Whether you are considering company formation, registering a branch, or you simply want to be doing business in Paraguay, read on to find out how the country’s residency opportunities and taxation regime could be to your benefit. The country is a founder member of Mercosur, giving it access to ports for exportation and lessening the impact of being landlocked. Doing business in Paraguay is already attractive and looks set to strengthen.

Key takeaways on doing business in Paraguay

| Is foreign ownership allowed in Paraguay? | Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals). Capital flows are not restricted. |

| Most important sectors in Paraguay | The main drivers of its economy are agriculture, livestock, retail, and construction. |

| Are there Free Trade Zones in Paraguay? | There are two in Ciudad del Este by the Argentine and Brazilian borders, focused on manufacturing and warehousing for export. |

| Incentives for Foreign Direct Investment in Paraguay | REDIEX is an organization run by the Ministry of Commerce which aims to assist foreign companies doing business in the country. Law 60/90 encourages FDI in certain regions. |

| International links | Paraguay has membership of Mercosur. The country also has free trade access to other key markets in the region. |

Crescimento consistente e estabilidade

Despite being a landlocked country, it is in a strong position for trade due to its proximity to Brazil and Argentina. These two countries have the region’s largest and third-largest economies, and gaining access to their markets is a strong reason for starting a business in Paraguay.

Paraguay’s rapid growth has been met with a concomitant increase in interest among international investors, with foreign direct investment (FDI) inflows growing to USD$207 million. In the past decade, Paraguay averaged four per cent yearly GDP growth.

The main drivers of its economy are agriculture, livestock, retail, and construction. Paraguay has a low tax burden and low public debt. There are strong trade relations with its neighbors, especially Brazil and Argentina.

Starting a business in Paraguay also means membership of the Mercosur trade bloc, a free trade initiative that recently celebrated its 30th anniversary. The country also has free trade access to other key markets in the region, thanks to its membership in the Southern Common Market (MERCOSUR), with the government maintaining a pro-business regulatory framework.

Como o país também tem custos de mão de obra relativamente baixos, fazer negócios no Paraguai representa uma perspectiva atraente para investidores estrangeiros que buscam se expandir na região, especialmente devido à iniciativa do governo de simplificar a obtenção de residência permanente.

Opportunities for doing business in Paraguay

Companies and entrepreneurs should be looking to invest in Paraguay for the following five reasons:

1. A young and competitive workforce

Paraguay boasts one of the youngest workforces in the region, with an average age of 26.3 years old. That workforce is also increasingly urbanized, with 62.5% of the population currently living in urban areas.

Employees are available at highly competitive rates.

Moreover, Paraguay has seen English proficiency rise in recent years and is now among the top five nations in the region for English proficiency, making it all the more attractive for doing business.

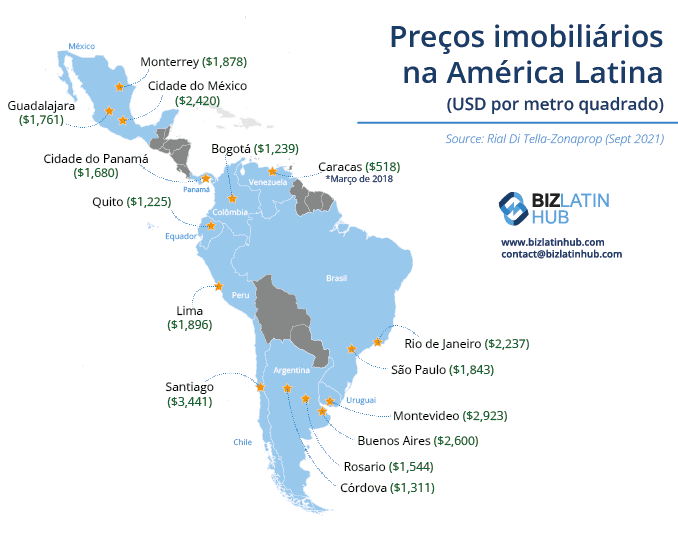

2. Strong real estate returns

Paraguay boasts one of the strongest real estate sectors in the region, with returns on investment often up to 50% higher than in other markets in the region, and buy-to-let

Those strong returns are bolstered by a low-tax regime, with value-added tax (VAT) set at just 10%, offering even more reason to invest in Paraguay.

