Understanding the complexities of the legal structures in Mexico is paramount for choosing the right corporate structure when looking to register a company in Mexico. With its business-friendly environment and growing appeal to foreign investors, Mexico offers great opportunities for investors. Collaborating with local experts allows you to navigate the regulatory framework with confidence and clarity. Whether opting for flexibility or liability protection, at Biz Latin Hub, we provide the knowledge and support you need to ensure seamless integration into Mexico’s vibrant entrepreneurial ecosystem.

Key Takeaways

| What are the common legal entity types in Mexico | S.A. de C.V. – Sociedad Anónima de Capital Variable (Stock Corporation). S de R.L. de C.V.- Sociedad de Responsabilidad Limitada de Capital Variable (Limited Liability Company – LLC). S.A.S.- Sociedad por Acciones Simplificada (Simplified Shares Company). |

| What is the most common Mexican business entity? | Popular with investors from the US is the Sociedad de Responsabilidad Limitada de Capital Variable (S de R.L. de C.V) that has similar benefits to an LLC in the US enabling a smoother access to the Mexican Market. |

| What are the primary considerations when choosing a business entity in Mexico? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

3 Types of legal structures in Mexico

Mexico has 3 types of legal structures from which you can choose. Here you can see what they are and what benefits each one has. Knowing which of the legal structures in Mexico suits you best will depend on the type of business you operate.

- S.A. de C.V. – Sociedad Anónima de Capital Variable (Stock Corporation).

- S de R.L. de C.V.- Sociedad de Responsabilidad Limitada de Capital Variable (Limited Liability Company – LLC).

- S.A.S.- Sociedad por Acciones Simplificada (Simplified Shares Company).

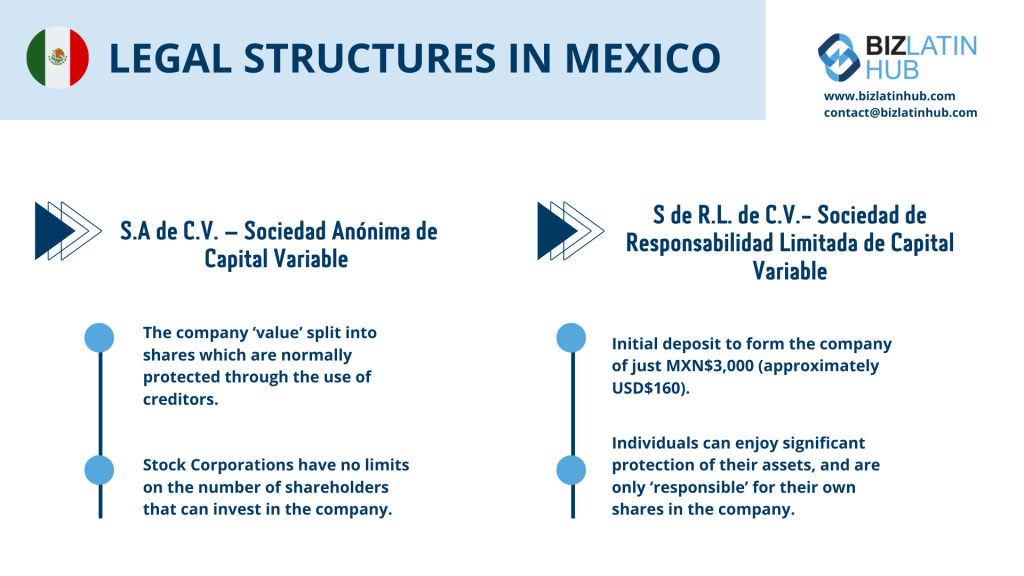

1. Sociedad Anónima de Capital Variable S.A de C.V. (Stock Corporation)

The key facts for the stock corporation and most popular legal structure in Mexico are:

- The company is formed and the company value split into shares which are normally protected through the use of creditors.

- Stock Corporations have no limits on the number of shareholders that can invest in the company. This means that raising the necessary capital (MXN$50,000 – approximately USD$2,700) is very achievable for new companies as an unlimited number of people can contribute.

- Although this structure includes certain bureaucratic and administrative burdens, it is undoubtedly the structure that has the largest potential for growth and profit.

2. Sociedad de Responsabilidad Limitada de Capital Variable S de R.L. de C.V. (Limited Liability Company – LLC)

The second most popular type of legal structures in Mexico is the Limited Liability Company. It is also based on shares and has the following distinguishing features:

- An LLC is very accessible for SMEs with an initial deposit to form the company of just MXN$3,000 (approximately USD$160).

- Another advantage is that taxes are paid through individual members’ tax return, rather than as a collective company.

- Individuals can enjoy significant protection of their assets, and are only ‘responsible’ for their own shares in the company, as suggested by the name.

