mistakes in Chile

- Choosing an SRL when you need a single owner (SpA is better)

- Underestimating disclosure and audit obligations of SA

- Registering a branch without knowing the liability risk

- Failing to appoint a legal representative in Chile

- Ignoring industry-specific restrictions (e.g., finance, mining)

Why Choose Biz Latin Hub for Incorporation in Chile?

Chilean authorities are aware of the importance of domestic and foreign investments for the growth of its economy. For this reason, they try to enhance legislation supporting business-friendly practices. One of them is providing a wide variety of types of companies in Chile. Choosing the right form of entering the market is extremely important and provides the fundamental building blocks for further business expansion.

For this reason, we highly recommend cooperating with a local partner when entering the Chilean market. Get in contact with Biz Latin Hub and our team of local experts and professionals will provide you with company formation services and will support you in establishing your business in Chile.

Unsure of your tax and accounting requirements in Chile? Let our team of experts help you. Contact us now.

FAQs: Company Types in Chile

1. Can a foreigner register a company in Chile?

Yes, foreigners can register a company in Chile. The process involves complying with the country’s registration requirements and immigration laws, but with proper guidance there should be no problem.

2. What type of legal entity is a simplified corporation (S.p.A) in Chile?

As suggested by the name, the simplified corporation has a less complicated structure that aims to encourage private entrepreneurship, attract new investments and facilitate the entrance of new types of companies in Chile. Like the corporation, its capital is divided into shares.

3. How do I create a legal entity in Chile?

To create any of the types of companies in Chile, you need to follow the registration process outlined by regulatory authorities. The process involves adhering to the country’s registration requirements and immigration laws that you can see in our article.

4. What is an LLC in Chile?

In Chile, an LLC refers to a Limited Liability Company, which provides owners with limited liability protection and simplified administrative requirements. This is closest to an S.R.L in Chile.

5. What is the business structure of an S.p.A in Chile?

There is no legislation prescribing the amount of minimum capital and the shareholders are liable only up to the amount of their subscribed shares. Individuals have two options on how to incorporate a simplified corporation: a) through a public deed or b) they are presenting a private document before the Chilean notary. Opposite to the corporation, the simplified corporation does not have to publish its financial statements.

6. What is the most flexible structure in Chile?

The SpA is highly flexible and allows incorporation with only one shareholder.

7. Can foreigners fully own Chilean companies?

Yes. Foreign individuals and entities can own 100% of companies in Chile.

8. How long does incorporation take?

It typically takes 2–4 weeks for simple structures like SpA or SRL.

9. Do I need a Chilean partner?

No, but a legal representative with a Chilean RUT is required.

10. What tax filings are mandatory?

Corporate income tax, monthly VAT returns (if applicable), and labor-related obligations.

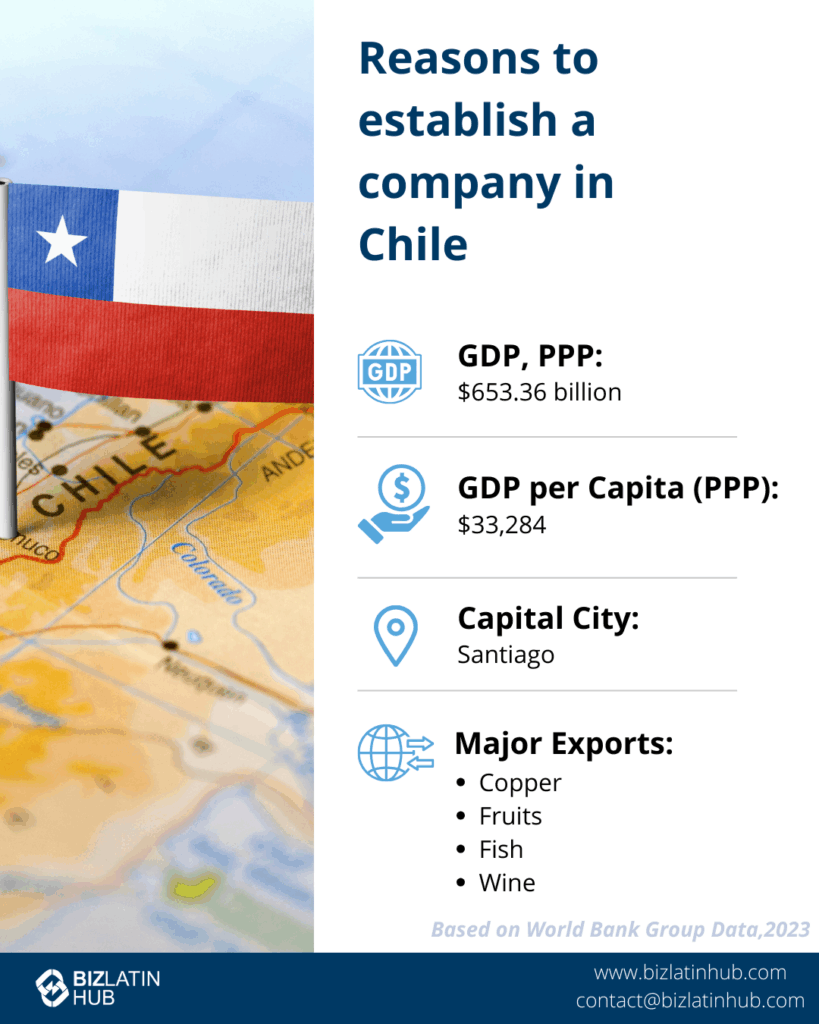

Why Invest in Chile?

Chile provides a stable and investor-friendly environment backed by a resilient economy and transparent governance. Its political stability and strong fiscal discipline create confidence for investors. The country’s numerous free trade agreements with major economies like the United States, China, and the European Union grant businesses access to 86% of global GDP.

Rich in natural resources, Chile leads the world in copper production and holds significant reserves of lithium, gold, and other minerals. It is also a hub for renewable energy, with vast potential in solar, wind, and hydroelectric power due to its deserts, winds, and coastlines. A well-developed infrastructure for transport, energy, and telecommunications supports efficient business operations.

Investment incentives, such as tax stability and protection under the Foreign Investment Promotion Law, further enhance Chile’s appeal. Its strategic location on the Pacific Rim connects investors to Asian markets while providing access to North and South America. A skilled, bilingual workforce and high rankings for ease of doing business make Chile a top choice for sectors like mining, energy, agriculture, and technology.