The opportunities on offer in the Paraguayan real estate market have seen it draw increasing interest from investors, with a particular influx of capital coming from neighbouring Argentina in recent years.

3. An increasingly international outlook

Once somewhat economically isolated from the world, Paraguay is adopting an increasingly international and outward facing outlook that encourages foreign investment.

That has seen it initiate talks with Chile over what would be the country’s first bilateral free trade agreement (FTA), to compliment the agreements it has in place via its membership of the Southern Common Market (Mercosur), an economic association that also includes the other Southern Cone nations of Argentina, Brazil, and Uruguay.

It also saw the country adopt new transfer pricing norms in keeping with standards established by the Organisation for Economic Co-operation and Development (OECD) — an international trade organization known as the “good practice club” that Paraguay is seeking to join as a full member.

4. Streamlined residency for those who invest in Paraguay

Among the measures the country has taken to encourage more people to invest in Paraguay is to streamline the residency process. The country has taken measures to slash the time taken to gain residency through investment from two years to just a few months.

That despite the fact that Paraguay already had one of the most favourable residency regimes for investors in the region.

5. Ease of doing business

Paraguay is a pro-business country that is not only highly encouraging of FDI, but also runs a regime that makes it easy to invest.

That includes no history of confiscations or sudden changes in investment rules, a robust set of employment laws, and strict protection of intellectual property, providing significant confidence to investors.

The country also boasts a company formation process with minimal red tape, a well-established industrial base for anyone seeking to enter the manufacturing sector, and a growing innovation sector.

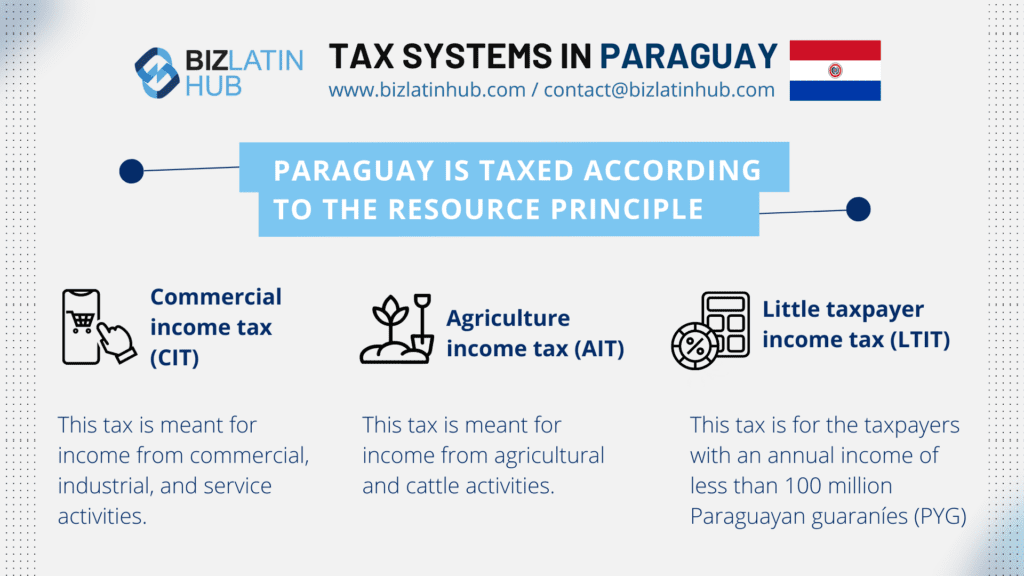

Impostos que você deve considerar ao fazer negócios no Paraguai

Se você está planejando fazer negócios no Paraguai, deve entender os seguintes impostos corporativos para estar em total conformidade com as autoridades fiscais e garantir a boa saúde de sua empresa:

Imposto de renda comercial para pequenas e médias empresas

In order to alleviate the tax burden on companies doing business in Paraguay, the government has established a streamlined corporate income tax.

