Transfer pricing in Brazil sets out the terms on which transferring goods and services between legally related entities or persons is based, in order to maintain competition in the market. If you have been considering company formation in Brazil, or are already active in this South American market, understanding this will make your life easier.

Brazil shares common boundaries with many of Latin America’s key markets and is also a founder member of the Southern Common Market (Mercosur), an economic bloc that also includes Argentina, Paraguay, and Uruguay. That makes it an ideal place to base yourself in the continent.

Read on to understand how transfer pricing in Brazil could affect your commercial operations in the country and how Biz Latin Hub can help you. Our array of market leading back-office services are there to keep you fully up-to-date and legally compliant, allowing you to focus on what you do best – growing your business.

What is the purpose of transfer pricing in Brazil?

The main purpose of transfer pricing in Brazil is to facilitate the proper calculation of costs for goods and services involved in any kind of transfer of assets and services between two related entities, where at least one person or entity involved in the transaction is legally resident in Brazil. Some examples of overseas entities related to entities or legal persons domiciled in Brazil include:

- A headquarter office domiciled abroad

- A subsidiary or branch domiciled abroad

- A natural or legal entity/person, resident or domiciled abroad, whose shareholding in its share capital identifies it as its parent company or an affiliate

- A natural or legal person, resident or domiciled abroad, who holds exclusivity as an agent, distributor, or concessionaire, for the purchase and sale of goods, services, or rights.

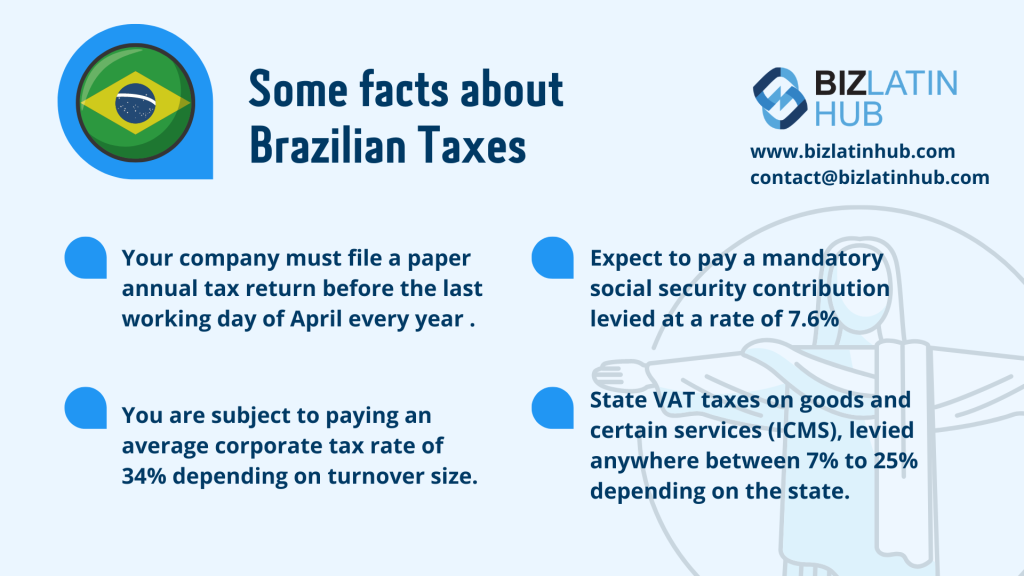

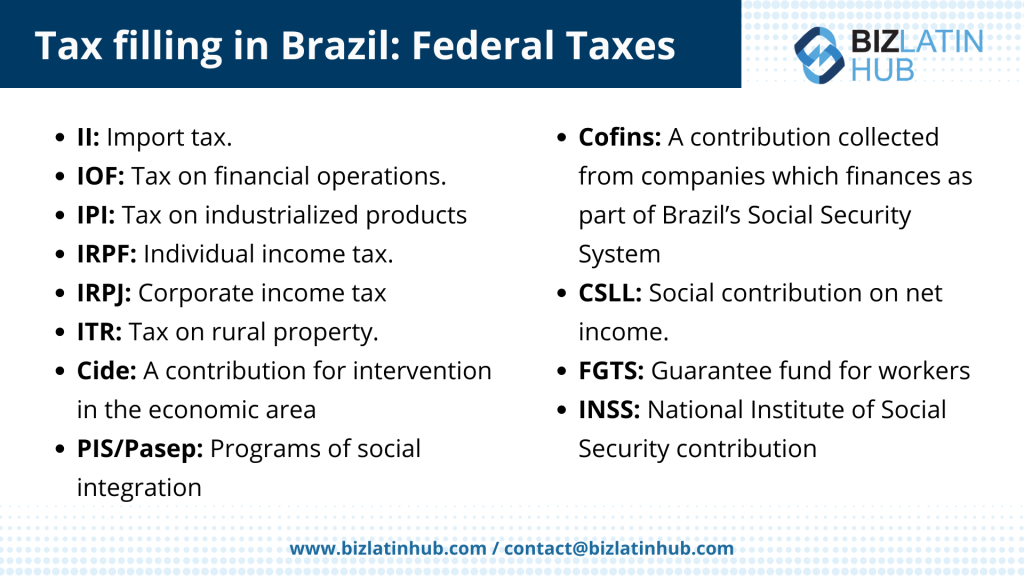

Transfer pricing applies to companies in the same economic group, but which are located in different countries and in Brazil is regulated by the Brazilian Federal Tax Authority (Receita Federal). Two of the main corporate taxes to be aware of and upon which transfer pricing in Brazil will have an effect are corporate income tax (IRPJ) and “Social Contribution on Net Profits” (CSLL).

