If you want to start doing business in Argentina, the first thing you will need to do is to decide which type of entity best suits your needs. If you have an established brand elsewhere and would be keen to avoid going through full company formation, an attractive option is to register a branch in Argentina.

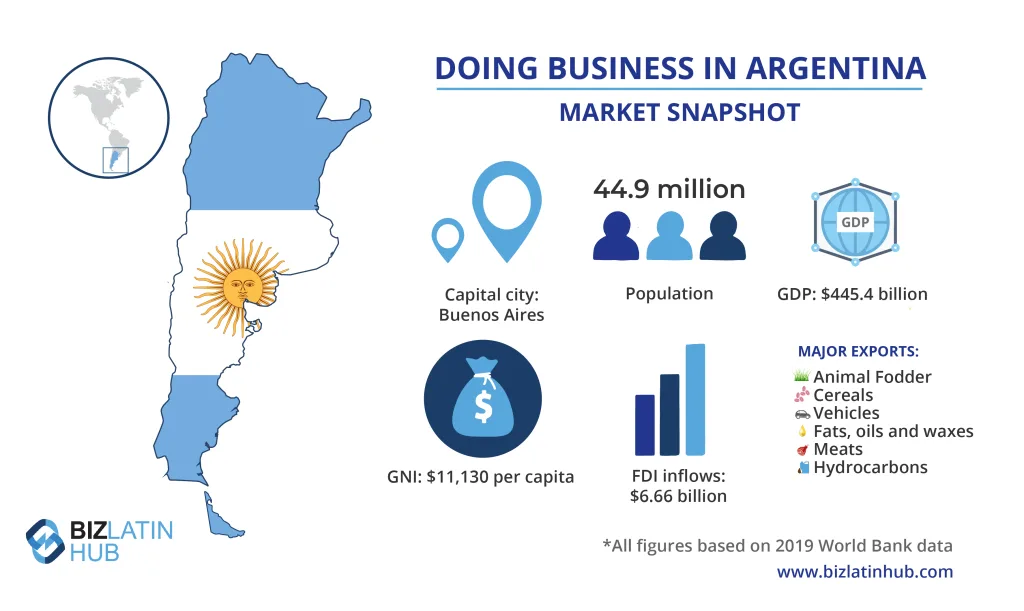

Argentina registered a gross domestic product (GDP) of $449,7 billion in 2019 (all figures in USD unless otherwise stated) and is the third-largest economy in Latin America, behind Brazil and Mexico. Argentina is also one of the main recipients of foreign direct investment (FDI) in the region, registering FDI inflows of $6.66 billion that same year.

Argentina is a co-founder of the Southern Common Market (Mercosur), a regional integration process, that has recently celebrated its 30th anniversary. Argentina founded this association with Brazil, Paraguay and Uruguay.

Argentina is an attractive market for foreign investors as it has the highest English proficiency and literacy rate among non-English speaking countries in Latin America and the Caribbean.

The top exports of Argentina are soybean, corn, delivery trucks, exporting mostly to Brazil, China, and Chile.

If you are considering doing business in the country, read on to learn about the advantages on offer if you register a branch in Argentina, as well as the steps involved in doing so. Or go ahead and reach out to us now to discuss your market entry options.

Argentina – What is a branch office in a foreing country

A branch office is very simple to define but may be more difficult to understand. It is simply any affiliated location to a company or business entity, that is not the head office, meaning that it is the head office that carries all legal responsibility. Despite being exempt from legal responsibility, a branch must have its own capital, its own legal representative and its own legal address and list of shareholders.

The cost of setting up a branch of a company in Argentina is between USD$400-500 and must be done before the Public Registry of Commerce.

Branch office registration requirements

To establish and register a branch of a foreign company in Argentina you will need the following documentation:

Step 1: Qualification report

This must be issued by a local notary or lawyer. Their signatures must be certified by one of the Argentine Notaries Public or BAR associations. The report must include:

- Legal minimum and maximum rules applicable to the meeting and to the company’s management body

- Principal location of the business (‘domicilio fiscal‘)

- A statement from the public notary or lawyers with the company’s book information.

Step 2: Documents of proof

- The articles of formation or incorporation, by-laws and amendments

- A certificate of good standing, registration and authorization to do business (issued in the home country)

- The resolution of the company’s governing body, including the fiscal year end, the location of the company’s principal place of business, capital assigned to the branch, and the appointment of a legal representative.

Step 3: Notice in the Official Gazette/Official Journal

Which must include:

- the principal place of business, the capital assigned and the date of closing of the fiscal year

- the appointed legal representative must include personal information, registered address and term of representation.

Step 4: Signed document by the representative

The document must be certified by a notary public or by the corresponding association. In the case of the representative being an accountant or a lawyer, the representative must:

- accept the appointment and provide personal information

- establish the principal place of business in Argentina

- establish his/her registered address within the relevant jurisdiction

Step 5: Payment of the registration fee

There is a registration fee for branch offices. The final step to set-up a branch of a foreign company is to show proof of the payment.

Additional documentation

Some additional documents are needed to prove that:

- The company is not prevented from carrying out its businesses in its home country

- The company is already established outside of Argentina

Once the branch office is established, it must obtain a tax number (CUIT) to begin operations.

How to obtain a tax number?

Each company in Argentina must show an accountancy balance each year and will pay the same amount of taxes as any other company in Argentina. This is 45% in income tax and 25% VAT.

Register a Branch in Argentina with the help of Biz Latin hub

At Biz Latin Hub, our multilingual team of company formation experts can help you register a branch in Argentina to take advantage of business opportunities in the country. With our full suite of accounting, recruitment, legal, and tax advisory services, we can be your single point of contact to register and manage any type of legal entity in Argentina, or any of the other 15 countries across Latin America and the Caribbean where we are present.

Contact us now to find out how we can assist your business.

Or learn more about our team of expert authors.