Honduras offers various legal structures for businesses. Understanding these options is crucial for entrepreneurs and investors. Each entity type provides distinct benefits and obligations that influence business operations.

The Limited Liability Company (SdeRL) is a popular choice due to its flexibility and limited liability for shareholders. In contrast, the Public Limited Company (SA) suits larger enterprises looking for capital through public shares. Additionally, foreign companies can establish Branch Offices or Representative Offices, each with specific regulatory implications.

This article explores the different legal entities available in Honduras. It covers governance structures, incorporation requirements, liability implications, and ongoing legal compliance. By understanding these factors, businesses can make informed decisions for successful operations in Honduras.

Overview of Business Structures in Honduras

In Honduras, businesses can choose from four main legal entities:

1. Proprietorship

- Ease of Setup: Proprietorships are the easiest to establish.

- Liability: Unlimited liability; the owner is fully responsible for all debts and assets.

- Ownership: Single owner.

- Shareholders: Not applicable.

2. Partnership

- Similarity to Proprietorship: Shared liability among partners.

- Liability: Liability is shared among partners.

- Ownership: Multiple owners (partners).

- Shareholders/Partners: Partners share responsibility.

3. Private Limited Liability Company (LLC) – Sociedad de Responsabilidad Limitada (SRL)

- Foreign Ownership Allowance: Full foreign ownership allowed.

- Requirements:

- Minimum capital: Approximately $250 USD.

- Minimum shareholders: 2, maximum shareholders: up to 25.

- At least one director required; can be any nationality.

- Liability limited to capital contributions.

4. Public Limited Company (PLC) – Sociedad Anónima (SA)

Public Limited Companies are more complex and typically involve public shareholders:

Requirements

- Requires at least two shareholders, who can be individuals or legal entities.

- At least one director needed; does not have to be a resident of Honduras but often requires a statutory auditor for financial oversight.

Each entity type has its own benefits and requirements. For instance, while a proprietorship is easy to establish, it involves unlimited liability. In contrast, an LLC limits liability but requires more complex setup.

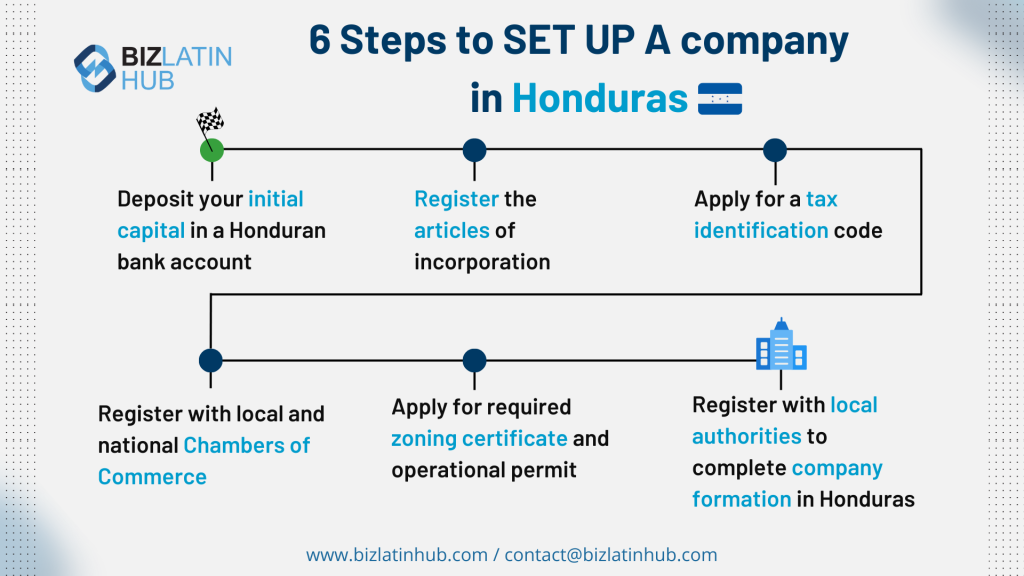

Regardless of the entity type, businesses must comply with several authorities. This step ensures legal operation but extends the registration timeline.

