When contemplating doing business in Bolivia, there are myriad avenues for establishing a legitimate business foothold in the country. Depending on the scope and nature of your investment efforts, one of the most advantageous routes could involve registering a subsidiary in Bolivia. By choosing to register a subsidiary in Bolivia, you gain access to a distinct legal entity with considerable autonomy from any headquarters located elsewhere. This approach not only ensures compliance with Bolivian regulatory frameworks, but also facilitates seamless integration into the local business landscape.

Bolivia’s gross domestic product (GDP) growth is expected to be 1.8% in 2024. This growth has been supported by public investment, which is expected to reach US$4.274 billion in 2024. Investment is mainly directed to strategic sectors that generate surpluses, such as hydrocarbons, electricity, mining, road infrastructure, communications, industry promotion, and capital injection in public companies.

The country has also experienced significant technological development driven by its growing software technology industry, most prominently in cities such as Cochabamba, La Paz, and Santa Cruz. That has been boosted through government support and investment from Silicon Valley, while the country has seen significant growth in tech outsourcing in the country.

If you have already a corporate lawyer in Bolivia to assist you in your expansion, they will be able to offer you sound advice on the best type of legal entity to establish in the country based on your needs — whether that be to register a subsidiary, form a branch, or even to go through full company formation.

If, however, you are still in the planning stages and want to understand more about what it means to register a subsidiary in Bolivia, and how that compares to other possible options, read on below to find out more.

What are the Advantages of Registering a Subsidiary in Bolivia?

Registering a subsidiary in Bolivia can reduce possible losses or liabilities for the parent company, as it is established as a separate entity. In other words, losses acquired by a subsidiary in Bolivia are not necessarily transferred to the parent company. In addition, a subsidiary can have its own bank account and is fully responsible for complying with Bolivian legal and tax regulations.

A subsidiary company in Bolivia can be registered as a Limited Liability Company (LLC) or as a Corporation. The choice of the type of company to register as a subsidiary will depend on the composition of the shareholders and the economic activity being developed. Once the decision is made, an experienced legal counsel will be able to guide you through the requirements and conditions imposed by law to register a subsidiary in Bolivia, such as:

- Shareholders can be Bolivian or foreign citizens, natural persons, or legal entities. If foreign documents are required, these must be duly notarized.

- A subsidiary company operating in Bolivia must register a local legal address.

- A subsidiary company must declare its capital to operate and the amount of time it will remain in Bolivia.

- For an LLC in Bolivia, a legal representative is required. This person can be a Bolivian or a foreign citizen with residence in Bolivia.

- Corporations must appoint a board of directors, with the president being the legal representative of the company.

