Ecuador has shown the world that it is open for investment by introducing a new legal entity known as the Simplified Shares Company (Sociedad de Acciones Simplificadas). This innovative corporate structure streamlines the process to set up a company in Ecuador, making it more accessible for entrepreneurs and investors. Before diving into the details of a SAS in Ecuador, let’s take a deeper look at the country’s economy and the opportunities it presents for business growth and development.

Ecuador is the eighth-largest economy in Latin America, with a gross domestic product (GDP) of USD$115 billion in 2022 and is projected to grow by 1.8% in 2024.

Quito, the capital, is seen as a startup hub in the region and offers skilled labor at competitive rates. Additionally, Ecuador is rich in hydrocarbon reserves, with oil drilling responsible for 40% of the nation’s export income. The services sector has become a key source of employment for the economy.

On February 28, 2020, the new Law of Entrepreneurship and Innovation came into force in Ecuador. This law introduced new regulations in the field of business promotion in this country and opened the way for the SAS in Ecuador. This follows in the footsteps of countries such as Uruguay and Colombia, which have established similar ideas in the name of business growth.

What are Simplified Stock Companies and how do you form a SAS in Ecuador?

A Simplified Stock Company (SAS) is a company where shareholders are only liable for the amount of money they invested in the company. Shareholders can choose to waive this limitation to insure with their own assets any operation of this type of entity.

It’s important to mention that the SAS in Ecuador cannot be listed on the stock exchange. You’ll need to register private documents in a new Registry of Companies by the Superintendence of Companies. Additionally, there is no minimum capital requirement.

This type of legal entity in Ecuador cannot carry out activities relating to the financial, stock market, insurance or any of the other industries that have special treatment under Ecuadorian law.

