How can our Company Formation Services help your Business in Latin America and the Caribbean?

Our Company Formation Services

Our Company Formation Services

We offer a comprehensive, streamlined solution for setting up and maintaining your local legal entity. Trust our local team of legal experts to help you understand the types of legal entities and guide you through the complete company formation and corporate bank account opening process.

Company Incorporation

Corporate Governance

Company Books

Legal Representation

Fiscal Domicile

Unique Tax Identifier

our clients on Company Formation services

Biz Latin Hub is a legal and accounting services firm rapidly gaining ground in the fast-evolving markets of Latin America. This has been possible thanks to the clarity of its objectives and its willingness to deliver sustained leadership. With an increased presence in small and big markets, Biz Latin Hub is developing formulas for pursuing appropriate segments, while at the same time creating new business opportunities and synergies. This is great news for companies interested in doing business and/or incorporating a legal entity within the region.

– Jairo Hernandez, Ambassador of Costa Rica to the Commonwealth of Australia

Click on a Flag for More information on how to Start A Company in Latin America & the Caribbean

Frequently Asked Questions on Company Formation

Based on our experience, these are the most commonly asked questions about how to form a company and how Biz Latin Hub can help.

Company formation is the process of legally incorporating a business as a limited company at the respective registrar of companies. It makes the business a distinct entity, separate from its owners, and allows it to benefit from certain legal protections.

A company formation agent is a service provider or specialist that helps individuals or businesses set up a new company. They handle the legal and administrative tasks required to register a company with the relevant authorities. These agents typically assist with filing the necessary documents, such as articles of incorporation, and ensure compliance with local laws. Using a formation agent simplifies the process for those unfamiliar with the legal requirements of starting a company.

An LLC formation refers to the process of creating a Limited Liability Company (LLC). An LLC is a business structure that offers limited liability protection to its owners, meaning their personal assets are protected from business debts or liabilities. The formation process usually involves filing articles of organization with the state local chamber of commerce, choosing a business name, and sometimes drafting an operating agreement, which outlines the rules and operations of the LLC.

Yes, a foreigner can create and own a company in almost all jurisdictions in Latin America and the Caribbean.

The most common legal entity types in Latin America and the Caribbean are the simplified stock company or simplified corporation, known as an SAS (sociedad por acciones simplificada) or a corporation, known as an SA (sociedad anónima).

