Understanding the characteristics of business types in New Zealand is essential for choosing the optimal corporate structure when looking to register a company in New Zealand. Understanding and adhering to all legal and accounting requirements specific to the legal entities will bolster your businesses’ smooth operations and continued compliance. Working with local experts allows you to navigate the regulatory framework with confidence and clarity. Whether opting for flexibility or liability protection, at Biz Latin Hub, we provide the knowledge and support you need to ensure seamless integration into New Zealand’s entrepreneurial ecosystem. This guide compares the advantages and disadvantages of the three primary structures—Sole Trader, Partnership, and Company—to help you make an informed decision.

Key Takeaways: Business Structures in New Zealand

| What are the three main business structures in New Zealand? | LLC. Partnership. Sole Trader. |

| Which structure is most suitable for foreign investors? | A Limited Liability Company offers the best personal liability protection, meaning that the company’s obligations are separate from those of its shareholders. |

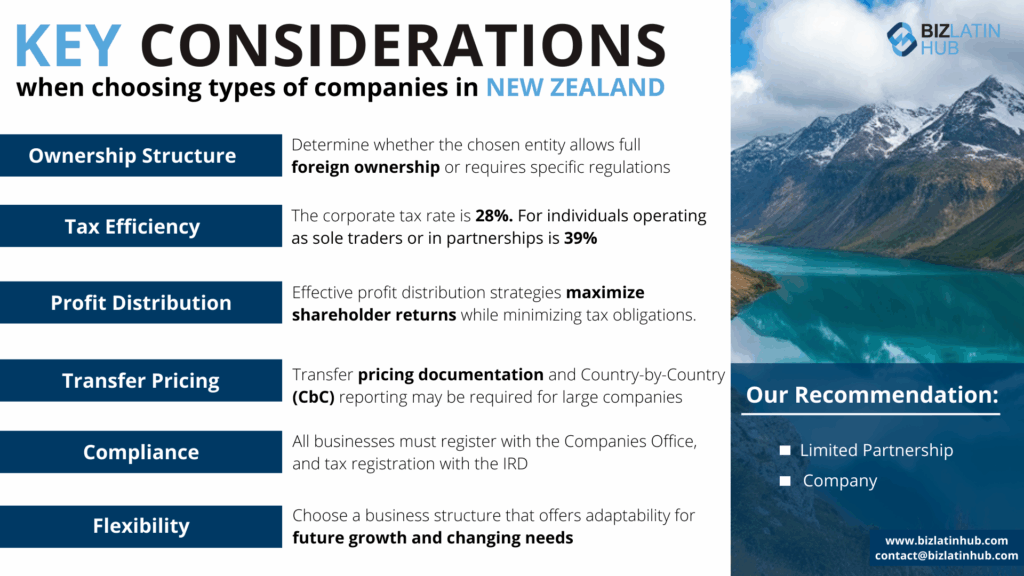

| What are the primary considerations when choosing a legal entity in New Zealand? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

| What are the key disadvantages of operating as a Sole Trader? | Unlimited personal liability for all business debts; limited access to capital; can be perceived as less professional. |

| What are the charactistics of a partnership? | A Partnership involves shared profits, losses, and joint liability. |

The 5 Most Common Business Types in New Zealand

There are various types of legal entities in New Zealand available for foreign investors, these include:

- Sole Trader.

- Partnership.

- LLC.

A fiscal address for the company needs to be specified as well as the person or people who will administer it.

Keep reading if you are interested in doing business in New Zealand and need to find out about the different types of companies available.

1. Sole Trader

- Pros: Easy and inexpensive to set up; full control over the business; minimal administrative requirements.

- Cons: Unlimited personal liability for all business debts; limited access to capital; can be perceived as less professional.

The Sole Trader structure is the simplest and most straightforward business structure in New Zealand. It is designed for individuals who wish to operate a business on their own. This structure does not create a separate legal entity, meaning the sole trader and the business are legally the same and can be set up in a couple days.

Sole traders have complete control over their business operations and decisions but are personally liable for all debts and obligations incurred by the business. This structure is particularly suitable for freelancers, contractors, and small business owners with low operational risks or investors looking to start off slow in the country.

Key Characteristics and Requirements:

- Legal Entity: The sole trader and the business are the same legal entity.

- Ownership: Owned and operated by one person.

- Liability: The sole trader is personally liable for all debts and obligations of the business.

- Taxation:

- Business income is taxed as part of the sole trader’s personal income.

- Sole traders must file an annual personal income tax return (IR3).

- Goods and Services Tax (GST) registration is required if annual turnover exceeds NZD $60,000.

- Legal Requirements:

- Registration with Inland Revenue (IR) for tax purposes.

- No formal registration with the Companies Office is required.

