Embarking on the journey of starting a business in Australia represents an attractive opportunity for those seeking a business foothold with convenient access to Asia or the South Pacific, or looking to take advantage of the thriving local market. According to Money.com.au’s 2024 research, Australia’s business landscape is robust with 2,662,998 active businesses, demonstrating remarkable resilience with a 76.5% first-year survival rate. The process of starting a business in Australia is remarkably straightforward and typically consists of five key steps. Whether you are an experienced entrepreneur or a beginner, starting a business in Australia is promising and has the potential for growth and success.

Read on to learn about starting a business in Australia in five key steps, or go ahead and contact us now to discuss your market entry options.

Key Takeaways

| Foreign Ownership | Yes, 100% foreign ownership is allowed. |

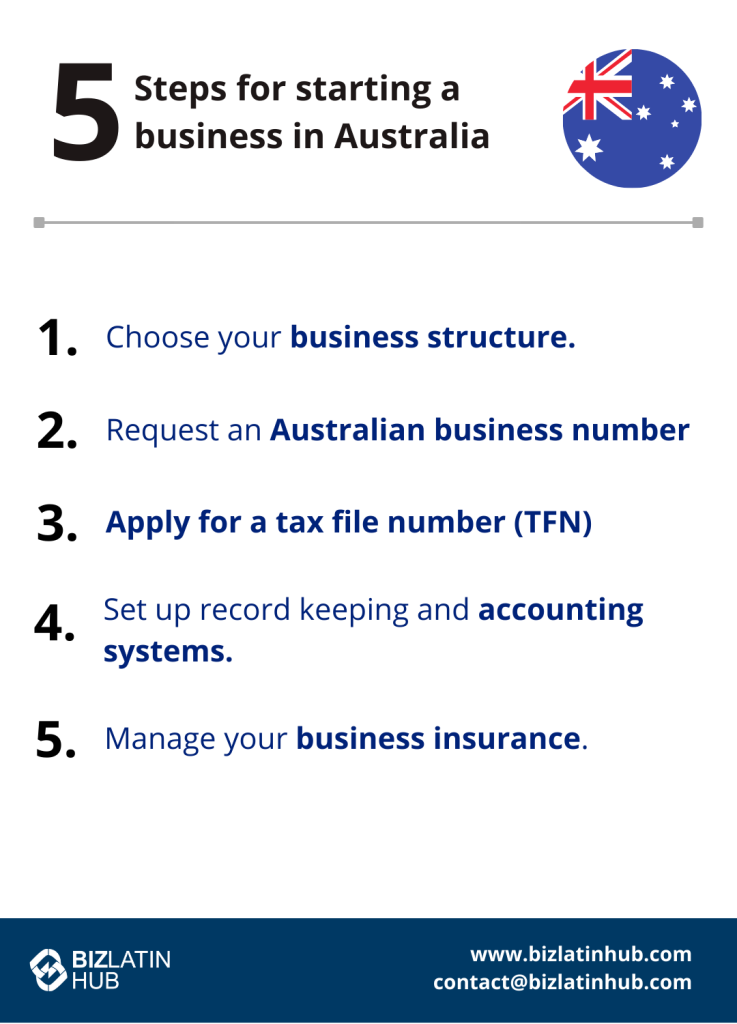

| Steps for Starting a Business in Australia | Step 1 – Choose your business structure. Step 2 – Request an Australian business number (ABN) and register your company name. Step 3 – Apply for a tax file number (TFN) when starting a business. Step 4 – Set up record keeping and accounting systems. Step 5 – Manage your business insurance. |

| Common Business Structures | Sole trader. Company. Partnership. Trust. |

5 steps for starting a business in Australia

Starting a business in Australia is a relatively straightforward process that can be completed in just a few days. When incorporating a company in Australia, you will need to complete the following five steps:

- Step 1 – Choose your business structure.

- Step 2 – Request an Australian business number (ABN) and register your company name.

- Step 3 – Apply for a tax file number (TFN) when starting a business.

- Step 4 – Set up record keeping and accounting systems.

- Step 5 – Manage your business insurance.

5 steps for starting a business in Australia

Step 1: Choose your business structure

Before entering the Australian market, you must choose a business structure that best suits your company’s needs. The four most common types of business structures in the country are:

- Sole trader.

- Company.

- Partnership.

- Trust.

To make this decision, it is important you pay attention to the key factors that govern each business structure, such as the licenses you require, the taxes you must pay, your possible personal liability, and the control you will have over your business once established.

