Chile’s stable economy and strong legal framework make it one of the most attractive countries for business in South America. A Professional Employer Organization (PEO) or Employer of Record (EOR) in Chile allows companies to hire employees locally without company formation in Chile. Biz Latin Hub provides fully compliant PEO and EOR services to support foreign companies operating in Chile, especially from Santiago.

Key Takeaways On Using A PEO In Chile

| Is it legal to hire through an PEO in Chile? | Yes, hiring through a PEO in Chile is legal. It ensures compliance with labor laws and simplifies employment without needing a local entity. |

| What are the benefits of hiring through an PEO in Chile? | Hiring through a PEO in Chile provides quick market entry without a local entity, allowing you to focus on core business operations seamlessly. |

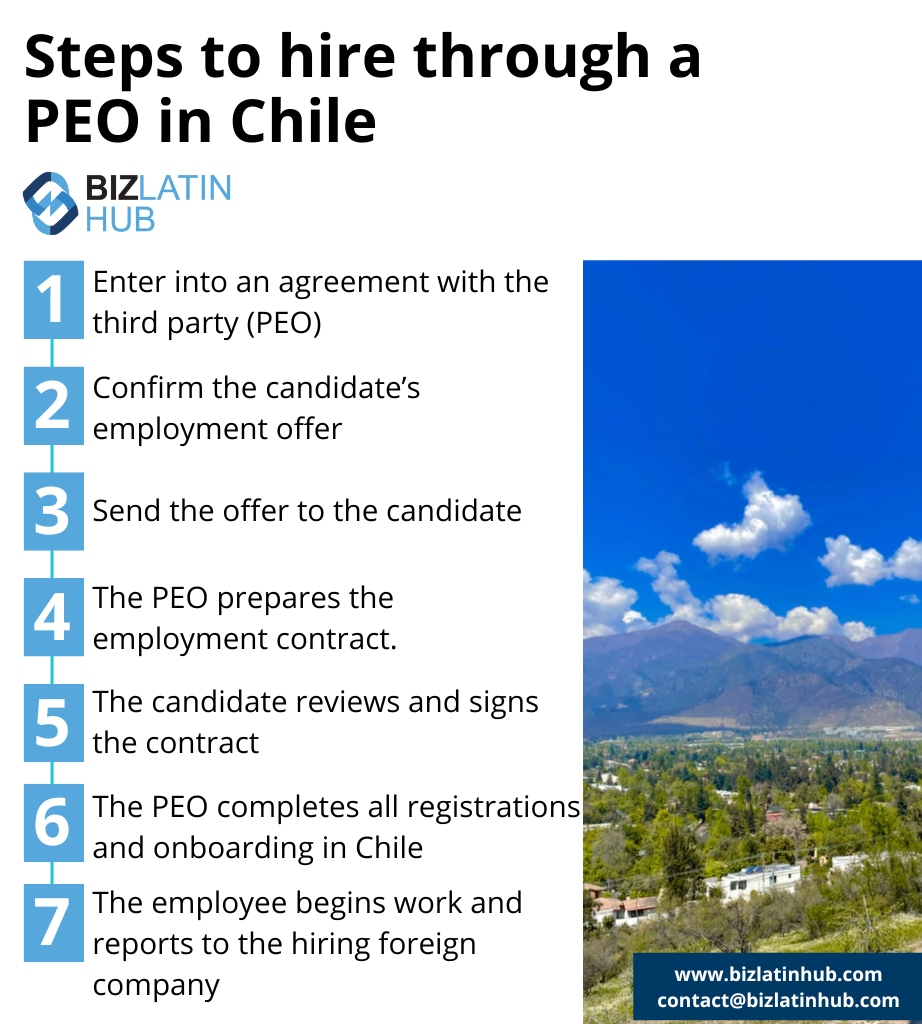

| Steps to hire through a PEO in Chile | Enter into an agreement with the third party (PEO). Confirm the candidate’s employment offer. Send the offer to the candidate. The PEO prepares the employment contract. The candidate reviews and signs the contract. The EOR completes all required employee registrations and onboarding in Chile. The employee begins work and reports to the hiring foreign company. |

| Why employ Chilean workers? | Hiring through a PEO in Chile enables fast market entry without a local entity, ensures compliance with Chilean labor laws, manages payroll and taxes, reduces legal risks, and allows you to focus on core business operations. |

What Is a Professional Employer Organization (PEO) in Chile?

A Professional Employer Organization (PEO), is a company that legally employs workers on behalf of companies who do not have an established office in a given country. As such, the PEO oversees and manages all human resource related functions. It is also possible to have an agreement with employer of record (EOR) in Chile, acting in a similar manner to a PEO, but it typically used more by clients that have no physical operations in a country.