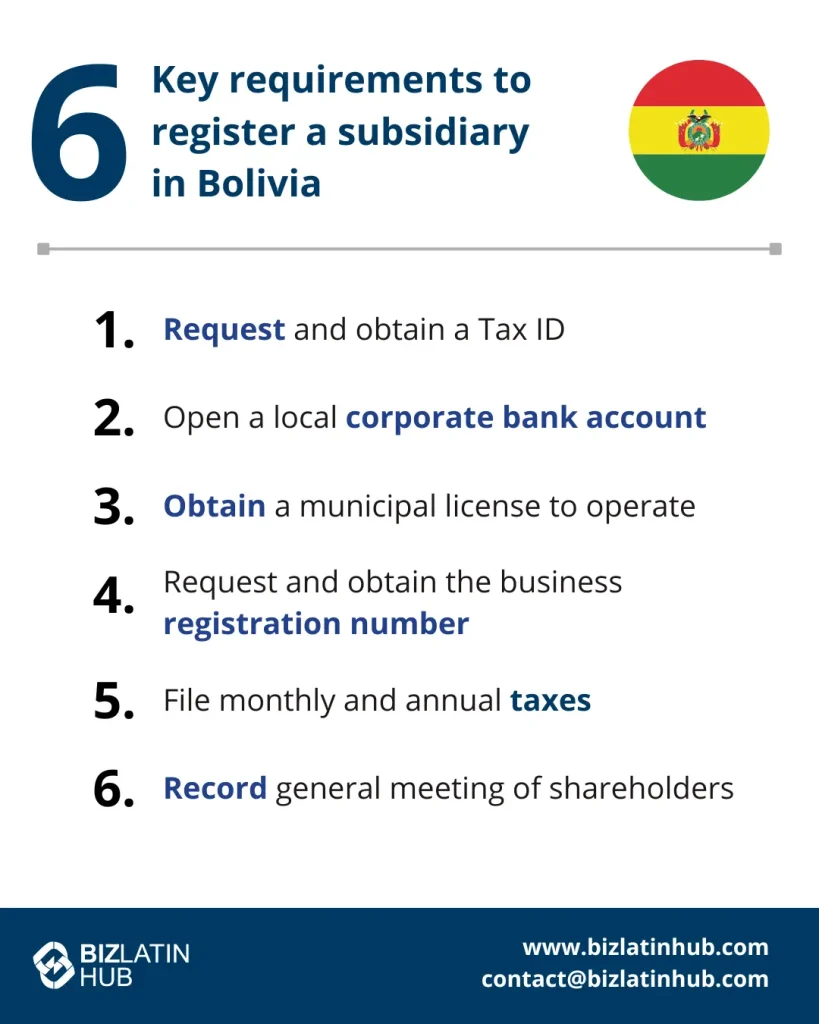

6 Key requirements to register a subsidiary in Bolivia

Bolivian commercial laws grant foreign companies the same rights and guarantees as local companies. Therefore, it is strongly recommended to engage with a trusted corporate lawyer able to help you navigate local regulations to successfully register a subsidiary in Bolivia. Some of the key requirements to register a subsidiary in the country include:

- Request and obtain a Tax ID (Número de Identificación Tributaria – NIT) with the National Tax Office ( Servicio de Impuestos Nacionales).

- Open a local corporate bank account.

- Obtain a municipal license to operate.

- Request and obtain the business registration number and renew it annually.

- File monthly and annual taxes before the due dates established by the National Tax Office.

- Record in a minute book any general meeting of shareholders and resolutions of the board of directors.

Form a branch in Bolivia: another option

Forming a branch in Bolivia is another possible option for companies looking to establish a permanent legal presence in the country. Unlike a subsidiary, a branch remains part of the same legal entity as the parent company and enjoys far less financial and operational independence.

International companies and foreign executives thinking about forming a branch in Bolivia must meet the following requirements:

- The parent company must authorize the opening of the branch in Bolivia and formalizes the appointment of the legal representative.

- The statutes of the parent company must regulate the internal administration of the branch and at the same time meet all local laws.

- The branch must open a corporate bank account in a Bolivian bank.

Once all requirements are met, the branch will be registered at the Bolivian Registry of Commerce and the National Tax Office.

Common Questions of Register a Subsidiary in Bolivia

1. How long does it take to register a subsidiary in Bolivia?

It can take 5 to 6 weeks after the required documentation has been provided by the client.

2. What are the minimum capital requirements for registering a subsidiary in Bolivia?

Bolivia does not have any specific minimum capital requirements for registering a subsidiary. However, it’s essential to have sufficient funds to cover initial expenses and operational costs.

3. Can foreign nationals create a subsidiary in Bolivia?

Yes, foreign nationals can create and own 100% of a subsidiary in Bolivia. There are no restrictions on foreign ownership in most industries.

4. Do I need to have a local director or shareholder to register a subsidiary in Bolivia?

No, there is no requirement to have a local director or shareholder to register a subsidiary in Bolivia. However, having a local representative can facilitate certain aspects of business operations.

5. Are there any incentives or benefits for foreign investors in Bolivia?

Yes, Bolivia offers various incentives and benefits for foreign investors, including tax exemptions, preferential treatment for certain industries, and access to international trade agreements.

Biz Latin Hub can help you register a subsidiary in Bolivia

Working with a locally-based partner with a proven track record is the soundest approach to entering the Bolivian market. That partner will be able to provide you expert advice on your best options while guaranteeing you are fully compliant with all local regulations.

At Biz Latin Hub, we’re committed to supporting foreign executives doing business in Bolivia, and throughout Latin America and the Caribbean. With our full portfolio of market entry and back-office services, we can provide comprehensive company formation services, as well as a wide range of corporate legal and accounting support.

Reach out now for further advice or a free quote.

Learn more about our team and expert authors.