Business opportunities between Canada and Mexico are often overshadowed by trade with the United States. Despite this, according to the World Integrated Trade Solution, Mexico is Canada’s fifth-largest trading partner. Mexico also has the eleventh-largest economy in the world with a population of almost 300 million.

Business between Canada and Mexico has strengthened since creating the North American Free Trade Agreement (NAFTA) in 1994. NAFTA is a free trade region between Canada, Mexico and the United States.

We outline top sectors and opportunities for business between Canada and Mexico.

Trade and business between Canada and Mexico

There are two major trade agreements that have created stronger economic ties between Canada and Mexico. The Canada-United States-Mexico Agreement (CUSMA, also known as T-MEC or USMCA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) provide Canada and Mexico with preferential access to each other’s markets.

The best sectors for business between Canada and Mexico have the highest growth potential, policy openness and leverage Canadian strengths. Top sectors include:

- Aerospace

- Mining

- Oil & gas

- Agriculture, food and beverages

Aerospace

In this sector, business between Canada and Mexico initiated in 2004 with the establishment of the Canadian aerospace company, Bombardier, in Mexico. This later sparked international interest towards the potential in the aerospace sector in Mexico. Since then, the Mexican Government has included aerospace as a priority sector for the country’s economic development.

In 2018, 93% of Canadian aerospace manufacturing firms were exporters and Mexico was one its top exporting markets.

The Mexican Government has launched various programs to develop this sector, thus facilitating aerospace business between Canada and Mexico. The “three helixes” initiative aims to unite the private sector, government, and academia for collaboration. This collaboration comes in the form of new employment opportunities, business incentives, workforce training programs and new universities.

Additionally, the Aerospace Industry National Strategic Program 2012-2020, also called Pro-Aereo, aims to position Mexico in the top 10 global aerospace suppliers by 2020. To achieve this, Pro-Aero includes policies for market development, domestic and international promotion, technological and human resource development, and vertical integration.

Key strengths in Canada’s aerospace sector include flight simulation, pilot and air-traffic-control training, air frames and avionics, commercial and business aircraft. These strengths perfectly match the new direction of Mexican aerospace manufacturing. For future business opportunities in Mexico, Canadians should engage in the following Mexican sub-sectors: supplying manufacturing and assembly plants, the entire aviation ecosystem, and the defense sector.

As an international leader in the aerospace sector, Canadian companies are in a good position to apply their expertise in Mexico.

Mining

Business between Canada and Mexico in the mining sector remains strong. More than 50% of mining projects listed on the Mexican Government’s website are run by Canadian companies. In addition, Canadian global mining footprint is the second greatest in Mexico, after the USA and tied with Chile.

According to Bradford Cooke, CEO of Endeavor, Mexico’s mining taxes, environmental laws and social laws have reached similar levels as those in Canada, the USA, Peru or Chile. Mexico’s key advantage is its abundant resource potential and is the best location to find silver.

In 2019, the Canadian Government launched the Canadian Minerals and Metals Plan aiming to increase the sector’s competitiveness and position it as a global leader. This further supports efforts for mining business between Canada and Mexico.

The best mining business opportunities exist for those companies that are able to work with other local partners through technology transfer, complementary product offerings or through offering niche high tech products/services that are not already provided within the local market.

Canada is a global leader in the mining sector and the Canadian Government’s goal is to build a more stable and predictable global mining environment by 2025. As such, the mining sector is promising for business between Canada and Mexico.

Oil & gas

Canada is the fourth-largest producer and exporter of oil in the world.

Canadian propane exports to Mexico increased from zero in 2014 to 583 million litres in 2017, a span of only 3 years. Between 2016 and 2017, the value of propane exports to Mexico increased almost eight times.

For oil and gas companies looking to do business between Canada and Mexico, it is recommended they consider the natural gas sector. The importance of the natural gas sector in Mexico is increasing and this need should be addressed.

