Mexico, often considered the gateway between the United States and Latin America, boasts abundant resources and a young, affordable workforce. Its economy has been on an upward trajectory, with a GDP increase of 2% between 2017 and 2018, reaching a substantial US$1,224 billion. Projections from the IMF and the World Bank indicate an overall growth rate of 2.1% for Mexico in 2019. These favorable conditions make it an ideal location for establishing a non-governmental organization (NGO). However, prospective founders should carefully navigate the legal and regulatory landscape to ensure successful implementation.

Mexico welcomes foreign business in all forms, including those that focus on supporting social causes. We explain how to set up your non-governmental organization in Mexico.

How to form an NGO in Mexico? What is a non-governmental organization (NGO)?

Quick Facts:

- Registration Timeline: 3-8 months

- Registration Costs: $100-$5,000 USD (excluding legal fees)

- Annual Compliance Cost: Varies by size and activity

- Success Rate: ~75% of applications approved (2023)

A non-governmental organization (NGO) is a group of voluntary, non-profit citizens that is organized at the local, national, or international levels. The function of an NGO can be to provide humanitarian service and assistance or to represent citizens to their governments.

Within NGOs, there are two main groups, according to the World Bank:

- Operational NGOs: focused on development projects

- Advocacy NGOs: promoting particular causes

Some NGOs may belong to both categories.

The different types of NGOs

As a company, an NGO can have different legal status or legal forms. Some examples include:

- BINGO: international and business-friendly

- INGO: International organization

- ENGO: Environmental organization

- GONGO: a non-governmental organization organized by the government

- QUANGO: Quasi-autonomous.

You must be future-focussed when electing your NGO type, and assess how you want your organization to evolve going forward. Choosing your legal status is one of them.

Funding processes

As non-profit organizations, NGOs cannot obtain funding like other business structures in Mexico, but they can use several sources for funding:

- Contributions from its members

- Individual or collective private donors

- Selling goods and/or services

- Receiving state subsidies

- International cooperation grants

- Corporate sponsorships

- Crowdfunding platforms

Note: Recent government policy changes have resulted in funding cuts of approximately USD $321 million to the NGO sector. Organizations are increasingly diversifying their funding sources in response.

Comparison of NGO Legal Structures

| Feature | AC (Civil Association) | IAP (Private Assistance) | CS (Civil Society) | Fideicomiso (Trust) |

|---|---|---|---|---|

| Setup Time | 2-3 months | 3-4 months | 2-3 months | 4-6 months |

| Minimum Members | 2 | 1 | 2 | 1 |

| Tax Benefits | Full exemption | Full exemption | Partial exemption | Varies |

| Governance | Board of Directors | Board + Oversight | Partners | Trustee |

| Best For | General purposes | Social assistance | Professional services | Asset management |