3. Sociedad por Acciones Simplificada S.A.S. (Simplified Shares Company)

The third major legal structure in Mexico is the S.A.S., which is mirrored in other Latin America jurisdictions such as Argentina and Colombia. It is a relatively new concept that was announced in 2016 as part of the reforms to the General Law of Commercial Companies. The advantage of this structure is clear and stems from the very reason that this structure was introduced. Mexico is making significant steps to open up their market for foreign investment, and have made many reforms to different pieces of commercial legislation to simplify and encourage foreign operations. The S.A.S. is a perfect example of this.

Some key characteristics of the Mexican S.A.S. include:

- A relatively cheap, fast and simple formation process and corporate structure, and is ideal for SMEs looking for an easy route-to-market.

- One potential problem involved with this corporate structure is the fact that there is an annual maximum permissible profit of MXN$5,000,000 (approximately USD$265,000). For this reason, the S.A.S. is preferred amongst SMEs as opposed to multinationals looking to expand operations.

Key Considerations When Choosing Types of Companies in Mexico

Ownership Structure

Assess whether the chosen business entity allows full foreign ownership, as Mexico permits 100% foreign ownership in most industries. However, certain strategic sectors, such as oil and gas exploration, electricity distribution, broadcasting, and domestic transportation, have restrictions requiring local partnerships or government involvement. Understanding these industry-specific regulations will help ensure compliance and smooth operations in Mexico.

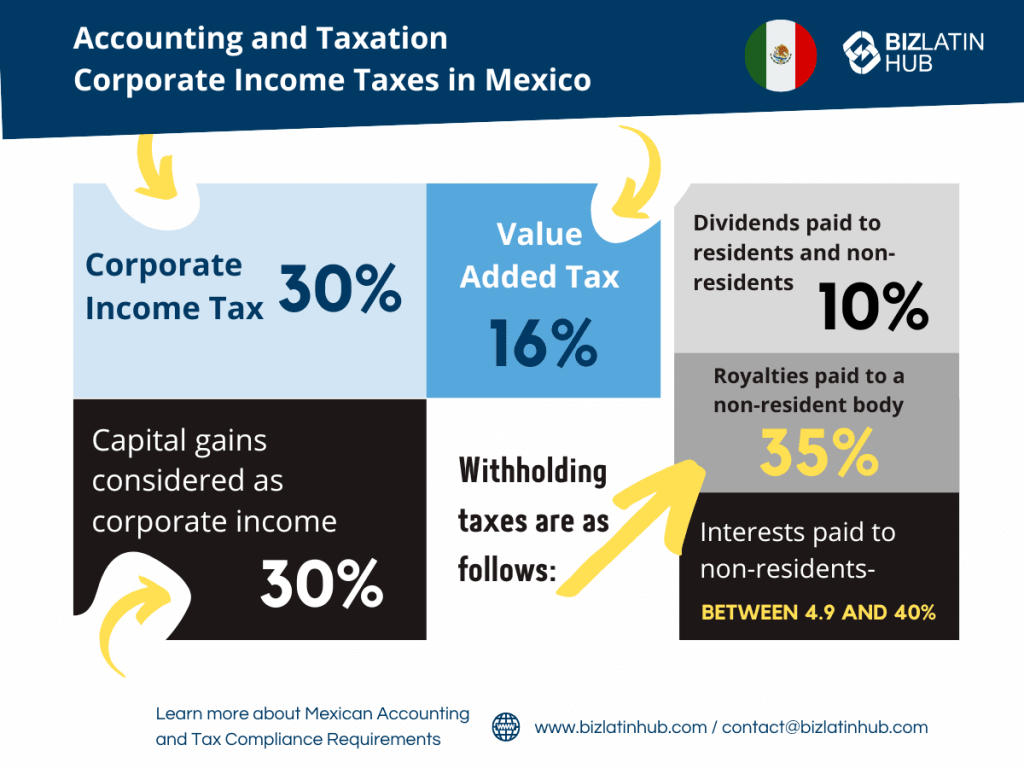

Tax Efficiency

Evaluate how Mexico’s tax system impacts your business. The corporate income tax rate (ISR) is 30%, and a value-added tax (IVA) of 16% applies to most goods and services. For businesses exporting goods or services, VAT refunds may be available. Mexico offers tax incentives for companies operating in Free Trade Zones (FTZs), specific industries like manufacturing (through the IMMEX program), and R&D initiatives. Proper tax planning, including reviewing eligibility for these benefits, is crucial for optimizing costs while maintaining compliance.

Profit Distribution

Consider the tax implications of distributing profits. Dividends paid to non-residents are subject to a 10% withholding tax, in addition to corporate taxes already paid at the entity level. Mexico has an extensive network of double taxation treaties with countries like the U.S., Canada, and European nations, which can reduce withholding taxes on dividends. Developing a sound repatriation strategy is essential to maximize shareholder returns and minimize tax burdens.

Transfer Pricing

Comply with Mexico’s transfer pricing regulations, which follow OECD guidelines. Companies engaged in cross-border transactions with related parties must ensure that these transactions reflect arm’s-length pricing. Annual transfer pricing documentation and disclosure in tax returns are mandatory for businesses exceeding specific revenue thresholds. Failing to comply can result in significant penalties and increased scrutiny from tax authorities.