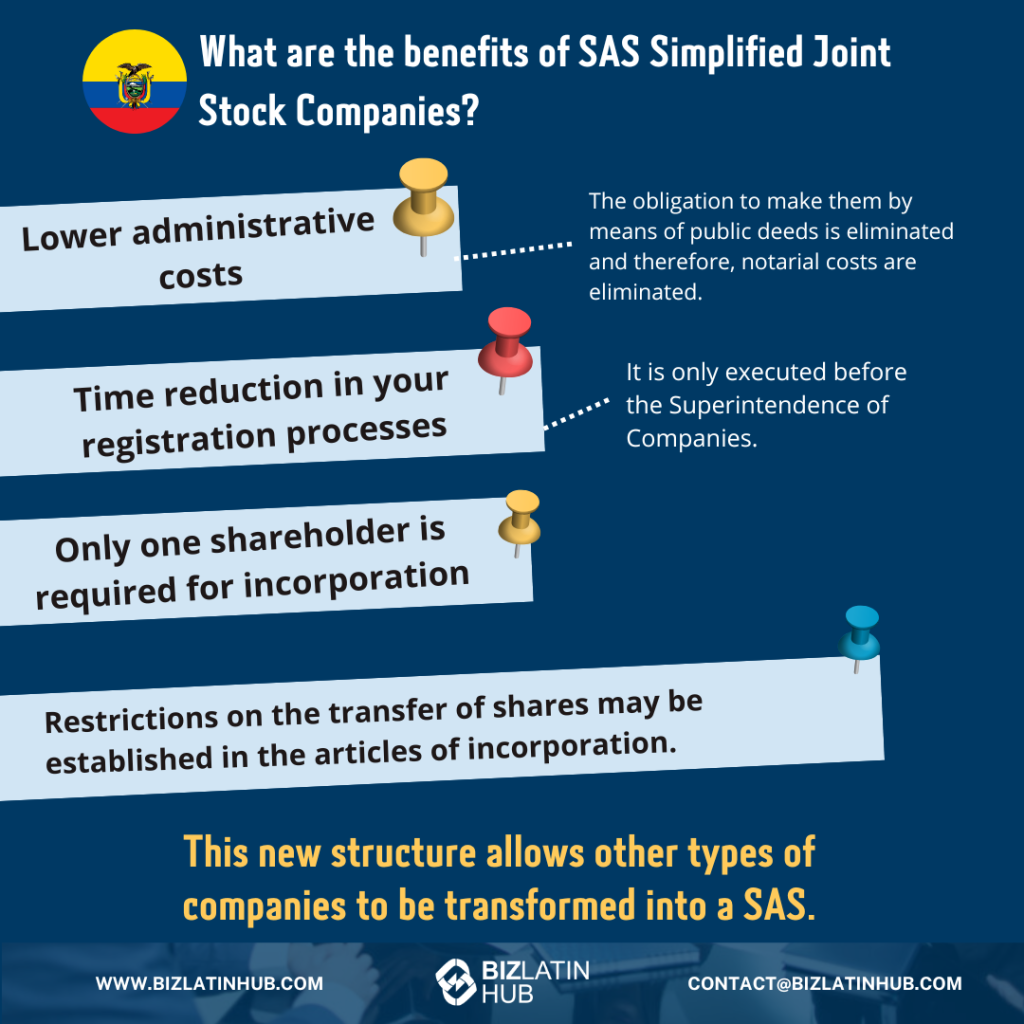

What are the benefits of an SAS?

The fist advantage of the SAS Simplified Stock Company is lower administrative costs. The SAS in Ecuador can be executed and implemented by means of private acts and documents. You don’t need any public deeds and so, notarial costs are cut.

The second benefit is that the incorporation process and subsequent activities are much faster. You don’t need to register this type of corporate act in the Commercial Registries and it is only executed with the Superintendency of Companies. This means business owners can form a SAS in Ecuador with reduced bureaucratic requirements and wait time.

Furthermore, unlike other corporate structures, when you incorporate a SAS in Ecuador, you only require a single shareholder. This adds simplicity and flexibility to management processes.

A fourth benefit of the SAS in Ecuador is that restrictions on the transfer of shares can be established in the incorporation statutes. Additionally, it can be established that the shares can give multiple votes. This helps to streamline the management of corporate governance for this type of entity.

Finally, this new structure allows other types of companies to turn into a SAS structure, unless they have a particular or special legal treatment. Consulting a local legal expert can help you understand how to make this transition for your company.

FAQs about the SAS in Ecuador

1. Can a foreigner own a SAS in Ecuador?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. How long does it take to register a SAS in Ecuador?

Registering a company in Ecuador takes 4 to 5 weeks.

3. What are the main advantages of incorporating a SAS in Ecuador?

The main advantages include simplified incorporation, limited liability protection, management flexibility, tax benefits and access to capital.

4. What is the minimum capital required to incorporate a SAS in Ecuador?

No minimum capital is required to establish an S.A.S. However, in our experience we strongly recommend a minimum capital of USD$400.

5. What is an SAS in Ecuador?

In Ecuador, SAS stands for Sociedad por Acciones Simplificada (Simplified Joint Stock Company). It is a type of legal entity specifically designed to facilitate the creation and operation of small and medium-sized businesses. This structure offers several advantages to entrepreneurs, such as simplified registration processes, limited liability protection for shareholders, management flexibility, potential tax advantages and easier access to capital.

Biz Latin Hub can be your single point of entry to Ecuador

In general terms, a Simplified Shares Company (SAS) in Ecuador offers an interesting and flexible alternative for your business in this country. If you’re thinking about expanding into Ecuador or changing your company’s structure, you’ll need local legal support.

At Biz Latin Hub, with extensive knowledge of company law at the regional level, our team of bilingual legal professionals will support you in all your needs and the necessary procedures to carry out your business in Ecuador.

For advice on opening or incorporating a SAS in Ecuador, and to get assistance to comply with the processes derived from this legal process, get in touch with us.

Contact our friendly team here at Biz Latin Hub for support to do business in Ecuador and throughout Latin America.