- Business name registration is optional but recommended for branding purposes.

If you grow a team quickly, you can still operate under this business structure, as you’re able to recruit and pay staff as part of your business.

2. Partnership

- Pros: Relatively easy to set up; shared workload and capital contribution; combined skills and expertise.

- Cons: Unlimited joint and several liability for all partners; potential for disputes between partners; profits must be shared.

Another common business structure in New Zealand is the partnership, which is formed with two or more individuals. Similarly to a Sole Trader business, you’ll be liable for all debts and challenges brought to your business, but you’re able to split the liability with other business partners and share day-to-day responsibilities. Many foreign investors choose to enter into a partnership in New Zealand with a local entrepreneur in order to bypass foreign ownership and enter into markets that are off-limits to international investors and require residency.

A Partnership is a business structure where two or more individuals or entities come together to run a business. Partnerships in New Zealand operate under the Partnership Act 1908 and are commonly used for professional practices (e.g., law firms, accounting firms) or small businesses.

Unlike a company, a partnership is not a separate legal entity, meaning the partners are personally liable for the debts and obligations of the business. A partnership agreement is strongly recommended to outline the rights and responsibilities of each partner, as well as the profit-sharing arrangements.

Key Characteristics and Requirements:

- Partners: Requires at least two partners, who can be individuals or legal entities of any nationality. There is no maximum limit.

- Liability: Partners share unlimited liability for the business’s obligations and debts, unless a Limited Partnership is established.

- Taxation:

- Partnerships are tax-transparent, meaning profits and losses are passed through to the partners and taxed at their individual tax rates.

- Partners must file individual tax returns.

- GST registration is required if annual turnover exceeds NZD $60,000.

- Legal Requirements:

- No formal registration with the Companies Office is required.

- Registration with Inland Revenue (IR) is required for tax purposes.

- A partnership agreement is optional but strongly recommended.

3. Limited Liability Company (LLC)

- Pros: Limited personal liability for shareholders; separate legal identity; easier to raise capital; professional credibility.

- Cons: More complex and costly to set up; significant administrative and compliance obligations; less flexibility in some decision-making.

A Limited Liability Company is one of the most commonly used legal structures in New Zealand, suitable for businesses of all sizes. It is a separate legal entity, meaning the company itself can own property, enter contracts, and incur debts independently of its shareholders and directors. This structure provides limited liability protection to its shareholders, making it an attractive option for entrepreneurs and businesses looking to protect personal assets while operating in a professional and scalable framework.

New Zealand companies are governed by the Companies Act 1993 and are registered with the Companies Office, which maintains a public record of registered companies. The flexibility and simplicity of incorporation make the company structure particularly appealing to both local and foreign investors.

Expert Tip: The Company is the Best Choice for Liability Protection

From our experience working with both local and foreign entrepreneurs, the Limited Liability Company is almost always the recommended structure. The key reason is liability protection. As a Sole Trader or Partner, your personal assets (like your house and car) are at risk if the business incurs debt or is sued. A company is a separate legal person, meaning business debts are the company’s responsibility, not yours personally. For any business that intends to grow, hire employees, or take on debt, the protection offered by a company structure is an essential and non-negotiable advantage.

Key Characteristics and Requirements:

- Legal Entity: A company is a separate legal entity distinct from its shareholders and directors.

- Shareholders: Requires at least one shareholder, who can be an individual or legal entity, either local or foreign.

- Directors: Requires at least one director, and at least one director must either live in New Zealand or be resident in an approved enforcement country (e.g., Australia).

- Liability: Shareholders’ liability is limited to the value of their shares. Directors, however, have certain legal obligations under the Companies Act.

- Capital Requirements: There is no minimum capital requirement; shares are issued as specified in the company constitution.

- Taxation:

- Companies are subject to corporate income tax at a rate of 28%.

- Dividends are subject to withholding tax but may qualify for imputation credits to avoid double taxation.

- Legal Requirements:

- Registration with the Companies Office is mandatory.

- The company must have a registered office and an address for service in New Zealand.

- An annual return must be filed with the Companies Office.

Other types of entity in New Zealand

Limited Partnership

The Limited Partnership (LP) is a flexible business structure that combines the features of a partnership and a company. It is commonly used for investment funds, joint ventures, or businesses involving passive investors who do not wish to participate in day-to-day management.

The Limited Partnerships Act 2008 governs LPs in New Zealand, offering a balance of limited liability for investors (limited partners) and operational control for managers (general partners). This structure is particularly attractive for businesses that require external investment while ensuring efficient management.

Key Characteristics and Requirements:

- Partners:

- Requires at least one general partner and one limited partner, who can be individuals or legal entities, either local or foreign.