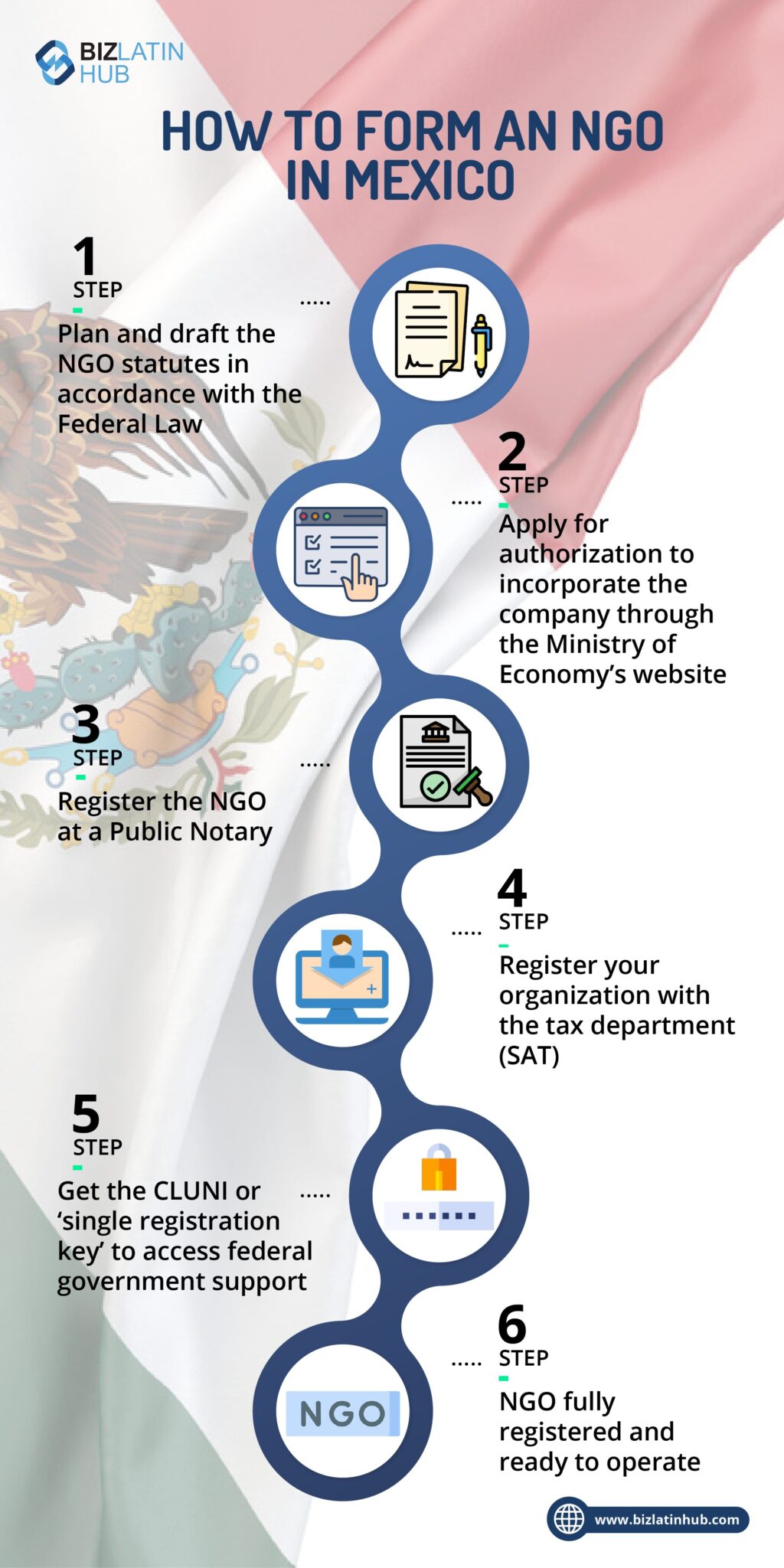

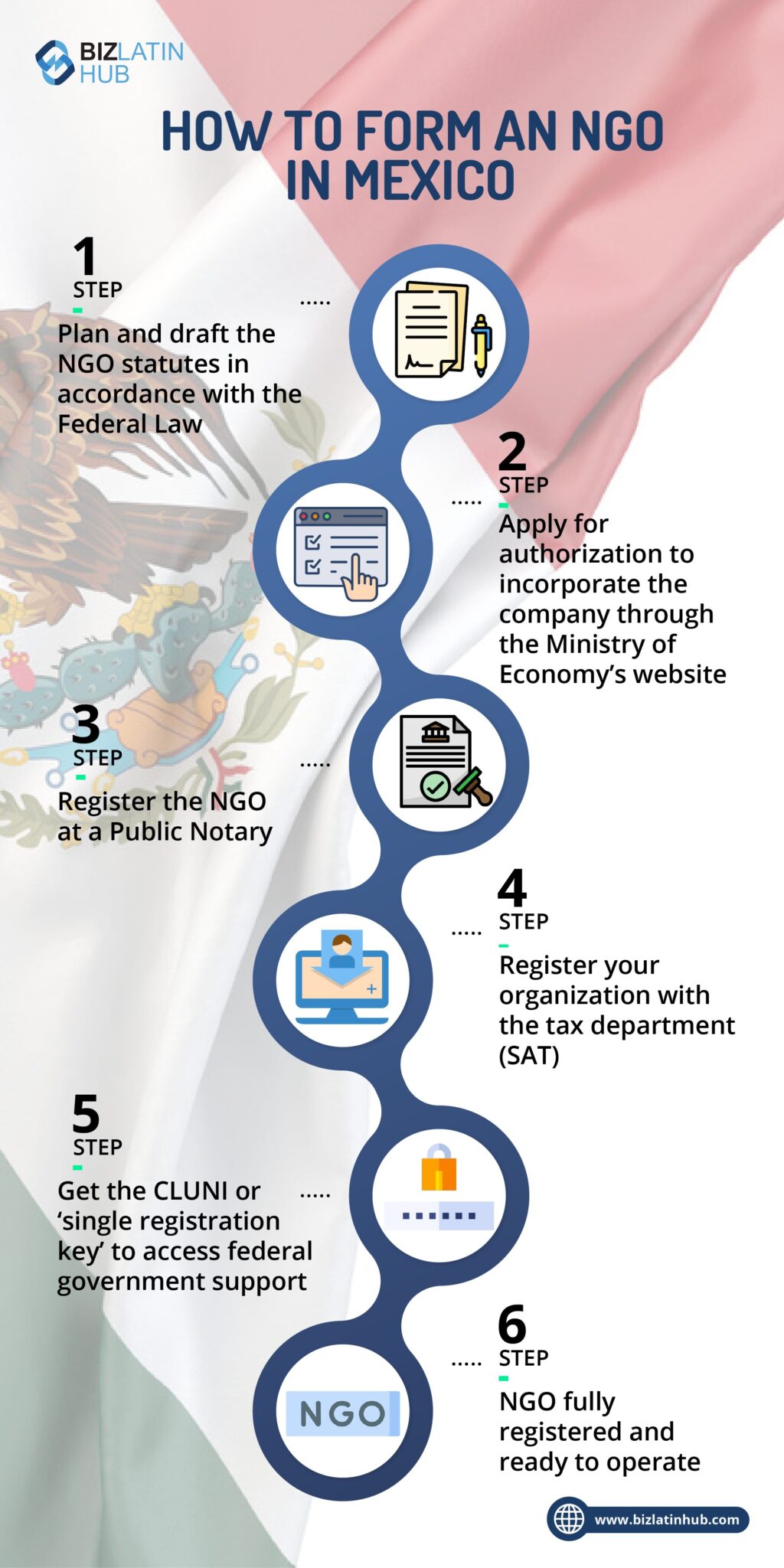

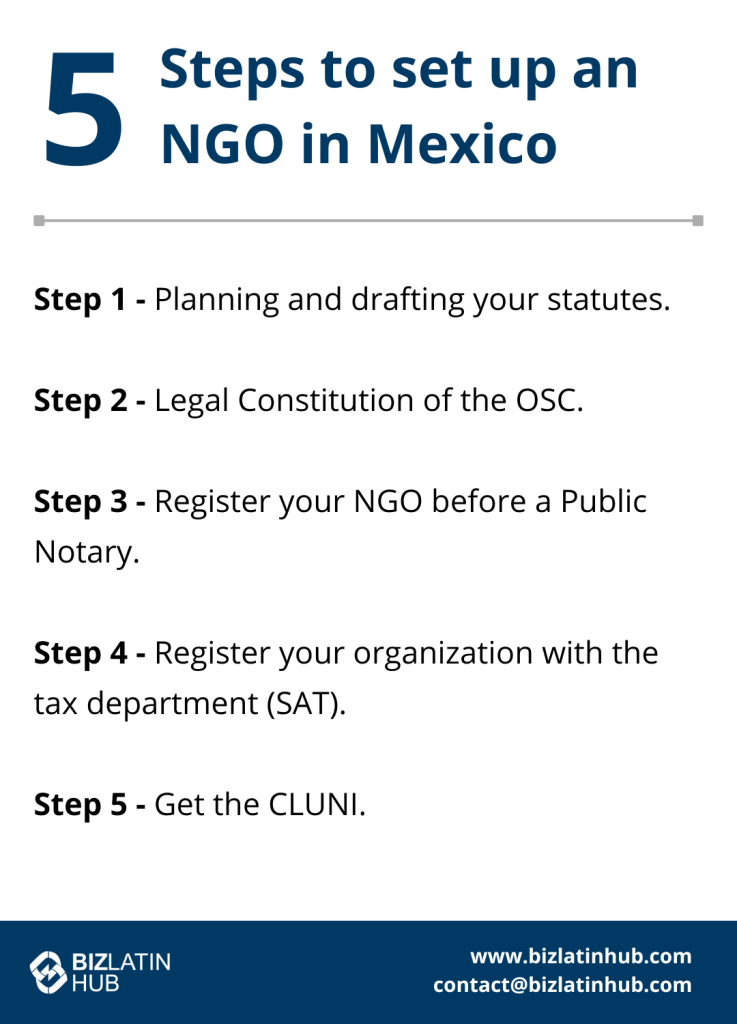

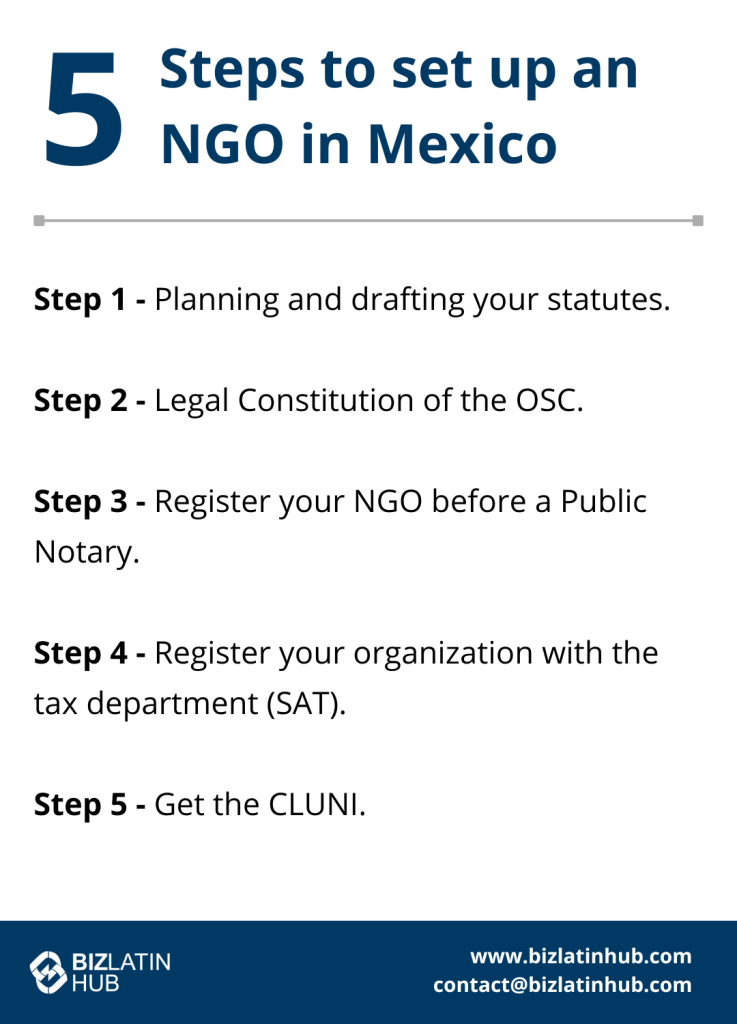

5 Steps to set up an NGO in Mexico

There are 5 key steps to register your NGO in Mexico. This process typically takes 3-8 months, with costs varying by region and complexity:

- Step 1 – Planning and drafting your statutes.

- Step 2 – Legal Constitution of the OSC.

- Step 3 – Register your NGO before a Public Notary.

- Step 4 – Register your organization with the tax department (SAT).

- Step 5 – Get the CLUNI.

1. Planning and drafting your statutes

The statutes of your company outline your business objectives. In this step, you’ll need to lay out the strategic aims and measures for your NGO by:

- Defining the corporate purpose and objectives

- Selecting the legal entity: its nature will change according to the number of members and their status.

- Choosing a name for your NGO

- Electing your authorized representatives and with them, deciding which clauses you wish to include in the event of liquidation proceedings of the OSC

- Develop your fundraising and project financing strategy

Make sure to build you statutes in accordance with the Federal Law on the Promotion of the Activities of Civil Society Organisations (Ley Federal de Fomento de las Actividades realizadas por las Organizaciones de la Sociedad Civil)

2. Legal Constitution of the OSC

To properly develop the legal constitution of your organization, you must first apply for authorization to incorporate a company through the Ministry of Economy’s website.

Through this portal, you can submit the name of your organization. You must present an electronic signature issued by the Tax Administration Department.