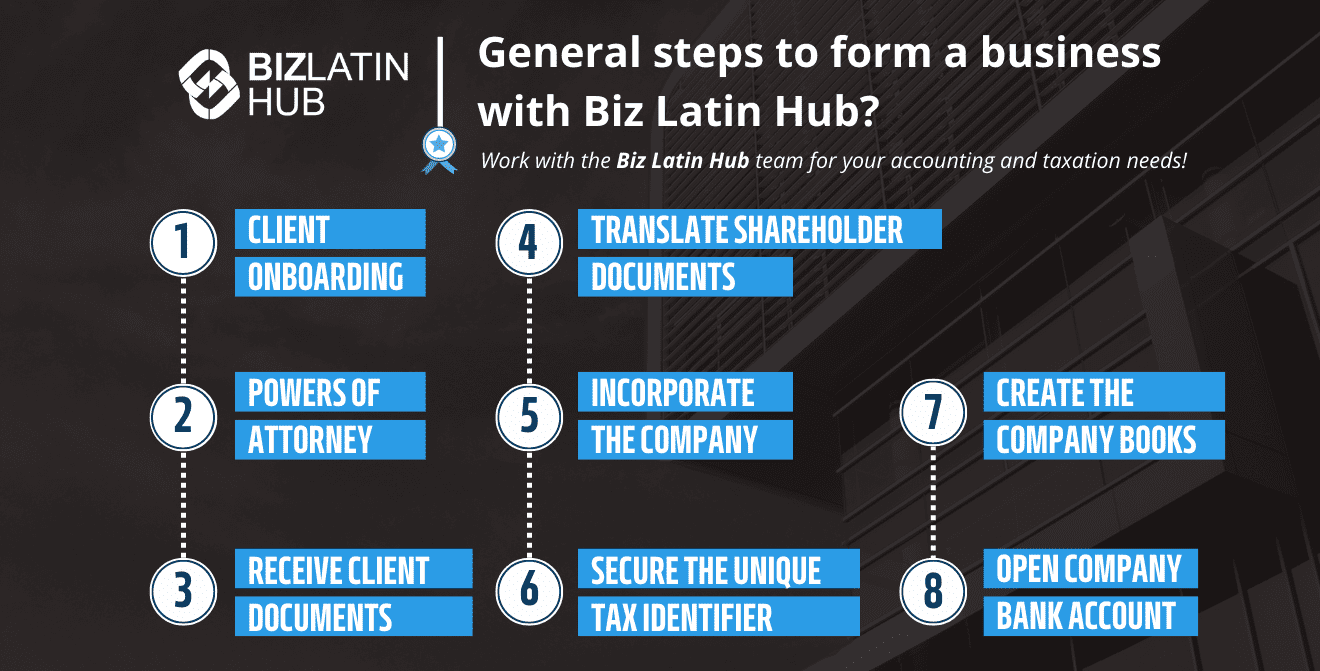

The process of company registration involves several steps, including preparing powers of attorney, apostilling shareholder documents, choosing a unique company name, preparing necessary documents such as the Memorandum and Articles of Association, registering with the appropriate government agency, and paying the necessary fees. The process may vary depending on the specific country’s regulations.

A legal representative is an individual authorized to act on behalf of a company or an organization in legal matters, particularly in jurisdictions where the company is not physically present. The legal representative has the power to sign contracts, file documents, represent the company in court, handle official communications, and fulfill other legal obligations required by local laws.

In many Latin American countries, appointing a local legal representative is a common requirement for company formation, especially for foreign investors. This person often must be a resident of the country in which the company is established and plays a crucial role in liaising with government authorities, handling tax matters, and ensuring the company complies with local regulations. The legal representative’s responsibilities and authority are usually outlined in the company’s bylaws or in a separate power of attorney.

The requirements to establish a company vary between jurisdictions, but in most Latin American countries you will need to have a local fiscal address and also appoint a legal representative for your new company during the incorporation process. Some jurisdictions also require additional obligations such as an appointed chartered accountant, and legal representatives for foreign shareholders.

Incorporating a company in Latin America can provide numerous benefits, including access to a growing market, favorable business regulations, and potential tax advantages. However, the process can be complex and requires a thorough understanding of local laws and customs.

Key considerations for company formation in Latin America include understanding the local business culture, legal requirements, tax implications, and potential market opportunities. It’s also crucial to have a reliable local partner to navigate these complexities.

No, in most cases, the company incorporation process can be completed through a power of attorney.

Timing for starting a business in Latin America varies between countries, but normally takes between one to four months on average.

Annual compliance requirements for companies in Latin America typically include filing financial statements, paying corporate taxes, and submitting VAT reports. Most countries require businesses to maintain detailed accounting records and undergo regular tax filings, which can include corporate income tax, withholding taxes on dividends, and VAT. The specific tax rates and deadlines vary across the region, with most countries aligning their fiscal year with the calendar year. In some countries, companies may also be subject to audits, labor and social security obligations, and additional industry-specific regulations.

To start your company registration, please reach out to the Biz Latin Hub via our contact us page.

A physical office address is typically required for company registration in most Latin American countries. However, many countries, such as Colombia, Mexico, and Peru, accept virtual offices or co-working spaces as valid registered addresses. This flexibility can help reduce costs for foreign investors. It is advisable to verify the specific requirements in each country, as some may have more stringent regulations regarding business addresses.

Beyond company formation, Biz Latin Hub offers a range of services including legal and accounting services, visa processing, hiring and recruitment, due diligence, and more. Our goal is to provide a comprehensive solution for businesses looking to expand into Latin America.

WHAT MAKES BIZ LATIN HUB DIFFERENT?

Your Local Partner

We can provide you the complete, fully-integrated and tailored back office, PEO and entity incorporation solution

Your Need is Our Focus

We know one size doesn’t fit all – we will work with you to understand your business needs and to provide a personalized market entry and back office solution

Globally Minded & Local Expertise

Trust our local team of lawyers and accountants to establish your business, form your legal entity, hiring employees and legal entity compliance

Communication at its Best

English, Spanish or Portuguese – Our local and expatriate team of accountants and lawyers can support you in multiple languages