Inevitable though they might be, taxes do not have to be scary. For international investors considering company formation in Mexico, it makes sense to consult taxation professionals to make sure you are within the law of the land. That’s where you need to look at tax advisory services in Mexico.

As the country’s economy grows, it is naturally attracting more and more international interest. Along with that comes increasing professionalism and more necessity for tax advisory services in Mexico. While the country is broadly in line with global norms, there are some local specifics that you should understand.

At Biz Latin Hub, we know all about tax advisory services in Mexico, thanks to our dedicated local office in the country. Not only that, but our market leading array of back-office services can give you ongoing support in all fields. With our team in your corner, you can relax in the knowledge you’re fully compliant and focus on what you do best – growing your business.

What are the main 4 tax advisory services to be considered in Mexico?

Generally speaking, the four most important services that international investors are looking for in Mexico are the following:

- Tax Planning

- International Taxation

- Corporate Taxation

- Tax Controversy and Dispute Resolution

Tax Planning

This involves looking for and then taking advantage of, schemes and incentives for certain industries and/or regions. In Mexico, these are generally found in Export Processing Zones or Special Economic Zones. These are mainly found in the northern border with the United States, but there are others across the country.

Many specialize in certain industries, with Queretaro focusing on aerospace tech and the Baijo region in the centre hosting the local car manufacturing sector. These various areas differ greatly in terms of their specific benefits, so you will need to consult tax advisory services in Mexico in order to make sure you are in the right place.

- Dividends received from a resident company do not have to pay withholding tax.

- Due to Mexico’s lack of exchange controls, businesses can freely send funds back to their country.

- Companies registered in Export Processing Zones are exempt from corporate income tax.

International Taxation

This involves looking at how a legal entity in Mexico will interact with businesses in other countries, or to investors and shareholders abroad. Here we are mainly talking about withholding taxes and double taxation agreements.

Mexico has signed double tax treaties (avoids or mitigates double taxation) with 61 countries, including the U.S., Canada, and many European countries.

According to the US-Mexico income tax convention, foreign taxpayers can be taxed up to 10% for dividends from the other country, which lowers to 5% if the taxpayer owns more than 10% of the voting shares of the distributing company.

Noting this, article 164 of the Income Tax Act states a 10% tax on dividends for foreign shareholders, which must be adapted to 5% if the condition stated above is complied with.

Corporate Taxation in Mexico

Company structure may significantly affect tax liabilities and responsibilities. That’s why it’s necessary to consider the correct set-up for your organization, depending on what exactly you want to do in the country, how large your company is and if you will be working internationally.

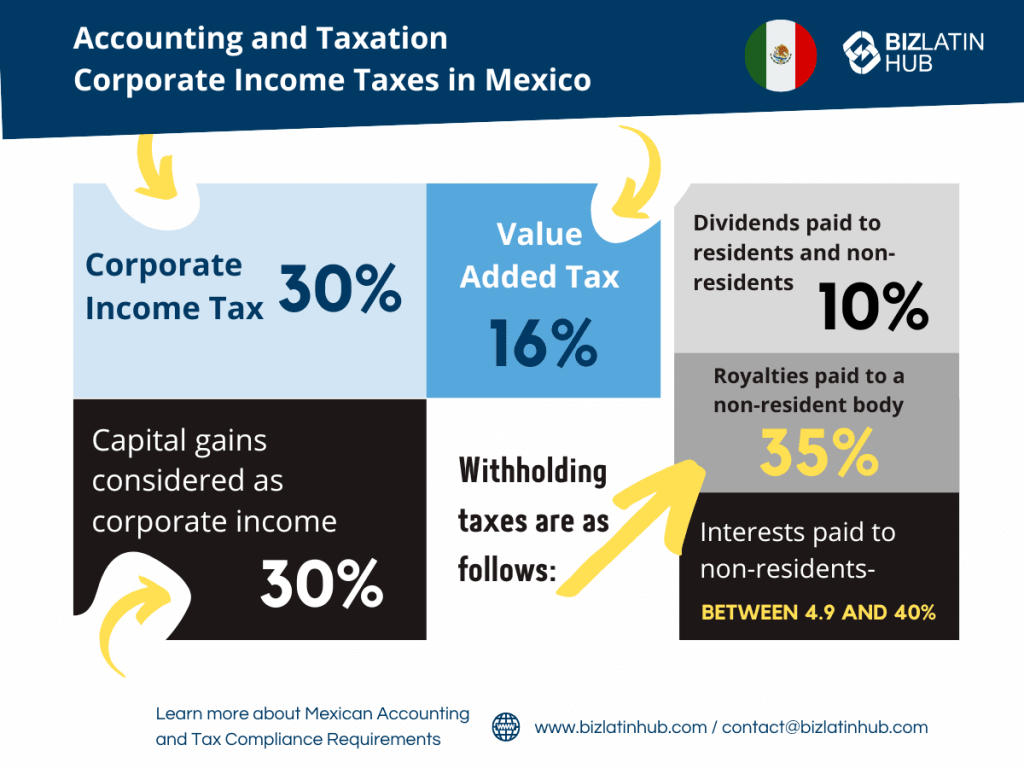

Corporations are subject to different tax rates than other business models, families, or individuals. They are listed by percentage here:

