For those contemplating the expansion of their business in Brazil, particularly for those already operating in other locations, incorporating a branch office may represent the most advantageous approach. By choosing to incorporate a branch in Brazil, you benefit from the possibility of leveraging already established products or services, streamlining your market entry process.

You also retain a greater degree of control over operations when you incorporate a branch in Brazil as opposed to forming a subsidiary or LLC formation in Brazil. However, that also means a greater degree of liability in terms of debts and taxes, with the parent company of a branch fully liable for such burdens.

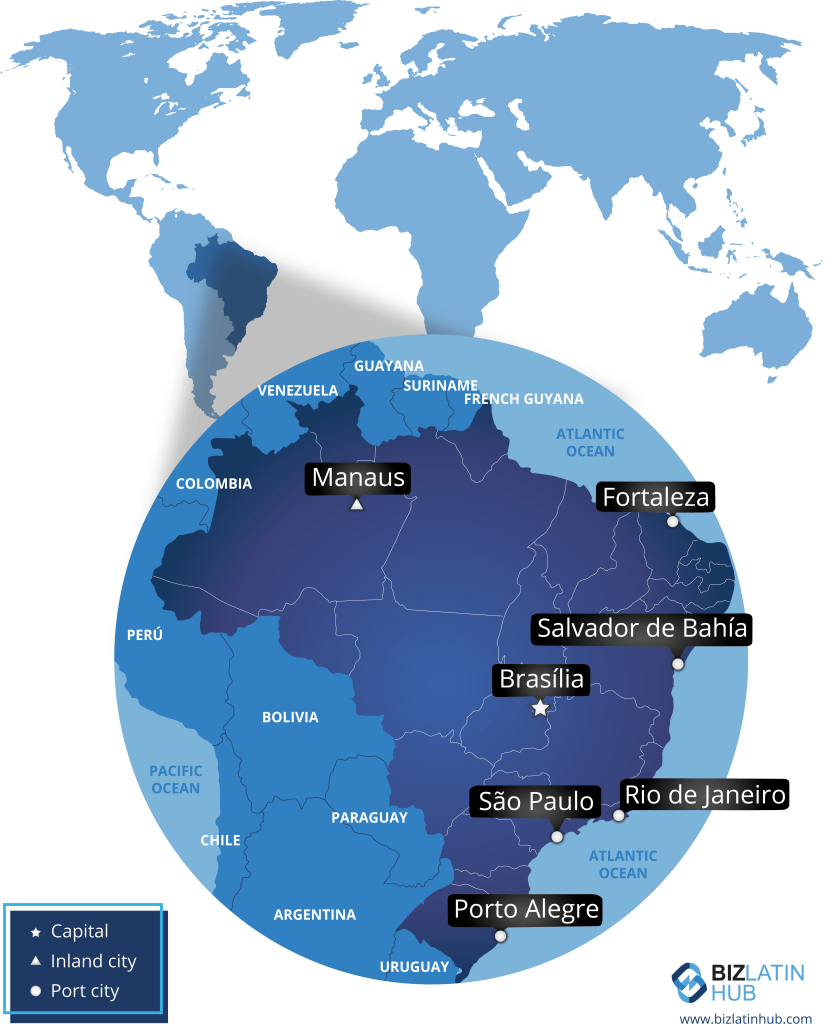

Brazil is well-known for having the biggest economy in Latin America, as well as being the region’s largest country by area and most populous. Brazil’s sheer scale means that a wide range of opportunities are on offer to investors in the country.

Being such an important source of raw materials and agricultural goods, Brazil is also a major hub for trade. The country has a range of free trade agreements (FTAs) and preferential trade agreements in place, offering better access to key markets around the globe.

Many of those agreements come through the country’s membership of Mercosur — a 30-year-old economic association that also includes Argentina, Paraguay, and Uruguay. Currently Mercosur is negotiating an FTA with the European Union — its biggest trading partner.

