Tax and accounting in Latin America are necessary to keep in mind if you’re considering investing in this dynamic region. With abundant natural resources, a skilled workforce, and a strategic geographic location, business owners are keen to invest and start a company in Latin America.

After forming a company, it is essential to stay up-to-date with all accounting and tax obligations to ensure compliance with local authorities. Our helpful guide will enhance your knowledge about tax and accounting in Latin America. However, it’s always best to check the specifics, as rules change when economies develop, especially in this growing region.

Biz Latin Hub can help you understand the rules on tax and accounting in Latin America that apply to your individual company. Not only that, but we can do the same across the region, thanks to our network of dedicated local offices spanning Latin America and the Caribbean.

Who collects tax?

In Latin America, taxes are usually collected at different levels, local and national. Larger countries such as Argentina, Brazil or Mexico can have extensive regional or local taxes with very devolved powers. Typical national taxes include:

- Income taxes.

- Minimum presumed income tax.

- Value-added tax (IVA).

- Import and export taxes.

- Tax on financial transactions.

- Net-worth tax.

- Withholding taxes on foreign dividends.

Local taxes vary widely and you will need to check with the country and/or region that you are considering investing in to see how these are applied. It is worth considering the various Free Trade Zones that exist in some countries, as these often have significant incentives, especially for foreign investment.

How high is taxation in Latin America?

Let’s start with the corporate tax rate, which ranges throughout the region but is usually around 20-30%. There may well be specific tax incentives for smaller businesses or certain sectors. Some countries have progressive rates depending on the level of income in the country.

Sales tax or VAT is usually known locally as IVA and varies from 10-20% with most countries having exemption schemes for essential products. There are also different levels for medium-essential goods and services in some countries. VAT usually applies to goods and services, although in some juristictions these are considered separately and there are parallel rates.

What tax agreements are there in Latin America?

Most countries in Latin America have signed agreements to avoid double taxation with most countries. These agreements were established to prevent double taxation between residents in different jurisdictions, with the primary aim of reducing the tax burden on residents under these agreements. These agreements vary by country, so make sure to double check.

In most countries you will be taxed on worldwide income in the place you are considered resident, although again this depends on a number of factors such as country and sector.

FAQs on tax and accounting in Latin America

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand tax and accounting in Latin America.

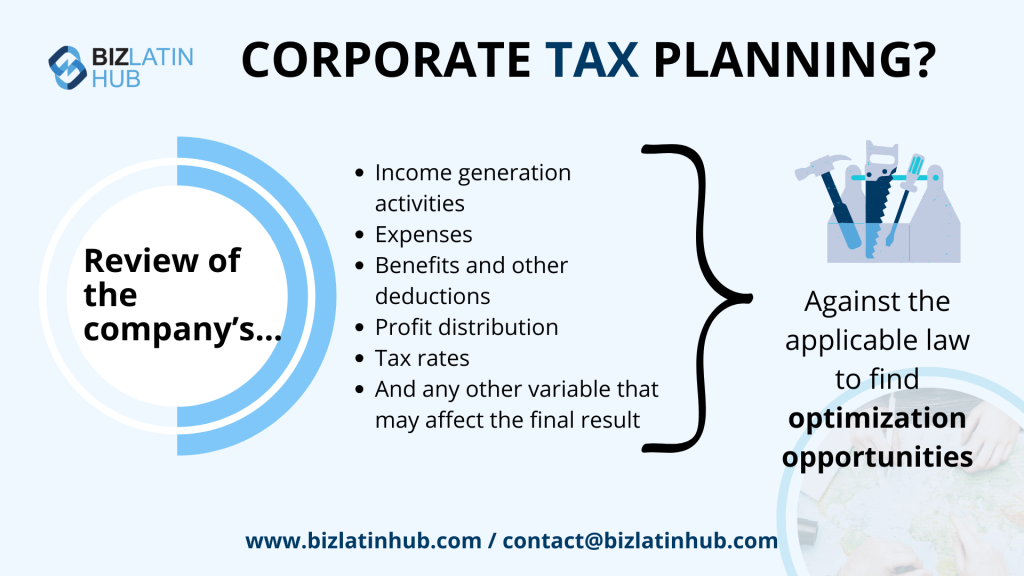

Corporate taxes vary according to the country, size of business and level of income in some places but is usually around 20-30%. There may well be specific tax incentives for smaller businesses or certain sectors. Some countries have progressive rates depending on the level of income in the country.

In Latin America, companies must pay VAT (sales tax) on products, some tariffs and import/export taxes depending on the region and local rules. The corporate income taxes they must pay could be at the local, provincial, and national levels.

Each country has its own dedicated tax office, usually run by the local finance ministry or equivalent. These bodies vary in terms of the powers they hold, but penalties in many countries are severe.

This depends according to the country, but many in the region follow IFRS rules either in part or full. It’s common to have stricter and more internationalized regulations for larger and/or publicly traded companies and local rules for smaller businesses.

Latin American countries typically require companies to prepare annual financial statements. These include a balance sheet and statements regarding changes in equity, comprehensive income, retained earnings, shareholders’ equity, cash flows, and cash position. Additionally, notes relating to the financial statements and a schedule containing details of investments are often required. Navigating these financial reporting requirements can be complex and potentially problematic if not handled correctly.

Most countries have a local chartered accountant’s body, but this varies dramatically by country. In most of the larger and/or richer countries, this will require certain qualifications and exams as well as periodical recertification. In other places, it may simply require paying a fee and registering yourself.

The IASB’s International Financial Reporting Standards (IFRS) are adopted in the region, but not in every case. These standards have different levels of application:

Biz Latin Hub can assist you with tax and accounting in Latin America

Biz Latin Hub provides tailored market entry support and integrated back-office service packages to meet the unique needs of our clients.

Our portfolio includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, and we are active in markets all around Latin America and the Caribbean,

That makes us the ideal partner for supporting cross-border operations and facilitating multi-jurisdiction market entry.

We are committed to compliance with regulations everywhere we operate, so working with us comes with the guarantee that your company will adhere to every aspect of employment law in Latin America or any other country where we assist you.

Contact us today to find out more about how we can support you in doing business in Latin America.

Or learn more about our team and expert authors.