To register a company in Panama you will need to follow six key steps. Following this appraoch ensures you meet Panama’s clear corporate laws accessing supportive government policies providing a solid foundation for your business to thrive. To open a company in Panama its advisable to work with a local partner that can keep you on track. Biz Latin Hub offers tailored support and expert back-office services to guide you through the incorporation process, ensuring compliance and positioning your business for success.

Key Takeaways On How To Register a Company in Panama

| Is There foreign-ownership availability in Panama? | Yes, 100% ownership is available. |

| Steps to Register a Company in Panama: | Step 1 – Organize the name and structure of your company. Step 2 – Company Incorporation: Draft and sign bylaws. Step 3 – Register your company in Panama. Step 4 – Obtain a Tax Identification Number (RUC). Step 5 – Open a Corporate Bank Account. Step 6 – Obtain Municipal Commercial License. |

| What Are The Common Entity Types? | Corporation (Sociedad Anónima – S.A.). Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.). Private Interest Foundation (Fundación de Interés Privado). |

| Why Set-up a Business in Panama? | Strategically positioned, the country continues to attract a constant flow of investers looking to open a company in Panama. |

6 Steps to Register Your Company in Panama

Please see below the 6 steps for incorporating a Sociedad Anónima (S.A.) in Panama:

- Step 1 – Organize the name and structure of your company.

- Step 2 – Company Incorporation: Draft and sign bylaws.

- Step 3 – Register your company in Panama.

- Step 4 – Obtain a Tax Identification Number (RUC).

- Step 5 – Open a Corporate Bank Account.

- Step 6 – Obtain Municipal Commercial License.

Step 1: Organize the name and structure of your company

As with most countries in Latin America, the first step to registering a business is to choose the name and legal structure of your company. The main types of company are:

- A Corporation/Joint Stock Company (Sociedad Anónima – S.A) – this is by far the most common type of company to form in Panama, which means that shareholders are only responsible for their contributions and assets.

- A Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L) – This will help provide insulation to you as an investor and will mean you are not personally liable for the debts or funds of your company.

PRO TIP: It is very important you think about this decision carefully as it can limit the type of business you can legally engage in, and once you sign your documents, amending the structure can be a very long and complicated process.

Step 2: Company Incorporation: Draft and sign bylaws

The bylaws of a company can be simply described as the ‘constitution’ of a company. These documents will contain all the crucial information about the structure and ethos of the company, including:

- Information regarding the frequency and nature of shareholder/board meetings.

- Documentation of all the details of the company (name, registered address, share capital, location, company type, Board of Directors, etc.).

- Procedure for record-keeping.

- Company’s objeto social which identifies the company’s business activities.

The bylaws will undergo notarization by a notary public in Panama, formalizing them as a public deed. This procedural step typically spans a duration of 5 to 10 business days.

Step 3: Register your company in Panama

The next process is to formally register your company in Panama. This step will ensure that the company is officially recognized in the country and that it is properly registered with the relevant tax authorities.

Remeber: Your physical presence in Panama is not required for the completion of the corporation formation process, instead this can be done through a power of attorney. So we can manage all necessary procedures efficiently without you needing to come to Panama.

Step 4: Obtain a Tax Identification Number (RUC)

Once a company is Registered, the next step is to apply for a tax identification number (Registro Único de Contribuyentes – RUC) with the Directorate General of Revenue (DGI).

Step 5: Open a Corporate Bank Account

The next step is to open a Panamanian Bank Account for your company. Here’s a general guide for opening a bank account for a Sociedad Anónima (SA):

- Match your business needs with a suitable Panama bank

- Complete all required banking documentation

Step 6: Obtain Municipal Commercial License

Acquire a commercial license from the municipal government where the company is located, which will enable you to legally commence operations.