This is known as a ‘simple tax’ for medium-sized companies and a ‘very simple tax’ for small companies.

These taxes are set annually, based on the amount of gross income obtained by the company the previous year.

Observe que esse regime tributário anual fixo reduz significativamente a quantidade de papelada e a contabilidade exigidas por lei.

Regras de preços de transferência de acordo com os padrões da OCDE

A legislação paraguaia aplica regras gerais de preços de transferência com base nas estipulações da Organização para Cooperação e Desenvolvimento Econômico (OCDE). As entidades afetadas pelas regulamentações de preços de transferência são incentivadas a se envolver com uma empresa de consultoria tributária confiável capaz de realizar um estudo profissional de preços de transferência.

Tax on dividends and profits for residents and non-residents

Esse imposto é aplicado aos lucros, dividendos e rendimentos pagos ao proprietário, consórcio, parceiros ou acionistas de entidades que fazem negócios no Paraguai, bem como aos estabelecimentos permanentes de entidades incorporadas no exterior. Observe que a alíquota desse imposto é de 8% quando o beneficiário dos lucros for uma pessoa física, jurídica ou residente no país e de 15% quando o beneficiário desses lucros for um não residente, incluindo empresas controladoras no exterior.

Taxes on personal services

O imposto de renda de pessoa física (IRP) aplica-se à renda proveniente de ganhos de capital e à renda derivada da prestação de serviços pessoais. A alíquota do IRP sobre ganhos de capital é de 8%, enquanto a alíquota do IRP sobre a renda derivada de serviços pessoais está entre 8% e 10%, dependendo da renda líquida do contribuinte.

Imposto de renda para não residentes

A lei paraguaia implementa um imposto sobre a renda de não residentes (INR) que é imposto sobre a renda ou os lucros obtidos por pessoas físicas, pessoas jurídicas e outras entidades não residentes que fazem negócios no Paraguai. A alíquota do INR é de 15% e é aplicada à renda líquida gerada no Paraguai.

FAQs on doing business in Paraguay

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Paraguay?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Paraguay?

| There are two in Ciudad del Este by the Argentine and Brazilian borders, focused on manufacturing and warehousing for export. |

3. How long does it take to register a company in Paraguay?

Registering a company in Paraguay takes 8 weeks.

4. Which sectors are important in Paraguay?

The main drivers of its economy are agriculture, livestock, retail, and construction

5. Does Paraguay have trade agreements with other countries?

Starting a business in Paraguay also means membership of the Mercosur trade bloc, a free trade initiative that recently celebrated its 30th anniversary. The country also has free trade access to other key markets in the region, thanks to its membership in the Southern Common Market (MERCOSUR), with the government maintaining a pro-business regulatory framework.

6. What entity types offer Limited Liability in Paraguay?

In Paraguay, both “S.A.S” (Sociedad por Acciones Simplificada) and “S.A” (Sociedad Anónima) are limited liability entity types.

Biz Latin Hub can help you with doing business in Paraguay

Você pode contar com um consultor tributário especializado para entender os impostos corporativos ao fazer negócios no Paraguai. Na Biz Latin Hub, nossa equipe multilíngue de especialistas em impostos está pronta para ajudar você a desenvolver com sucesso seu empreendimento comercial no Paraguai e aproveitar o ambiente favorável aos negócios do país.

Entre em contato conosco agora para que possamos começar a ajudar você a melhorar sua conformidade fiscal no Paraguai.

Saiba mais sobre nossa equipe e autores especializados.