Step 2: Request an Australian business number (ABN) and register your company name

An Australian business number (ABN) is a unique 11 digit number that identifies your business. Through the modernized Business Registration Service platform, you can now seamlessly complete your registration process. Current eligibility criteria, as outlined by the Australian Taxation Office, require businesses to:

- Have a legitimate enterprise or be starting one

- Meet residency requirements

- Maintain proper business records

- Register for GST if annual turnover exceeds $75,000

You can use your ABN to:

- Recognize your business to others when ordering and invoicing

- Claim goods and services tax (GST) credits

- Get an Australian domain name

- Access the modernized Business Registers (MBR) Program services

The registration process has been streamlined through ASIC Connect, integrating business name registration, tax registrations, and digital verification requirements into a single platform.

Step 3: Apply for a tax file number (TFN) when starting a business

Regardless of the type of company you want to incorporate, you must have a tax file number (TFN) which is a unique number issued by the Australian Taxation Office (ATO) to individuals and organizations. Note that the type of TFN your business requires depends on your business structure.

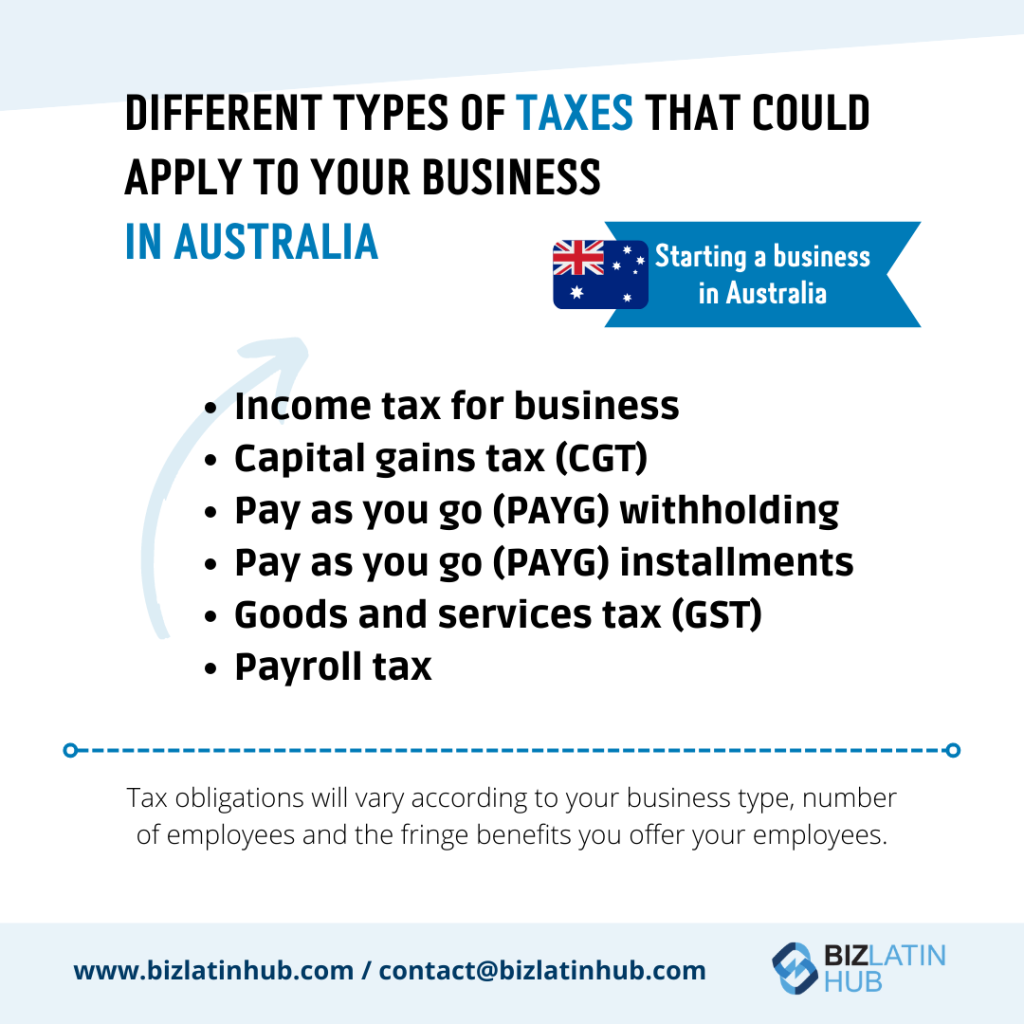

Once you have your TFN, you will need to understand the different types of taxes that could apply to your business. In Australia, some of the different taxes include:

- Income tax for business.