Deduction of imports and price calculation

Import deduction is applied to costs, expenses, and charges related to goods, services, and duties stipulated in the import or acquisition documents. The price calculation to be used as a parameter must observe one of the four types of calculation methods defined by Brazilian law, which include:

- Compared independent price: is the weighted arithmetic average of the prices of goods, services, or rights, calculated in Brazil and other countries during purchase and sale operations, performed under similar payment terms.

- Resale price minus profit: is determined by the total resale prices obtained, deducting unconditional discounts granted, and returns made.

- Production cost plus profit: is the weighted average cost of producing identical or similar goods, services, or duties in a given country, plus the taxes and fees charged by that country for carrying out export activities. A 20% profit margin is also charged.

- Price under import quotation: is based on the daily average values of the quotation of goods or rights subject to public prices on internationally recognized commodity and futures exchanges.

Deduction of exports and price calculation

In accordance with Brazilian regulations, revenues earned on transactions with a related person or organization are subject to arbitration when the average sale price of goods, services, or rights in exports made during the respective calculation period is less than 90% of the average price practiced in the sale of goods, services, or rights in the Brazilian market, during the same period, under similar payment conditions.

The price calculation methods involved during a deduction of exports process include:

- Selling price on exports: is the weighted arithmetic average of sales prices in exports made by the legal entity itself, or by another national exporter of goods, services, or rights during the period for calculating income tax and other similar payment conditions.

- Wholesale price in the country of destination, minus profit: is the weighted arithmetic average of the sale prices of goods identified in the wholesale market of the destination country, minus taxes included at the local price, and a profit margin of 15% on the wholesale price.

- Retail sales price in the destination country, decreased from profit: is the weighted arithmetic average of the sale prices of goods identified in the retail market of the country of destination, less taxes included in the price, and a profit margin of 30% on the retail price.

- Cost of acquisition or production plus taxes and profit: is the weighted arithmetic average of the costs of acquisition or production of exported goods, services, or rights, plus taxes and contributions charged in Brazil and a 15% profit margin over the sum of costs plus taxes and contributions.

- Price under export quotation: refers to the daily average values of the quotation of goods or rights subject to public prices on internationally recognized commodity and futures exchanges.

Due to the complexity of the Brazilian tax system, any decisions made based on the transfer price must be carefully examined to avoid future problems with Brazilian tax authorities.

FAQs on transfer pricing in Brazil

The main purpose of transfer pricing is to facilitate the proper calculation of costs for goods and services involved in any kind of transfer of assets and services between two related entities, where at least one person or entity involved in the transaction is legally resident in the country where the transfer pricing is taking place.

Some examples of overseas entities related to entities or legal persons domiciled in Brazil include:

A headquarter office domiciled abroad

A subsidiary or branch domiciled abroad

A natural or legal entity/person, resident or domiciled abroad, whose shareholding in its share capital identifies it as its parent company or an affiliate

A natural or legal person, resident or domiciled abroad, who holds exclusivity as an agent, distributor, or concessionaire, for the purchase and sale of goods, services, or rights.

Import deduction is applied to costs, expenses, and charges related to goods, services, and duties stipulated in the import or acquisition documents. The price calculation to be used as a parameter must observe one of the four types of calculation methods defined by Brazilian law, which include:

Compared independent price: is the weighted arithmetic average of the prices of goods, services, or rights, calculated in Brazil and other countries during purchase and sale operations, performed under similar payment terms.

Resale price minus profit: is determined by the total resale prices obtained, deducting unconditional discounts granted, and returns made.

Production cost plus profit: is the weighted average cost of producing identical or similar goods, services, or duties in a given country, plus the taxes and fees charged by that country for carrying out export activities. A 20% profit margin is also charged.

Price under import quotation: is based on the daily average values of the quotation of goods or rights subject to public prices on internationally recognized commodity and futures exchanges.

In accordance with Brazilian regulations, revenues earned on transactions with a related person or organization are subject to arbitration when the average sale price of goods, services, or rights in exports made during the respective calculation period is less than 90% of the average price practiced in the sale of goods, services, or rights in the Brazilian market, during the same period, under similar payment conditions.

The price calculation methods involved during a deduction of exports process include:

Selling price on exports: is the weighted arithmetic average of sales prices in exports made by the legal entity itself, or by another national exporter of goods, services, or rights during the period for calculating income tax and other similar payment conditions.

Wholesale price in the country of destination, minus profit: is the weighted arithmetic average of the sale prices of goods identified in the wholesale market of the destination country, minus taxes included at the local price, and a profit margin of 15% on the wholesale price.

Retail sales price in the destination country, decreased from profit: is the weighted arithmetic average of the sale prices of goods identified in the retail market of the country of destination, less taxes included in the price, and a profit margin of 30% on the retail price.

Cost of acquisition or production plus taxes and profit: is the weighted arithmetic average of the costs of acquisition or production of exported goods, services, or rights, plus taxes and contributions charged in Brazil and a 15% profit margin over the sum of costs plus taxes and contributions.

Price under export quotation: refers to the daily average values of the quotation of goods or rights subject to public prices on internationally recognized commodity and futures exchanges.

Take advantage of transfer pricing in Brazil with the help of Biz Latin Hub

At Biz Latin Hub, our multilingual team of accounting and tax experts can help you navigate transfer pricing in Brazil and provide you with additional tailored legal and recruitment services to facilitate your operations in the South American country.

With our comprehensive portfolio of market entry and back-office services, we are your single point of contact to maximize the chances of success when doing business in Brazil.

Reach out to our team for personalized assistance.

Learn more about our team and expert authors.