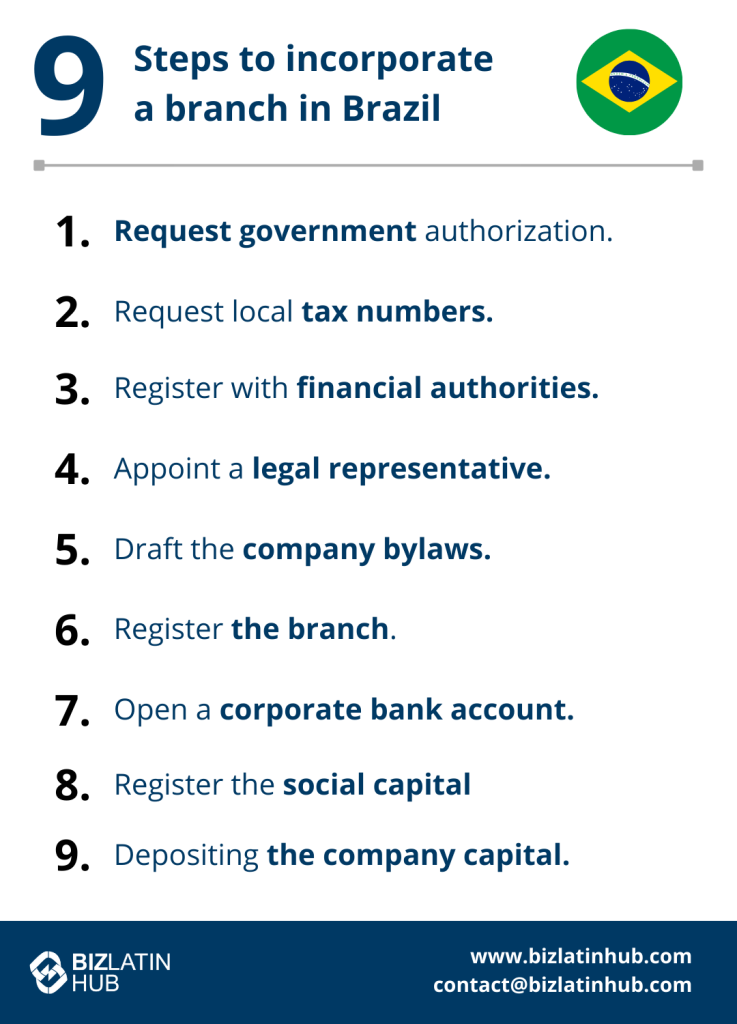

To incorporate a branch in Brazil, some essential steps must be undertaken and some basic requirements must be met. Below an overview of those nine steps is included.

Incorporate a branch in Brazil in 9 key steps

The process to incorporate a branch in Brazil involves the following 9 steps:

- Step 1 – Request government authorization.

- Step 2 – Request local tax numbers.

- Step 3 – Register with financial authorities.

- Step 4 – Appoint a legal representative.

- Step 5 – Draft the company bylaws.

- Step 6 – Register the branch in Brazil.

- Step 7 – Open a corporate bank account.

- Step 8 – Register the social capital.

- Step 9 – Complete the process to incorporate a branch in Brazil by depositing the company capital.

Step 1: Request government authorization

The first step when you want to form a branch in Brazil is to request authorization from the Brazilian Federal Government, which must be granted before you can move on with the process.

Step 2: Request local tax numbers

Once the government has authorized you to register a branch in Brazil, the next step is for the company shareholders to obtain a Brazilian tax ID. For companies, this is known as the CNPJ, while for individuals this is the CPF.

Step 3: Register with financial authorities

Once the shareholders have obtained their identification numbers, they must be registered before the Central Bank and then before the Federal Revenue of Brazil.

Step 4: Appoint a legal representative

Once the shareholders have been registered before financial authorities, you must appoint a legal representative in Brazil via a power of attorney (POA).

Step 5: Draft the company bylaws

Once you have appointed a legal representative, they will be able to assist you with drafting the company bylaws.

Step 6: Register the branch in Brazil

With the company bylaws drafted, you will be able to register the branch in Brazil before the local Board of Commerce, as well as other authorities.

Step 7: Open a corporate bank account

In order to form a branch in Brazil, you will need to have a corporate bank account for the entity. To complete this part of the process, the following documents will be needed:

- Documentation related to all shareholders

- Articles of incorporation

- Taxpayer IDs.

- UBO Organization Chart.

Step 8: Register the social capital

The penultimate step is registering the entity’s social capital with the Central Bank.