Below is a quick comparison:

| Entity Type | Ownership | Liability | Shareholders |

|---|---|---|---|

| Proprietorship | Single | Unlimited | Not applicable |

| Partnership | Multiple | Shared | Partners |

| LLC | Multiple | Limited to capital | 2 to 20 owners |

| PLC | Multiple | Public responsibility | 2 or more |

Understanding these structures helps in choosing the right fit for business needs.

Limited Liability Company (SdeRL)

Governance Structure

A Limited Liability Company (LLC) in Honduras follows a defined governance structure outlined in its formation document, known as the Escritura Publica. The highest authority in an LLC is the general assembly, or Asamblea General, of its partners. This body makes crucial decisions, such as approving the balance sheet and discussing profit distribution. The general assembly can appoint managers and monitor company administrators. Although non-executive roles are not mandatory, they can be established if specified in the founding document. The assembly has the power to approve share transfers and admit new partners. It may also act against any harmful decisions made by company administrators.

Requirements for Incorporation

In Honduras, incorporating an LLC requires at least two shareholders. Full foreign ownership is permitted. The process includes appointing at least one director and committing a minimum share capital of 5,000 Lempiras, about US$210. All partners must sign the incorporation deed before a notary public. Incorporation is efficient, typically completed within one to two weeks. Businesses must register with local authorities like the Revenue Administration Service (SAR) and the Social Security Institute (IHSS). Compliance with subsidiary laws is essential to meet specific requirements tied to the company’s formation and operation.

Capital Obligations

An LLC in Honduras must have a minimum share capital of 5,000 Lempiras. This capital is divided into quotas, representing indivisible portions of the company’s capital. Quotas must be fully subscribed at the time of incorporation. For branches, the minimum requirement is US$1,300, while a public limited company needs US$25,000 Lempiras. Adhering to these capital obligations ensures the company meets the Commercial Code’s standards.

Liability Implications for Shareholders and Directors

Shareholders in an LLC in Honduras enjoy limited liability. They are liable only for debts up to their capital contributions, thus protecting personal assets. Directors in these entities maintain privacy as their names are not publicly disclosed. This adds a layer of confidentiality to their roles. Although statutory auditors are necessary for S.A. companies, they are not requisite for LLCs.

Governance Structure

The governance structure of a Limited Liability Company (LLC) in Honduras is based on the act of constitution, known as Escritura Publica. This document can specify the appointment of a non-executive branch if needed.

Key Points of Governance:

- General Assembly (Asamblea General):

- Acts as the highest authority.

- Discusses and approves the balance sheet.

- Determines profit distribution.

- Appoints managers.

- Powers and Responsibilities:

- Supervise company procedures by administrators.

- Veto harmful decisions.

- Approve share transfers.

- Admit new partners.

- Authorize legal actions for damages against other corporate bodies.

Non-executive directors are not required in Honduran LLCs. However, if appointed, their roles are defined by the Escritura Publica or its updates.

Summary Table:

| Governance Body | Roles and Responsibilities |

|---|---|

| General Assembly | Balance sheet approval, profit distribution |

| Management appointments, supervision | |

| Non-Executive | Optional, defined roles in documentation |

This structure ensures the effective management and regulatory compliance of an LLC in Honduras.

Public Limited Company (SA)

A Public Limited Company, known as Sociedad Anónima (SA) in Honduras, offers a flexible business structure. This company type requires at least two shareholders. These shareholders can be individuals or legal entities. The company must appoint at least one director. This director does not need to be a Honduras resident.

A statutory auditor is mandatory for an SA. The auditor ensures compliance with financial regulations. The SA has no restrictions on the nationality of its shareholders or directors. This feature allows more flexibility in ownership. The company is designed to accommodate public investment.

The SA structure supports broader capital generation. This is beneficial compared to other business entities in Honduras. Below is a brief overview:

| Feature | Requirement |

|---|---|

| Minimum Shareholders | Two individuals or legal entities |

| Director Residency | Not required in Honduras |

| Statutory Auditor | Mandatory |

| Nationality Restrictions | None on shareholders/directors |

In conclusion, an SA in Honduras is efficient for public investment and capital growth. This company type provides flexibility and meets key business needs.