- Corporate Income Tax- 30%

- Capital gains considered as corporate income- 30%

- Value Added Tax- 16%

Withholding taxes are as follows:

- Dividends paid to residents and non-residents- 10%

- 5% royalties from railway rentals

- 25% royalties for technical assistance

- 30% royalties for patent rental

- Interests paid to non-residents- between 4.9 and 40%

Tax Controversy and Dispute Resolution

While most of this is relatively straightforward and unlikely to present issues, from time to time disputes and errors can occur. That’s where you will really need good tax advisory services in Mexico. First off, you need to know who the relevant authority is, which is the Tax Administration. Related to this are audits, which can help identify problems before they occur.

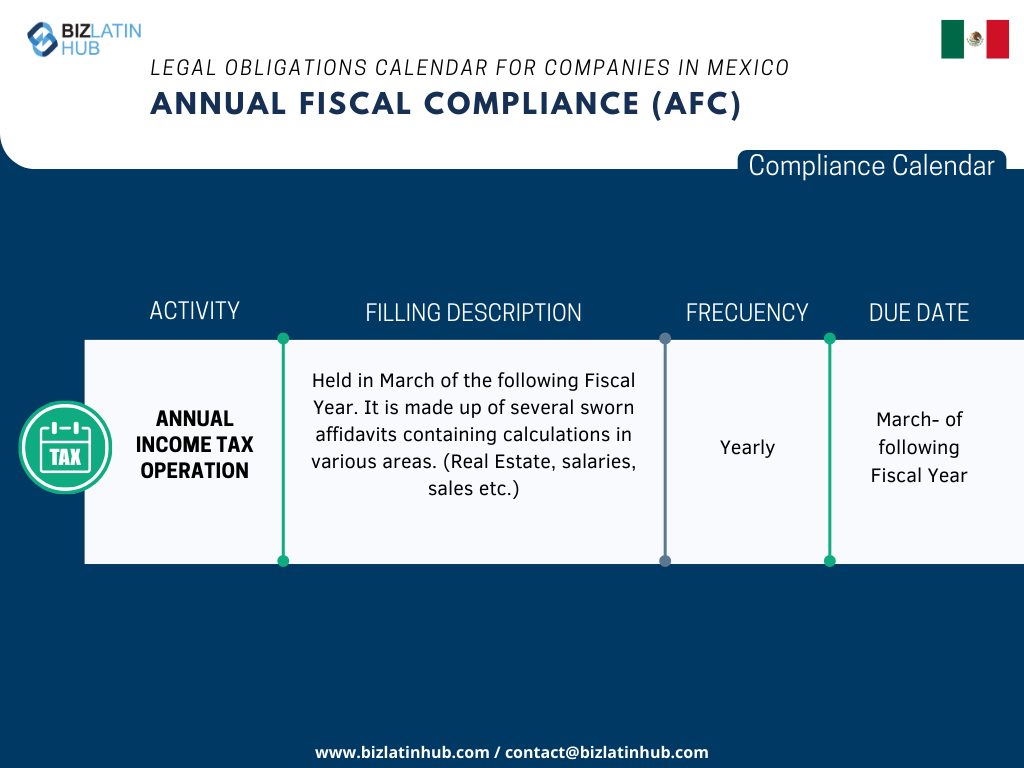

The Tax Administration is similar to the IRS in the USA and has its regulations and timelines. It is required for all companies to file annual tax returns in Mexico with the Tax Administration within 3 months of the end of the upcoming fiscal year. Later than the 17th of each month, the Value Added Tax must be filed. Digital invoices are required for every transaction that a trading company in Mexico makes.

An auditor in Mexico is a legal necessity for companies that are considered to have a significant presence in the country. This is defined locally as MXN$80 million of assets, MXN$100 million in annual revenue or more than 300 employees. It is also important to note that accounting records must be kept in Spanish.

FAQs on tax advisory services in Mexico

A tax advisory service is a specialized offering where tax professionals guide clients in tax planning and compliance. They ensure accurate tax filing, optimal utilization of tax deductions and credits, and legal tax savings.

International tax law comprises regulations that govern taxation for individuals and businesses with international operations. These laws cover various taxes, including income, corporate, capital gains, estate, and gift taxes. Countries establish their tax rates and rules, which can differ significantly based on the type of business activity.

A tax advisor can help you understand tax laws, save money, and avoid potential legal issues related to taxation.

Yes, there are a few, especially for companies based in the USA:

Dividends received from a resident company do not have to pay withholding tax.

Due to Mexico’s lack of exchange controls, businesses can freely send funds back to their country.

Companies registered in Export Processing Zones are exempt from corporate income tax.

The Tax Administration is similar to the IRS in the USA.

Biz Latin Hub can provide tax advisory services in Mexico

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with 18 offices in major cities across the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of tax advisory services in Mexico, our portfolio of services includes hiring & PEO, ongoing accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean. Or read about our team and expert authors.