- A person or entity cannot simultaneously act as both a general and limited partner in the same partnership.

- Liability:

- General partners have unlimited liability for the partnership’s debts and obligations.

- Limited partners’ liability is restricted to the amount they contribute to the partnership.

- Legal Entity: While an LP is a separate legal entity, it is transparent for tax purposes (taxed as a partnership rather than a company).

- Taxation:

- Profits and losses are passed through to the partners and taxed at their respective tax rates.

- General partners may be taxed as self-employed individuals.

- Legal Requirements:

- Registration with the New Zealand Companies Office under the Limited Partnerships Register.

- An LP agreement must outline the operational and financial terms of the partnership.

- The LP must have a registered office and address for service in New Zealand.

Trust

A Trust is a legal arrangement in which a trustee manages assets on behalf of beneficiaries. Trusts are widely used in New Zealand for asset protection, estate planning, and managing investments. They are governed by the Trusts Act 2019, which modernized and clarified the responsibilities of trustees and the rights of beneficiaries.

Trusts can be set up for a variety of purposes, including business operations. A trust that operates a business is typically known as a “trading trust.” Trustees have a fiduciary duty to act in the best interests of the beneficiaries while adhering to the terms of the trust deed.

Key Characteristics and Requirements:

- Trustees: At least one trustee is required, who can be an individual or a corporate entity.

- Beneficiaries: The trust must name one or more beneficiaries who will benefit from the assets held in the trust.

- Liability: Trustees are personally liable for the trust’s obligations but can limit their liability if the trust deed specifies this.

- Taxation:

- Trusts are taxed at a flat rate of 33% on retained income.

- Income distributed to beneficiaries is taxed at their individual tax rates.

- GST registration is required if annual turnover exceeds NZD $60,000.

- Legal Requirements:

- A trust deed must be prepared, outlining the purpose and rules of the trust.

- Trustees must keep detailed financial and operational records.

- Registration with Inland Revenue (IR) is required for tax purposes.

Summary: Choosing the Right Structure

The choice of business structure is a foundational decision with long-term legal and financial implications. The best structure depends on your personal liability tolerance, capital requirements, and long-term business goals.

Ownership Structure

New Zealand provides a highly favorable environment for foreign investors, allowing 100% foreign ownership in most industries without requiring local partners. However, certain sectors, such as telecommunications, aviation, and land purchases (especially sensitive or rural land), may require approval from the Overseas Investment Office (OIO). Understanding these industry-specific regulations and obtaining necessary permissions is critical for smooth operations and legal compliance.

Tax Efficiency

New Zealand has a straightforward tax system, with a flat corporate income tax rate of 28%. For individuals operating as sole traders or in partnerships, income is taxed at personal rates, which are progressive and capped at 39%. There is no capital gains tax in New Zealand, but some transactions, such as property sales, may be taxed as income. Additionally, the Goods and Services Tax (GST) is 15%, applied to most goods and services. Businesses exporting goods or services may be eligible for GST exemptions. Tax planning is vital for optimizing profitability while remaining compliant with New Zealand’s Inland Revenue Department (IRD) regulations.

Profit Distribution

Profits distributed to shareholders are taxed under New Zealand’s imputation system, where companies attach imputation credits to dividends to reflect the corporate tax already paid. This system helps prevent double taxation for resident shareholders. For non-resident shareholders, dividends are subject to a withholding tax of 15%, which may be reduced under New Zealand’s double taxation treaties with countries like Australia, the UK, and the US. Effective profit distribution strategies maximize shareholder returns while minimizing tax obligations.

Transfer Pricing

Comply with New Zealand’s transfer pricing regulations, which align with OECD guidelines. Businesses must ensure that related-party transactions reflect arm’s-length pricing. Companies engaging in cross-border transactions, such as intercompany loans or the transfer of goods, services, or intellectual property, must maintain proper transfer pricing documentation to avoid penalties. Larger companies may also need to comply with Country-by-Country (CbC) reporting requirements.

Compliance

Prepare for New Zealand’s regulatory compliance obligations. All businesses must register with the Companies Office, and tax registration with the IRD is required to obtain an IRD number. Financial reporting requirements vary depending on the company’s size and structure. Small and medium-sized enterprises (SMEs) often face fewer reporting obligations, while larger companies may need to comply with International Financial Reporting Standards (IFRS). Monthly or bi-monthly GST filings and annual income tax returns are mandatory. Compliance with New Zealand’s employment laws, including paying into KiwiSaver (a voluntary retirement savings scheme) and other employee benefits, is essential to avoid penalties and maintain a good business reputation.

