Inevitable though they might be, taxes do not have to be scary. For international investors considering company formation in Peru, it makes sense to consult taxation professionals to make sure you are within the law of the land. That’s where you need to look at tax advisory services in Peru.

As the country’s economy grows, it is naturally attracting more and more international interest. Along with that comes increasing professionalism and more necessity for tax advisory services in Peru. While the country is broadly in line with global norms, there are some local specifics that you should understand.

At Biz Latin Hub, we know all about tax advisory services in Peru, thanks to our dedicated local office in the country. Not only that, but our market leading array of back-office services can give you ongoing support in all fields. With our team in your corner, you can relax in the knowledge you’re fully compliant and focus on what you do best – growing your business.

What are the main 4 tax advisory services to be considered in Peru?

Generally speaking, the four most important services that international investors are looking for in Peru are the following:

- Tax Planning

- International Taxation

- Corporate Taxation

- Tax Controversy and Dispute Resolution

Tax Planning

This involves looking for and then taking advantage of, schemes and incentives for certain industries and/or regions. In Peru, these are generally found in the five Special Economic Zones (SEZs) around the country. These differ depending on which industry they are serving and where they are, so you will need to investigate which one is correct for you.

However, they share many things in common – tax incentives (usually an exemption or reduction on corporate tax), fully supported infrastructure and in some cases lower or no export duties. These often come with certain conditions, but these are rarely restrictive.

The five different SEZs are Tacna, Ilo, Paita, Chimbote, and Amazonas, each of which is specialized according to the existing local economy. Paita and Ilo, for example, focus on shipping transit, while Tacna is built to trade with Peru’s southern neighbor Chile.

International Taxation

This involves looking at how a legal entity in Peru will interact with businesses in other countries, or to investors and shareholders abroad. Here we are mainly talking about withholding taxes and double taxation agreements.

Before we start looking at Peru’s bilateral trade agreements, you may be wondering where Mercosur stands amongst all this. While Peru is only an associate member of MERCOSUR, this initiative bore fruits for the country because since 2012 Peru does not pay any tax when it trades with Argentina and Brazil. There are also Free Trade Agreements with Chile, Mexico and the US.

The European Union is a crucial market Peru needs to have access to and so it does, with lower tariffs on a range of products. Peru and China have been sharing close economic ties since the beginning of the century. In 2010, the free trade agreement was enacted, granting Peru access to a market of more than 1.35 billion consumers. There are also agreements with South Korea, Australia and Thailand.

As a member of the Andean Community, there is a double taxation exemption agreement on all other members of the bloc, plus a further 8 full double taxation agreements with countries around the world. Peru only taxes residents on earnings within country.

Corporate Taxation in Peru

Company structure may significantly affect tax liabilities and responsibilities. That’s why it’s necessary to consider the correct set-up for your organization, depending on what exactly you want to do in the country, how large your company is and if you will be working internationally.

From a tax perspective, all companies registered in Peru are considered residents of Peru and have to pay taxes to the national tax authority, SUNAT.

They are subject to a corporation tax rate of 29.5% (2017-2023) and to meet their annual corporation tax liability, entities must make monthly advanced payments on account calculated as 1.5% of their monthly revenue. At the end of the year, the company simply deducts these advance payments on account of their total corporation tax liability to determine the balance payable.

Companies listed on the local stock exchange (SMV – Superintendencia de Mercado de Valores) must apply full IFRS whilst all other companies must follow the General Business Accounting Plan based on IFRS but less rigorous in its discloser requirements.

Peru uses the so-called “tax unit” (UIT), the amount is determined each year by the Peruvian Ministry of Economy and Finance. The applicable tax unit for 2023 is equal to PEN 4,950.

