If you are considering entering the Honduran market for a short-term or limited-scale commercial activity, or would simply like to get to know the business environment better before making a deeper investment, hiring staff via a professional employer organization (PEO) in Honduras can be a good option. When you hire via a professional employer organization in Honduras — which can also be known as an employer of record (EOR) — you retain full control over those staff without having to go through company formation in Honduras.

Key takeaways on using an PEO in Honduras

| Hiring support | Full support |

| Legality of using a PEO in Honduras | Fully legal |

| Presence in the country | Limited – company formation will be necessary for full presence |

| Working hours | 44 hours weekly |

| Minimum monthly wage covered by an PEO in Honduras | Depends on a number of factors and ranges from 8,134 Lempiras (approximately USD$325) to a maximum of 16,856 Lempiras (approximately USD$760) |

How can a professional employer organization in Honduras help you?

A professional employer organization in Honduras will essentially hire staff on your behalf via its locally established entity. That means that those workers will be considered employees of the PEO firm in the eyes of local authorities, but you will retain full control over their workloads and schedules.

That means you can enter the market in only the time it takes to find the right staff and exit in the time it takes them to serve their statutory notice period. When you contract the professional employer organization in Honduras to seek those staff out, using their established recruitment network, that means you can have workers in a couple of weeks, or even a few days, depending on the profile you are looking for.

Once those workers have been found, the PEO in Honduras will manage their payroll and guarantee compliance with all local norms, including timely payment of salaries and statutory benefits, as well as honoring leave and vacations.

While PEO services will come with a cost-per-employee hired, that will generally be significantly less than going through company formation and liquidation. This is another reason to hire via a PEO in Honduras.

Advantages of hiring via a professional employer organization in Honduras?

Hiring via a professional employer organization in Honduras comes with the following benefits:

Limited commitment: When you hire staff through a professional employer organization in Honduras, you limit your commitment to the market, allowing you the opportunity to get to know it better ahead of making a deeper investment, as well as to swiftly exit the market whenever needed.

Time-saving: Being able to secure local staff in just weeks or days, depending on their profiles, getting staff via a professional employer organization in Honduras can be a rapid and convenient process.

Established network: While the established recruitment network of your PEO in Honduras will help you to find staff quickly, you will also be able to tap into the local business connections the PEO firm has, which could be highly beneficial to your organization later down the road.

Building familiarity: By hiring via a professional employer organization in Honduras in Honduras, you have the opportunity to get to know the local market better, building familiarity with the regulatory regime, and understanding some of the foibles of doing business in the market, which will be useful should you decide to take your investment to the next level via company formation.

Reduced costs: The PEO fees you will incur will likely be considerably less than the costs associated not only with company formation, but also hiring staff to manage payrolls and oversee your statutory compliance in the country.

Legal representation: When you hire via professional employer organization in Honduras, you can count on the advice and support of their local legal experts, who will not only be able to represent your organization in front of authorities, but will also be able to provide you with ongoing advice on legislative changes that may affect your business.

Employment law in Honduras: Key guidelines

- Employment Probation Period

- Working Hours

- Annual Leave in Honduras

- Sick Leave

- Maternity Leave

Employee Probation Period: During the initial assessment phase, a probationary period not exceeding 60 days is observed.

Working Hours: Typically, the duration of work per day should not surpass eight hours, and the cumulative weekly limit is 44 hours. For individuals working night shifts, the weekly workload must not exceed 36 hours. For those working a combination of day and night shifts, the upper limit stands at 42 hours per week.

Annual Leave in Honduras: The allocated minimum vacation duration for employees under the Honduran jurisdiction is as outlined:

- 10 days of vacation following the completion of the first year of employment

- 12 days after the second year

- 15 days following three years of service

- 20 working days for a tenure of four years or more.

Sick Leave: Employees have the right to receive paid sick leave when facing short-term incapacitation due to an occupational accident. This compensation is granted at a rate of two paid sick days per month within the initial 12 months of employment and subsequently at a rate of four paid sick days per month. The cumulative allowance extends to a maximum of 120 paid sick days.

Maternity Leave: As stipulated by the Labor Code, employees are entitled to a span of 10 weeks or 70 days for paid maternity leave. To receive this benefit, a worker is required to provide the employer with a medical certificate detailing the pregnancy, anticipated delivery date, and the intended commencement date of the maternity leave. This period encompasses 4 weeks preceding the birth and 6 weeks succeeding it.

FAQs on hiring through an PEO in Honduras

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through an PEO in Honduras:

You can hire an employee by incorporating your own legal entity in Honduras, and then using your own entity to hire employees, or you can hire through an employer of record (EOR), which is a third party organization that allows you to hire employees by acting as the legal employer. With an EOR you do not need a Honduran legal entity to hire local employees.

Collective bargaining agreements (CBAs) and labor unions wield significant influence within Honduras, impacting the dynamics of your relationship with employees. It is imperative to factor in these elements before proceeding to hire and offer employment in the country.

Honduran regulations mandate employers to formulate robust employment contracts encompassing crucial details like compensation, benefits, termination protocols, and more. It’s crucial to express all remuneration figures in Honduran lempira, the local currency. Additionally, your contractual documentation must align with the provisions outlined in any applicable CBA or labor union regulations.

An important legislative change occurred in April 2022 with the repeal of the law permitting hourly employment. As of June 2022, only indefinite term contracts, fixed term contracts, and project contracts remain permissible. This shift in regulation necessitates a proactive adjustment in your approach to employment contracts within the country.