Branch Office (Sucursal)

A branch office, known as “Sucursal,” in Honduras provides an extension for foreign companies. It requires a minimum share capital of $1,300. The branch must align its operations with the parent company’s activities. The Honduran Commercial Code allows foreign businesses to open branch offices. This move can facilitate their local operations.

To incorporate a branch office, a registered agent is necessary. This agent must be a Honduran citizen. The registered agent represents the foreign entity’s interests in the country. Additionally, the branch office should appoint a representative who resides permanently in Honduras. This person will act as the branch’s point of contact.

The liabilities and obligations of the branch match those of its parent company. When engaging in local trade, companies must weigh these responsibilities. Here is a concise overview:

| Feature | Requirement |

|---|---|

| Minimum Share Capital | $1,300 |

| Registered Agent | Must be a Honduran citizen |

| Local Representative | Must be a Honduran permanent resident |

| Connection to Parent Company | Follows parent company activities |

| Liabilities & Obligations | Same as parent company |

Liability Implications

In Honduras, company structures like the Sociedad Anónima (S.A.) and Sociedad de Responsabilidad Limitada (S.R.L.) safeguard shareholder assets. These structures offer limited liability protection. Shareholders’ personal assets stay protected beyond their contributions.

The SRL is particularly appealing for its simplicity. It offers a straightforward pathway compared to the S.A. Its minimum capital requirement is 5,000 lempiras. This sets a financial boundary for partner liability.

The limited liability encourages investment by minimizing partners’ risk. This is limited only to their capital input. The SRL is versatile and suits various business types. Small businesses and industrial enterprises alike enjoy its protections. Key features include:

- Limited Liability Protection: Personal assets are safeguarded.

- Minimum Capital for SRL: 5,000 lempiras required.

- Encouragement for Investment: Risk limited to contributed capital.

- Versatility: Suitable for diverse businesses.

Liability Implications

In Honduras, both the Sociedad Anónima (S.A.) and Sociedad de Responsabilidad Limitada (S.R.L.) provide limited liability protection. Shareholders’ personal assets remain secure, only risking their company contributions. This setup encourages investment by limiting potential losses.

Key Liability Features

- Limited Liability: Both S.A. and S.R.L. protect personal assets.

- Attractiveness: S.R.L. appeals to local and foreign entrepreneurs for reduced risks.

- Investment Encouragement: Liability matches partner capital contributions.

Minimum Capital Requirement

The S.R.L. structure requires a minimum capital of 5,000 lempiras. This sets a clear financial cap on liability for partners.

Versatile Corporate Form

The S.R.L. is adaptable, benefiting small and large businesses. This adaptability supports varied commercial activities while ensuring limited liability.

| Entity Type | Minimum Capital | Liability Type |

|---|---|---|

| S.R.L. | USD 200 | Limited |

| S.A. | USD 1,100 to USD 1,250 | Limited |

Limit liability and encourage investment with these flexible Honduran business entities.

Representative Office (Oficina de Representación)

A Representative Office (Oficina de Representación) in Honduras acts as a link between foreign entities and their parent companies. This setup is not a legal entity and cannot conduct commercial activities. The office serves mainly for market research and promotional tasks.

Key Points about Representative Office:

- Activities: Limited to market research and promotional activities.

- Legal Status: Not a legal entity; cannot engage in commercial activities.

- Share Capital: No minimum share capital required.

- Personnel: Must appoint at least one resident representative.

- Nationality: The representative can be of any nationality.

- Purpose: Non-commercial.

Setting up a Representative Office is simpler than starting a full branch or company. It involves registering with the relevant local authorities. This process ensures compliance with local regulations but remains straightforward compared to other business entities.

| Requirement | Description |

|---|---|

| Legal Entity Status | Not a legal entity |

| Minimum Share Capital | None required |

| Commercial Activities | Not allowed |

| Required Personnel | At least one resident representative |

| Activities Permitted | Market research and promotion |

In summary, a Representative Office is ideal for foreign entities focusing on specific, non-commercial objectives in Honduras.