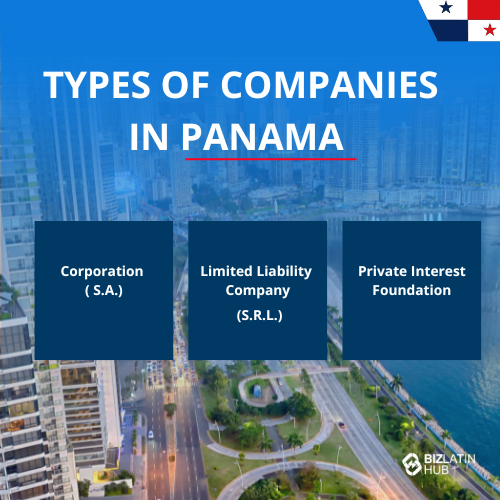

Choose Your Entity: 3 Types of Companies in Panama

Considerations such as the nature of the business, the number of owners, liability, and tax implications should be taken into account when choosing the structure to use to register a company in Panama.

There are several different types of legal structures in Panama to choose from, but the three most commonly utilized options are:

- Corporation (Sociedad Anónima – S.A.).

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.).

- Private Interest Foundation (Fundación de Interés Privado).

1. Corporation (Sociedad Anónima – S.A.)

A corporate structure that provides limited liability to shareholders and is commonly employed for various business activities. It is crucial to note some key characteristics associated with the formation of this entity. Most notably, shareholders bear responsibility solely for their assets and contributions. Panama’s legislation does not specify a minimum social capital requirement for the company, although a recommended minimum of USD$10,000 is advised.

Recommendation: In most cases, we would recommend clients to establish a Sociedad Anonima for their business needs because:

- S.A.s in Panama offer operational flexibility, tax benefits for international operations, and an agile structure for management.

- They are known for privacy and structural flexibility, resembling a public limited company.

- They also offer limited liability for shareholders, protecting them from significant losses that may result from business failures, legal claims, or unforeseen events.

2. Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.)

A company structure that offers limited liability to its members and is well-suited for small or micro-sized businesses.

3. Private Interest Foundation (Fundacion de Interes Privado)

A unique legal entity that operates similarly to a trust, providing a flexible framework for asset management, estate planning, and charitable purposes. To learn more about this type of structure please get in touch with the Biz Latin Hub team.

What are The Minimum Requirements to Incorporate an SA in Panama?

The minimum requirements to incorporate an SA in Panama are:

- A name for your legal entity

- (1) shareholder, which can be of any nationality and reside outside of Panama and can be either a natural or legal person (i.e. an individual or a legal entity).

- Appoint at least (3) Directors for your company

- Appoint a resident agent within the bylaws of the company

- Describe the main company activities

- A minimum initial capital, although no minimum capital amount is required by law, we would strongly recommend a minimum share capital of USD$1,000 however it should be commensurate with your planned business activities.

- Register a Fiscal Address which must be within the country and is used for official correspondence

Important Tip: The founding shareholder(s) do not need to physically travel to the country as the establishment can be completed by our local Panamanian team.

Common FAQs when forming a company in Panama

In our experience, these are the common questions and doubtful points of our clients.

1. Can a foreigner own a business in Panama?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. What is the Panama Company Tax ID?

The Panama Company Tax ID is known as RUC (Registro Único de Contribuyentes), which translates in English to Single Taxpayer Registry, a unique identification number for tax purposes in Panama.

3. How long does it take to register a company in Panama?

It takes 8 weeks to register an operating company in Panama.

4. What does an S.A. company name mean in Panama?

The S.A. in a company name in Panamá refers to a Sociedad Anónima, which is similar to a joint stock company. This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure holds substantial prominence in Panamá due to its exceptional adaptability and flexibility, rendering it the favored option for a diverse range of business ventures.

5. What does an SRL company name mean in Panama?

SRL in Panamá stands for Sociedad de Responsabilidad Limitada, which is similar to a Limited Liability Company in English. This legal entity operates independently from its shareholders, offering them limited liability. SRL companies are prevalent due to their simplified requirements, making them a popular choice for business structures.

6. What entity types offer Limited Liability in Panama?

In Panamá, both S.A (Sociedad Anónima) and S.R.L (Sociedad de Responsabilidad Limitada) are limited liability entity types.

