El Salvador is an emerging destination for companies expanding into Central America. However, managing compliance, labor obligations, and payroll can be complex. Partnering with a Professional Employer Organization (PEO) or Employer of Record (EOR) in El Salvador allows your company to hire employees without needing to form a local legal entity. Biz Latin Hub offers comprehensive PEO and EOR solutions to help you operate legally and efficiently or to register a company in El Salvador if you wish.

Key Takeaways

| Is it legal to hire in El Salvador through PEO services? | Yes it is legal to work with PEO providors to outsource HR and Payrole functions in El Salvador. |

| What are the benefits of hiring through an PEO in El Salvador? | Hiring through a PEO in El Salvador provides quick access to the market without the need to establish a local entity, letting you get started in days not months. |

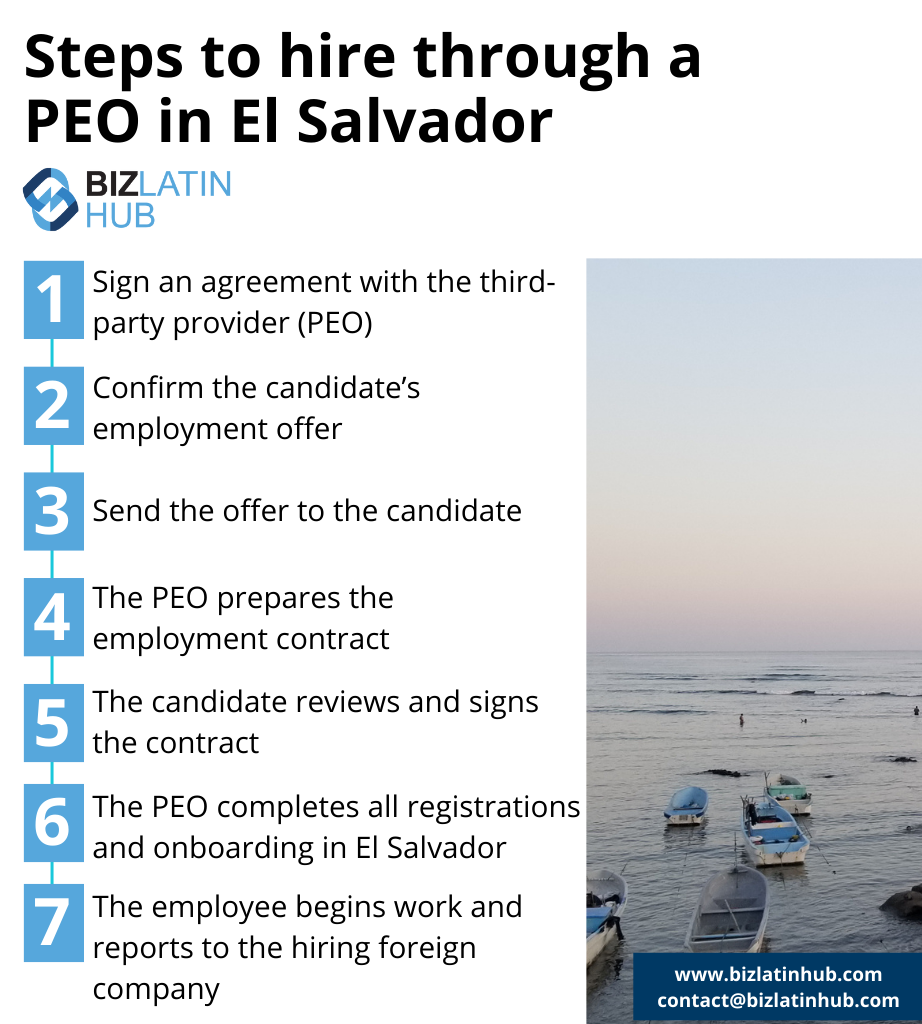

| Steps to hire through a PEO in El Salvador | Sign an agreement with the third-party provider (PEO). Confirm the employment offer for the candidate. Share the employment offer with the candidate. Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record. The candidate reviews and signs the employment contract. The PEO completes all mandatory employee registrations in El Salvador. The employee starts work and reports to the hiring foreign company. |

| Why employ El Salvadorian workers? | Hiring through a PEO in El Salvador ensures compliance with labor laws, reduces costs, streamlines payroll, mitigates risks, provides local expertise, and simplifies HR tasks, enabling businesses to focus on growth. |