To address this need, the Mexican Government has initiated a natural gas transportation and storage system plan. This plan involves the construction of new pipelines to ultimately reach 5,150 additional kilometres.

Mexico’s demand for oil and natural gas exceeds their domestic production. As such, in 2019, Mexico imported 890,000 barrels of crude oil per day. In contrast Canada produces more oil than it consumes. Exports of Canadian crude oil have been increasing, reaching 3.7 million barrels per day in 2018.

Given Mexico’s demand and planned infrastructure, as well as Canadian production capabilities, the oil and gas sector is promising for business between Canada and Mexico.

Agriculture, food and beverages

Fortunately, the food import market in Mexico is large and easily accessible. In 2018, 5% of Canada’s globally traded processed agri-food and beverages (including seafood) were shipped to Mexico. The fact that most Canadian food products can enter Mexico duty-free, eases business between Canada and Mexico.

Top Canadian imports into Mexico include fresh hams, shoulders and cuts, fresh boneless beef, canola oil, malt and frozen French fries, totaling a value of CA$522.4 million.

Due to rising concerns of obesity and diabetes, both Mexicans and the Mexican Government are becoming more health conscious. Demand in Mexico is increasing for health and wellness products, such as food and beverages for weight/disease management and products with wellbeing credentials. Mexicans are now looking for more products described as natural, fresh, low in fat, low in sugar or organic.

Canadian agri-food and beverage companies can take this health and wellness trend as an opportunity for business.

We support companies doing business between Canada and Mexico

Canadian companies can take advantage of the business opportunities in Mexico. Before doing business between Canada and Mexico, make sure to engage with local experts to ensure you comply with all Mexican regulations.

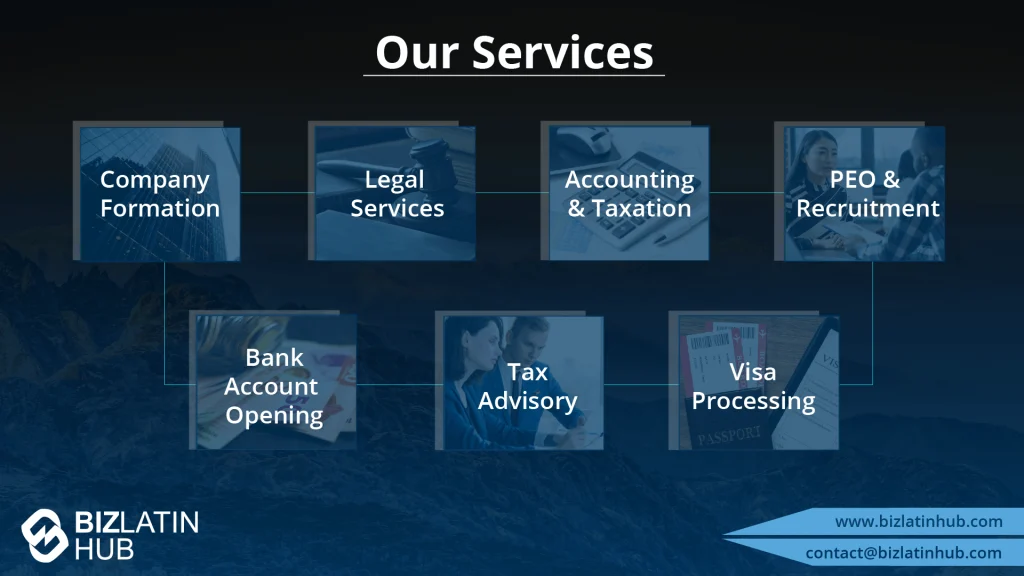

At Biz Latin Hub, we can provide you with our professional market entry and back office services. Biz Latin Hub is a market leader for supporting businesses from over the world start their business in Mexico and Latin America.

Our team of qualified, multilingual professionals in Latin America provides a suite of customizable market entry and back office services to support your expansion.

Contact us here at Biz Latin Hub for more information and become part of the Mexican business scene.

Learn more about our team and expert authors.