Main Differences Between SA and LLC in Panama

| Aspect | LLC (Limited Liability Company) | S.A. (Sociedad Anónima) |

|---|---|---|

| Shareholders | Requires at least two shareholders. | Can be incorporated with one shareholder. |

| Registration | Shareholders must be registered within the Public Registry. | Shareholder’s registration is not required within the Public Registry. |

| Incorporation Structure | Requires one administrator, two shareholders, and the appointment of an agent resident. No board of directors is necessary. | Requires the establishment of three directors (President, Secretary, and Treasurer) and the appointment of an agent resident. |

| Responsibility of Shareholders | Shareholders are jointly and severally liable for the debts of the company up to the amount of their contributions. | Shareholders are jointly and severally liable for the debts of the company up to the amount of their contributions. |

| Regulation | Regulated by Law 4 of January 9, 2009. | Regulated by the law of anonymous societies (Law N° 32 of 1927). |

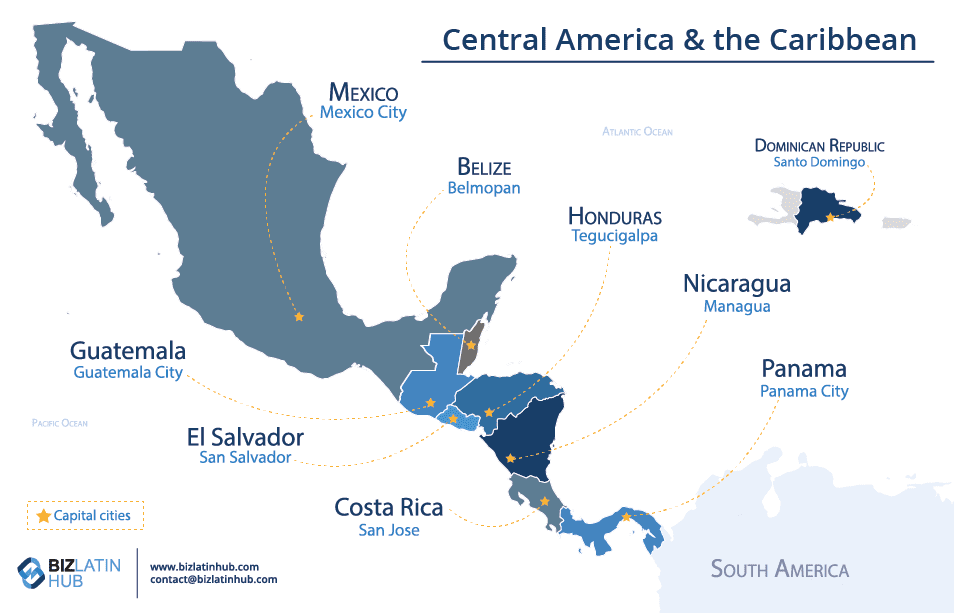

Why Choose to Incorporate a Company in Panama?

Although it is most famous for the canal, Panama has a lot more going on. The banking system is world famous, and there is a growing tourism and services sector that offers interesting opportunities to foreign investors. If you register a company in Panama, you will be in good company — with over 500,000 others, it is the second most popular place in the world to do so.

As a hub for global trade, the country is well used to international enterprises and extremely business-friendly. When you register a company in Panama, you will gain access to a well-established infrastructure, favorable tax regulations and a strategic geographic location that facilitates global business operations.

In terms of key industries, the strategic importance of the Panama Canal, an influential spot for maritime trade, has made Panama a leader in exports to the northern tip of South America whilst also providing crucial access to the Pacific and Atlantic Oceans.

Major exports include chemical products such as oxygen compounds and sulfonamides (accounting for over 18% of exports), passenger and cargo ships (9.8%), and packaged medication (8.2%). Other exciting business prospects include a growing tourism industry in a country that boasts natural beauty in abundance and retail, with the largest commercial center in Latin America, Albrook Mall.

According to research from the Banker, 41 of the top 100 Central American banks are in Panama. The country boasts some of the best banks in the region in terms of attractiveness of investment and security for assets. Banco General, Bladex, and Bancolombia Panama are all in the top 5.

Biz Latin Hub can support you in registering a company in Panama

With Panama being such an exciting business opportunity and only seeming to be growing in terms of economic stability and buoyancy, now is the perfect time to start a venture in the country and incorporate your company. Biz Latin Hub has an office in Panama and in 17 other locations across the region.

If you have any questions about the entity incorporation process or the steps involved with the business registration, please do not hesitate to contact us here at Biz Latin Hub.