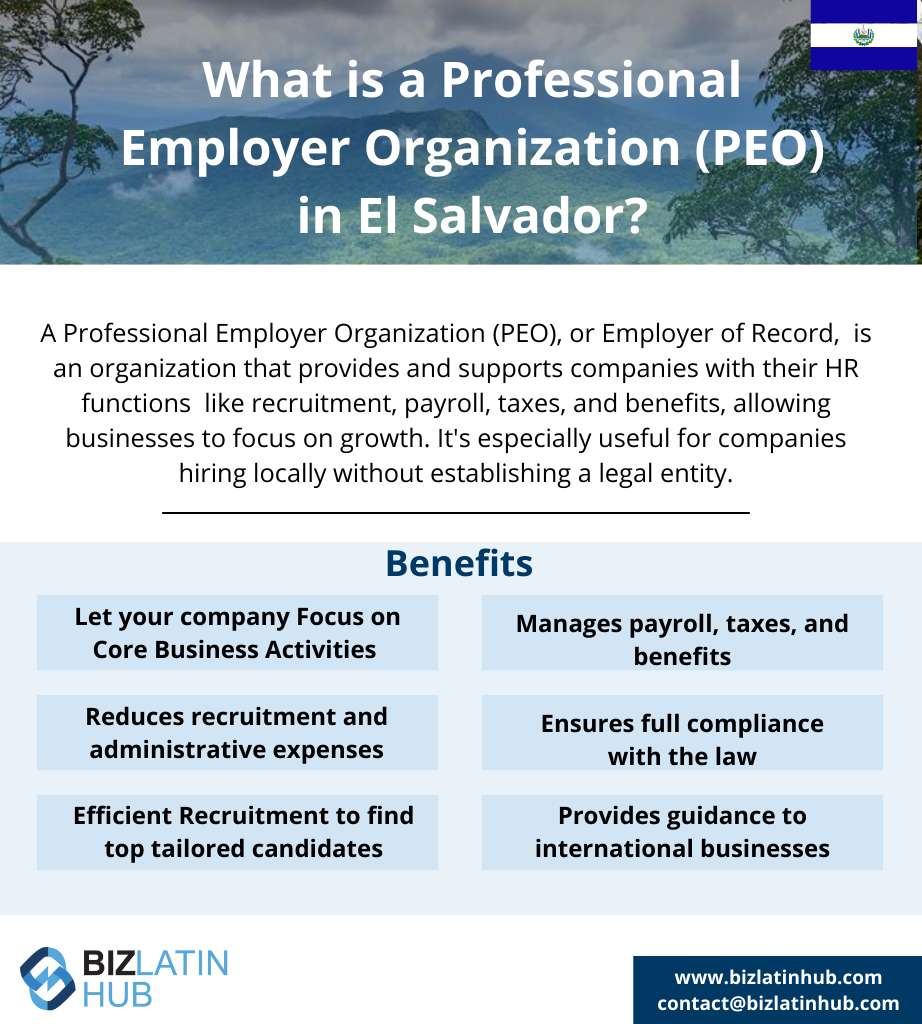

What Is a Professional Employer Organization (PEO) in El Salvador?

All companies thinking about hiring staff in El Salvador must take into account compliance with regard to the following labor obligations:

Each legal requirement mentioned below can be completed by a Professional Employer Organization in El Salvador.

- Work contracts – It is the obligation of every employer that every employee must formalize with them an employment contract, which can be for an indefinite or fixed term.

- Foreign employees –The hiring of foreign personnel in El Salvador is allowed, however, this type of contract has its limitations; within the company, foreign employment cannot exceed 10% and that of the total salaries paid to foreigners cannot exceed 15%. These rules do not apply if the foreign person holds the positions of Director, Administrator or Manager. The person’s position must be registered in the Commercial Registry and may have up to 4 foreign employees under this type of position.