Step 9: Complete the process to incorporate a branch in Brazil by depositing the company capital

With all other steps completed, you will be able to finalize the process of registering your branch by depositing the initial company capital.

Additional information to incorporate a branch in Brazil

Here is some extra information you should know before starting your process of incorporating a branch in Brazil:

How is the appointment of a proxy to incorporate a branch in Brazil?

A foreign firm is required to appoint a corporate and tax proxy to act as the company’s legal representative in the country. This individual must be a Brazilian citizen or have a permanent visa and fixed residence in Brazil.

This individual plays a very important role in the company. They have both legal and fiscal responsibilities before the Brazilian authorities.

After the appointment of the proxy, someone should be chosen to administrate the company. They must also be a native Brazilian or have a permanent visa and a fixed residence in Brazil.

Legalization of documents of foreign partners

All original documents produced abroad must be apostilled in the country in which they were issued.

Please note that for validity documentation will require sworn translations by an officially registered translator.

Company and individual registrations

All companies that are created in Brazil must obtain a CNPJ identification number, issued by the Secretariat of the Federal Revenue of Brazil.

All foreign partners must obtain a CPF identification number. The application for this can be initiated on the Federal Revenue of Brazil website in English, Spanish or Portuguese. The completed application document must be delivered along with copies of personal documents to a Brazilian consulate or embassy.

If partners are companies, then a CNPJ enrollment for the foreign partners will also be required.

Statutes of the new company registration

For the branch of a foreign company to be established, it is necessary to write the company statutes. These statutes shall include the entity’s objectives, the registered company address, corporate capital, information related to the administration, and contractual clauses.

After the statutes of the company are finalized, they should be registered before public authorities. This is necessary to facilitate the collection of taxes and duties by the Federal Revenue of Brazil.

Opening a business bank account is an essential step to incorporate a branch in Brazil

For companies or foreign partners to make financial movements, including investments, loans, or capitalization, a bank account must be opened with the Central Bank of Brazil. The Central Bank regulates these records through the Electronic Declaratory Record (RDE).

Frequently Asked Questions About Incorporating a Branch in Brazil

In our experience, these are some of the most frequently asked questions by our clients

1. How long does it take to register a branch in Brazil?

It takes approximately 8 weeks.

2. Can a foreigner own a branch in Brazil?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

3. What are the essential documents for setting up a branch?

The essential documents are the articles of incorporation, registered office, tax identification number, shareholders documents, company bylaws (if applicable, when shareholders are legal entities) and power of attorney. In addition, you may need specific permits and licenses depending on your industry.

4. What are the tax implications of incorporating a branch in Brazil?

Branches are subject to corporate income tax (IRPJ) and social contribution on net profit (CSLL) at a combined rate of 34%. In addition, branches may be subject to other taxes, such as PIS and COFINS (3.65%) and ISS (5%) and withholding taxes.

5. Do I need a local partner to set up a branch in Brazil?

Although it is not mandatory to have a local partner, it facilitates the incorporation process and provides valuable information about the Brazilian market.

6. What is the difference between a Subsidiary and a Branch in Brazil?

| Characteristic | Subsidiary | Branch |

| Legal Status | Separate legal entity distinct from the parent company | Not a separate legal entity; extension of the parent company |

| Ownership | Wholly or partially owned by the parent company | Fully owned by the parent company |

| Liability | Limited liability for the parent company | Parent company assumes all liabilities |

| Management | Independent management structure | Managed by the parent company |

| Taxation | Subject to Brazilian tax laws and regulations | Taxed as part of parent company’s income |

Biz Latin Hub can help you to incorporate a branch in Brazil

At Biz Latin Hub, we provide integrated market entry and back office services to investors throughout Latin America and the Caribbean. We have offices in 17 key cities throughout the region, including Brazil’s economic epicenter Sao Paulo. Our unrivaled presence means that we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Our extensive portfolio includes company formation, corporate accounting & taxation, legal services, and hiring & PEO, among others.

Contact us today for more information on how we can support you when doing business in Brazil.

If you found this article on how to incorporate a branch in Brazil of interest, you can find the rest of our coverage of the country here.

Or read about our team and expert authors.