Mexico is the 11th largest country in the world. Its population of 128 million people corresponds to the population of Spain, Colombia and Australia combined. Furthermore, Mexico has 10 Free Trade Agreements covering 45 countries. Thanks to it’s large population with a high private consumption and low average age (approx. 26 years), Mexico ranks as one of the most attractive countries for investment in the alcoholic beverages industry. In the following article, we will highlight commercial opportunities in the beer, liquor and wine market in Mexico.

Import-Export to Mexico: The Number One Beer Exporter Worldwide

Although being renowned for Tequila and Mezcal, Mexico’s favourite alcoholic beverage is actually beer. According to statistics, beer has been the largest market segment with a market volume of US$13,734 million in 2017. Regarding exports, Mexico is the number one beer exporter in the world, and its brand is present in more than 180 countries. The United States as the main importer of Mexican beer at 86% of the total exports. Mexico is located among the largest beer producer markets in the world, next to United States, Brazil and China. Therefore, it is no surprise that mexican beer producers generate more than 55,000 jobs directly from the industry, and another 2.5 million jobs indirectly.

Business Opportunties – Why Mezcal and Tequila Exports Are Booming

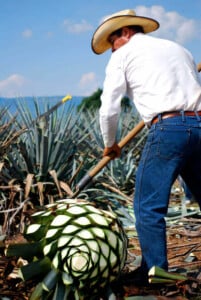

The main ingredient for the production of Tequila and Mezcal is the agave. For the world-famous tequila, the blue agave fruit is fermented and distilled twice. Then the distillate is bottled in oak barrels and matures for up to three years or more. Tequila exports had an accumulated growth of 16.24 percent from 2014 to 2016, with growth expected to continue.

Mezcal is similar to the national drink, but differs in the production process and region. The agaves are roasted to give them a special taste. Mexcal is known for a special ingredient including in the beverage; a worm that is added purely for advertising purposes. Mezcal sales had an accumulated growth of 266.74% from 2014 to 2016. Mezcal and Tequila experienced an 11,6% growth in exports in 2017 and there is no downfall in sight. In Fact, the demand is exceeding the current capacities, leading to an agave shortage. Mexico has to and will comply with the rising demand, further benefiting the people of Mexico and their growing economy.

Mexican Wine Gaining Quality and Popularity

Sure, Mexico isn’t renowned as a wine producing Nation, but it has a mentionable market dominated by clients from the traditional upper class as well as young, successful and educated men and woman, and not to forget the millions of tourists traveling to Mexico every year. Wine is slowly gaining popularity as it is considered as a more healthy and sophisticated alcoholic beverage. More and more Mexican wine brands are getting imported to Mexicos Latin-American compatriots, even wine-famous nations such as Argentina and Chile. Even the local products from regions like Baja California and premium brands ‘Valle de Guadalupe’ are enjoying greater popularity thanks to their high quality. Mexico won 18 medals in the Concours Mondial de Bruxelles an international wine tournament with 9000 wines from all over the world

What Are the Opportunities in the Mexican Alcoholic Beverage Industry?

In 2014, the average Mexican drank 64 litres of alcoholic beverages. In 2019, it is etimated that the average Mexican will drink 70 litres, according to euromonitor international, with Spirits such as Tequila and Mezcal being well-positioned to satisfy the growing demand. There is a bright future for the Mexican alcoholic beverage industry. This is partly due to a growing disposable income among the population in addition to new lifestyle trends created by the development of appealing brands and flavors. New brands and products are now competing with traditional market leaders such as GBO Anheuser-Busch InBev will fuel market growth and offer a plethora of opportunities for investors and entrepreneurs. Even though the market is already huge, the annual revenue growth is predicted to stay above 4.8% until 2021.

Want to Find Out More About the Alcoholic Beverage Industry in Mexico?

At Biz Latin Hub we have a team of local and expat professionals with extensive experience in the alcoholic beverage industry. Send an email to Alex at contact@bizlatinhub.com to see how we can be of assistance.

If you are thinking of incorporating a company in Latin America, learn how our market entry and back-office services can be useful for a successful entry into the Latin American region. There are several risks to consider when entering the Latin American market, like language and cultural differences, security risks, legal and judiciary risks, and opportunity costs. We can help manage this risk through our understanding of the local market, validation of the business opportunity, and completion of a business development visit so that we can help you establish a market entry plan.