- Social Security – All the employees that you have under your payroll must be registered in the Salvadoran Social Security Institute (ISSS).

- Pension Fund – This applies the same as the ISSS; all employees under payroll must be registered with a Pension Fund Association (AFP).

The labor regulations through the region can be complicated to navigate without the help of a Professional Employer Organization in El Salvador. They will be able to ensure your company is compliant and operating within the legal framework in the country.

Key Advantages of PEO and EOR Services for Expanding into El Salvador

A Professional Employer Organization in El Salvador will enable your company to maintain your focus on your business’ development while the HR burdens are outsourced to the PEO/EOR.

- Cost-effective – Reduces recruitment and administrative expenses and saves you money if you want to hire local staff but do not have a fully incorporated company.

- Recruitment – Assists you in finding the most suitable and qualified staff for your company.

- Limited liability – Limits your level of liability with respect to tax and labor obligations.

- Time-effective – Removes the need for you undertaking the time-consuming but fundamental tasks of processing payrolls, payment of employee benefits and other HR administration.

- Local expertise – A Professional Employer Organization in El Salvador will ensure that you are in compliance with all El Salvadorian employment laws and regulations, due to their expertise of local laws and regulations.

Foreign nationals who have the intention of registering a business in El Salvador must first take into account the fundamental employment laws and regulations. Companies must ensure 100% compliance with the legal requirements before entering into an employment relationship in El Salvador. This is made easier with the help of a quality Professional Employer Organization in El Salvador.

Benefits of Using PEO & EOR Services in El Salvador:

- Hire staff without incorporating locally

- Comply with El Salvador’s Labor Code and social security (ISSS)

- Centralized payroll and HR compliance

- Shorten your go-to-market timeline

- Manage risk and reduce administrative burden

- Local bilingual team support

Understanding Employer of Record (EOR) Services in El Salvador

o partner with a PEO, the hiring company signs a contract with a third-party organization, designating them as the professional employer of record (EOR) in El Salvador for the staff members they wish to hire in El Salvador. This designation ensures that, on official documentation in El Salvador, the third-party organization (the PEO/EOR) is responsible for complying with all employment regulations for the employees.

This arrangement allows the foreign company to avoid the complexities of navigating El Salvador’s employment laws independently. As a result, the foreign company mitigates the risk of non-compliance and can focus on business development and market expansion in El Salvador.

The process of hiring an employee through an employer of record in El Salvador is straightforward. Below is an outline of the steps involved:

- Sign an agreement with the third-party provider (PEO).

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record.

- The candidate reviews and signs the employment contract.

- The PEO completes all mandatory employee registrations in El Salvador.

- The employee starts work and reports to the hiring foreign company.

What labor rights will a PEO in El Salvador handle?

The labor regulations through the region can be complicated to navigate without the help of a PEO in El Salvador. They will be able to ensure your company is compliant and operating within the legal framework in the country.

In El Salvador, labor laws are more aligned with the protection of the rights and benefits of workers rather than employers. It’s important to take into account what these additional benefits are. A quality PEO in El Salvador will be able to handle these responsibilities in a compliant manner.

Work contracts: It is the obligation of every employer that every employee must formalize with them an employment contract, which can be for an indefinite or fixed term.

Foreign employees: The hiring of foreign personnel in El Salvador is allowed. However, this type of contract has its limitations; within the company, foreign employment cannot exceed 10% and that of the total salaries paid to foreigners cannot exceed 15%. These rules do not apply if the foreign person holds the positions of Director, Administrator or Manager. The person’s position must be registered in the Commercial Registry and may have up to 4 foreign employees under this type of position.

Social Security: All the employees that you have under your payroll must be registered in the Salvadoran Social Security Institute (ISSS).

Pension Fund: Applies in the same way as it does for the ISSS; all employees under payroll must be registered with a Pension Fund Association (AFP).

Bonus: A premium must be paid to workers at the end of the year between December 12 and 20, depending on the amount of time the worker has worked for the employer:

a) From 1 to 3 years: an employee must be remunerated for 15 days of their standard salary.

b) From 3 to 10 years: an employee should be remunerated for 19 days of their standard salary.

c) 10 or more years: An employee should be remunerated for 21 days of their standard salary.