3. Register your NGO before a Public Notary

For this step, you must go to a Public Notary to confirm the establishment of your NGO. You must present your public deed or articles of incorporation of your OSC. These documents must contain the full name of the partners, the name (or company name) of the organization, followed by the legal form you have chosen to operate with.

4. Register your organization with the tax department (SAT)

To apply for your registration card at the Federal Taxpayers Registry (Registro Federal de Contribuyentes or RFC), you must submit your NGO Servicio de Administración Tributaria (SAT). This is equivalent to service tax administration in English, and is used to pay your taxes in Mexico.

5. Get the CLUNI

The CLUNI or ‘single registration key’ is an indispensable tool for non-governmental organization to access federal government support and to facilitate the implementation of their activities. Through a government portal, you can apply for a CLUNI position.

Requirements to maintain your NGO in Mexico

Some of the obligations that NGOs in Mexico must comply with are the following:

- Present the annual report of activities by January 31st to the Federal Register of Civil Organizations (required for CLUNI)

- Submit monthly tax returns to SAT by the 17th of each month

- File annual tax returns by February 15th

- Maintain proper accounting records following Mexican Financial Reporting Standards (NIF)

- Report any changes in corporate purpose within 45 days

- Keep detailed records of all donations and grants

- Submit quarterly transparency reports if receiving public funds

- Maintain active status with local and federal registries

Pro Bono Resources

Several organizations offer free or low-cost support for NGOs:

- CSPro Network: Legal assistance and compliance guidance

- ProBono Mexico: Document preparation and registration support

- Nuevo Leon NGO Ecosystem: Regional support and networking

- National NGO Network: Capacity building and training

Banking Requirements

To open an NGO bank account in Mexico, you’ll need:

- Constitutive act and statutes

- Tax ID (RFC)

- Proof of address (not older than 3 months)

- Official identification of legal representatives

- Initial deposit (varies by bank, typically $500-1,000 USD)

Need assistance setting up an NGO? BLH can help you

Setting up an NGO in Mexico may seem complicated at first glance. Thankfully you can utilize local expertise to make your incorporation journey easier. You can partner with a reliable firm that will ensure your business remains in compliance with commercial and tax laws and processes to achieve the best start.

Contact our Mexico City office and receive guidance and support from our team of local and expatriate professionals throughout your expansion process. At Biz Latin Hub, we offer customized market entry and back-office business solutions to ensure your success in a new market.

Reach out to us to get started today.

Mexico, often considered the gateway between the United States and Latin America, boasts abundant resources and a young, affordable workforce. Its economy has been on an upward trajectory, with a GDP increase of 2% between 2017 and 2018, reaching a substantial US$1,224 billion. Projections from the IMF and the World Bank indicate an overall growth rate of 2.1% for Mexico in 2019. These favorable conditions make it an ideal location for establishing a non-governmental organization (NGO). However, prospective founders should carefully navigate the legal and regulatory landscape to ensure successful implementation.

The oil and gas, automotive, financial services, communications, retail trade, and tourism sectors are Mexico’s most important revenue generators. The country is the second-largest destination for foreign investment in Latin America with $31.6 trillion in foreign direct investment in 2018.

Mexico welcomes foreign business in all forms, including those that focus on supporting social causes. We explain how to set up your non-governmental organization in Mexico.

How to form an NGO in Mexico? What is a non-governmental organization (NGO)?

A non-governmental organization (NGO) is a group of voluntary, non-profit citizens that is organized at the local, national, or international levels. The function of an NGO can be to provide humanitarian service and assistance or to represent citizens to their governments.

Within NGOs, there are two main groups, according to the World Bank:

- Operational NGOs: focused on development projects

- Advocacy NGOs: promoting particular causes

Some NGOs may belong to both categories.

The different types of NGOs

As a company, an NGO can have different legal status or legal forms. Some examples include:

- BINGO: international and business-friendly

- INGO: International organization

- ENGO: Environmental organization

- GONGO: a non-governmental organization organized by the government

- QUANGO: Quasi-autonomous.

You must be future-focussed when electing your NGO type, and assess how you want your organization to evolve going forward. Choosing your legal status is one of them.

Funding processes

As non-profit organizations, NGOs cannot obtain funding like other business structures in Mexico, but they can use several sources for funding:

- Contributions from its members

- Individual or collective private donor

- Selling goods and/or services

- Receiving state subsidies.

