Doing business in Guyana is an increasingly attractive prospect for foreign investors following years of rapid economic growth, with numerous opportunities available and the country set to enjoy the highest growth in Latin America and the Caribbean in 2021 and 2022. The process to register a business in Guyana involves seven key steps, as outlined below.

Located in the northeast of South America, where it is bordered by Brazil, Suriname, and Venezuela, Guyana is considered a Caribbean nation and is one of only three mainland countries from the region that is a member of the Caribbean Community (Caricom) — an economic association that includes Belize, Suriname and 13 mainly English-speaking Caribbean island nations, and is headquartered in Georgetown, the capital of Guyana.

Through Caricom, Guyana has free trade agreements (FTAs) in place with the likes of the Dominican Republic and Costa Rica, while the Caribbean Basin Trade Partnership Act (CBTPA) offers preferential access to the US market to businesses resident in Guyana.

Guyana has experienced rapid and exponential growth over recent years, with gross domestic product (GDP) increasing more than 600% between 2005 and 2020.

It is also one of the few countries in the world to have seen its economy continue to grow significantly during the COVID-19 pandemic, with GDP growing a staggering 43.5% in 2020 when most economies from the region saw decline, according to a recent report from the World Bank. While GDP growth has been predicted to drop back to 21.2% in 2021, it is then projected to hit 49.7% in 2022, according to that same report.

Much of those gains are due to a significant increase in oil production, with the government earlier this year seeking out partners to help it market its growing share of the crude oil being produced off its coast.

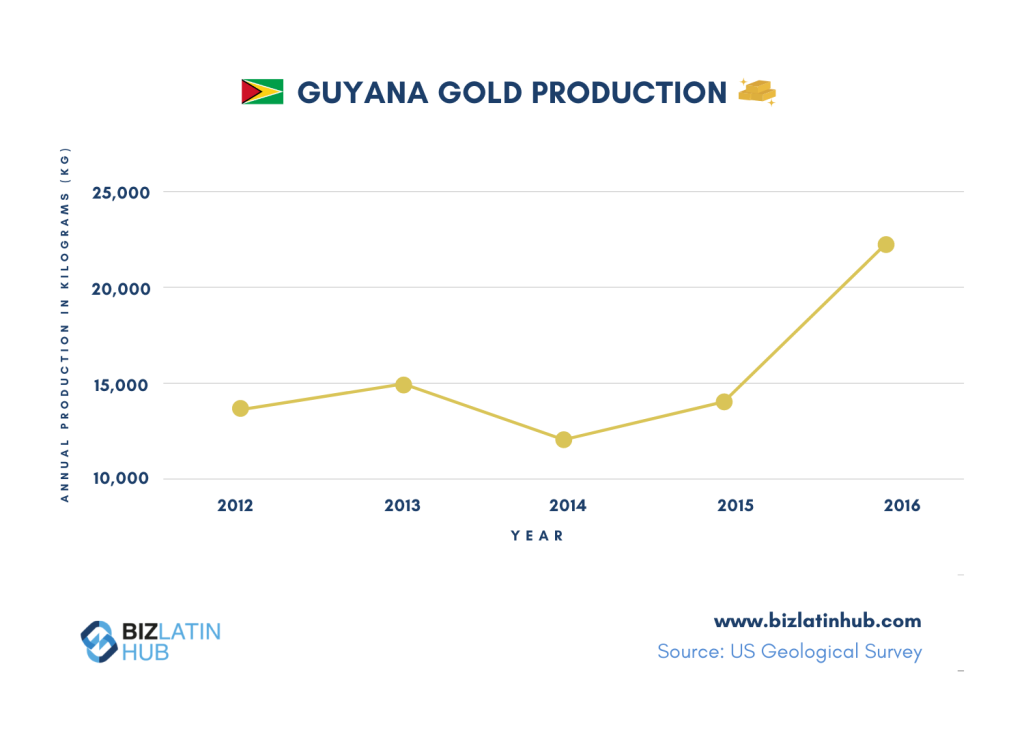

As well as oil, the country also has significant deposits of gold, diamonds, and aluminium ore, among other mineral deposits, while it has a large shipbuilding and shipping container building industry that contributes significantly to the economy. Beyond that, Guyana is a major producer of cultivated goods such as cereals and fish.