Legal Compliance for Maintaining Entities

Investors in Honduras must follow legal rules to avoid issues and fines. Business types include LLCs, public limited companies, branch offices, and representative offices. Each has unique requirements. Branches of foreign companies must meet specific rules, like minimum share capital, and remain under the parent company’s control. Compliance involves sales tax registration, acquiring operational permits, and company book approval. Social security registration is also necessary.

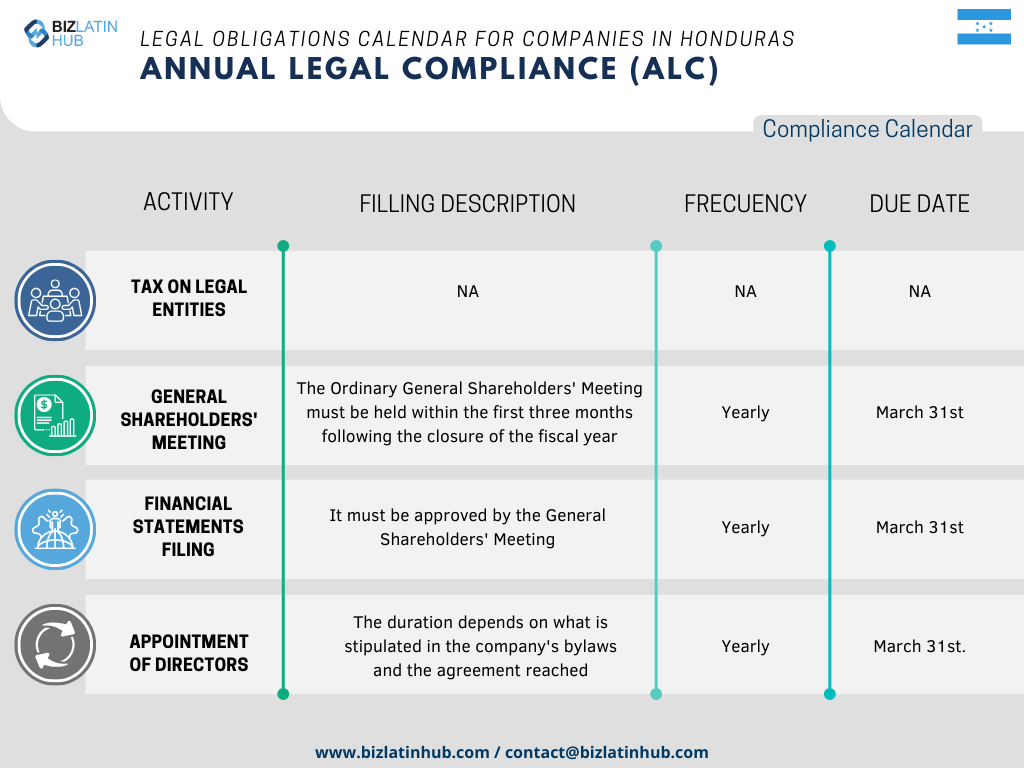

Annual Filings and Documentation

Understanding annual compliance is critical before registering a company in Honduras. Documents must be notarized and filed with the Mercantile Registry. After incorporation, companies need to register with Honduran tax authorities for a tax identification number (RTN). They must file annual returns and keep accurate accounting records. Specific permits may be required based on business activities.

Taxation Obligations

Honduran companies pay 25% corporate income tax on profits, with an extra 5% for incomes over HNL 1 million. A 15% value-added tax applies to goods and services. Municipal taxes, varying by location, include industry and commerce taxes, calculated on production volume or sales. Property tax is due annually, with August 31 as the payment deadline. Companies must register and comply with municipal tax obligations.

| Tax Type | Rate | Calculation Basis |

|---|---|---|

| Corporate Income Tax | 25% | On profits |

| Additional Surcharge | 5% | On taxable income exceeding HNL 1 million |

| Value-Added Tax | 15% | On sale of goods and services |

Labor Regulations

Honduras follows the Labor Code and the National Program of Employment Per Hour. Employment agreements must be in writing or verbal, as specified by local bylaws. Employers pay taxes from 15.1% to 16.6%, plus a 5% healthcare contribution. Employers with 10 or more staff must contribute 1.5% to the Pension Regimen de Aportaciones Privadas. Employee contributions range from 5.1% to 6.6% for various benefits.