Although NGOs are not dependent on a government, some in itself collect considerable amounts of grants to support their activities. Some reach budgets close to $1 billion, for example, World Vision finished its 57th year with nearly 26,000 employees and a budget of $2.6 billion.

As a civil law country, with a federal structure (or legal figure), Mexico officially recognizes 4 primary forms of Organización de la Sociedad Civil (OSC) organizations:

- The civil association (AC)

- The private assistance institution (Institución de Asistencia Privada) (IAP)

- Civil society (CS)

- The trust (Fideicomiso)

Being an OSC means having a different tax regime than a traditional business. They are exempt from Value-Added Tax (VAT) under Article 79 of the Mexican Income Tax Act is an “authorized donee. As such, may issue exemptions from the Income Tax Act to such donors. The same applies to an American who wishes to become a donor of a Mexican OSC, will be able to deduct it from these taxes.

5 Steps to set up an NGO in Mexico

There are 5 key steps to register your NGO in Mexico. This process can take between 3-8 months:

- Step 1 – Planning and drafting your statutes.

- Step 2 – Legal Constitution of the OSC.

- Step 3 – Register your NGO before a Public Notary.

- Step 4 – Register your organization with the tax department (SAT).

- Step 5 – Get the CLUNI.

1. Planning and drafting your statutes

The statutes of your company outline your business objectives. In this step, you’ll need to lay out the strategic aims and measures for your NGO by:

- Defining the corporate purpose and objectives

- Selecting the legal entity: its nature will change according to the number of members and their status.

- Choosing a name for your NGO

- Electing your authorized representatives and with them, deciding which clauses you wish to include in the event of liquidation proceedings of the OSC

- Develop your fundraising and project financing strategy

Make sure to build you statutes in accordance with the Federal Law on the Promotion of the Activities of Civil Society Organisations (Ley Federal de Fomento de las Actividades realizadas por las Organizaciones de la Sociedad Civil)

2. Legal Constitution of the OSC

To properly develop the legal constitution of your organization, you must first apply for authorization to incorporate a company through the Ministry of Economy’s website.

Through this portal, you can submit the name of your organization. You must present an electronic signature issued by the Tax Administration Department.

3. Register your NGO before a Public Notary

For this step, you must go to a Public Notary to confirm the establishment of your NGO. You must present your public deed or articles of incorporation of your OSC. These documents must contain the full name of the partners, the name (or company name) of the organization, followed by the legal form you have chosen to operate with.

4. Register your organization with the tax department (SAT)

To apply for your registration card at the Federal Taxpayers Registry (Registro Federal de Contribuyentes or RFC), you must submit your NGO Servicio de Administración Tributaria (SAT). This is equivalent to service tax administration in English, and is used to pay your taxes in Mexico.

5. Get the CLUNI

The CLUNI or ‘single registration key’ is an indispensable tool for non-governmental organization to access federal government support and to facilitate the implementation of their activities. Through a government portal, you can apply for a CLUNI position.

Requirements to maintain your NGO in Mexico

Some of the obligations that NGOs in Mexico must comply are the following:

- Present the annual report of activities performed during the period, in regards to the corporate purpose of your NGO This is due each January at the Federal Register of Civil Organizations, and is a requirement in order to keep your CLUNI

- Notify any changes to the corporate purpose before the Federal Register of Civil Organizations

- Perform the financial statements of your NGO, according to the accounting standards

- Present all corporate information (bylaws, accounting records, activities, for example) as required by any authority

- Present the monthly tax return before SAT (Servicio de Administración Tributaria) of the withhold income tax by day 17 of each month

- Present the annual tax return before SAT (Servicio de Administración Tributaria) by 15 February each year.

Requires for assistance? BLH can help you

Setting up an NGO in Mexico may seem complicated at first glance. Thankfully you can utilize local expertise to make your incorporation journey easier. You can partner with a reliable firm that will ensure your business remains in compliance with commercial and tax laws and processes to achieve the best start.

Contact our Mexico City office and receive guidance and support from our team of local and expatriate professionals throughout your expansion process. At Biz Latin Hub, we offer customized market entry and back-office business solutions to ensure your success in a new market.

Reach out to us to get started today.

Learn about our team and expert authors.