PEOs partner with businesses in order to provide them with complete HR outsourcing to support a company’s human resources management, employee benefits, regulatory compliance, and payroll. A PEO works through a co-employment arrangement, meaning the PEO contractually shares various employer responsibilities with the company.

Key Advantages of PEO and EOR Services for Expanding into Chile

There are many benefits to using a PEO in Chile. By partnering with a company that is an expert in the local legislation, you minimize risk and ensure that your company stays on top of local law and regulation. In addition, you save on time by reducing your amount of administrative tasks, allowing you to focus on growing the company.

Without increasing your headcount, working with a PEO will allow you to benefit from HR support.

Moreover, you are able to hire employees quickly, in compliance with Chilean labor laws, and without having to establish and maintain a local Chilean legal entity. This allows you to start doing business quicker and test out the market.

Using a PEO is an enticing option to begin doing business in Chile. It enables a company to start commercial activities in the first phase of an expansion into the region. Some companies may find that a local entity formation may suit them after first operating through an EOR in Chile to get a better understanding of the local market.

Benefits of Using PEO & EOR Services in Chile:

- No local entity required to hire staff

- Legal compliance with Chilean Labor Code and Dirección del Trabajo

- Manage payroll, tax declarations, and contracts

- Faster hiring process with fewer risks

- Flexible solutions for long- and short-term expansion

- Local support in Santiago from a bilingual team

What is The Process for Hiring Through a Professional Employer Organization (PEO) in Chile?

A quality Professional Employment Organization (PEO) in Chile can navigate and manage the complexities of employment contracts available in the country. While similar to an Employer of Record (EOR) in Chile, there are distinct differences in how the employment relationship is legally structured. Based on our experience, the process typically follows these steps:

- Assess the Need to Hire in Chile – Analyze your business needs and determine the necessity of hiring locally.

- Source Local Talent – Identify skilled candidates through direct search or with assistance from local recruitment agencies.

- Select a Professional Employment Organization (PEO) – Choose a dependable PEO partner and review their services and pricing.

- Approve the Offer Letter – Finalize the employment terms, including compensation, benefits, and compliance with Chilean labor laws.

- Onboard the Employee via the PEO – Facilitate a seamless onboarding process, with the PEO managing legal and administrative requirements.

PEO vs. EOR: Which Is Right for Your Business?

When expanding into Chile, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. Hiring through an EOR in Chile is legal and ensures compliance with Chilean labor laws.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms. In Chile specifically, a PEO works through a co-employment arrangement, while an EOR is the legal employer of your employees.

Important Tip: While an EOR provides a quick-entry solution for the Chilean market, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Chile. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Chile’s regulations, establish entities, and ensure full HR compliance with the country’s labor laws. Whether you need a fast market entry or a stable long-term presence in Chile, we can guide you through the process.

PEO vs. EOR: Which Is Right for Your Business?

| Feature | PEO Chile | EOR Chile |

|---|---|---|

| Legal Employer | Client (entity needed) | Biz Latin Hub (acts as legal employer) |

| Hiring Speed | Medium | Fast |

| Compliance Responsibility | Shared | Fully managed by EOR |

| Best For | Companies with a Chilean presence | Market entry without local setup |

| Contract Ownership | Company-employee | EOR-employee |

This table outlines key differences to help guide your decision when expanding into Chile.

6 Key Labor Laws in Chile

When establishing a company abroad, it is vital to comply with local labor laws. For most foreign investors, it is a challenge to understand and comply with the local employment standards. For this reason, a PEO in Chile can be a great alternative to hire staff, facilitating the process of complying with local laws. The most important aspects of the Chilean Labor Law are summarized below:

- Employment contracts: The employment contract needs to be in writing and completed within 15 days from the initiation of services.

- Fixed-term contracts: These contracts can be made for a maximum duration of one year. This limit jumps to two years for managers or individuals who have obtained a professional or technical degree delivered by a state-recognized institution.

- Foreign workers: The Labor Code states that at least 85% of employees who work for the same employer must be of Chilean nationality.

- Committees: Regarding legislation, two committees are required. The first one is a joint health and safety committee which is mandatory whenever more than 25 employees are present in the workplace. The second one, a bipartite training committee, is required whenever the company has more than 15 employees.

- Unions: Employees benefit from the constitutional and statutory right to unionize and form labor unions, these represent the employees before the company.

- Termination: If an employment relationship is ended due to “company needs”, the employer must send the employee a written communication informing about the labor contract termination one month in advance, unless the employer pays the employee a compensation equivalent to 30 days of work.

What employee benefits exist in Chile?