Minimum salary: The National Minimum Wage Council is the institution responsible for establishing the minimum wage of each sector of economic activity, and each year updates the corresponding values. Currently, the minimum salary for trade and services depends on sector and area, but tops out at USD$365 monthly.

Because the minimum salary fluctuates, it is important to hire a Professional Employer Organization in El Salvador. They will be able to ensure your company is up-to-date with payroll expectations and remain compliant.

Overtime: The labor laws of El Salvador establish that the maximum number of ordinary working hours that can be performed is 44 hours weekly. Any time that exceeds this period must be remunerated with a 100% surcharge on the employee’s base salary.

Vacation period: Every employee has the right to enjoy vacations annually, the number of days they can enjoy is 15 days, and vacations must be paid with 30% of the base salary.

Sick leave: Employers must pay 75% of the worker’s basic salary for the duration of the illness, not exceeding 60 days a year.

Maternity or paternity leave: Maternity leave consists of 16 weeks, 10 of which must be taken after birth. Paternity leave consists of 3 days counted from birth.

PEO vs. EOR: Which Is Right for Your Business?

When expanding into El Salvador, businesses often choose between a Professional Employer Organization (PEO) or an Employer of Record (EOR) to hire and manage employees.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR is legal in El Salvador and allows foreign companies to hire local staff without establishing a legal entity.

Note that in El Salvador, PEO and EOR are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in El Salvador. Biz Latin Hub offers both PEO and EOR solutions, helping businesses navigate El Salvador’s regulations, establish entities, and ensure full HR compliance with local labor laws. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

| Feature | PEO El Salvador | EOR El Salvador |

|---|---|---|

| Legal Employer | Client (local entity needed) | Biz Latin Hub (acts as legal employer) |

| Hiring Speed | Medium | Fast |

| Compliance Responsibility | Shared | Fully handled by EOR |

| Best For | Companies with legal presence | Foreign entities without local setup |

| Contract Ownership | Company-employee | EOR-employee |

This comparison helps you assess the best fit based on your current operational structure and business goals in El Salvador.

How to use a payroll calculator

If you want to get an idea of the possible costs involved in payroll outsourcing or a PEO in El Salvador, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, in comparison to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in El Salvador would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs when hiring through a PEO in El Salvador

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee by incorporating your own legal entity in El Salvador, and then using your own entity to hire employees or you can hire through a PEO in El Salvador, also known as an Employer of Record (EOR), which is a third party organization that allows you to hire employees in El Salvador by acting as the legal employer. Meaning you do not need a Salvadoran legal entity to hire local employees.

A standard Salvadoran employment contract should be written in the Spanish (and can also be in English) and contain the following information:

– Name, ID, Tax ID, social benefits numbers of the employee, address of the employer and employee

– City and Date

– Job Title

– Work Hours

– Location where the service will be provided

– Salary and payment frequency

– Social benefits

– Probation period (Has a maximum of 30 days)

– Specific agreements with the employer

The mandatory employment benefits in El Salvador are the following:

– Social Security and Pensions contributions

– Vacation

– Aguinaldo (13th Month Bonus)

– Severance Pay* Only applies if the employee’s contract is terminated without just cause.

For more information on mandatory employment benefits read our recent article on Employment laws in El Salvador.

The total cost for an employer to hire an employee in El Salvador can vary depending on the salary; however, as a rough estimate, the employer’s cost for mandatory employment benefits typically ranges from 25% to 35% of the gross employee salary. This is in addition to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

Forming a legal entity is different to hiring an EOR in the following ways:

– Slower to establish.

– Permanent presence in the country.

– All costs deductible through a local entity.

– Ability to sign contracts and agreements locally.

– Ability to invoice through local entity.

– Legal entity compliance support required.

– Hire employees directly.

Yes, and Biz Latin Hub can help with entity formation and employee transition.

A PEO provides HR and payroll services for companies with a legal entity, sharing employment responsibilities with the client.

An EOR hires staff on behalf of your company and manages compliance with Salvadoran labor laws, even if you don’t have a local entity.