Compliance

Prepare for Mexico’s extensive compliance requirements. Companies must register with the Public Registry of Commerce (RPC) and obtain a Tax ID (RFC) from the tax authority (SAT). Financial reporting must align with Mexican Financial Reporting Standards (NIF) or IFRS for larger entities. Annual tax declarations and monthly VAT and payroll tax filings are mandatory. Labor compliance is critical, including contributions to the Mexican Social Security Institute (IMSS) and adhering to local employment laws. Meeting these obligations ensures legal standing and minimizes risks.

Flexibility

Select a business structure that fits your operational needs and long-term goals. Common business structures in Mexico include:

- Sociedad Anónima (S.A.): A widely used structure for larger companies, allowing the issuance of shares and raising capital through private or public investors. It requires a minimum of two shareholders and provides limited liability.

- Sociedad de Responsabilidad Limitada (S. de R.L.): Ideal for small to medium-sized businesses, offering limited liability and simpler governance. It limits the number of partners to 50, making it suitable for closely-held entities.

- Sociedad por Acciones Simplificada (S.A.S.): A flexible and simplified structure designed for small businesses or sole proprietors. It can be incorporated with just one shareholder and features reduced compliance requirements.

Choosing the right structure is essential for flexibility in adapting to Mexico’s dynamic regulatory and economic environment.

Note: Our recommendation to clients is forming a Simplified Shares Company (S.A.S.) as it offers simplicity and speed in incorporation, with minimal capital requirements and a quick formation process. Additionally, the S.A.S. structure provides flexibility in ownership, making it a suitable option for various business models.

Adapting Your Corporate Structure for Success in Mexico

If your company exceeds the profit limit of MXN$5,000,000, you can adjust your legal entity to adopt a new corporate structure. The ideal structure depends on your business objectives and operational needs in Mexico. Consulting local experts before incorporating ensures you select the most suitable legal framework.

Two advanced corporate structures, SAPI (Stock Corporation for Investment Promotion) and SOFOM (Multi-Purpose Financial Company), cater to companies aiming to enter the Mexican Stock Exchange (MexBol or BMV). For further guidance on these structures or other inquiries, contact our team for expert assistance.

FAQs on Types of Legal Structures in Mexico

1. Can a foreigner register a company in Mexico?

Yes, foreign individuals and entities can register a company in Mexico. However, there are certain legal requirements and procedures that need to be followed, including obtaining the appropriate visa or residency status, complying with investment regulations, and registering the company with the Mexican authorities.

2. What type of legal entity is a S.A.S in Mexico?

The S.A.S is a limited liability type of company. Its shareholders contribute capital to the company in exchange for shares.

3. How do I create an S.A de C.V. (Sociedad Anónima de Capital Variable) in Mexico?

To create an S.A.S in Mexico, you’ll need to follow specific steps outlined by the Mexican government. This typically involves drafting articles of incorporation, obtaining a tax identification number, registering with the Public Registry of Commerce, and fulfilling any additional regulatory requirements.

4. What is an LLC (Sociedad de Responsabilidad Limitada de Capital Variable) in Mexico?

An LLC, or Limited Liability Company, in Mexico is known as S de R.L. de C.V. It is a flexible business structure that combines elements of partnerships and corporations. LLCs offer limited liability protection to their members while allowing for simplified management and taxation.

5. What is the business structure of SAS (Sociedad por Acciones Simplificada) in Mexico?

The Simplified Shares Company (S.A.S) is a relatively new legal entity in Mexico designed to streamline the process of starting a business. It offers a combination of speed, flexibility, and investor-friendly features that make it a suitable choice for both domestic and foreign businesses looking to establish a presence in Mexico.

Why invest in Mexico?

One new Mexican market that has experienced particular success in recent years is the production of medical equipment and devices. As of 2016, this industry is valued by ProMexico, the governmental agency responsible for encouraging foreign investment, at over USD$13 billion.

This same report highlights savings of over 20% when compared to fabrication in the US. This industry, as typifies all emerging industries in Mexico, is driven by an incredibly well educated, and economically accessible workforce.

The most straightforward way to tap into the goldmine of opportunities that exist is to incorporate a Mexican company directly into the local market.

Biz Latin Hub can Advise you on Legal Structures in Mexico

The time could not be riper to get involved in the emerging, dynamic market growth in Mexico. The wide range of attractive industries and sectors is complemented by a number of different legal structures in Mexico that all provide different advantages for investors with different requirements.

Biz Latin Hub is a leader in providing support and consultancy services for companies in all major Latin jurisdictions. The Biz Latin Hub Mexico team will be the perfect partner for helping you to establish successful operations in Mexico.

Reach out to us now to discuss how we can support you in achieving your business goals.

Or read about our team of expert authors.