Key destinations for Guyanese exports include Canada, Ghana, Norway, Portugal, and Trinidad and Tobago.

If you are interested in doing business in this rapidly-growing Caribbean nation, read on to understand the seven key steps you will need to follow in order to register a business in Guyana.

Or go ahead and contact us now to discuss how we can support you entering and doing business in the country.

How to register a business in Guyana in 7 steps

The following guide is based on the process to form a limited liability company (LLC) — which is one of the most common entity types used by investors when they register a business in Guyana. In most cases, the process will be the same, regardless of the type of entity you register.

1. Choose your company name

By undertaking a search through Guyana’s companies registry, you will be able to ascertain whether another business is operating in the country under a similar name to the one you intend to use. In the event of a clash, you will need to come up with a new name.

2. Receive a declaration of compliance

To form an LLC, you will need to receive a declaration of compliance from a locally-registered lawyer. This document will declare that all signatories to the new companies articles of incorporation are eligible to be signatories, and as such your lawyer in Guyana will request information and documentation in order to be able to sign it, meaning the process will usually take a couple of days to complete.

Being eligible requires a person to be a legal adult, of sound mind, and not prohibited from being a signatory by outstanding legal matters.

3. Register the company with the Guyana Registry of Companies

With a name chosen and the compliance declaration signed, the next step to register a business in Guyana is to register the entity with the Guyana Registry of Companies, which will publicize issuing your company’s certificate of incorporation in the Official Gazette of Guyana.

This will include information such as the name of the company, its registered address, information on directors and shares, and restrictions to the business activity. This process will generally take around a week to complete.

4. Apply for a tax identification number

With the business registered, you will need to apply to the Guyana Revenue Services or a tax identification number (TIN), which will be used to identify your company for all tax purposes and invoicing matters. To complete this process, you will need to submit a completed TIN application along with the certificate of incorporation, as well as documentation proving the identities of directors. This process can be completed in a single day as long as all documentation is in order.

5. Register for a value-added tax

Within 15 days of business operations beginning, you must register for value-added tax (VAT) with the relevant department of the Guyana Revenue Authority. As long as the application is in order, a certificate will be issued by the department within 10 business days.

Note that in 2017, Guyana cut VAT to 14 percent and raised the annual sales threshold at which VAT registration is mandatory to 15 million Guyanese dollars (approximately $71,800 as of October 2021).

6. Register for the social security

The next step to register a business in Guyana is to register for social security, which will usually take around a week to complete and can be done at the same time as registering for VAT. The Guyanese National Insurance Scheme covers anyone between the ages of 16 and 60 who is working in insurable employment. Anyone outside of that age range may be covered on a voluntary benefit, but only for industrial benefits, which self-employed people are not eligible for.

For employees within the age range, social security contributions total 14% of their salaries, of which employers must cover 8.4% and deduct the remaining 5.6% from pay packets. For self-employed people, the total is 12.5%, while voluntary contributors pay 9.3%.

7. Complete the process to register a business in Guyana by creating a company seal

Under local legislation, to complete the process to register a business in Guyana, the company must create an embossed or rubber seal — the latte of which is most popular — with steel embossed stamps usually taking a week to arrive, while rubber stamps can come sooner. While this is the last step in the process, in practice it can be undertaken as soon as the certificate of incorporation is published.

Biz Latin Hub can help you register a business in Guyana

At Biz Latin Hub, our multilingual team of corporate support specialists can assist you when you register a business in Guyana, as well as helping you with ongoing operation in this fast-growing nation.

We offer a comprehensive portfolio of back-office services that includes company formation, accounting & taxation, corporate legal services, visa processing, and hiring & PEO, meaning we can put together a tailored services agreement to suit every need.

We have teams in place in 16 countries around Latin America and the Caribbean, as well as trusted partners in other markets, meaning that we can assist you almost anywhere in the region, and also specialise in multi-jurisdiction market entry and cross-border tax planning.

Contact us today to find out more about how we can support you.

Or read about our team and expert authors.