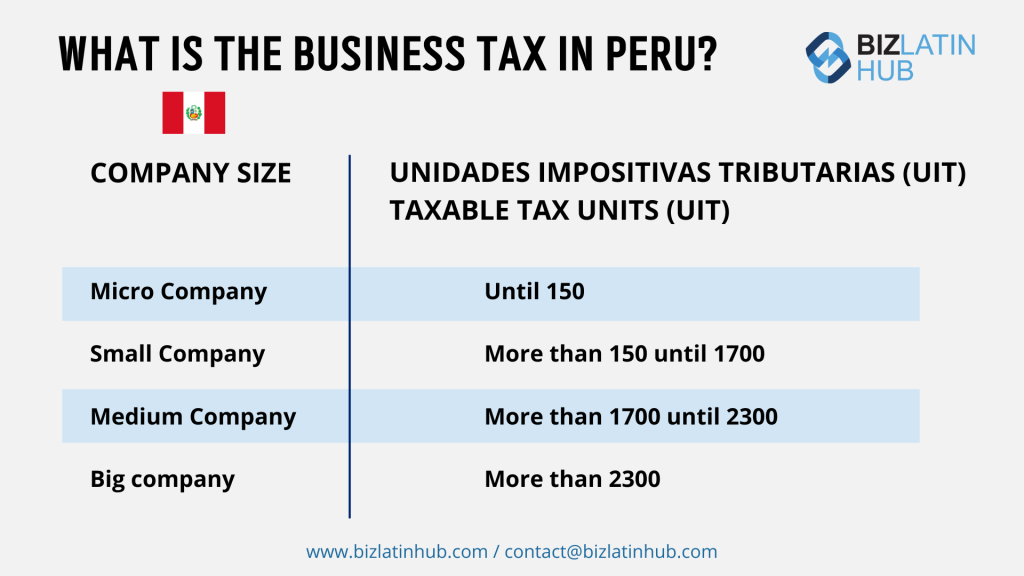

In Peru, the type of company and level of sales revenue has to be taken into account to determine the exact tax statutes of the company. Smaller companies pay a lower tax rate than larger companies. The government classifies companies based on their annual sales revenues in UIT (Tax Unit) per annum.

Taxation for companies in Peru could include:

- Corporate Tax.

- Value Added tax rate.

- Temporal Net Asset Tax.

- Financial Transaction Tax (FTT TAX).

The following table illustrates the different classifications:

Tax Controversy and Dispute Resolution

While most of this is relatively straightforward and unlikely to present issues, from time to time disputes and errors can occur. That’s where you will really need good tax advisory services in Peru. First off, you need to know who the relevant authority is, which is known as SUNAT. Related to this are audits, which can help identify problems before they occur.

When doing business in Peru, all companies have to declare their income and expenses on a monthly and yearly basis. The tax year for a company is its accounting year, which ends on December 31st. Therefore, companies have to make 12 monthly advanced payments of income tax based on their monthly taxable income.

Additionally, an annual tax return must be filed and the final tax has to be paid within the first three months, which follow the end of the tax year using the PDT program (Programa de Declaración Telemática). If taxes are not paid on time or at all, the company has to pay penalties to the national tax authority, SUNAT.

An auditor in Peru is a legal necessity for companies that are considered to have a significant presence in the country. This is defined locally as companies with more than 3,000 UIT (the local tax reference unit, around USD$1,380) in annual revenue. That’s over 4 million US dollars per year, so a relatively high bar. It is also important to note that accounting records must be kept in Spanish.

FAQs on tax advisory services in Peru

A tax advisory service is a specialized offering where tax professionals guide clients in tax planning and compliance. They ensure accurate tax filing, optimal utilization of tax deductions and credits, and legal tax savings.

International tax law comprises regulations that govern taxation for individuals and businesses with international operations. These laws cover various taxes, including income, corporate, capital gains, estate, and gift taxes. Countries establish their tax rates and rules, which can differ significantly based on the type of business activity.

A tax advisor can help you understand tax laws, save money, and avoid potential legal issues related to taxation.

In Peru, these are generally found in the five Special Economic Zones (SEZs) around the country. These differ depending on which industry they are serving and where they are, so you will need to investigate which one is correct for you.

However, they share many things in common – tax incentives (usually an exemption or reduction on corporate tax), fully supported infrastructure and in some cases lower or no export duties. These often come with certain conditions, but these are rarely restrictive.

The five different SEZs are Tacna, Ilo, Paita, Chimbote, and Amazonas, each of which is specialized according to the existing local economy. Paita and Ilo, for example, focus on shipping transit, while Tacna is built to trade with Peru’s southern neighbor Chile.

It is called the Superintendencia Nacional de Aduanas y de Administración Tributaria or SUNAT and is responsible for the administration of the taxes of the Peruvian National Government.

Biz Latin Hub can provide tax advisory services in Peru

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with 18 offices in major cities across the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of tax advisory services in Peru, our portfolio of services includes hiring & PEO, ongoing accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean. Or read about our team and expert authors.