Flexibility

Choose a business structure that suits your operational needs and long-term growth strategy. The common types of business entities in New Zealand include:

- Company:

The most common structure for businesses of all sizes, offering limited liability for shareholders and flexibility in raising capital. Companies require at least one director and one shareholder, with directors needing to meet residency requirements (at least one director must reside in New Zealand or an approved jurisdiction such as Australia). - Limited Partnership:

A structure combining the benefits of limited liability for passive investors (limited partners) and operational flexibility for active partners (general partners). Limited partnerships are ideal for investment-focused businesses or joint ventures, offering privacy as limited partners’ identities are not publicly disclosed. - Sole Trader:

A simple and cost-effective structure for individual entrepreneurs, where the owner and the business are legally the same. The sole trader retains full control but is personally liable for all debts and obligations. It is suitable for small-scale operations or those just starting out. - Partnership:

A structure for two or more individuals or entities carrying on a business together. Partners share profits, responsibilities, and liabilities based on their partnership agreement. It is straightforward to set up and is often used for small or family-run businesses. - Trust:

Often used for holding and managing assets, a trust is controlled by trustees who manage the business or assets on behalf of beneficiaries. Trusts are particularly useful for estate planning or protecting assets and can provide tax advantages depending on the circumstances.

Selecting the right structure ensures your business can operate effectively within New Zealand’s legal and regulatory framework, while also providing flexibility to adapt to future growth or market changes.

Common FAQs About Business Types in New Zealand

A Sole Trader is the simplest structure. It is an individual running a business on their own. There is no legal distinction between the owner and the business, meaning the owner is personally responsible for all business debts.

In a partnership, “joint and several liability” means that each partner is individually liable for the full amount of the partnership’s debts, regardless of who incurred the debt. If the business fails, a creditor can pursue any one partner for the entire amount owed.

- Labour: Entering into a partnership means labor is shared between partners, reducing the stress and responsibility of establishing a business in a new market. Remember to foster a great company culture to ensure all partners are on the same wavelength.

- Capital: Partnerships allow entrepreneurs to combine their investments, increasing their yield and allowing them to enter into industries that require upfront capital. Most partnerships are formed on equal investments and ownership, though not always.

- Risk: Incorporating a business in New Zealand does not come without its risks – if you choose the wrong niche or industry, you could lose money. Entering into a partnership enables businesses to reduce their level of risk and upfront investment.

- Entity: Partnerships are not separate entities, and you and any partners will share ownership of the business. This can have drawbacks in some industries, where firms prefer to work with Companies, or if you were to grow and want to add shareholders.

- Liability: Partners are jointly liable when incorporating a Partnership, though if one cannot pay their Partnership debts, the other may be solely responsible.

- Relationships: Whilst a partnership offers real benefits, it requires business partners to remain on good terms and agree on all major business decisions – something that is not always possible. Protect yourself by working with a lawyer to create partnership agreements that outline your business, investment, profit share, liability, and plan should the partnership be dissolved, including the distribution of capital and assets.

The main advantage is that the company is a separate legal entity. This limits the owner’s (shareholder’s) personal liability for business debts to the amount they have invested in the company.

- Regulation: Companies in New Zealand must follow strict regulations, legislation, and guidelines, or face severe consequences. Working with a company that offers local business law makes sense, and ensures your firm remains fully compliant.

- Recording: Companies are required by law to record shareholder meetings and other business activities, and report to Companies House as and when necessary.

- Incorporation: Incorporating a Company is more expensive than Sole Traders and Partnerships. It is recommended that you work with a business lawyer or solicitor.

Yes. A Sole Trader has the simplest requirements, typically just registering with Inland Revenue. A Partnership has a partnership agreement. A Limited Liability Company has the most formal requirements, including registration with the Companies Office, filing an annual return, and keeping formal records.

Why Choose to Invest in New Zealand?

Home to a growing population of close to five million people and a strong GDP, New Zealand is becoming an increasingly popular choice for entrepreneurs considering starting a business in a foreign country.

Indeed, foreign investment in the country doubled between 2001 and 2015, reaching new highs of $100 billion per annum according to the latest data.

With the United States, Canada, Australia and the United Kingdom among the top investors, entering into the market sooner rather than later is the key to your success.

New Zealand dominates in sectors such as fishing, mining, forestry, and financial services, and there are huge opportunities for entrepreneurs looking to incorporate a company and take advantage of its growing markets.

But to do so, you not only need to find a gap in the market but also determine the most effective company structure before you begin trading.

Biz Latin Hub can help you with legal entities in New Zealand

At Biz Latin Hub, we offer a range of back-office services to support foreign entrepreneurs make an impression on New Zealand. If you’re ready to get started in the country, but don’t know the best business structure or require legal or due diligence support, you can depend on our time-served New Zealand business experts, who are based in the country.

To get started, get in touch with us for personalized support.