- Capital gains tax (CGT).

- Pay as you go (PAYG) withholding.

- Pay as you go (PAYG) installments.

- Goods and services tax (GST).

- Payroll tax.

Your tax obligations will vary according to your business type, number of employees and the fringe benefits you offer your employees.

Step 4: Set up record keeping and accounting systems

When starting a business in Australia, the ATO requires that:

- An income tax return is filed each year to report your business income and claim deductions. Additionally, you may also need to file other annual reports or returns if you are registered for other types of taxes. Most companies in Australia are also required to submit declarations of business activity.

- Keep most records for five years and if required be able to show the ATO your records.

- Records must be in English or able to be easily converted to English.

Note that records can be kept electronically or in paper form.

Step 5: Manage your business insurance

When starting a business in Australia, be aware of the types of insurance that are compulsory for most companies in the country, those are:

- Workers’ compensation insurance: this type of insurance is obligatory if your company has one or more employees.

- Public liability insurance: this type of insurance covers your business from third party death or injury and is mandatory for only certain types of companies.

- Third-party personal injury insurance: this insurance is compulsory if your business owns a motor vehicle and it is often part of your vehicle registration fee.

Why setup a business in Australia?

The Australian business sector shows significant diversity in its composition. According to recent industry analysis, construction leads as the largest sector with 452,820 businesses, while healthcare stands as the biggest employer, providing jobs to 1.66 million people. Notably, the oil and gas extraction sector maintains the highest profit margins at 58.2%, highlighting the lucrative opportunities in resource-based industries.

Australia ranks among the world’s most business-friendly nations, with a diverse business structure comprising 43% companies, 30% sole proprietors, 18% trusts, and 8% partnerships. The country’s economic landscape is particularly dynamic, with New South Wales leading business activity with 896,485 registered businesses, while Queensland has emerged as a preferred destination for business relocation.

Australia has enjoyed more than two decades of consistent economic growth and is now ranked 14th out of 190 countries for ease of doing business, according to the World Bank’s Doing Business 2020 report. The South Pacific country is also well known for having some of the highest scores in the Rule of Law Index, also issued by the World Bank.

With a gross domestic product (GDP) of $1.39 trillion (all figures in USD) and foreign direct investment inflows (FDI) of $40 billion in 2019, the country’s dynamic economy is 80% service-based and has a highly-developed mining sector and a strong agricultural industry that benefits from heavy demand in Asia.

Australia is also a promoter of global free trade, and has a range of free trade agreements (FTAs) in place, including with the likes of the Association of Southeast Asian Nations (ASEAN), China, Japan, South Korea, and the United States.

Some of Australia’s main export commodities include coal briquettes, iron ore, petroleum gas, gold, and aluminum oxide. Its key export destinations include China, India, Japan, South Korea, and the United States.

State-by-State Business Analysis

According to the latest research by Money.com.au, business activity varies significantly across Australian states:

| State/Territory | Number of Businesses | Key Industries |

|---|---|---|

| New South Wales | 896,485 | Finance, Technology |

| Victoria | 745,639 | Manufacturing, Education |

| Queensland | 582,744 | Tourism, Agriculture |

| Western Australia | 298,456 | Mining, Resources |

| South Australia | 176,892 | Wine, Defense |

| Tasmania | 45,672 | Agriculture, Tourism |

| ACT | 37,890 | Government Services |

| Northern Territory | 15,220 | Mining, Tourism |

Queensland has emerged as a preferred destination for business relocation, offering attractive incentives and lower operational costs compared to other states.

Digital Integration and Modern Business Services

The Australian government has implemented significant improvements to streamline business operations through digital transformation:

- Modernized Business Registers (MBR) Program

- Consolidated registration platform

- Streamlined digital services

- Enhanced data security

- Digital Verification

- Modern identity verification systems

- Secure online transactions

- Integrated business solutions

- Registry Services Evolution

- Real-time processing capabilities

- Automated compliance checks

- Improved user experience

Biz Latin Hub can help you starting a business in Australia

While starting a business in Australia is relatively straightforward, it pays to have professional support to guarantee the smooth running of the process. At Biz Latin Hub, our team of multilingual company formation specialists has extensive experience supporting foreign investors expanding into Australia and New Zealand. With our full suite of corporate legal, recruitment, and tax advisory services, we can be your single point of contact to ensure the success of your commercial operations in the South Pacific, as well as in Latin America and the Caribbean.