PEO requires an entity. EOR allows you to hire without one and handles full compliance.

Yes, Biz Latin Hub ensures compliance with Ministry of Labor regulations, ISSS, and AFP pension contributions.

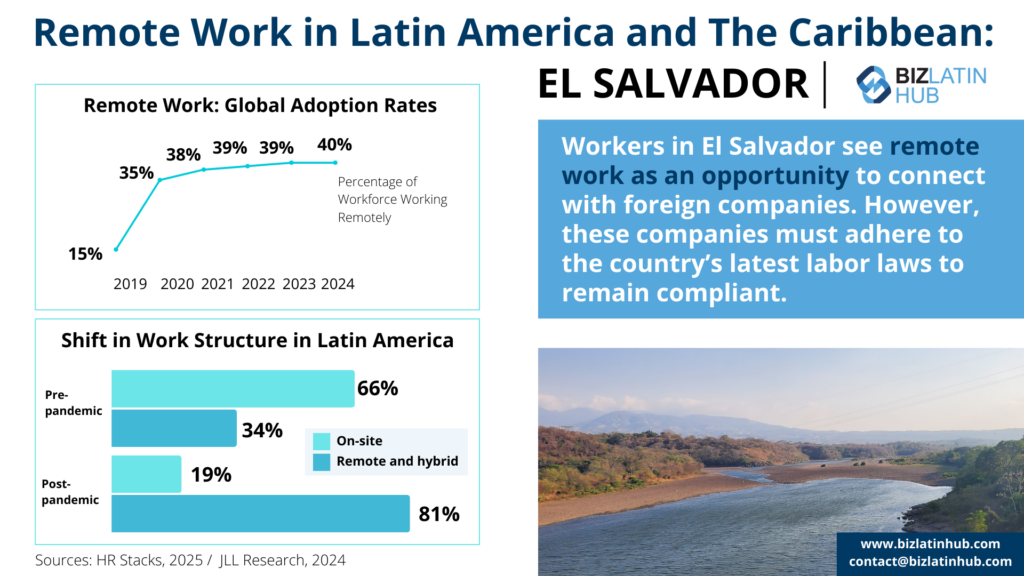

Why invest in El Salvador?

There are several reasons that explain why El Salvador is a popular market for investors.

It has an investment friendly environment, after the government implemented measures to attract foreign investment. It established the Proesa agency, which focuses on promoting exports and attracting investment to the country. El Salvador ranked 96th out of 190 countries in the World Bank’s Ease of Doing Business Index 2020, showcasing improvements in the business environment.

El Salvador has a young and talented workforce. The country has invested in education and vocational training programs to develop skilled professionals. El Salvador is known for its expertise in industries such as information technology and services, manufacturing, and textiles. A quality PEO in El Salvador can help your business tap into the highly-skilled talent pool the region has to offer.

In addition, El Salvador’s strategic geographic location offers advantages for businesses. It is situated in Central America, providing access to regional markets and is part of the CAFTA-DR free trade agreement with the United States, offering preferential access to the largest consumer market in the world.

El Salvador has been actively promoting digital transformation initiatives. The country puts a strong focus on technology and innovation, with government programs supporting startups and technology-driven businesses. El Salvador is becoming a hub for fintech and digital entrepreneurship. A PEO in El Salvador will be able to keep your company up-to-date with changes in the technology sector.

Finally, El Salvador has embraced renewable energy sources. The country has significant geothermal, solar, and wind energy potential. It aims to generate 100% of its energy from renewable sources by 2025, which has attracted investments in the renewable energy sector.

Biz Latin Hub can help with a PEO in El Salvador

El Salvador is a nation full of potential, awaiting the investment of those aware of all it has to offer. The opportunities, especially in services, are more than plentiful for those who are willing to take them.

If you want to hire local employees, but do not have an incorporated local entity and want to avoid the administrative burden of establishing and maintaining a local company, then a Professional Employer Organization or PEO in El Salvador may be the perfect solution.

Contact our bilingual Team on Biz Latin Hub El Salvador to learn more about how we can support you throughout the hiring and recruitment process.