In addition to complying with labor laws, a company must be able to provide all the benefits Chilean workers are entitled to to its employees. Using a PEO in Chile facilitates this process, because they assume responsibility for managing employee benefits. The most important employee benefits are summarized below:

- Working hours: The Labor Code states that the maximum working schedule per week is 45 hours, distributed in no more than six and no fewer than five days. However, managers, employees with the power to manage, and employees without direct supervision working at home or in another location than the workplace are excluded from the above-mentioned limit. Ordinary work per day cannot exceed 10 hours, and only two hours of overtime are allowed per day.

- Overtime: All employees who are not excluded from the working hours’ limit mentioned previously are entitled overtime pay. It is calculated at 150% of the ordinary hourly salary.

- Annual vacation: The annual holiday consists of 15 working days. It is increased by one day for every three years in employment with the current employer after the first 10 years of work for one or different employers.

- Sick leave: Employees have the right to sick leave following a doctor’s orders. During this time, the employee will receive an amount equivalent to his or her salary paid by the respective health institution. There is no annual limit on the number of days of sick leave an employee can take.

- Maternity leave: Female employees are entitled to a paid maternity leave starting 6 weeks prior to the birth of the child and continuing 12 weeks following the birth.

- Probationary period: The Labor Code does not consider a probationary period.

How to Use a Payroll Calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Chile, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Chile would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

Why do business in Chile?

Chile, classified as a high-income economy by the World Bank, is South America’s most stable and prosperous nation. It leads the region in competitiveness, income per capita, globalization, economic freedom, and low corruption levels, making it an attractive destination for businesses seeking Professional Employment Organization (PEO) services. The World Bank ranks Chile fifth in its “Ease of Doing Business” report, further highlighting its favorable business climate.

Employers in Chile are required to share profits with their employees. This can be done by paying either 25% of the employee’s annual remuneration or 30% of the company’s annual net profits. This legal framework promotes equitable income distribution and strengthens the employer-employee relationship.

Chile’s economy thrives on foreign trade and a robust mining sector, supported by government policies encouraging international investment. The nation hosts several multinational companies, reflecting its global business appeal and strategic importance in the South American market.

FAQs on a PEO in Chile

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through a PEO or EOR in Chile:

1. How does one hire employees in Chile?

You can hire an employee by incorporating your own legal entity in Chile, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Chile by acting as the legal employer. With an EOR you do not need a Chilean legal entity to hire local employees.

2. What does a standard employment contract contain in Chile?

A standard Chilean employment contract should be written in Spanish (and can also be in English) and contain the following information:

- ID and address of the employer and employee

- City and date

- Job/function/responsibilities of the worker

- Working hours

- Agreed remuneration

- Frequency of payment of remuneration

- Health and pension systems; unemployment insurance contribution held by the employee

- Start and end date of employment contract

- Confidentiality clause

- Non-competition clause

3. What are the mandatory employment benefits in Chile?

The mandatory employment benefits in Chile are the following:

- Legal gratifications

- Employer’s contributions

- Worker’s holidays.

- Lunchtime.

4. What is the total cost for an employer to hire an employee in Chile?

The total cost for an employer to hire an employee in Chile may vary depending on the salary. However, as an indication, the cost to the employer of mandatory employment benefits is approximately 29.21% as a percentage of the employee’s gross salary and benefits.

Please use our Payroll Calculator to calculate employment costs.

5. What is the difference between hiring through an EOR and forming a legal entity?

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

- Slower to establish.

- Permanent presence in the country.

- All costs deductible through a local entity.

- Ability to sign contracts and agreements locally.

- Ability to invoice through local entity.

- Legal entity compliance support required.

- Hire employees directly.

6. What is the difference between a PEO and an EOR?

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

7. What is a PEO in Chile?

A PEO supports HR and payroll needs for companies that already have a local company in Chile.

8. What is an EOR in Chile?

An EOR serves as the legal employer for your team, enabling compliant hiring without establishing an entity.

9. Can I transfer staff from an EOR structure to my own company?

Yes, Biz Latin Hub helps manage this transition once your entity is operational.

10. Are these services fully compliant with Chilean regulations?

Yes. Our team ensures all labor contracts, social security contributions, and payroll reports comply with Chilean law.

Biz Latin Hub can help with a Professional Employment Organization (PEO) in Chile

Chile has the best-qualified economy in Latin America and one of the best regarded among the world’s emerging economies, thanks to its sustained economic growth and social progress, along with government changes designed to attract foreign direct investment (FDI).

A PEO solution will enable you to maintain day-to-day control of your employees, while the PEO takes care of all risk mitigation, compliance, payroll, and employee benefits.

Contact our Country Manager, Allan, here at Biz Latin Hub to learn more about how we assist your hiring and recruitment needs in Chile.