Vacational Leave in Honduras: The allocated minimum vacation duration for employees under the Honduran jurisdiction is as outlined:

10 days of vacation following the completion of the first year of employment

12 days after the second year

15 days following three years of service

20 working days for a tenure of four years or more.

Sick Leave: Employees have the right to receive paid sick leave when facing short-term incapacitation due to an occupational accident. This compensation is granted at a rate of two paid sick days per month within the initial 12 months of employment and subsequently at a rate of four paid sick daysper month. The cumulative allowance extends to a maximum of 120 paid sick days.

Maternity Leave: As stipulated by the Labor Code, employees are entitled to a span of 10 weeks or 70 days for paid maternity leave. To receive this benefit, a worker is required to provide the employer with a medical certificate detailing the pregnancy, anticipated delivery date, and the intended commencement date of the maternity leave. This period encompasses 4 weeks preceding the birth and 6 weeks succeeding it.

The total cost for an employer to hire an employee in Honduras can vary depending on the salary. However, as a rough estimate, the employer’s cost for mandatory employment benefits is approximately 13% of the gross employee salary. This is in addition to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

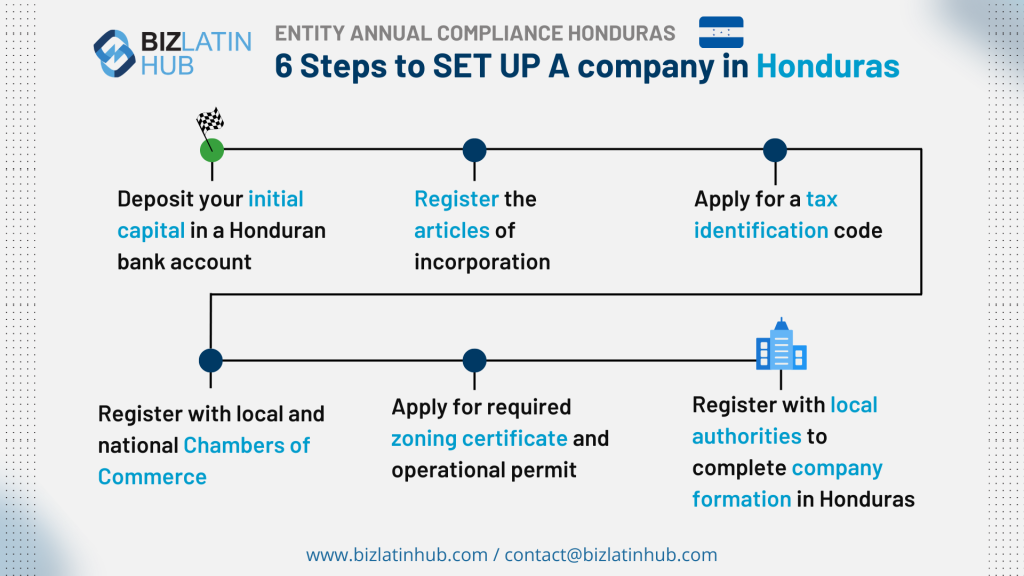

Forming a legal entity is different to hiring an PEO in the following ways:

– Creates a permanent presence in the country.

– Expenses are deductible through a local entity.

– Enables the ability to execute contracts and agreements locally.

– Facilitates invoicing through a local entity.

– Requires compliance support.

– Empowers direct hiring of employees.

A PEO operates as a co-employer alongside your company, whereas an EOR serves as the official employer of your staff. An EOR typically offers a broader range of services than a PEO.

Professional Employer Organization in Honduras – Free Trade Zones

Honduras is party to a range of free trade agreements, both via agreements struck collectively with other Central American nations, as well as bilateral accords, providing businesses with preferential access to the likes of Canada, the European Union, Mexico, the United States, and the United Kingdom.

The country has a well-developed agricultural sector, with farmed products such as bananas, coffee, and fish key to the economy. Meanwhile, a growing industrial base sees the company produce considerable amounts of garments and electrical equipment for export, with many manufacturers based in the country’s free trade zones (FTZs). These FZAs make it beneficial to hire via a professional employer organization in Honduras

Free Trade Zones (FTZs) in Honduras are designated areas aimed at attracting foreign investment and promoting economic growth by offering various incentives to businesses. Established in the early 1970s, these zones have played a crucial role in boosting Honduras’ manufacturing and export sectors. The most prominent FTZ is the Puerto Cortes zone, located near the country’s main port, which facilitates easy import and export of goods.

Companies operating within these zones enjoy benefits like tax exemptions, duty-free import and export of raw materials and finished products, streamlined customs procedures, and simplified regulatory requirements. This business-friendly environment attracts foreign investors, creating employment opportunities for the local population and encouraging technology transfer and skills development. Continue reading to learn more concerning how to hire via a professional employer organization in Honduras.

If you are interested in doing business in this growing Central American economy, read on to understand what a professional employer organization in Honduras can do for you, as well as some of the advantages of choosing a PEO firm. Or go ahead and contact us now to discuss your options.

Biz Latin Hub provides hiring & PEO services in Honduras

At Biz Latin Hub, our multilingual team of PEO & hiring experts is equipped to quickly help you find your ideal staff in Honduras. With our complete portfolio of back-office support options, including legal, accounting, company formation, and commercial representation services, we can be your single point of contact for entering the market and doing business in Honduras, or any of the other 17 countries around Latin America and the Caribbean where we are present.

Reach out now for personalized assistance or a free quote.

Or learn more about our team and expert authors.